Chart of the Week and Weekly Report Highlights

This week: China Macro and Markets, Emerging ex-Asia, European Equities, UK Equities, Global Banks, Commodities, US Dollar technicals

This email provides a look at what we covered in the latest Weekly Insights report

The Weekly Insights Report is part of our entry-level service: presenting some of the key findings from our institutional research service.

Chart of the Week - Over/Under (reaction)

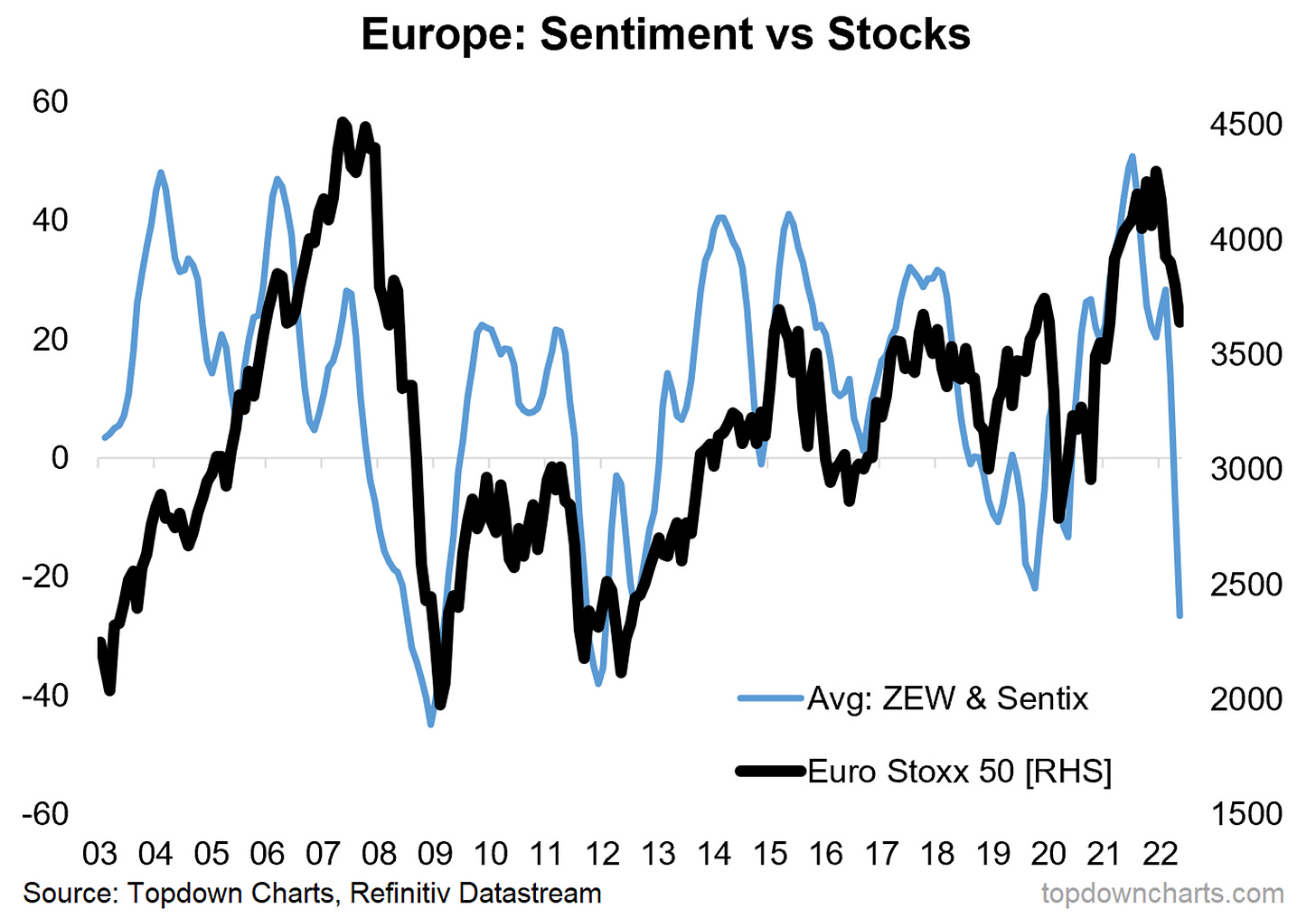

European Equities — Sentiment vs Stocks: After a very promising looking - almost textbook breakout last year, European equities have come all the way back down to support (former resistance), and the way sentiment is looking there could be still more downside to come.

In fairness, a big part of the shock drop in sentiment was the headline *fear factor* from geopolitics (but also the very real direct and indirect macroeconomic impacts of the Ukraine invasion e.g. shortages, inflation, tighter financial conditions).

While we might be able to write-off some of this as overreaction, the near-term macro/risk outlook for Europe remains sketchy as monetary conditions continue to tighten (growth headwinds), bank lending standards have tightened (and credit spreads are on a widening trend), not to mention apparent global recession risk.

Perhaps the only consolation for European equities is that support has held-up so far, and some might argue that sentiment is too pessimistic. It’s also entirely possible that the ECB either doesn’t even get a chance to hike rates, or finds itself back in renewed easing before long. So for now, neutral is the easy answer, with more of an eye on downside risks than upside risks given the prevailing macro currents.

Key point: European equities are at risk of further downside.

If you haven’t already, be sure to subscribe to our paid service so that you can receive the full reports ongoing (along with access to the archives, monthly asset allocation review, and Q&A).

ALSO: please feel welcome to share the Chart of the Week! I would greatly appreciate it if you can help spread the word :-)

Topics covered in the latest Weekly Insights Report:

China Macro: Downside risks dominate, but looking for opportunities.

EM ex-Asia: Review of EM ex-Asia, and in particular focused on LatAm equities.

Europe: Outlook for European equities (and EURUSD), further downside risks.

UK Equities: See some sources of upside for UK equities (and GBPUSD).

Global Banks: Review of macro/technicals vs valuations for this sector.

US Fund Flows: Equity fund flows rapidly catching down to bond flows.

US Dollar Technicals: Did somebody say blow-off top?

Subscribe now to get instant access to the report so you can check out the details/charts, as well as gaining access to the full archive of reports ↓↓

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

Also, for your reference, check out the Chart Of The Week Archives