Chart of the Week and Weekly Report Highlights

This week: Global Equity Technicals, Valuations & Monetary Policy, EMFX, EM Fixed Income, LatAm Equities, China H-Shares, Bank CDS, sentiment, and the US dollar index

This email provides a look at what we covered in the latest Weekly Insights report

The weekly insights report presents some of the key findings from our institutional research service, providing an entrée experience (in terms of price and size).

Chart of the Week - Equity Valuation… reset?

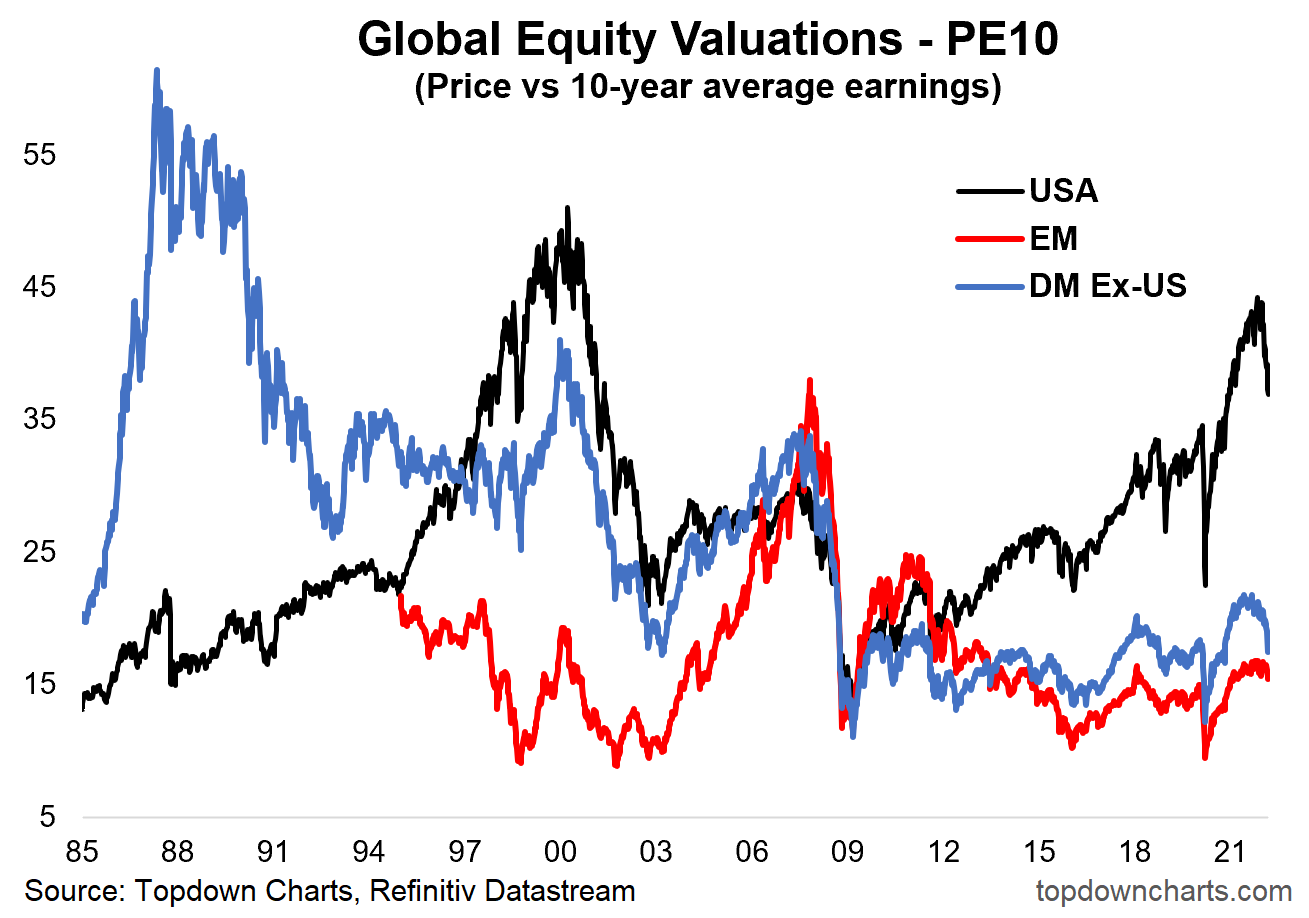

Global Equity PE10 Valuations: So there’s a few things that stand out on this chart of PE10 valuations. Perhaps the most obvious is the USA line, which sees US equities still tracking at historically high levels (despite dropping from 44x 10-year trailing average earnings, down to 34x). But US equities don’t just look elevated vs their own history, in fact the US PE10 is still 2x. and 2.1x respectively the PE10 for Developed ex-US and Emerging Markets.

Aside from the obvious, a little more subtle is the reasonably decent drop in the Developed Markets ex-US (DM Ex-US) line from 21.8x to 16.7x, which takes it into very close proximity with emerging markets (which meanwhile haven’t really moved all that much just yet).

So as noted in a recent report there does not appear to be any stand out amazing opportunities as there were in March 2020, but the relative levels and movements are very interesting (US expensive vs history and the rest, while developed has seen the biggest improvement in relative valuations so far).

EDITS: updated the stats to 12-May-2022

Key point: No big absolute value opportunities yet, but clear relative value.

If you haven’t already, be sure to subscribe to our paid service so that you can receive the full reports ongoing (along with access to the archives, monthly asset allocation review, and Q&A).

Topics covered in the latest Weekly Insights Report:

Global Equity Technicals: clear signs of weakness for global equities.

Valuations & Monetary Policy: comparing/contrasting 2020 vs 2022.

EMFX: a look at where EMFX sits ex-RU, as mixed signals prevail.

EM Fixed Income: compelling valuations and improved tactical signals.

LatAm Equities: a surprisingly strong and interesting corner of the markets.

China H-Shares: plunge in price has PE ratio at multi-year lows.

Bank CDS: US bank credit default swaps are on the move again.

US Dollar Index: Rallying to reclaim long-term uptrend line.

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn