Chart Of The Week - US Housing Market

This week: global monetary policy pulse, housing markets and the mortgage rate shock, US Dollar, Capex outlook, Commodities, market comment and short-term global equity technical risk flag alert...

This email gives you a brief overview of what was covered in the latest Weekly Insights report including of course, the Chart Of The Week.

Check out the full archives of the Chart Of The Week for more charts.

Chart of the Week - The Mortgage Shock in Context

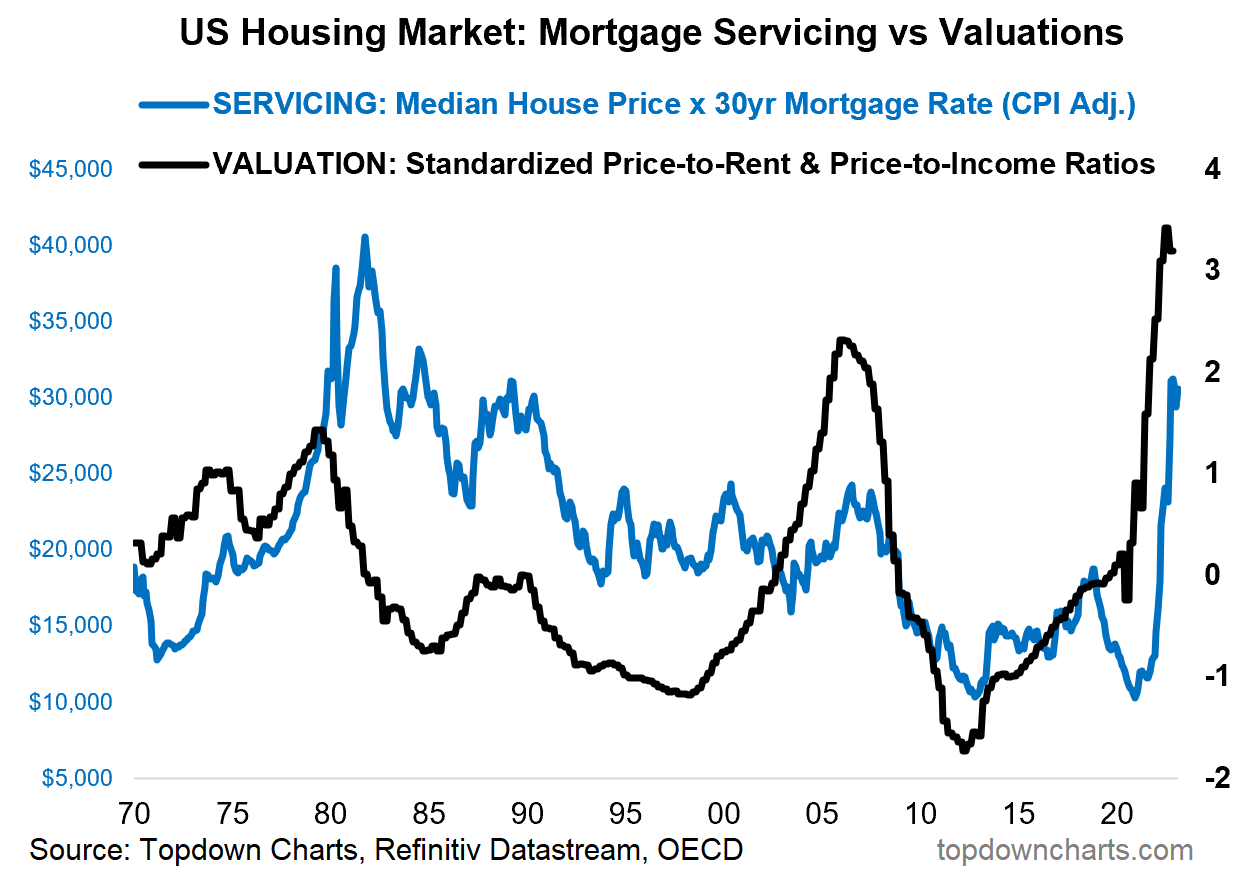

Mortgage Rate Shock — Important Historical Context: It’s remarkable to note how the inflation-adjusted servicing cost indicator for new mortgages (after rising 3x off the lows) is now on par with levels seen during the 80’s …back when housing market valuations were slightly cheap vs record expensive now.

For reference, the housing market valuation indicators used include the OECD standardized house price-to-income ratio and house price-to-rent ratios. I have combined the signal from both indicators in the chart below (black line) — the higher it is the more expensive the market is vs history.

A scenario of “higher for longer” interest rates (if that is to be the outcome) will necessitate a meaningful adjustment to housing market valuations.

Mathematically that adjustment can come in the form of lower house prices or stable house prices and higher rents/incomes (or some combination thereof). Either way, even without the mortgage rate shock, the stratospheric valuations reached this cycle are truly extreme and historically unprecedented.

Key point: The mortgage rate shock necessitates a period of valuation adjustment.

NEW: Like these charts? Check out our paid service with a 7-day Free Trial

Topics covered in the latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and took a bite out of some really important macro/asset allocation issues right now:

Global Policy Pulse: peak in the pace of hikes, pause soon, pivot later.

Housing Markets: a period of adjustment is required.

US Dollar: zooming out the dollar is down and out.

CapEx: the capex rebound theme largely run its course.

Commodities: remain bearish, but mindful of resurgence risk.

Short-Term Outlook: review of Global Equity technical risk flags.

Market Update: tracking treasury yields.

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service check out this recent post which highlights:

a. What you Get with the service;

b. the Performance of the service (results of ideas and TAA); and

c. What our Clients say about it.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn