Chart of the Week - CRE Prices in Perspective

Probing price history, cycles, and risk in this important asset class...

They say real estate always goes up.

And when the credit taps are on that’s generally the case.

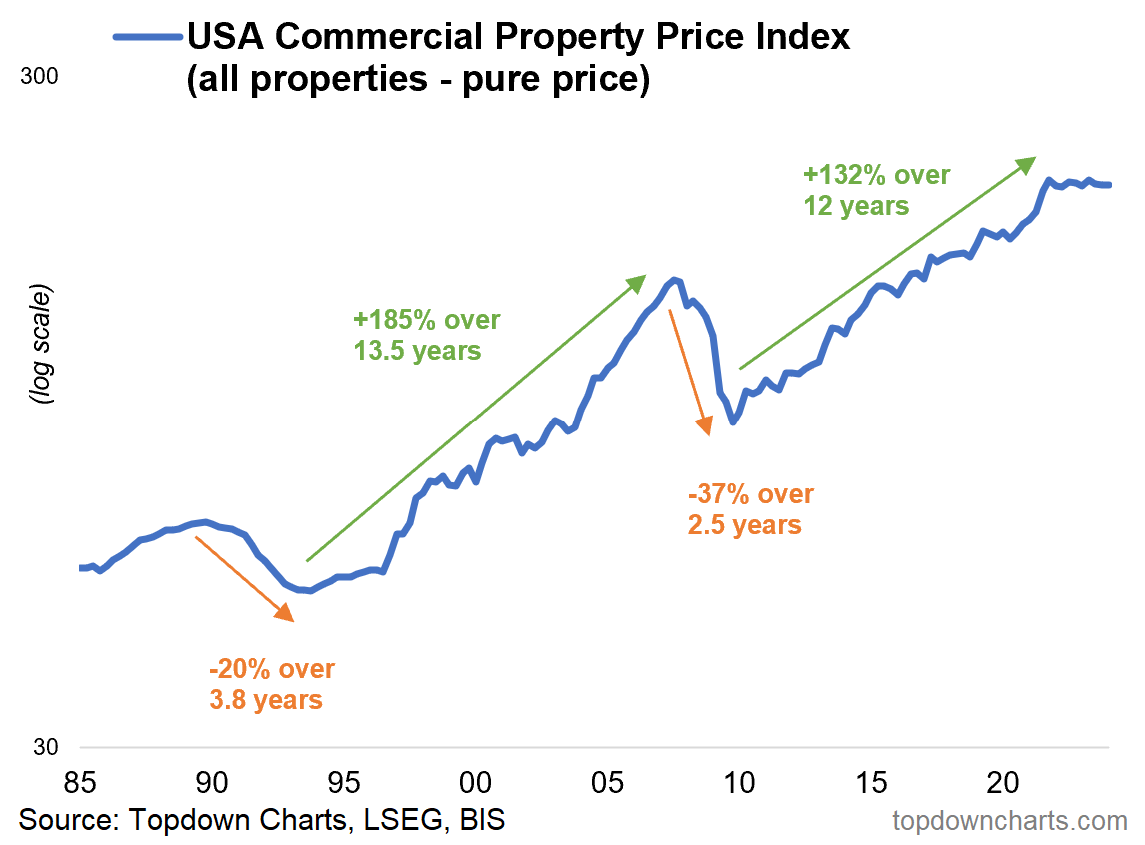

Indeed, the longer-term picture for US commercial real estate prices is up and to the right — long periods of large positive returns.

Punctuated by the occasional *ruinous* downturn.

Looking a little further back, it’s interesting to note that such deep prolonged drawdowns are actually relatively rare — and more of a product of recent times.

Indeed, it may surprise some to see CRE turning in solid consistent price gains during the 1970’s decade of inflation shocks and interest rate surges.

CRE can withstand higher rates if inflation is high enough because generally inflation means higher asset prices and higher rents.

Picturing it slightly differently, if we look at the major drawdowns, it’s really only the early-90’s and 08 financial crisis that stick out… and there’s a clue there.

As I said at the start, if the funding taps are on and credit is flowing then it’s up and to the right. The problems come when you have a period of dumb behavior by banks and investors (over-leveraging, lax lending, risk amnesia) — ultimately terminating in a banking crisis.

Banking crises hit CRE so hard because it becomes circular: higher rates put over-extended borrowers under pressure, banks tighten up, borrowers come under greater pressure, banks take losses, credit taps turn *off*, borrowers hit the wall, fire sales ensue, banks take further losses, scramble to call in loans… crisis mode activated.

Typically by that point a monetary policy (and/or regulatory) response ensues, and the healing process begins…

Arguably, part of the regulatory/monetary/behavioral response is (or should be) an institutional memory and regulatory shackle that attempts to correct the misbehavior of the past.

Given this and demonstrated Fed responsiveness you might argue we are *not* due for another catastrophic downturn in CRE. And if you focus on the point that the only way you really get a proper downturn in property is when the banks come undone… well, let’s face it CRE will be the last of our worries in that scenario (unless you are a highly leveraged CRE investor!) and the usual best practice approaches in strategic and tactical asset allocation should help defend against that (diversification, hedging, market timing).

But in terms of things to monitor, obviously we need to keep an eye on the level of rates (another surge higher for longer could trigger weak spots), the path of the economy (recession would mean lower demand for commercial real estate leasing, tenant stress, bank credit tightening), and indeed the banking sector itself (but also private credit and shadow banking!).

Indeed, private credit is often marketed as an alternative to bank financing — which is a double edged sword: on the one hand there is another pool of capital to swoop in on troubled assets (providing liquidity) and filling the funding gap (lending when banks won’t). On the other hand, this could lead to more aggressive risk appetite in lending decisions (especially as investors pile into private credit).

And from a banking/credit system standpoint that’s the usual path to trouble. Folk think they’ve invented a new way of doing things, reinvented the wheel, when more often than not they’re either performing regulatory arbitrage or pushing harder on risk. This is not a prediction or attack on private credit (it has its place), but a prompt to ponder as investors chase returns and the cycles of the economy, rates, and risk-taking run their natural course.

Key point: Large drawdowns in CRE are relatively rare (but ruinous), and tend to be a product of banking crises (and symptom of wider misbehavior).

SPOTLIGHT: Topdown Charts Professional

Since launching in 2016, our institutional research service has become a trusted source of insights to some of the world’s largest investors. We provide clients with a flow of ideas, risk management input, and meaningful macro insights from a global multi-asset investor perspective. Try it now or get in touch for more info.

Topics covered in our latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and dug into some intriguing global macro & asset allocation issues on our radar:

Global Equity Technicals: health check on equities across DM/EM/FM

China Macro: important update on the policy picture, macro, markets

EM Equities: what’s the outlook, key drivers, how it stacks up

EM Bonds: value/cycle/monetary/sentiment picture for EM sovereign

US Housing: does an adjustment need to take place? (and how?)

REITs: the upside vs downside risks, strategic vs tactical view

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service *check out this recent post* which highlights:

a. What you Get with the service;

b. the Performance of the service (results of ideas and TAA); and

c. What our Clients say about it.

But if you have any other questions on our services definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn