Chart of the Week and Weekly Report Highlights

This week: Fiscal/Tax Risk outlook, Capex Outlook, Equity Sentiment Snapshot, Equity Valuations, Scenarios and Sources of Upside, Treasury Yields, Gold at risk...

This email gives you a look at what was in the latest Weekly Insights report

The Weekly Insights Report is part of our entry-level service: summarizing the key points, ideas and charts from our institutional research service.

Chart of the Week - Global Stockmarket Valuations

Forward PE Ratios — Real Cheap (but for real?): We have seen a major move in forward PE ratios across countries this year. The median forward PE ratio across countries has dropped to levels that you would clearly call cheap, and the proportion of countries with a “cheap” forward PE ratio (more than 1 S.D. below average) has surged to over 1/3rd …but the problem is, do we believe the forward PE?

First, let’s just make this crystal clear: the forward PE takes price divided by Wall Street Analysts consensus estimates of earnings over the next 12 months. Both are pieces of quantitative information, but one is fact, and the other is opinion…

One issue that I have previously pointed out on the forward PE is the extreme volatility in forward EPS that the pandemic brought about e.g. forward PE ratios were looking “expensive” in mid-2020 which was clearly a false signal resulting from the earnings collapse (that’s what happens when you turn the economy off over night).

Since then, earnings post-pandemic have surged thanks to extreme monetary + fiscal stimulus, pandemic related demand, and reopening rebounds. So there certainly is a question to be raised around the sustainability of those earnings, particularly in the face of removal of all of that stimulus, a global economic slowdown and high likelihood of recession.

In other words, yes global equities are cheap if you believe earnings stay strong and the global economy avoids recession…

Key point: Global forward PE ratios look cheap, but there is uncertainty on the “E“.

[!! EXTRA CHART !!] To celebrate Topdown Charts turning 6 years old, I have thrown in a bonus chart this week :-)

Also, in case you missed it, be sure to check out my blog post where I reflect on the Ups and Downs of Topdown.

“Changes and Choices: My Third 2 Years in Business”

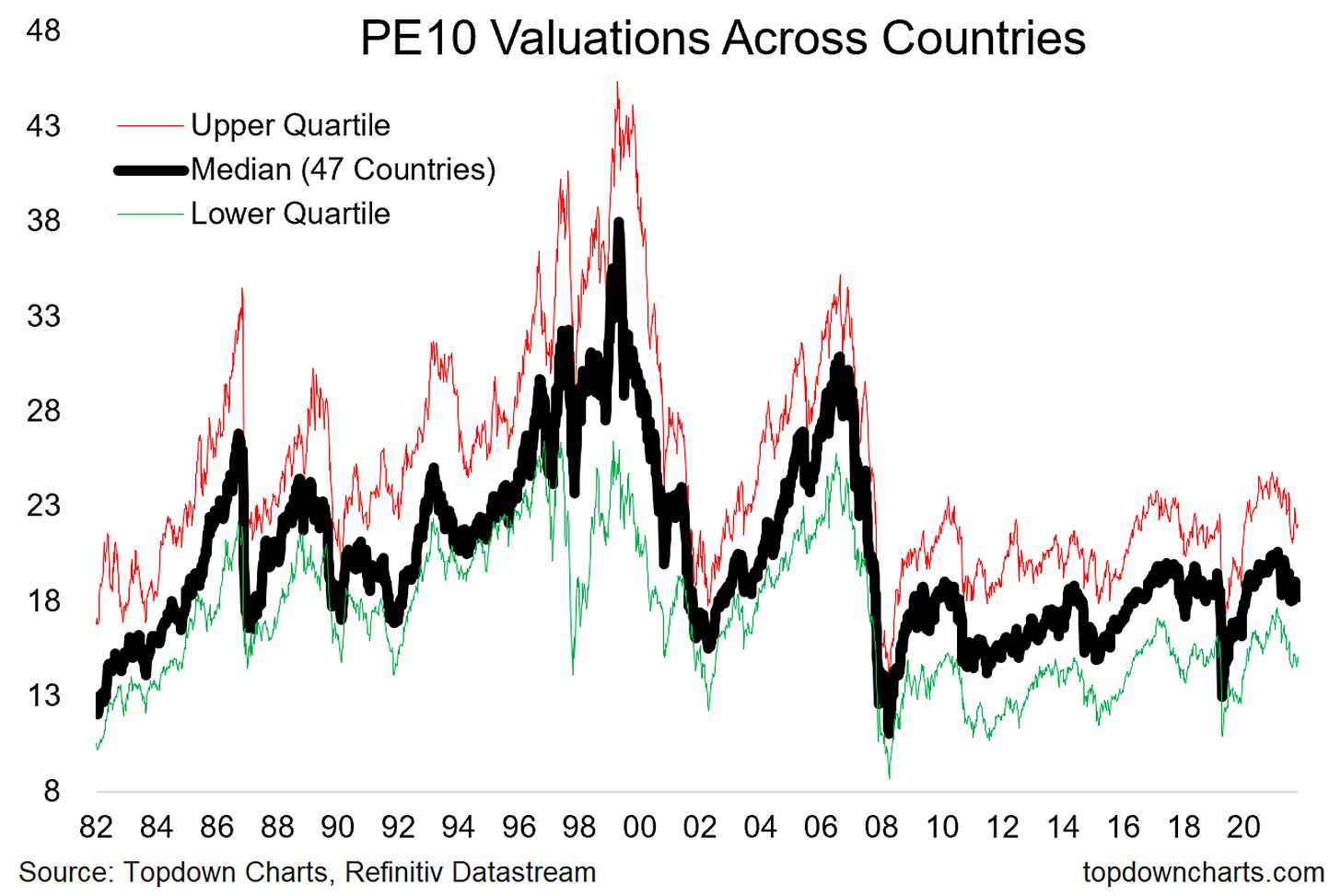

PE10 Valuations Across Countries: One way to ameliorate the issues in the previous chart is to look at the PE10 ratio (price vs trailing average 10 years earnings), which is designed specifically to smooth out the volatility in earnings that I mentioned above.

On this lens we see that yes the median PE10 has come down, but nothing like the move in the median forward PE.

If there were no distortions around the pandemic, and if central banks were moving back to easing (instead of accelerating tightening) then I would look at that forward PE chart as a reason to close your eyes and buy.

But the broader picture is simply still not equity positive, not to mention the fact that we likely still require a greater valuation cushion to offset lingering macro risks. So yes: equities are no longer expensive, but no: I would not say valuations are compelling cheap just yet either.

Key point: Global PE10 ratios are not expensive, but not compelling cheap either.

Please feel welcome to share the Chart of the Week!

I would greatly appreciate it if you can help spread the word ↓

The easiest way to help do that is to simply forward this email to your friends, or you can just share the chart/link on social media (be sure to mention us! :-).

Topics covered in the latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and took a bite out of some really important macro/asset allocation issues right now:

Fiscal/Tax Risk: fiscal sustainability issues and tax hike prospects.

Capex Outlook: looking at cyclical vs thematic (and post-pandemic).

Equity Sentiment Snapshot: reviewing sentiment/flows/positioning.

Equity Valuations: issues with current global equity valuation metrics.

Sources Of Upside: summary of all possible sources/scenarios of upside risk.

Treasury Yields: treasury market technicals update.

Gold: weighing up the risks and outlook for gold.

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service check out this recent post which highlights: What you get with the service; Performance of the service (results of specific ideas and TAA); and importantly: What our clients say about it…

But if you have any other questions on our services definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn