Chart of the Week and Weekly Report Highlights

This week: Fed Thoughts, Credit risk-watch, EM ex-Asia equities, US Small Caps, Global Small Caps, Bond fund flows, EMFX check

This email provides a look at what we covered in the latest Weekly Insights report

The weekly insights report provides highlights from our institutional research service, offering an entry-level option to receive a flow of investment insights.

Chart of the Week - The Fed vs The Stockmarket

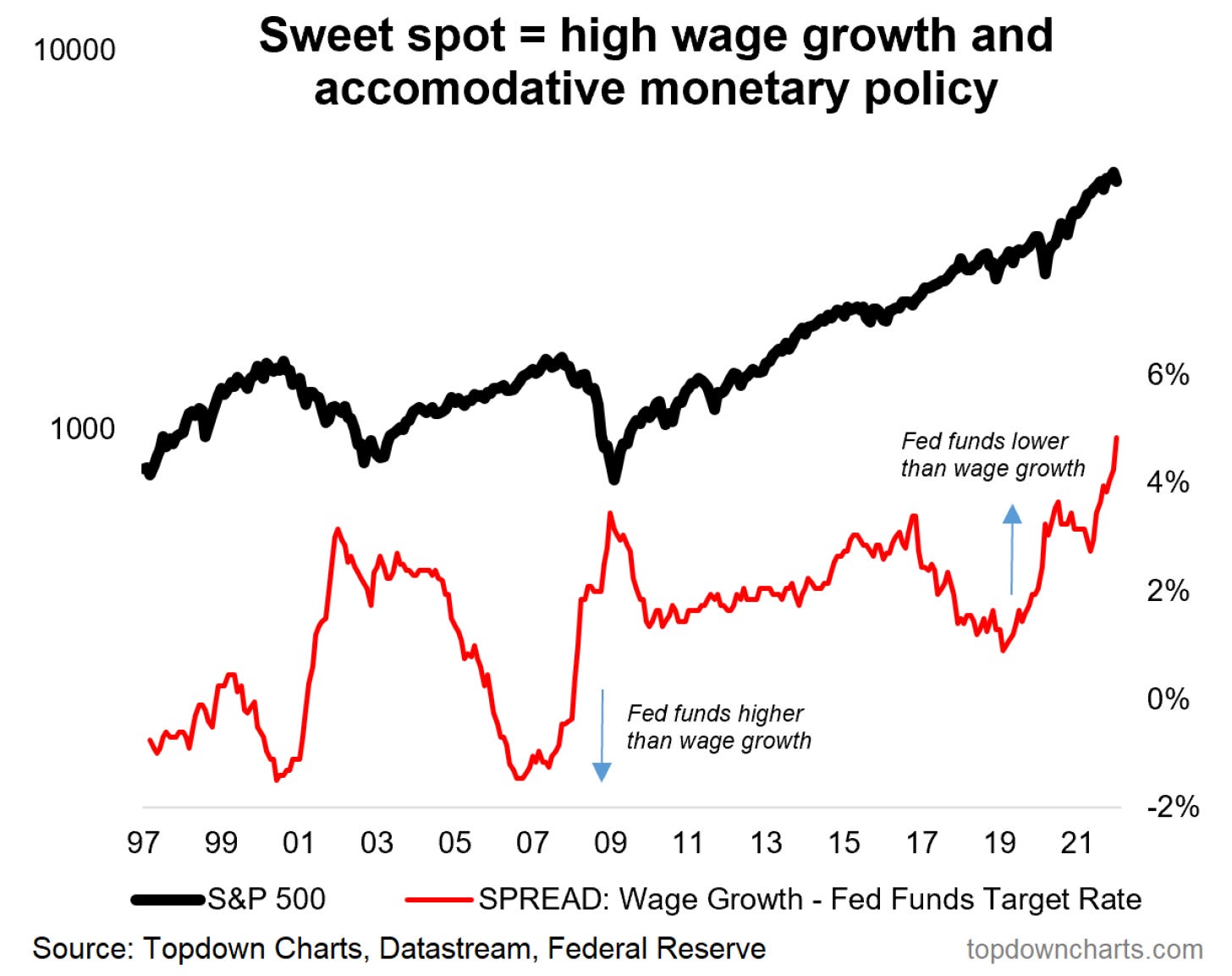

Fed Sweet Spot Indicator: Rate hikes, all else equal, tend to be bad for risk assets in that it incrementally removes monetary tailwinds, raises the discount rate used in valuations, reduces the equity risk premium, raises the odds of a recession, and overall — sends a signal to investors that the game is changing.

But context matters: rapid wage growth provides some offset, and based on recent history (in the chart below) it looks like the Fed could hike multiple times before pushing the market over. Indeed, the gap between the Fed funds rate and wage growth has only widened further in recent months.

That said, volatility has increased recently as the market wakes up to the reality that monetary policy will eventually be tightened (the signal has been sent!). Meanwhile valuations are tracking at expensive levels vs history and vs global peers. So it ends up being a case of proceed with caution (a keen eye on risk management and paying close attention to the signals and signposts!).

Key point: The Fed can probably hike multiple times before sinking stocks.

NOTE: If you haven’t already, be sure to try out our paid service so that you can receive the full reports ongoing (along with access to the archives, monthly asset allocation review, and Q&A).

Topics covered in the latest Weekly Insights Report

The weekly insights report presents the key takeaways from our full service, so you get a flow of ideas, meaningful macro insights, and risk management input — along with some interesting charts of course!

Here’s what we looked at this week:

Fed Thoughts: the Fed sought to avoid one risk, now it faces another.

Credit Spreads: changing the view on credit as the indicators evolve.

EM ex-Asia: it pays to differentiate the view within emerging markets.

US Small Caps: after the rain comes the sun for small vs large equities.

Global Small Caps: a unique angle on small vs large in global equities.

Bond Flows: something is happening with bond fund flows.

EMFX: quietly achieving - a review of technicals and triggers.

Subscribe now to get instant access to the latest report so you can check out the details around the topics above, as well as gaining access to the full archive of reports.

If you have any questions check out the resources section here for more background.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn