Chart of the Week and Weekly Report Highlights

This week: China Macro, Capex Outlook, Corporate Tax Rates, European Equities, US Dollar, Corporate Bond Sentiment, Real Estate Sentiment

This email provides a look at what we covered in the latest Weekly Insights report

The weekly insights report presents some of the key findings from our institutional research service, providing an entrée experience (in terms of price and size).

Chart of the Week - China Property Market

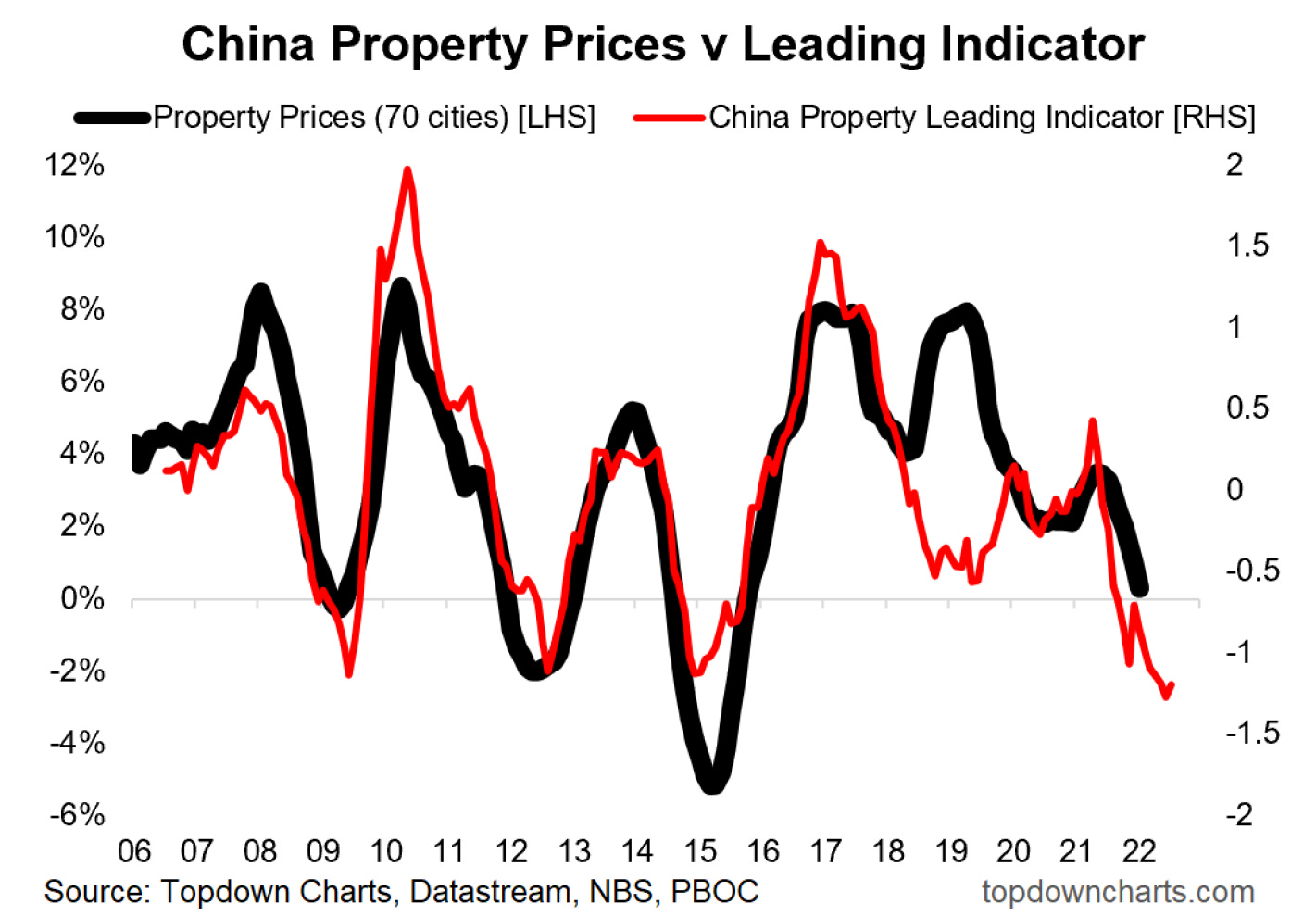

China Property Prices: The Chinese property market downturn extended through January, with the majority of cities seeing prices fall vs December, and close to 50% of cities seeing house prices decline vs this time last year. On top of that, the composite leading indicator (money supply, interest rates, property stocks) continues to point to further downside for property prices.

I remain of the view that this is perhaps the most important chart for China macro, emerging markets, and commodities. It highlights the risks and downdrafts currently facing the Chinese economy, but also points to the imperative for policy easing.

With Chinese inflation gauges beginning to taper off, clear softening in the macro pulse (+wobbles in the global growth picture), and downside risks to property… along with the fact that this is basically an “election year” for Xi Jinping (his 3rd 5-year term is scheduled to be confirmed later this year — stability is top of mind): all signs point to more stimulus.

Key point: Expect stepped-up monetary/fiscal/credit stimulus in China this year.

If you haven’t already, be sure to subscribe to our paid service so that you can receive the full reports ongoing (along with access to the archives, monthly asset allocation review, and Q&A).

Topics covered in the latest Weekly Insights Report:

China Macro: Review of policy settings/drivers and likely shifts.

Capex Outlook: Why a multi-pronged global investment boom is likely.

Corporate Tax Rates: Expect an end to this 40-year trend.

European Equities: Weighing up risks vs opportunities.

US Dollar: Change in view given shifts in technicals, macro picture.

Corporate Bond Sentiment: Bearishness prevails and fund flows plunge.

Real Estate Sentiment: Sentiment is souring as headwinds set-in.

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn