Monthly Asset Allocation Review - December 2021

Review of markets and succinct guide to risk vs return outlook across asset classes

This email is a relatively new part of the Topdown Charts Substack service, it provides a look at some of the key outputs of our Market Cycle Guidebook - giving you a clear snapshot of our thinking on asset allocation.

Specifically, covered in this email is:

Global data pulse, policy monitor, valuation snapshot

Global economy and risk outlook

Core views across asset classes (short + medium term)

Capital market assumptions update (i.e. longer-term)

This email report is aimed at an active asset allocator audience, but should be useful to most investors in terms of providing a big picture perspective on the macro and market outlook.

Monthly Asset Allocation Review - December 2021

Topdown foreword: December saw growth assets rebound to finish the year mostly higher; the opposite was true for much of fixed income. Across assets there was decidedly mixed prospects, and it sure looks like the idea of mixed prospects will continue into 2022.

As we kick-off the year, a number of risks are front of mind (covid, geopolitics, inflation, monetary policy). On the plus side, there are pockets of relative value, a prospective capex/investment boom, clearing of backlogs, and ongoing (but stop-start) reopening to underpin growth.

Heading into 2022 the risk vs return outlook is clearly and steadily shifting across asset classes, and we’ll need to focus on both short and longer-term indicators to navigate risk as we progress later in this strange but familiar cycle.

Global Business Cycle Macroscope

Global Monetary Policy Monitor

Valuation Snapshot

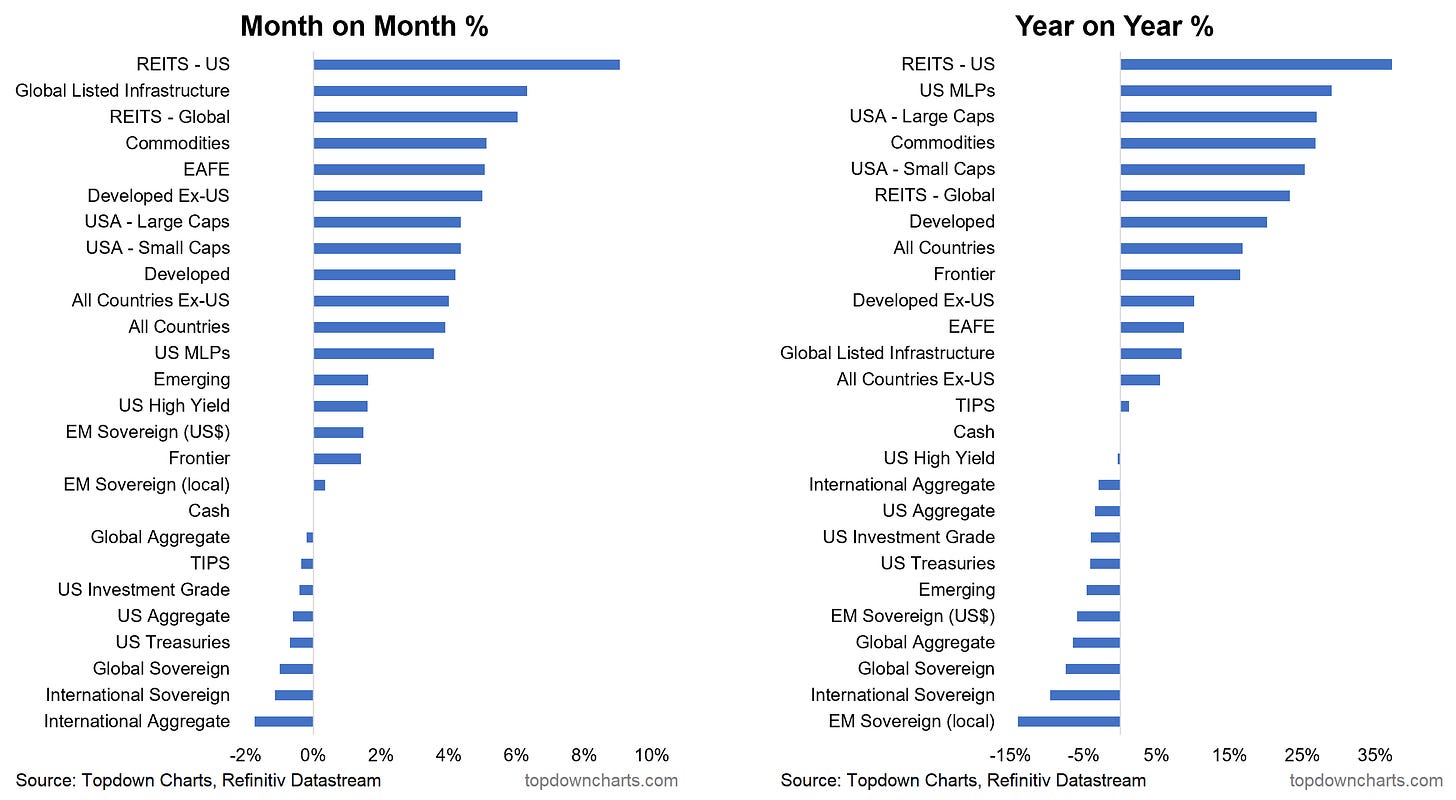

Market Overview -- Month to December: Growth assets bounced back in December to cap-off a fairly strong year, while the opposite was true across much of fixed income. Within equities the US was the standout, while EM ended slightly lower. EM fixed income also lagged behind, while commodities and REITs performed particularly well – riding the waves of pandemic disruption and inflation.

Macro Outlook

Global Economic Outlook: The base case is that the stimulus/reopening driven recovery continues into 2022 and gets a boost from a prospective capex/investment boom, clearing of backlogs, and further reopening and normalization. However, a couple of issues present uncertainty on that: the pandemic remains a reality, and while it can get better it can also get worse e.g., Europe case surge, Omicron.

The other issue is that many leading economic indicators are starting to turn down as previous tailwinds begin to fade or turn outright to headwinds. Likewise, inflation remains elevated and there has been some capitulation on the idea that it will just be transitory. The pivot by central banks from easing to tightening means the outlook headed into 2022 is a lot less optimistic than what it seemed earlier last year. The big open question will be as to whether the economy can now stand on its own feet with less stimulus.

Risk backdrop: The biggest risk to growth assets from a structural standpoint seems to be that inflation triggers a faster and more widespread removal of monetary stimulus than expected – this is not a tail risk as such because it is already in progress. Shorter term of concern is the varying speed of vaccine rollout vs virus mutation, with the delta + omicron variants examples of this risk. Diverging economic prospects likely see pressure points exposed e.g., in emerging markets where monetary policy is being rapidly tightened. Geopolitical risk also remains a big concern with “Cold War 2.0” sentiment simmering.

Summary View Across Asset Classes

The below table provides a “cheat-sheet“ summary of our views across the major asset classes. Short-term is typically in the order of months/quarters (less than a year), while medium-term is more a through-the-cycle view (multi-year).

Asset Class Ratings and TAA Guide

As a reminder, we do not manage any money, or provide personal financial advice, nor offer securities. The purpose of the following tables is to provide a high-level positioning indication based on our analysis and indicators across the various asset classes, from an unbiased/generic multi-asset investor perspective. The asset class ratings are quantitatively driven, but judgement is applied.

Capital Market Assumptions (Long-Term View)

The following is an extract from our capital market assumptions dataset. These represent a 5-10 Year forecast based largely on quantitative inputs. They are presented in nominal terms, on an annualized basis, and are stated from the perspective of a US dollar denominated investor.

December Update: Strong rebound in markets during December saw expected returns drop slightly for equities and commodities, higher bond yields helping the forward-looking prospects for fixed income.

If you haven’t already, be sure to subscribe to this paid service so that you can receive these reports ongoing (along with full access to the archives and Q&A).

Thanks for your interest. Feedback and thoughts welcome in the comments below.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn