Chart of the Week - Hating REITs

Examining investor Hatred of REITs (and the CRE Correction...)

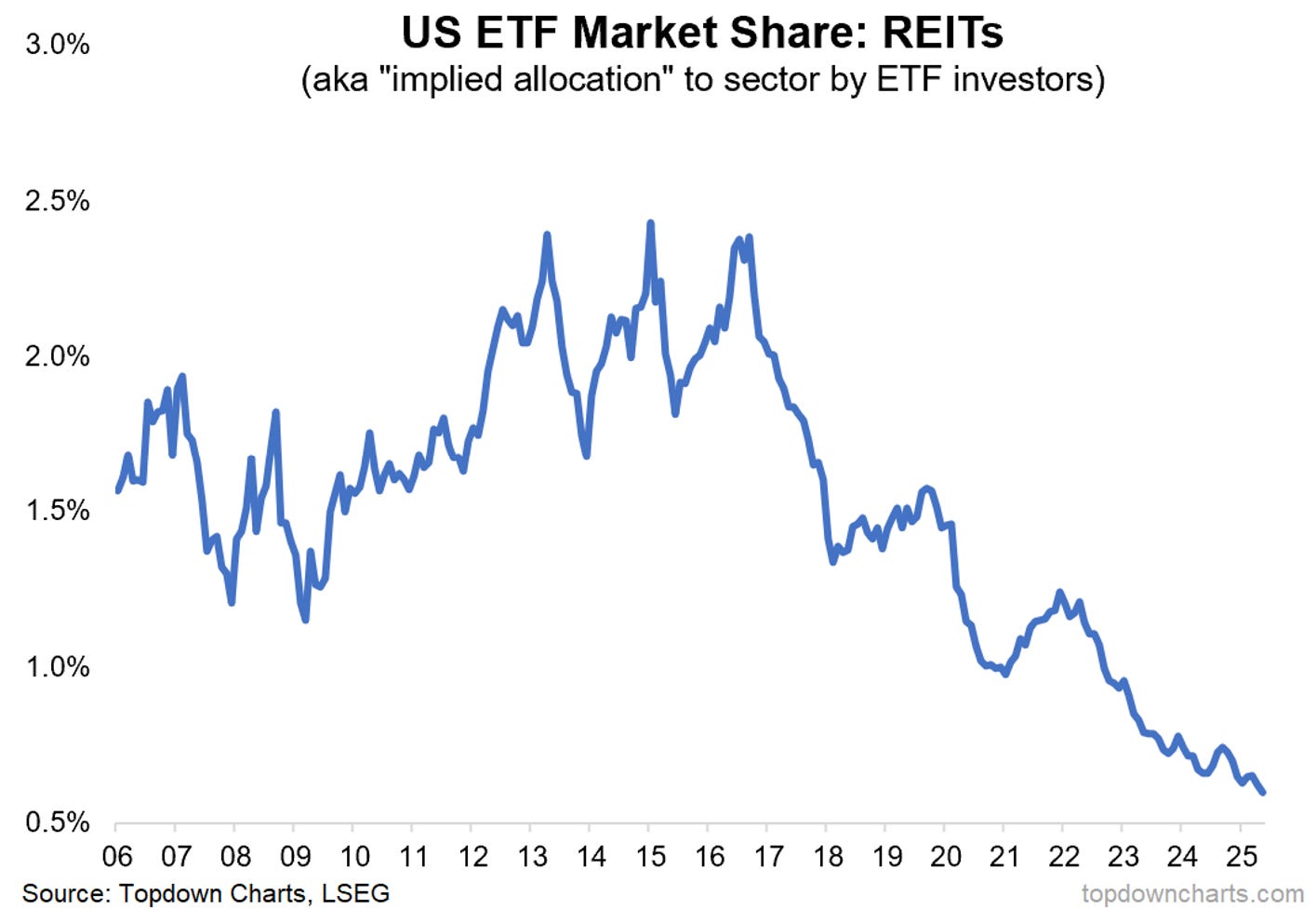

Investors hate REITs (judging by the shift in market share of REIT funds).

I call this week’s indicator (i.e. total assets under management in REIT ETFs as a percentage of all ETF assets) “implied allocations“ because we can think of it as a rough proxy for how investors in ETFs are positioned in the aggregate.

This indicator has reached an all-time low as investors have steadily drifted out of REITs and into other hotter and growthier parts of the market.

There’s to two key factors driving this.

1. Market Movements: if investors make no changes to their portfolios, market movements will shift allocations for them as some assets do better than others. For example over the past 5 years US REITs are up about 5% while the Nasdaq is up about 120% — that by itself will drive a big shift in allocations if investors just do nothing.

2. Flows and Rebalancing: but as you might guess, investors rarely do nothing — there are a further 3 forces at play; rebalancing, flows, and active decisions.

Rebalancing involves investors who started with an ideal allocation in mind bringing the portfolio back to those weights basically by selling a portion the winners and buying the losers within their portfolio.

Flows is 2-fold.

One aspect is the point that for many investors they’ll be injecting more funds into their portfolio over time, and either investing according to some ideal allocation mix or making decisions on the fly.

The other aspect is performance chasing flows; as a group investors tend to chase yesterday’s winners and shun yesterday’s losers. This behavioral dynamic is well documented, easily observable, and reinforces momentum effects. And in some respects this is a combination of flows AND market movements (as price drives sentiment and future decision making).

The final part is active decisions, which are interlaced throughout all this — rebalancing might be fully discretionary, new investors might decide to go all-in on the top performing sectors, and new money in the portfolio has to go somewhere.

But also, from time to time you change your ideal allocations and get new ideas; make active decisions in portfolio strategy and allocations.

All of this is a long way of saying that the line in the chart below moves partly due to price movements but also is heavily influenced by investor behavior and decision making. And after-all, even if you argue that it’s all just a result of market movements, the thing is investors could still decide to not go with the flow…

As for the implications, simply put: if you like REITs you’re in the minority — it’s a contrarian position to be bullish REITs, and if the sector started doing better it would leave many people surprised and underexposed.

Key point: Investor allocations to REITs are at record lows.

Bonus Chart: The CRE Correction…

In real (CPI adjusted terms) US Commercial Real Estate prices are down -26% off the peak, and have been declining for a period of 3.5 years so far.

The chart below compares and contrasts the past two major downturns in commercial real estate: the late-80’s/early-90’s was much more drawn out and also deeper than the current downturn, while the 2008 crash saw a much more rapid adjustment process and a steeper drop in prices.

It’s hard to say how much further the current downturn will run, but so far it has been a material move in both price and time — the cycle is well-progressed.

The risks from here would include: higher for longer interest rates further pressuring profitability and removing yield-chasing tailwinds, potentially alongside ongoing work-from-home and maybe even AI impacts on occupancy… along with the ebb and flow of the economic cycle (as it influences funding availability, risk appetite, and rental pricing and occupancy).

The upside would be: we’ve already seen a major adjustment in valuations, investment in new supply (construction) has been limited, and a resilient economy and labor market + hybrid/back-to-work trends have seen some work-from-home effects offset. Meanwhile this time around leverage and lending standards in the lead-up to this correction were much tighter than previous cycles (making the market somewhat less vulnerable to credit stress vs previous cycles).

So again, for a market that many commentators have been cautious on, maybe the contrarian take is that the downturn in commercial real estate is closer to turning the corner than we think. That would help REITs, and probably come as a surprise to most.

Topics covered in our latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and dug into some intriguing global macro & asset allocation issues in our latest entry-level service weekly report:

Defensive Stocks: technical bullish signals for defensives

Global Policy Pulse: trends in monetary policy, implications

US Housing Market: the pressures building up, adjustment risks

REITs: multiple mixed messages, but an interesting case

Frontier Markets: reviewing the bull case for FM equities

Commodity Equities: outlook for commodities + commodity stocks

Subscribe now to get instant access to the report so you can check out the details around these themes + gain access to the full archive of reports + flow of ideas.

For more details on the service check out the following resources:

Getting Started (how to make the most of your subscription)

Reviews (what paid subscribers say about the service)

About (key features and benefits of the service)

But if you have any other questions definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

NEW: Services by Topdown Charts

Topdown Charts Professional —[institutional service]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack —[Gold charts]

Australian Market Valuation Book —[Aussie markets]

Don’t buy reits until the great refinancing of 2025 (2026?) occurs. The bottom is only in for high end new builds in major cities that changed hands in the past 6mos. Still a long way to go…