Chart of the Week - China Property

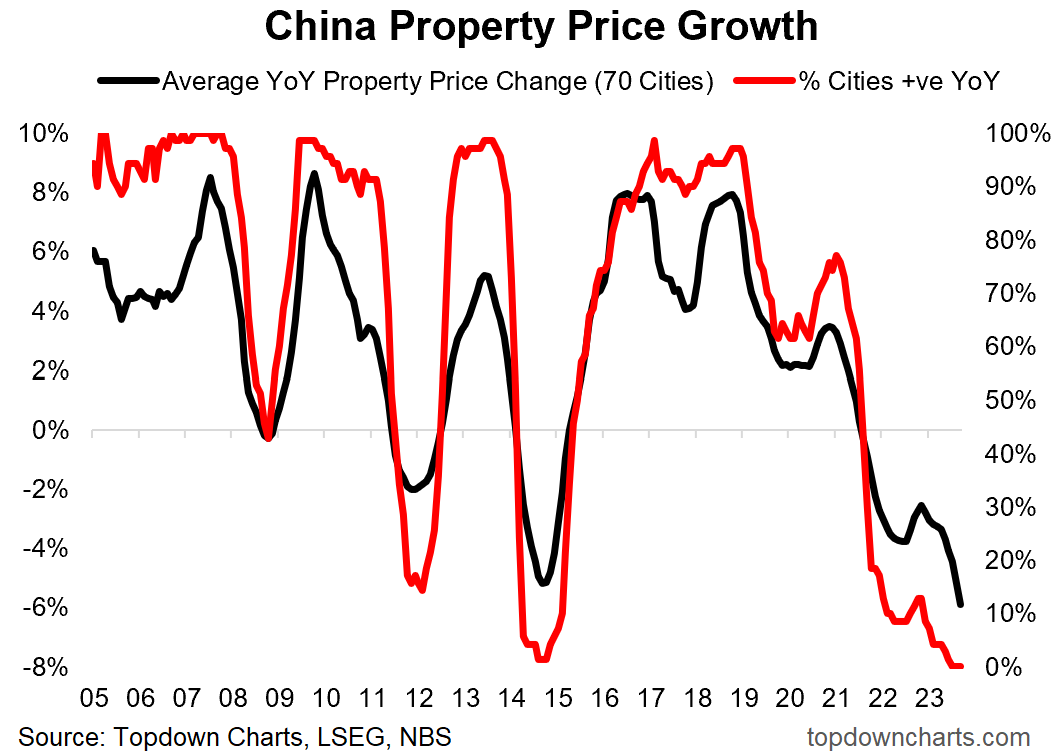

The property price downturn has been steep, broad, and drawn-out...

The latest data showed China’s property downturn worsening through March.

The annual pace of declines is the worst in recent recorded history — all 70 cities are seeing annual + monthly price declines, and the duration of the declines is also highly unusual in recent times.

The Chinese property market has historically been a key driver of commodity prices, and the current downturn is a headwind. However this has been offset so far by the global capex theme, reacceleration, and supply constraints.

Another key implication is that along with clear and persistent domestic disinflation, a weak jobs market, and poor consumer confidence – the door is wide open for monetary easing in China, and although some initial steps have been made, more needs to be done.

Hence China remains an important macro swing factor:

Stepped up stimulus would be reflationary, boost the global economy, push up commodities, EM equities.

(however), an ongoing or worsening downturn would be deflationary, present headwinds for global growth, and downside risks for markets.

Expect further stimulus, but also suspect maybe more pain is needed for more significant stimulus given the reluctance demonstrated so far, and constraints on the currency side (China rate cuts vs Fed rate hikes/hold).

Either way, keep a close eye on this corner of the macro universe… surprises on the macro front are rarely true surprises, there are always clues, and you’re being given a major clue right here!

Key point: The current property market downturn in China could have a major impact on global macro and markets in the coming months.

SPOTLIGHT: “The Weekly ChartStorm”

There’s a reason why over 40,000 people follow The Weekly S&P500 #ChartStorm – it provides a balanced and unbiased fact-check on the market.

It’s a handpicked selection of 10 charts that capture the key drivers of risk and return …helping you identify opportunities in the short-term as well as offering unique perspectives on longer-term trends.

Subscribe now, get charts, gain perspective.

Topics covered in our latest Weekly Insights Report (part of our paid entry-level service here)

Aside from the chart above, we looked at several other charts, and dug into some intriguing global macro & asset allocation issues coming into focus:

Market Update: how global markets are tracking

Healthy Correction? a damage assessment on risk assets so far

China Property: checking in on this major macro theme

REITs: looking at the potential upsides and real risks for REITs

Frontier Market Equities: technicals + valuation bull case

CMA Update: annual review of expected growth/earnings inputs

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service *check out this recent post* which highlights:

a. What you Get with the service;

b. the Performance of the service (results of ideas and TAA); and

c. What our Clients say about it.

But if you have any other questions on our services definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn