Chart of the Week and Weekly Report Highlights

This week: Review of Core Views, Treasury Yields, Credit Spreads, Copper tactical indicators, US Dollar, Commodities, inflation, stocks vs bonds, expected returns

This email gives a look at what was in the latest Weekly Insights report

The Weekly Insights Report is part of our entry-level service: summarizing the key points, ideas and charts from our institutional research service.

Chart of the Week - From Not Enough to Too Much

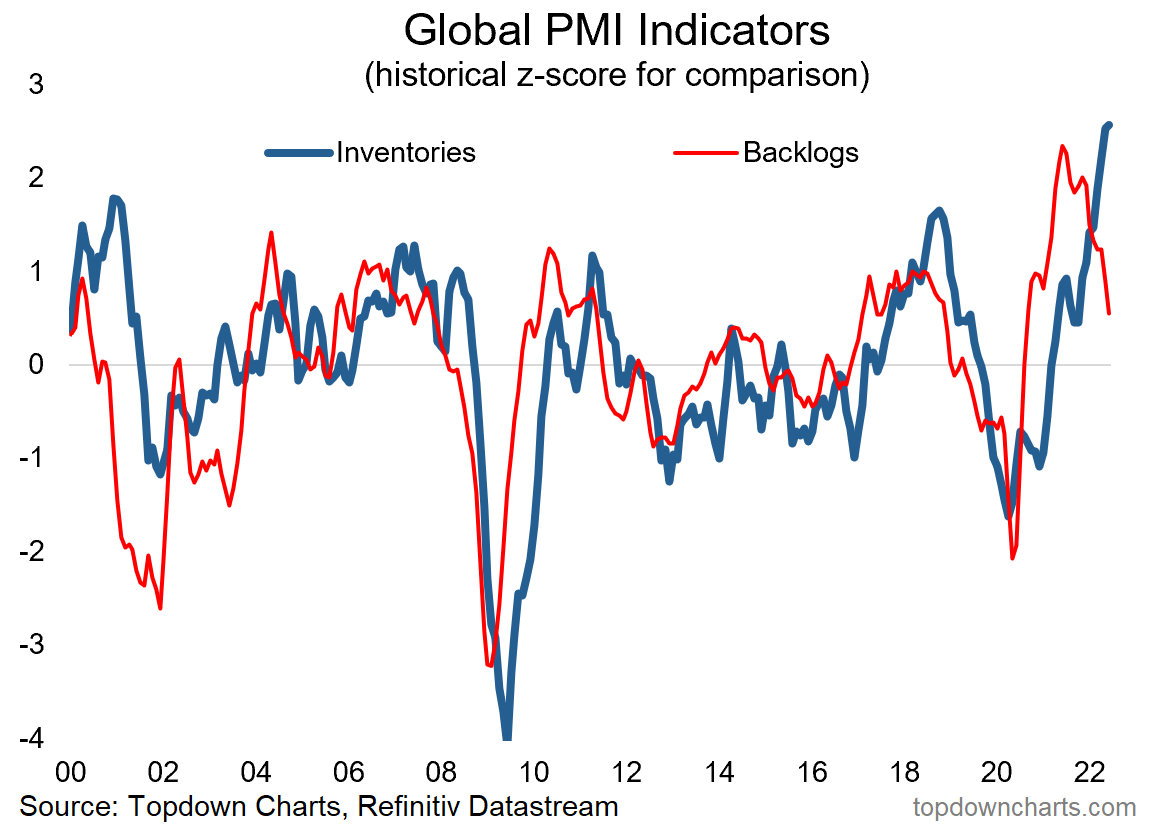

Backlog Backdown and Inventory Increase: This is one of the most intriguing charts on my desk at the moment, it shows our composite global PMI backlogs indicator falling to the lowest level in almost 2 years… meanwhile inventories are surging to record levels.

Part of this may well be a transition from the old “Just in Time“ method of inventory management, which was one of many reasons/vulnerabilities that contributed to the chaos and disarray of the pandemic supply chain hell… to more of a “Just in Case“ inventory management strategy.

The slump in backlogs likely reflects an element of simply working through things, reopening, retooling and reinvigorating supply lines, but as I have said all along — if there is no demand then there is no backlogs. So demand is also key.

And in this chart that notion is affirmed in some respects with the surge in inventories: part of this may indeed be overcompensating for “yesterday’s battle”, but equally, this is the type of thing you expect to see when demand comes to a sudden stop…

Inventories pile up, factory orders plunge, and backlogs are no longer an issue. The next step is a growth slowdown, and disinflationary impulse. Any questions?

Key Point: Backlogs are backing down, and inventories are surging.

Please feel welcome to share the Chart of the Week!

I would greatly appreciate it if you can help spread the word ↓

The easiest way to help do that is to simply forward this email to your friends, or you can just share the chart/link on social media (be sure to mention us! :-).

Topics covered in the latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and took a bite out of some really important macro/asset allocation issues of the moment:

Review of core views: highlights from our quarterly strategy pack.

Treasury Yields: treasury yields falling through first support level.

Credit Spreads: spreads widening across the board, some significant moves.

Copper Sentiment: shake-out in positioning as industrial metals plunge.

US Dollar: USD looks to be on the cusp of breaking out on multiple fronts.

Commodities: weakness emerging as risks shift.

Stocks vs Bonds: the odds favor one but not the other.

Capital Market Assumptions: a look at the history of our expected returns.

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service check out this recent post which highlights: What you get with the service; Performance of the service (results of specific ideas and TAA); and importantly: What our clients say about it…

But if you have any other questions on our services definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn