Chart of the Week and Weekly Report Highlights

This week: Asset Class Sentiment, Sovereign Bond Yields, EM Monetary Conditions, Global Equities ERP, shadow policy rates, US dollar valuation indicator.

This post gives you a look at what was covered in the latest Weekly Insights report, along with our hand-picked Chart Of The Week

The Weekly Insights Report is part of our entry-level service: summarizing the key points, ideas and charts from our institutional research service.

Chart of the Week - Global Equity Risk Premium

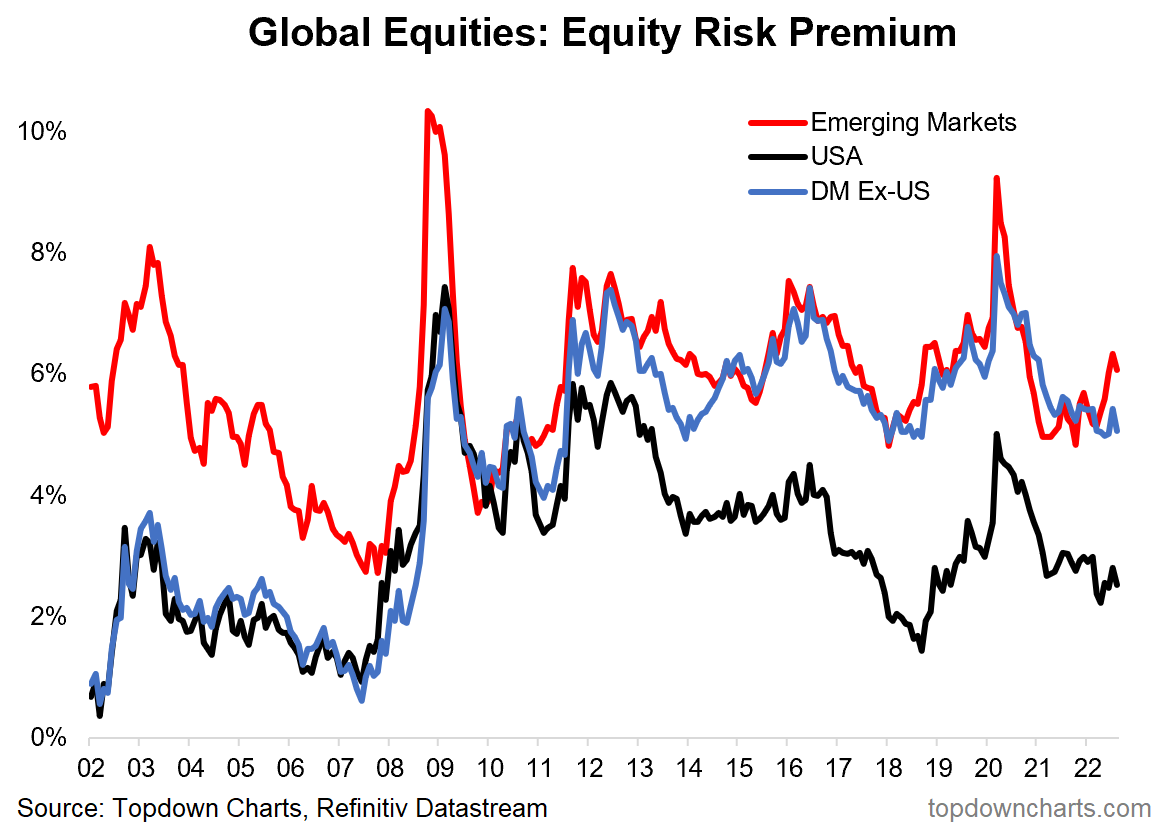

ERP Valuation Indicator: This is an important chart for global equities. Despite some reduction in valuations (e.g. PE Ratios have fallen), the issue is that bond yields have gone up as well, so the equity risk premium has not really improved.

For instance, compare and contrast the current levels of the ERP [Equity Risk Premium] vs that seen during the peak of the pandemic panic or the 2008 financial crisis. Current levels are simply not compelling, certainly not compared to those episodes.

The ERP works well as a key input for asset allocation e.g. by giving buy signals when it spikes (n.b. higher = better) because it reflects outright valuations, but also valuations relative to the risk free alternative (i.e. bonds) — and indirectly also reflects sentiment and monetary conditions with regards to changes in bond yields.

Simply put, the higher the ERP, the better compensation you are getting for being in risky assets vs “safe“ assets. So clearly, a lower ERP means less compensation for risk, and hence a riskier setup, all else equal.

The key takeaway is that the current level of the ERP is not particularly attractive for US equities. Even the rest of the world, while boasting a higher ERP vs the USA, still hasn’t moved up to previous major buying opportunity levels at this point. Hence again, we see another indicator saying “not yet“ for global equities.

Key point: Global ERPs have not improved much since the onset of bear market.

Please feel welcome to share the Chart of the Week!

I would greatly appreciate it if you can help spread the word ↓

The easiest way to help do that is to simply forward this email to your friends, or you can just share the chart/link on social media (be sure to mention us! :-).

Topics covered in the latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and took a bite out of some really important macro/asset allocation issues right now:

Asset Class Sentiment: review of sentiment across the major asset classes.

Sovereign Bond Yields: further moves in bond yields (+real yields).

EM Monetary Conditions: looking at leading indicators for Emerging Markets.

Shadow Rates vs Global Equities: monetary policy casting a long shadow.

Bond Yields vs the PMI: higher bond yields mean further headwinds.

US Dollar Index Valuations: an update on where things sit for the USD.

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service check out this recent post which highlights: What you get with the service; Performance of the service (results of specific ideas and TAA); and importantly: What our clients say about it…

But if you have any other questions on our services definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn