There’s a change in the air.

The gloomy macro clouds of the past few years are starting to lift.

Once weak and lagging parts of macro and markets are starting to stir,

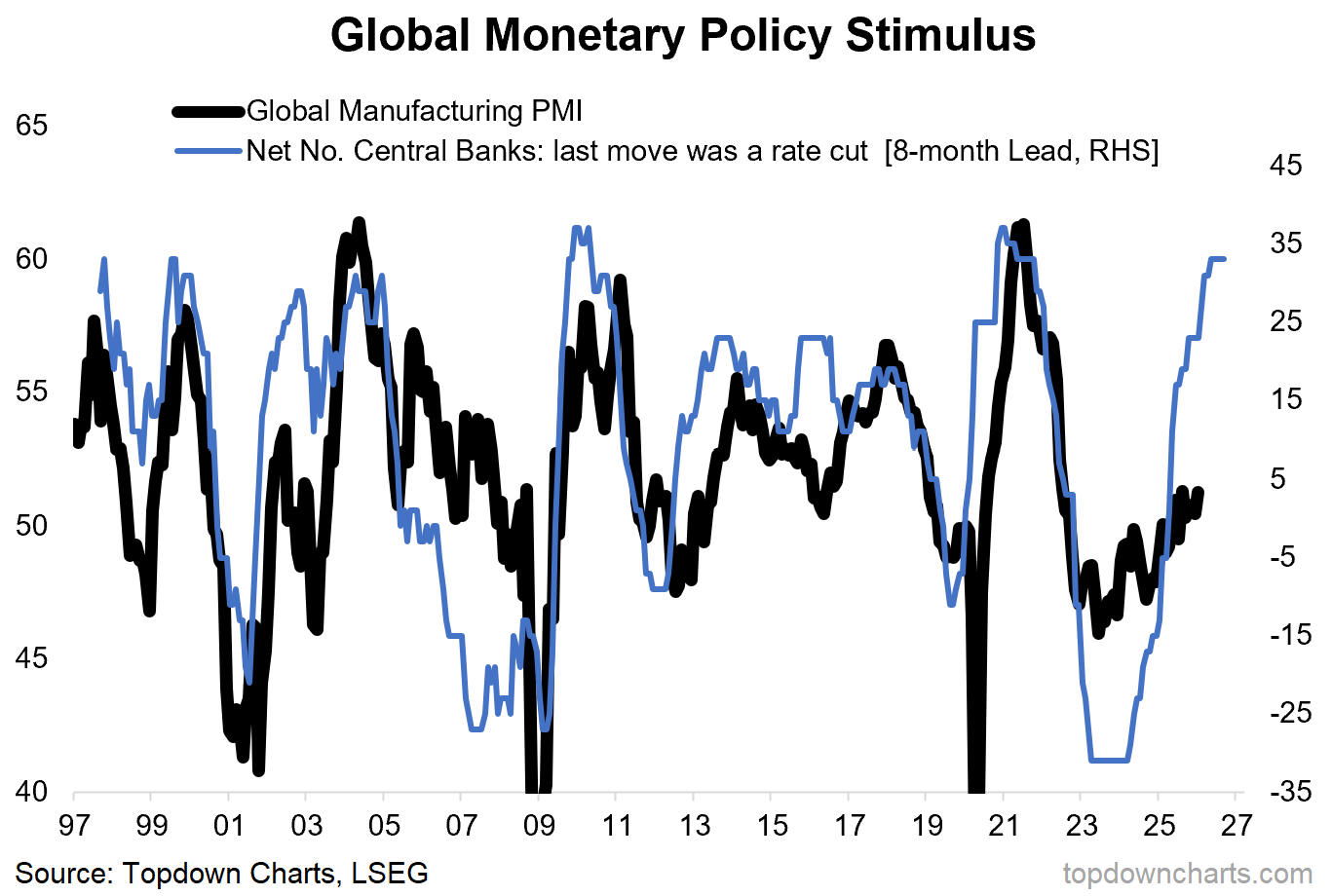

and a major macro theme I’ve been tracking is showing increasing signs of finally kicking full-swing into gear — today’s chart lays it out simply.

Basically what we’re looking at here is a procession of policy pivots from big easing in 2020/21, panic tightening in 2022/23, and then back to easing in 2024/25.

The result?

Major monetary tailwinds are kicking-in right now.

And we are seeing this having a clear positive impact on some of the key areas of the global economy that have previously been in deep stagnation: manufacturing, global trade, commodities, heavy industry.

Real world, real growth, traditional cyclical parts of the economy are waking up from slumber (and seemingly taking back charge in relative stock market performance after a decade+ of software and tech domination).

If this is true, and there is plenty of emerging evidence (such as the chart below), then we are likely to see a robust and durable rally in commodities, emerging markets, and traditional cyclicals. The downside is that tech, crypto, and fixed income likely take a back seat in this type of macro environment (and that’s precisely what we’ve seen playing out over the past few months).

So it’s key development, a key theme, with major implications for investors — and something we’re tracking closely (stay tuned for more updates!).

Key point: Global growth reacceleration is underway.

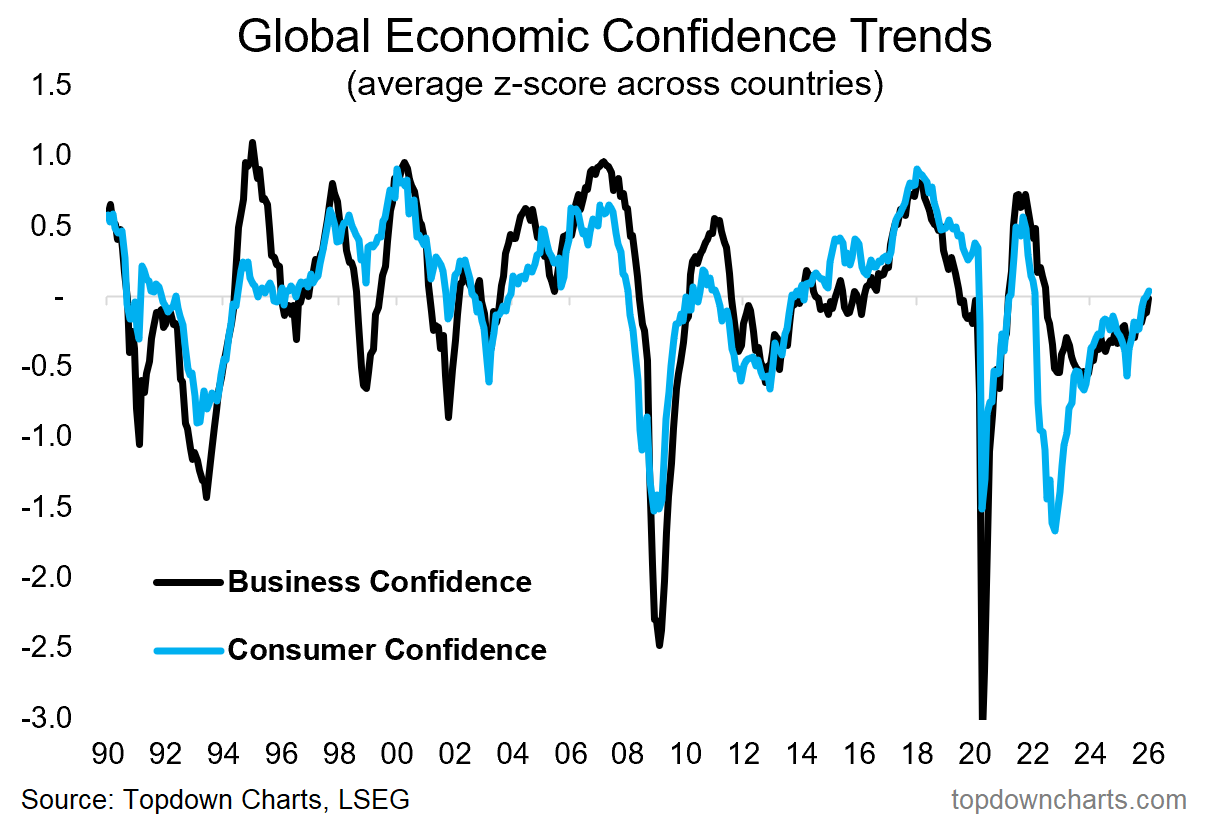

Bonus Chart — Confidence Revival

With all I discussed above I couldn’t keep this one to myself!

This chart tracks the average z-score (i.e. normalizing each series in terms of where it is tracking vs long-term average so it can be put in common comparable terms) across every country that has consumer and business confidence surveys.

In other words, it is a global barometer of economic confidence.

The first thing to note is how out there in the real world, consumers and businesses have been having a tough time in recent years — while there was no official recession, with the inflation shock, rise in rates, and exhausting (geo)political news/noise flow, we’ve basically been through a confidence recession [albeit others call it a k-shaped economy, stealth recession, vibecession, etc!].

And now, as I noted earlier, the clouds are lifting…

Poll: what’s your take?

n.b. If you haven’t yet, be sure to subscribe to this [free] Chart Of The Week series or better yet: Upgrade to Paid for Premium macro-market Content.

Topics covered in our latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and dug into some intriguing global macro & asset allocation issues in our latest entry-level service weekly report:

Global Markets Update: equities, fixed income, FX, commodities

Global Equity Technicals: rotation is the key word!

Macro Radar: key events and technical levels to watch

Asset Allocation Review: link to monthly pack

Ideas Inventory: latest listing of live ideas/views/recommendations

Subscribe now to get instant access to the report so you can check out the details around these themes + gain access to the full archive of reports + flow of ideas.

For more details on the service check out the following resources:

Getting Started (how to make the most of your subscription)

Reviews (what paid subscribers say about the service)

About (key features and benefits of the service)

But if you have any other questions definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

NEW: Services by Topdown Charts

Topdown Charts Professional —[institutional service]

Topdown Charts Entry-Level Service —[entry-level version]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack —[Gold charts]

Australian Market Valuation Book —[Aussie markets]

I'm in the middle+, I.e. a modest pickup ...

I would say I am not sure monetary policy has had any impact since the bazooka of 2020... i.e. tinkering around with FF rate did not seem to have any effect...massive money printing and fiscal have been the drivers, no?