Chart of the Week - China Upside of Downside

This week: market update, risk outlook for global equities headed into 2023, China recession, policy shifts, bond market seasonality, profit margins, fund flows...

This email gives you a look at what was in the latest Weekly Insights report

Check out the full archives of the Chart Of The Week for more charts.

Chart of the Week - China Starts 2023 in Recession

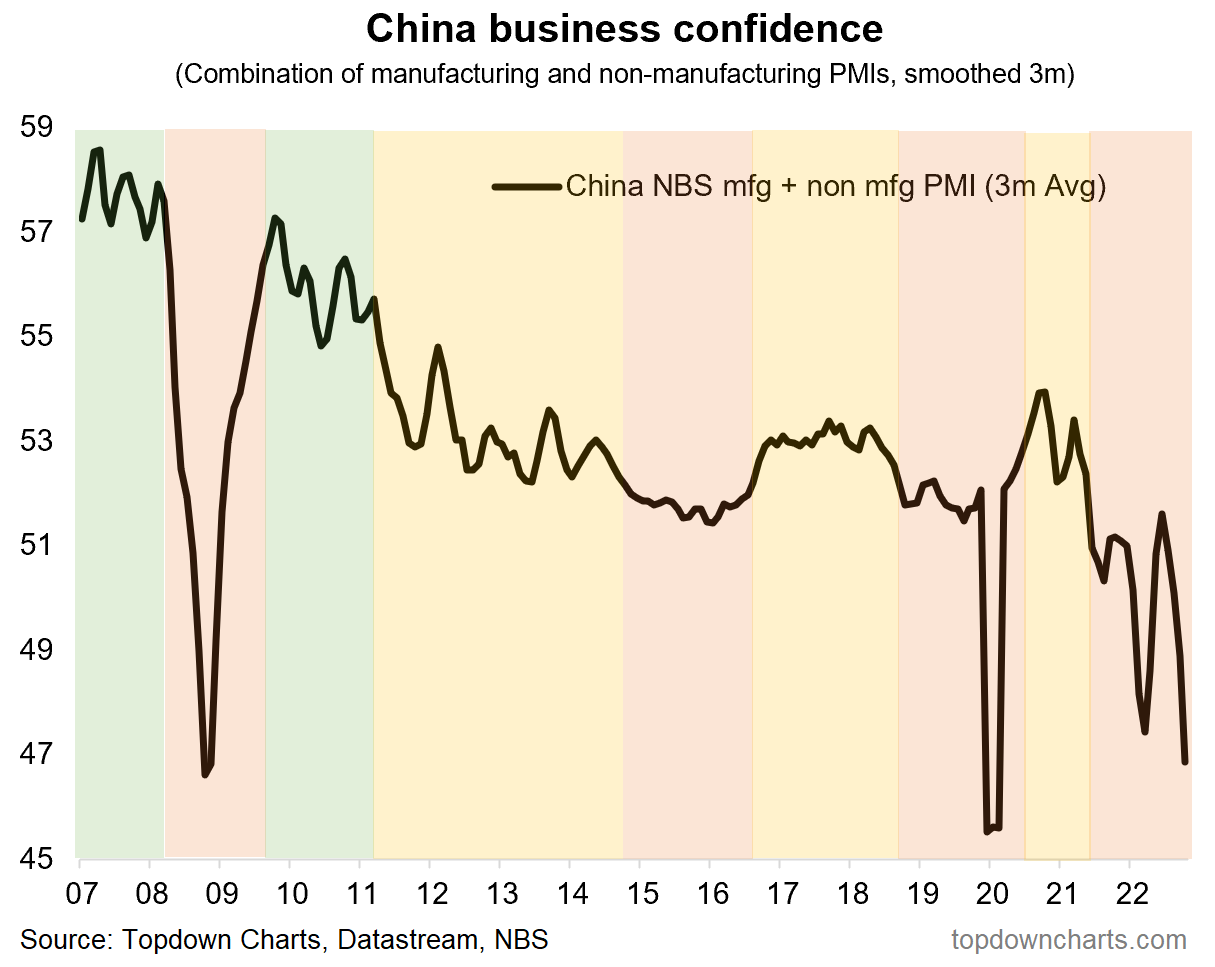

China Recession: The December PMI data showed China diving deeper into recession. The details behind the headline numbers were just as bad; employment, new orders, trader orders, services, manufacturing, all plunging to multi-year lows.

While there were already significant macro downdrafts underway (slowing global economy, property market downturn, ongoing pandemic impacts), the abrupt pivot in covid policy has further knocked confidence and activity short-term. On the upside though, it is likely a situation of short-term pain for medium-term gain (as we have seen around the rest of the world with reopening and normalization).

The other upside is that the downside in the economy means that China will need to focus more on economics and less on geopolitics… so that probably means lower risk of escalation on the Taiwan front, and perhaps even some thawing of relations with the US as the constraint of economics trumps the preference of ideologies.

And of course the other key aspect is that it raises the odds of perhaps finally some more forceful stimulus measures (particularly as USD strength goes into the rearview mirror and the Fed gets closer to finishing rate hikes — something that had previously been a barrier to more significant easing in China given exchange rate dynamics).

So while on the surface it looks like a bad news story, and in the short-term it is, thinking further there are some sources of upside here… amongst an otherwise gloomy 2023 outlook.

Key point: China starts 2023 in recession, but there are upsides to the downside.

Be sure to Subscribe the Chart of the Week so you can receive this emails ongoing.

Also, check out the full archives of the Chart Of The Week for more interesting charts.

Topics covered in our latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and took a bite out of some interesting and important macro/asset allocation issues right now:

Market Update: value vs growth, emerging markets, credit spreads, bond yields.

Global Equity Technicals: decidedly bearish tone headed into 2023.

China Outlook: recession is clearly there, but some upsides.

Small Central Bank Pivot: smaller central banks are on the move.

Bond Market Seasonality: surprising seasonal trends for H1.

Peak Profit Margins: globally, profit margins are peaking at stretched levels.

Fun With Fund Flows: from “buy everything“ to ”sell everything”.

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service check out this recent post which highlights:

— What you get with the service;

— Performance of the service (results of specific ideas and TAA); and importantly:

— What our clients say about it…

But if you have any other questions on our services definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn