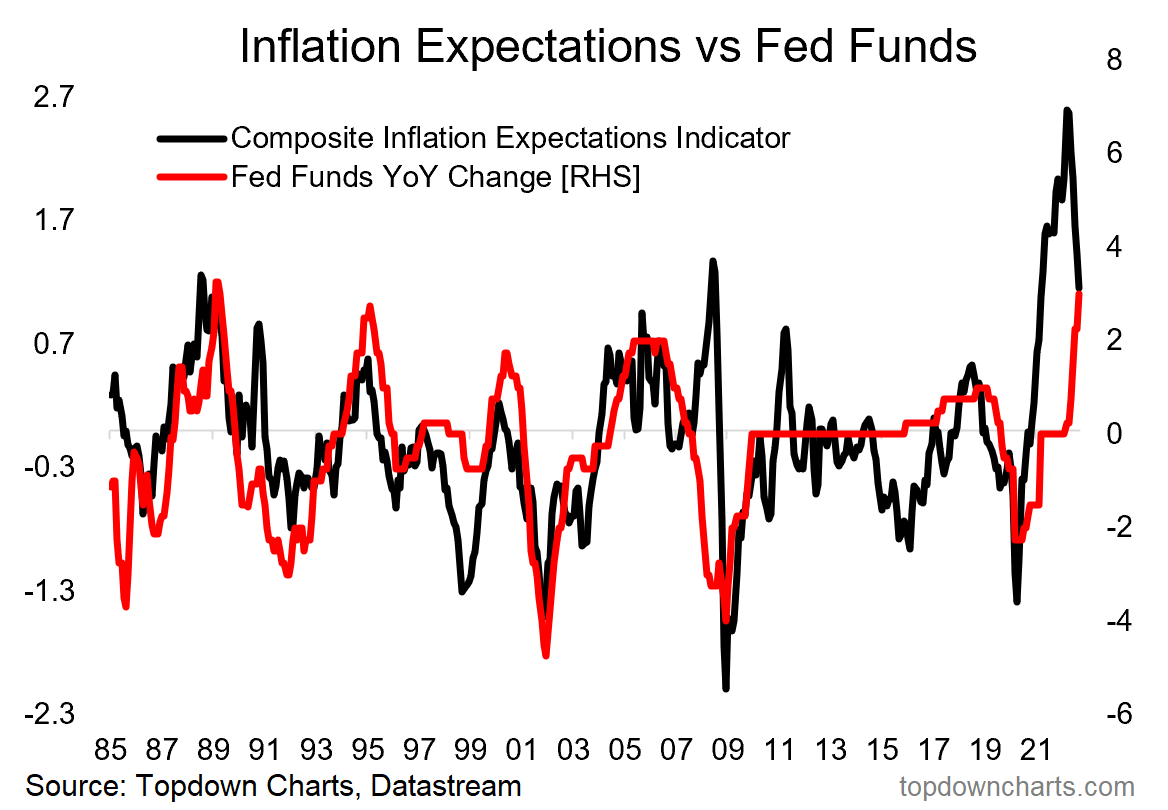

Chart of the Week - Inflation Expectations vs Fed Pivot Prospects

Inflation expectations are falling fast, but is it enough to derail the Fed's aggressive tightening plans? or is it a little bit more complicated than that....

This email gives you a look at what was in the latest Weekly Insights report

The Weekly Insights Report is part of our entry-level service: summarizing the key points, ideas and charts from our institutional research service.

Chart of the Week - Inflation Expectations and the Fed

(dis)Inflation Expectations: Declining inflation expectations will be well received by the Fed and markets with respect to the prospects of a pivot or at least a pause in monetary policy tightening.

However, despite the decline, inflation expectations are still historically high.

Central banks the world over are going to be concerned that **even if inflation expectations might have peaked** inflation ends up anchoring higher (e.g. short-term inflation expectations remain close to 40-year highs).

Persistently high inflation is (even more) damaging to central bank credibility and so they will want to know inflation is well and truly crushed before making any moves to pivot — despite a growing chorus begging for that to be so.

History has shown that pivoting too early can lead to resurgent inflation (which was initially thought to be on the decline) as was the case in the 1970s.

Promise of a pause? Pivot possibilities? Patience, please.

Key point: Falling inflation expectations are positive for eventual Fed pivot prospects, but there is still a way to go yet — and still risks of inflation staying high.

Please feel welcome to share the Chart of the Week!

I would greatly appreciate it if you can help spread the word ↓

The easiest way to help do that is to simply forward this email to your friends, or you can just share the chart/link on social media (be sure to mention us! :-).

Topics covered in the latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and took a bite out of some really important macro/asset allocation issues right now:

Quarterly Strategy Pack: webinars + Q&A being held tomorrow!

Credit Spreads: credit spreads at risk with various headwinds.

Global REITs: some progress made, but downside risks still clear.

Inflation: signs of improvement, but more work to be done.

US Asset Valuations: look at stocks vs bonds valuations.

DXY Drivers: examining the upside vs downside risks in USD.

EM Equities: update on emerging market valuations.

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service check out this recent post which highlights: What you get with the service; Performance of the service (results of specific ideas and TAA); and importantly: What our clients say about it…

But if you have any other questions on our services definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn