Chart of the Week and Weekly Report Highlights

This week: PMI Pulse, Bond Yields and Inflation, Global Listed Infrastructure, REITs, SCANNZ Economies, Equity Sentiment, Bond market technicals

This email provides a look at what we covered in the latest Weekly Insights report

The weekly insights report presents some of the key findings from our institutional research service, providing an entrée experience (in terms of price and size).

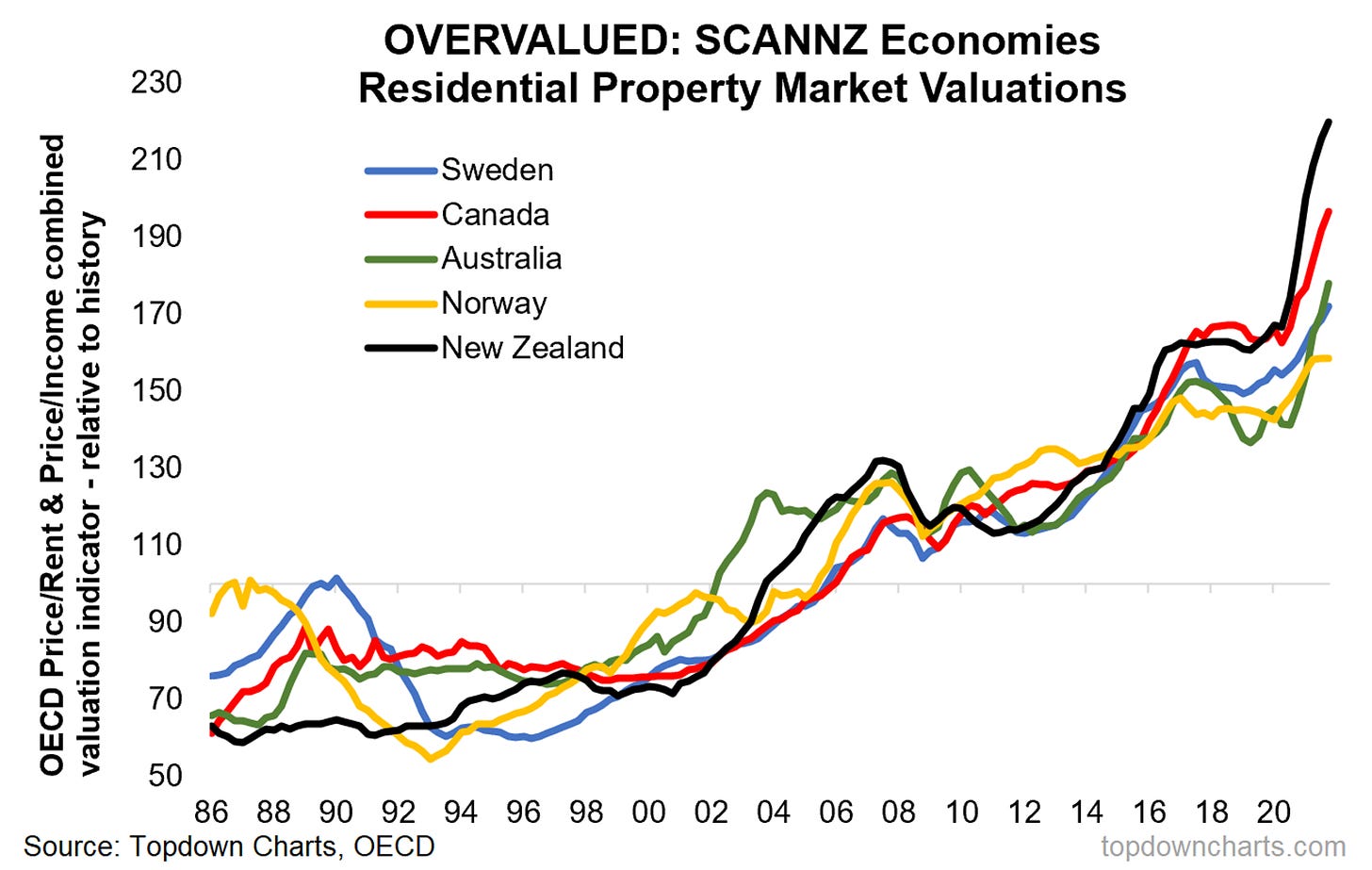

Chart of the Week - The “SCANNZ Economies“

Pondering the Probability of Echo-Crises: The SCANNZ economies (Sweden, Canada, Australia, Norway, New Zealand) share an interesting set of common features e.g. small open economies, exposure to commodities, have their own currency, independent central bank, and of course they all have overvalued housing markets. And these commonalities are important…

Because of their sensitivity to commodities, the central banks of the SCANNZ economies cut interest rates during the 2014-16 commodity crunch – which drove their housing markets higher. Then of course, 2019/20 saw another wave of rate cuts and another wave of house price appreciation… and left these economies with a significant vulnerability and sensitivity to a significant increase in borrowing costs in the form of record high housing market valuations.

The problem is this risk-scenario appears to be exactly what is getting underway right now, with rate-hike lift-offs spreading and bond yields up substantially off the lows. We probably don’t see ‘systemic stress’ like what happened in Europe with the “PIIGS economies” during the sovereign debt crisis (which was basically an echo-crisis of 2008), but you could easily see *simultaneous* stress across the SCANNZ economies if a similar kind of echo-crisis were to be triggered by bursting housing bubbles.

Key point: Expensive housing markets leaves the SCANNZ at risk of an echo-crisis.

If you haven’t already, be sure to subscribe to our paid service so that you can receive the full reports ongoing (along with access to the archives, monthly asset allocation review, and Q&A).

Topics covered in the latest Weekly Insights Report:

PMI Pulse: pricing pressures, waning momentum, China covid complications.

Bond Yields and Inflation: where-to next for bonds in the “strange macro”.

Global Listed Infrastructure: mixed outlook, despite strong run.

REITs: reviewing all the key facets of REITs to weight the risk outlook.

SCANNZ Economies: pondering the probability of echo crises.

Equity Sentiment: a look at where surveyed sentiment sits vs positioning.

Developed Market Bond Yields: bond yields are breaking out across DM.

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn