Chart of the Week - Frontier Markets

Explorations on the Frontier of global equities...

Frontier Markets is one of those obscure corners of Global Equities that often gets overlooked. There’s not much data and research on them, perceptions often see them as risky —not worth bothering with when you can just get emerging markets, and performance post-2008 has been fairly uninspiring.

Firstly, what is it? I am referencing the MSCI Frontier Markets Index — basically it’s the next tier down from emerging markets (while developed markets is the next tier up). They tend to be smaller, less liquid, less developed stockmarkets vs those in Emerging Markets, but are still otherwise investable. See: MSCI country classifications.

The country membership in this index is a bit of a revolving door — the best ones tend to get promoted to emerging markets, and then the worst emerging markets are often demoted to frontier. But you also get some countries kicked out of frontier altogether into standalone status if geopolitics or capital market/FX issues make them uninvestable.

That said, it tends to be a very diverse set of countries …literally on the frontier of where investors usually hunt for opportunities. The current list covers Asia (Bangladesh, Pakistan, Sri Lanka, Vietnam), Middle East (Jordan, Oman, Bahrain), Eastern Europe (Croatia, Estonia, Iceland, Kazakhstan, Latvia, Lithuania, Romania, Serbia, Slovenia), and a dozen African nations.

And the data reflects this; Frontier Markets have historically had a lower correlation to developed markets than Emerging Markets, and lower historical volatility. So rather than adding risk, Frontier equities actually add diversification.

Meanwhile as a group, Frontier Market countries have superior demographics, and are set to see significantly higher population growth vs the rest of global equities (underpinning growth/earnings), this along with cheap valuations positions them well in terms of longer-term return expectations.

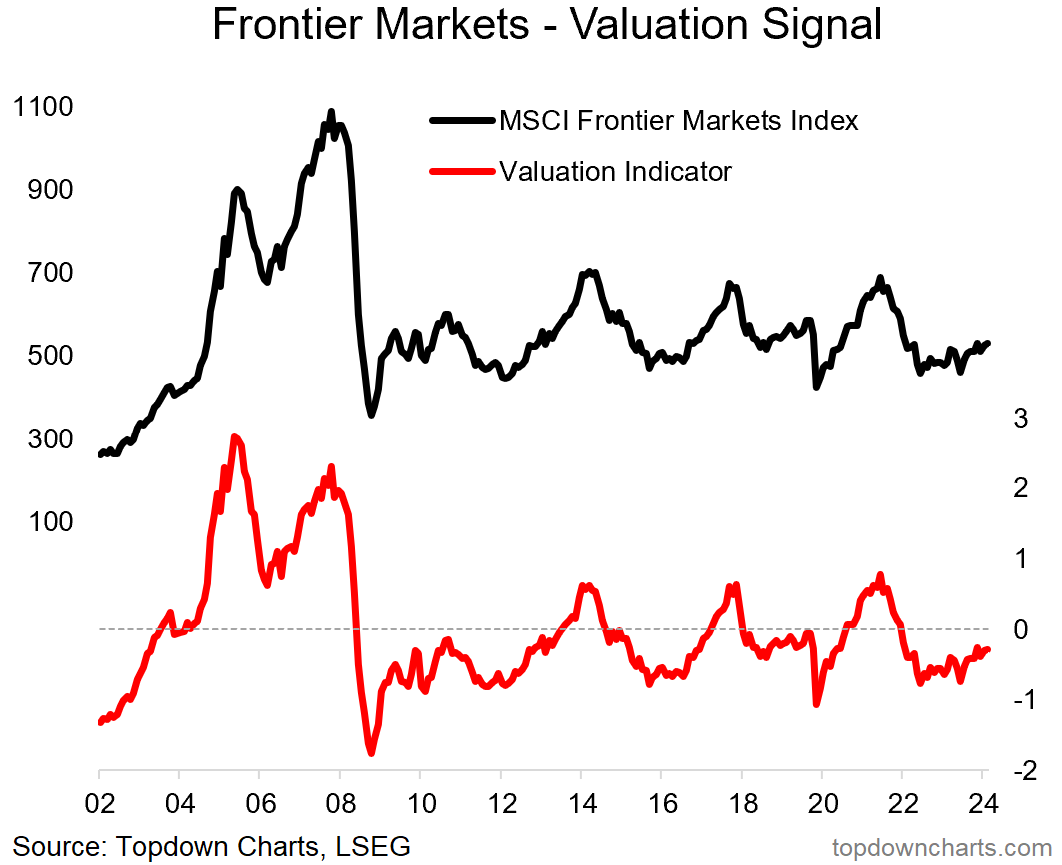

And that brings us to this week’s chart from the latest Weekly Insights report (and covered in more detail in the Weekly Macro Themes chart pack).

Frontier market equities are currently showing up as cheap (and the indicator has turned up from previous extreme cheap — a bullish cyclical sign). Breadth and technicals have also been on an improving path, but the key from here in completing the bottoming process will be to break through current overhead resistance and make new post-2022 bear market highs (and there are potential catalysts, as noted in the report).

So it’s an interesting corner of the market, with interesting strategic features, and increasingly interesting tactical features…

Key point: Frontier Market equities are cheap and appear to be in the later stages of establishing a new cyclical bull market.

ICYMI: Perspectives Pack - 91 Charts on US Stock Market

The Weekly ChartStorm presents: Perspectives Pack special report

Topics covered in our latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and dug into some pressing + provoking global macro & asset allocation issues on our radar:

Markets: tech stocks, treasuries, USD and commodity charts

Crude Oil Outlook: tracking near-term upside risks (technicals)

Interest Expense Trends: corporate interest expense + outlook

EM Fixed Income: risks vs opportunities in emerging market debt

GSV vs ULG: Global Small Value stocks vs US Large Growth

REITs: a very mixed picture, but some upside charts to noted

Frontier Markets: a closer look at value, technicals +catalysts

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service *check out this recent post* which highlights:

a. What you Get with the service;

b. the Performance of the service (results of ideas and TAA); and

c. What our Clients say about it.

But if you have any other questions on our services definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn