Chart of the Week and Weekly Report Highlights

This week: Outlook 2022, emerging markets, geopolitics, policy outlook, upside case, US dollar sentiment/positioning, crude oil supply, commodities sentiment

This email provides a look at what we covered in the latest Weekly Insights report

The weekly insights report presents some of the key findings from our institutional research service.

n.b. Quarterly Strategy Pack - Macro/Asset Allocation 2022 Outlook — I’ll be holding webinars and Q&A sessions tomorrow to go through the slide deck: upgrade your subscription to “Add Quarterly“ now if you’d like to join the calls.

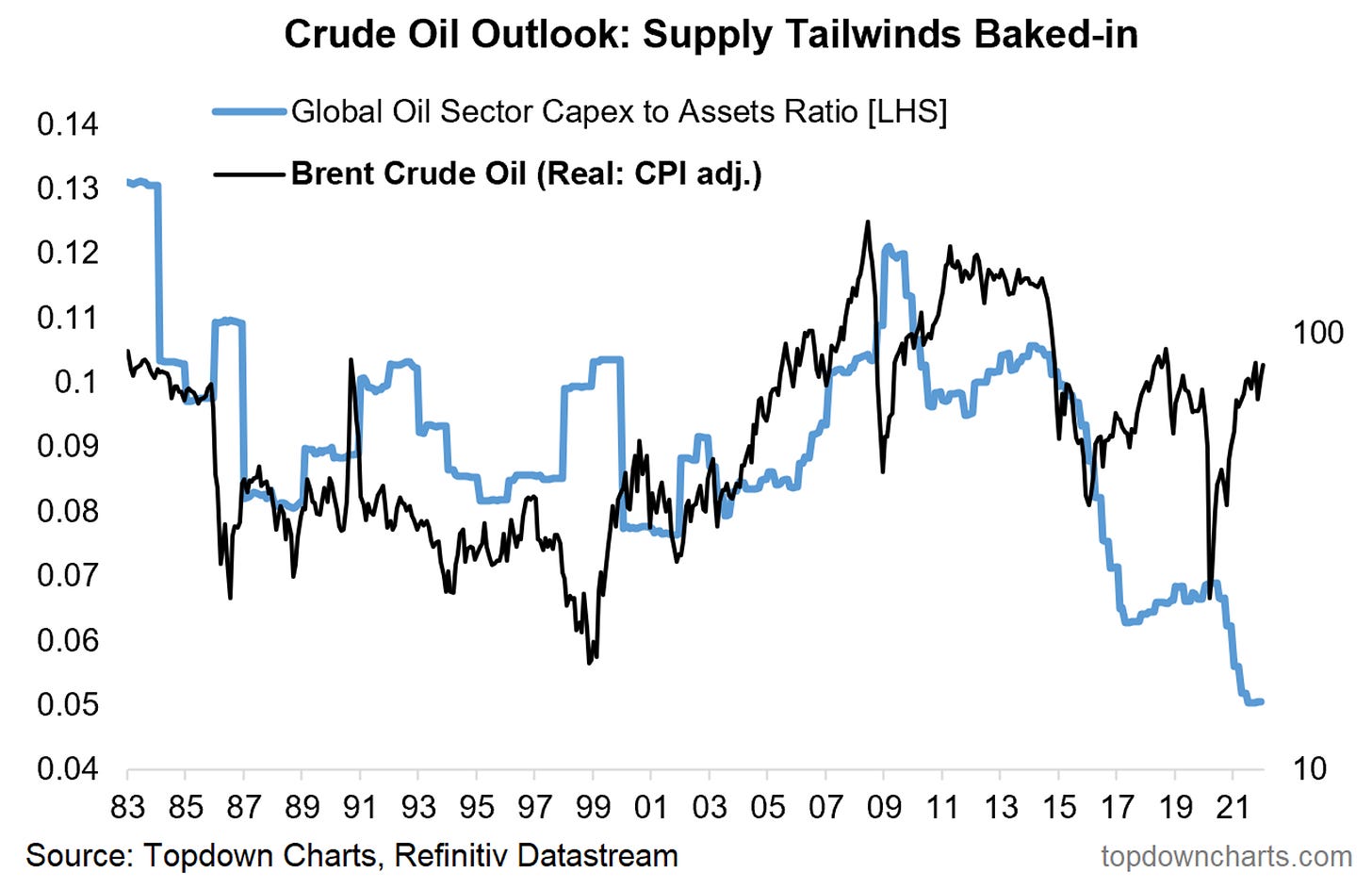

Chart of the Week - Crude Oil Capex Collapse

Crude Oil Supply Tailwinds: Crude oil has been quietly achieving, and I would say overall the path of least resistance is still higher for crude in the coming months and quarters. One key reason is the substantial supply tailwinds already baked-in.

First it was the commodity crunch of 2014-16 that sunk commodity related capex, and then a second wave of commodity crashes in 2020 (need I remind you of the brief foray into negative prices for WTI crude?!) where the pandemic also caused tremendous and varied disruption to commodity investment.

Add to that steady shifts in investor preferences and social/political attitudes — i.e. the rise of ESG investing and the quest for carbon zero. Basically this has starved the oil & gas sector of funding, and essentially engineered a new bull market in energy.

All that’s left now is for reopening and post-pandemic normalization to drive a more fulsome recovery on the demand side and crude could easily top $100/bbl.

Key point: Crude oil likely sees further upside on the back of major underinvestment.

If you haven’t already, be sure to subscribe to our paid service so that you can receive the full reports ongoing (along with access to the archives, monthly asset allocation review, and Q&A).

Topics covered in the latest Weekly Insights Report:

2022 Outlook Highlights: high-level overview and key points

EM Investor Sentiment: substantial shift over the past year

Geopolitics: how are markets reacting to the Russia/Ukraine situation

Macro Outlook: the path of policy, risks, and sources of upside

US Dollar: something big is going on with the DXY

Commodities: prepare for the next phase of the bull market

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn