Chart of the Week and Weekly Report Highlights

This week: Stock/Bond Ratio review, Treasuries tactics, Value vs Growth, Global Banks, Energy Sector, Macro sentiment, US dollar technicals

This email provides a look at what we covered in the latest Weekly Insights report

The weekly insights report presents some of the key findings from our institutional research service, providing an entrée experience (in terms of price and size).

Chart of the Week - Bank Stock Break Out

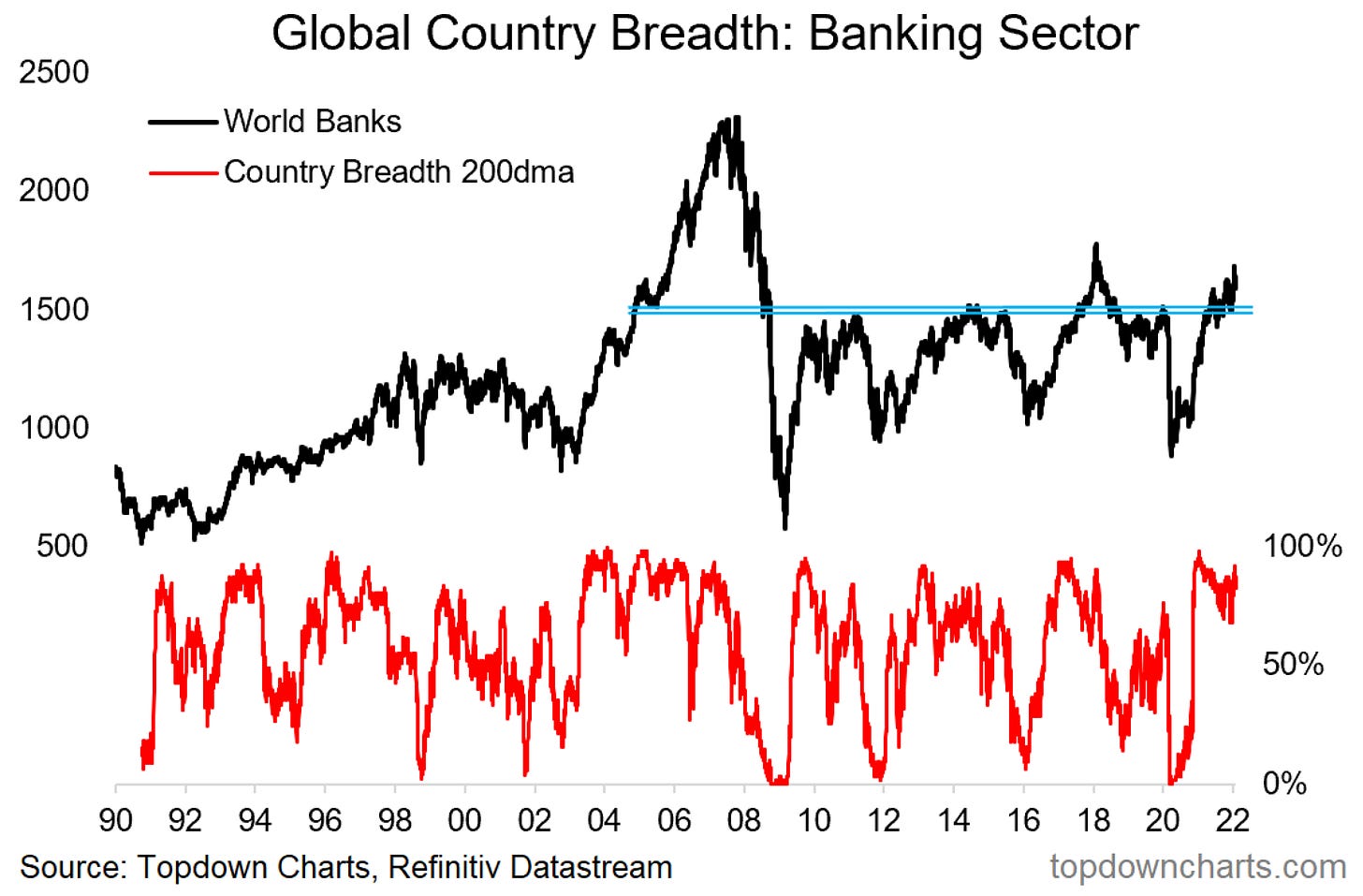

Global Banking Stocks: The banking sector has been counted out and dismissed by many investors — partly due to thematic narratives e.g. the rise of crypto/defi (decentralized finance), booming VC investment into FinTech, and social/political/regulatory crackdowns on the banking sector following the fallout from the global financial crisis. And to be fair, global banks have been a big fat range trade since 2008.

But something is brewing in the banking sector. The global bank stock index is in the process of undertaking what may well be a major breakout. Aside from the interesting price action in the index, if we look across countries the strength has been widespread with 90% of countries’ bank stock indexes tracking above their respective 200-day moving average (by contrast, just over 50% of the S&P500 is tracking *below* their 200dma).

Supporting the bullish technicals is an attractive valuation setup (global banks are cheap vs history, cheap vs the rest of the market, and global ex-US banks are cheap vs US banks). Also of note is the macro outlook: the banking sector is here to stay, certainly at least in the immediate term, and will benefit from higher yields, strong housing markets, and recovering real activity as reopening resumes.

Key point: global banking stocks are breaking out.

If you haven’t already, be sure to subscribe to our paid service so that you can receive the full reports ongoing (along with access to the archives, monthly asset allocation review, and Q&A).

Topics covered in the latest Weekly Insights Report:

Stock/Bond Ratio: stocks set to lose ground vs bonds?

Treasuries: a window of further weakness in treasuries

Value vs Growth: talk on turning points and drivers

Global Banks: key things to think about on the outlook

Energy Sector: the case for further upside

Macro Sentiment: where is sentiment tracking now

US Dollar: technicals and tactics

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn