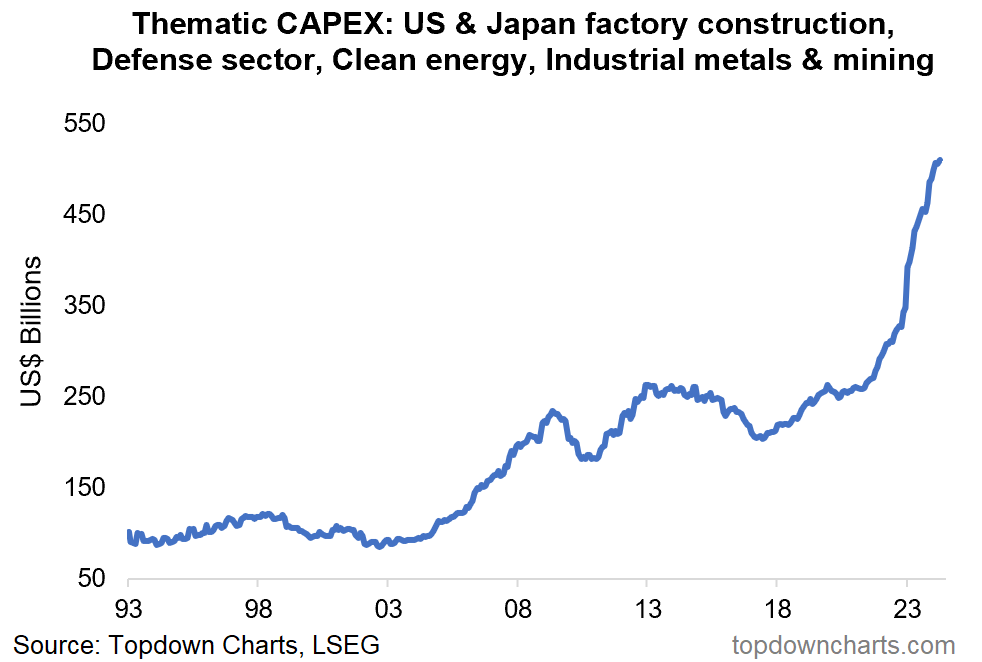

As I noted late last year, a multi-faceted capex boom is underway. The chart below aggregates some of the key components, and shows the combined upsurge (and breakout from previous stagnation).

As a reminder, the key components are US (and Japan) factory building, Europe and US defense spending, clean energy, and industrial metals and mining sector investment.

These trends are driven by a combination of geopolitics, regulatory changes, social/political movements, pandemic response, and reinforced by the ongoing post-pandemic economic expansion and lingering stimulus effects.

This theme has been one of a few factors offsetting some of the previous economic headwinds, helping key economies like the US avoid recession, and underpinning the demand outlook for commodities.

Key point: A multi-faceted thematic investment boom is underway.

Guest Post — US Reshoring Theme in Focus

As a logical follow-on, this week’s edition features a guest post from Tema ETFs talking about one of the most important trends moving markets today.

Heightened geopolitical tensions are creating more instability, sending the world into a new era of de-globalization which is forcing both governments and companies to adapt.

Supply chains are at the center of these tensions. As firms face a barrage of supply chain issues, the question for executives and governments is where to build or move productive capacity?

This has given birth to a multi-year trend, particularly in the US: reshoring, the process of firms bringing production back home. This multi-year megatrend is unfolding with far- and wide-reaching implications as well as investment opportunities captured in the RSHO fund.

Some background: Starting in the 1960s, American industrial firms began to move production overseas. Their chief motivation was lower costs of production, primarily labor. This era of globalization and trade liberalization was spurred by two major events - the creation of the World Trade Organization (WTO) in 1995 and the accession of China in 2001. China benefitted more than any other country from offshoring, as the world’s supply chains took advantage of their rapid industrialization and abundant low-cost labor.

Why are companies reshoring?

Labor cost arbitrage has narrowed. China has lost wage competitiveness against the US in a dramatic way. In the late 1990s Chinese average wages were nearly 40x cheaper than those in the US. Thirty years later, driven largely by policy (Chinese domestic minimum wages were required to rise 13% p.a.) that figure is now closer to only 4x.

Supply chains have become insecure due to increasing geopolitical tensions, such as the war in Ukraine or attacks in the Red Sea. Cost calculations are being augmented with considerations of risks to supply.

Trade wars have proliferated. The mainstream view has held that the Biden administration would be good for trade, and that Trump’s tariff fights were an aberration. Yet this has not been the case, evidenced by recent legislation. In fact, it could be argued the US took a protectionist turn as far back as 15 years.

What are the advantages of reshoring on the US economy?

Reduced order cycles, resulting from the elimination of the 6–8-week container ship journey, are making companies more responsive to end demand.

“This allows us to rapidly respond to changing customer demand and helps manage our carbon footprint”

Lego COO Carsten Rasmussen, WSJ

Lower inventories can lead to better cash flow conversion.

More reliable supply chains bring crucial component and ingredient production back home, reshoring entire supply loops.

Lower total cost – when accounting for all factors, the cost of producing domestically becomes more attractive.

Subsidies both at the federal and state level are being used as incentives for reshoring firms, which directly benefits the bottom line.

Intellectual property protection – a key risk with offshoring is no longer present.

Reshoring is also addressing a legacy infrastructure deficit. For 19 straight years, the US has been awarded a D grade for its infrastructure by its own American Society of Civil Engineers (ASCE). The US lags best-in-class countries in terms of percentage of GDP spent on infrastructure – a gap that today amounts to 0.7% of its GDP.

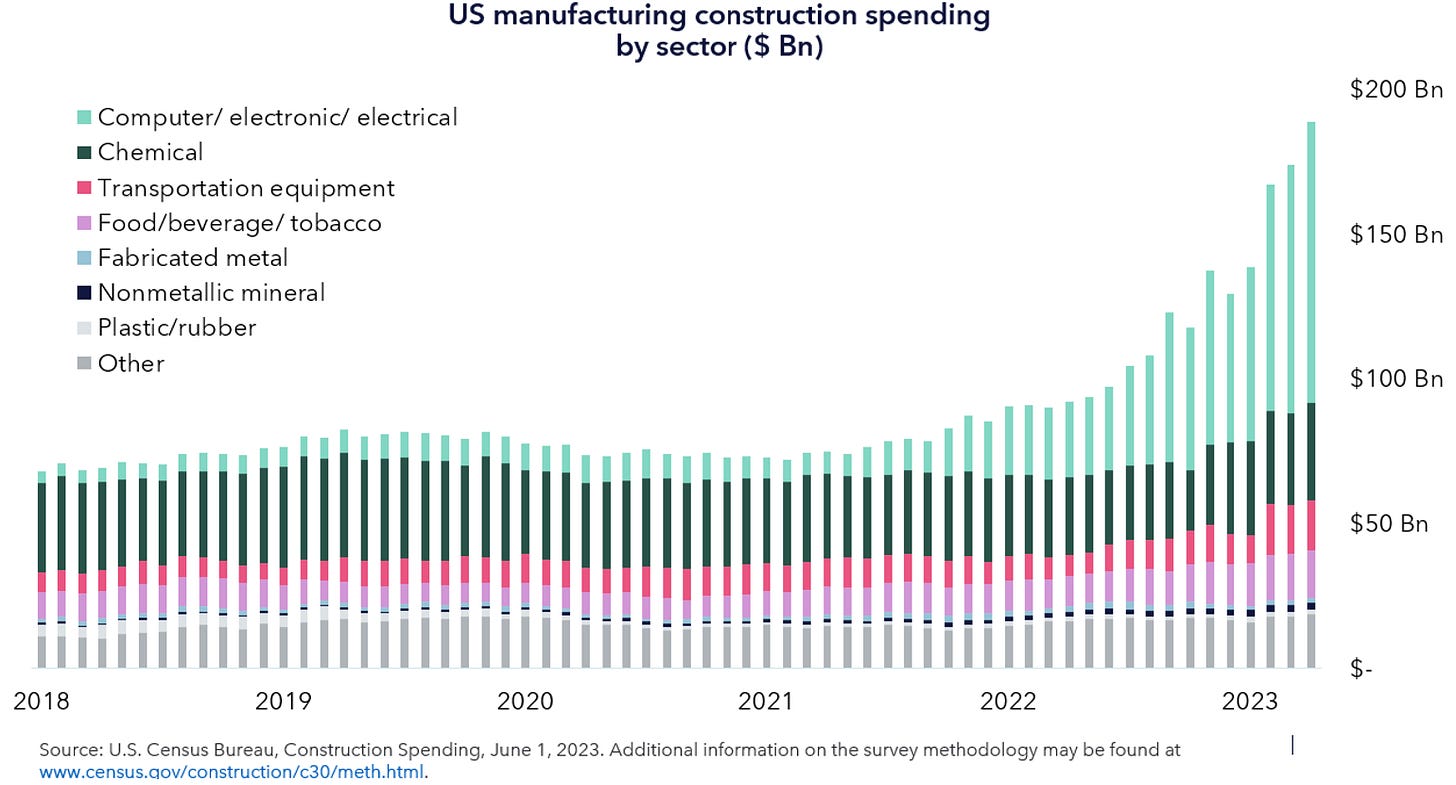

To this end, Bipartisan support through the Chips and Science Act, the Inflation Reduction Act, and the Infrastructure Investment and Jobs Act are accelerating reshoring through $1.85 (one point eight-five) trillion of commitment to industrial planning and infrastructure, the largest since the Cold War. This unprecedented government spending is already stimulating growth, with spending related to US manufacturing surging in recent years.

This brings us to this week’s chart:

Construction spending related to manufacturing, i.e. new factories, has taken a clear step up.

As US re-industrialization accelerates, automation starts to play a crucial role in transforming production processes. Automation technology has the potential to enable companies to achieve higher levels of productivity and improved product quality. All this extends well beyond simply bricks and mortar infrastructure. Reshoring is also spreading to more sectors including business equipment, autos, electrical supplies and non-energy materials. Healthcare as well is being caught up with the prospects of the US Biosecure act.

For those interested in investing behind the trend, Tema ETFs’ $RSHO solely focuses on the relocation of manufacturing and supply chains back to the United States. RSHO seeks to provide long-term growth through investment in the enablers and beneficiaries of this ongoing American industrial renaissance.

Topics covered in our latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and dug into some intriguing global macro & asset allocation issues on our radar:

Market Update: moves in equities, fixed income, FX, commodities.

Commodities & Emerging Markets: update on recent moves.

Macro Radar: what to watch the week ahead.

Ideas Inventory: update on current live ideas/outlook.

Monthly Pack: key asset allocation and macro views.

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service *check out this recent post* which highlights:

a. What you Get with the service;

b. the Performance of the service (results of ideas and TAA); and

c. What our Clients say about it.

But if you have any other questions on our services definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn