Monthly Asset Allocation Review - July 2021

Key insights from the monthly report: macro outlook, asset class views

NEW: This is a new report for the Topdown Charts entry-level Substack service.

>> I would call this experimental, so feedback is very welcome.

Just like how the Weekly Insights email summarizes the findings of our weekly reports, this new monthly email provides a look at some of the key outputs of our Market Cycle Guidebook - giving you a clear snapshot of our thinking on asset allocation.

Specifically, covered in this email is:

Global data pulse, policy monitor, valuation snapshot

Brief recap of the previous month

Global macro/risk outlook

Core views across asset classes (short + medium term)

Capital market assumptions update (i.e. longer-term)

I decided to add this to the entry-level service because I think it provides a good high-level state-of-the-world assessment, with fairly clear takeaways across all the major asset classes. So you’ll never be left guessing what our core views are.

Hope you find it interesting and useful.

Monthly Asset Allocation Review - July 2021

Topdown foreword: The beginning of the second half of the year has brought what feels like a new phase of the recovery. Previous rotations have “un-rotated”, policy is increasingly pivoting from easing to tightening, virus resurgences are driving short-term economic divergences, and backlogs continue to bight.

Heading into the next phase of the recovery, we look for the consumer and a prospective multi-pronged capex/investment boom to drive demand and further tighten capacity utilization. It’s worth echoing again the assertion that the pathway into the pandemic was abrupt and unknown, but the pathway out looks more familiar: and hence we should pay close attention to the reliable macro/market signposts to guide us on the evolving risk vs return outlook.

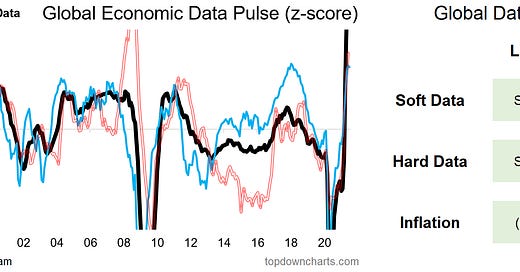

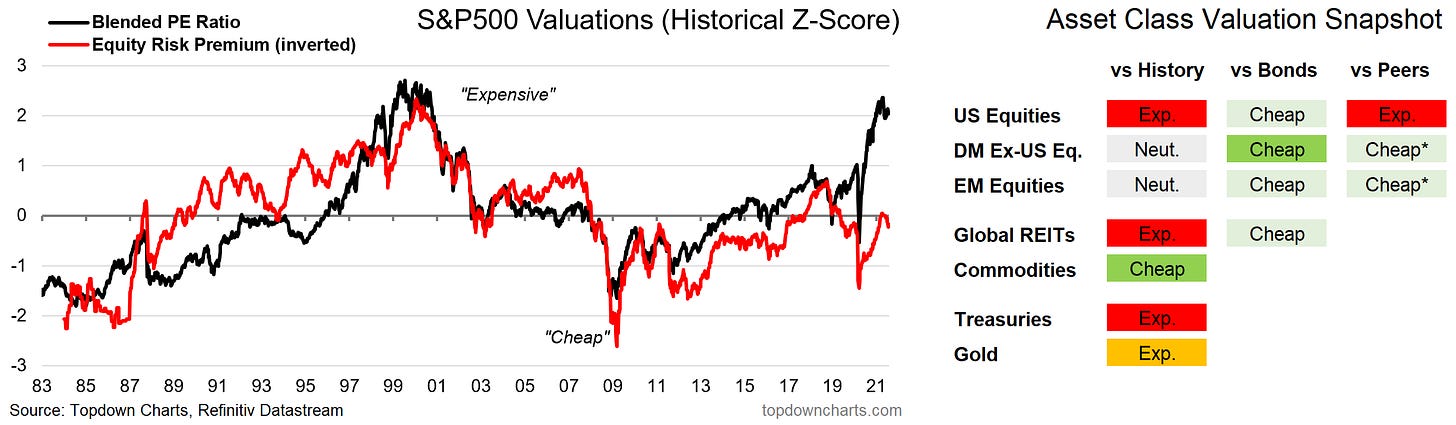

Global Business Cycle Macroscope

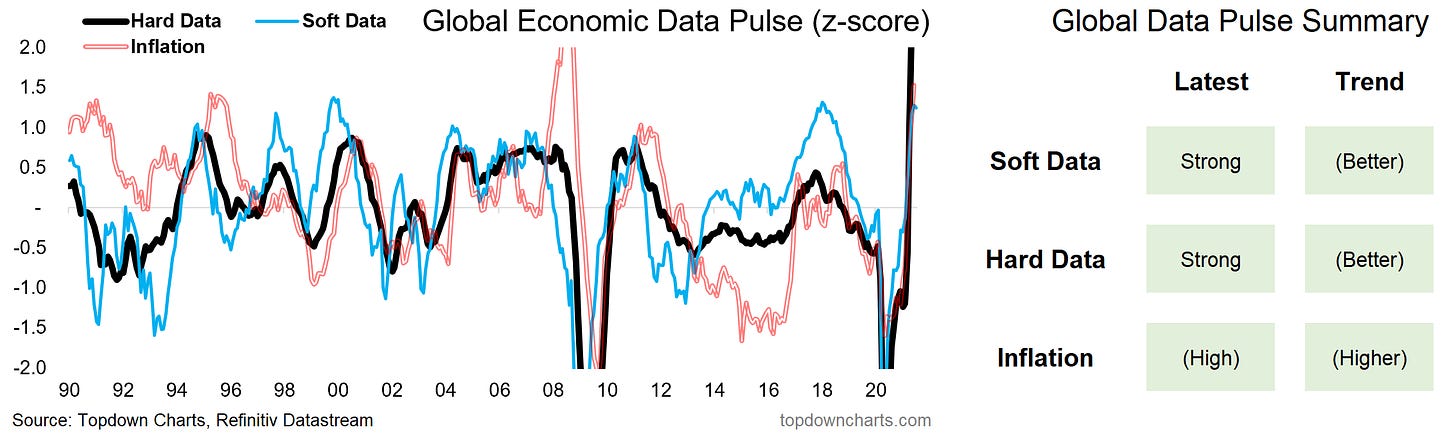

Global Monetary Policy Monitor

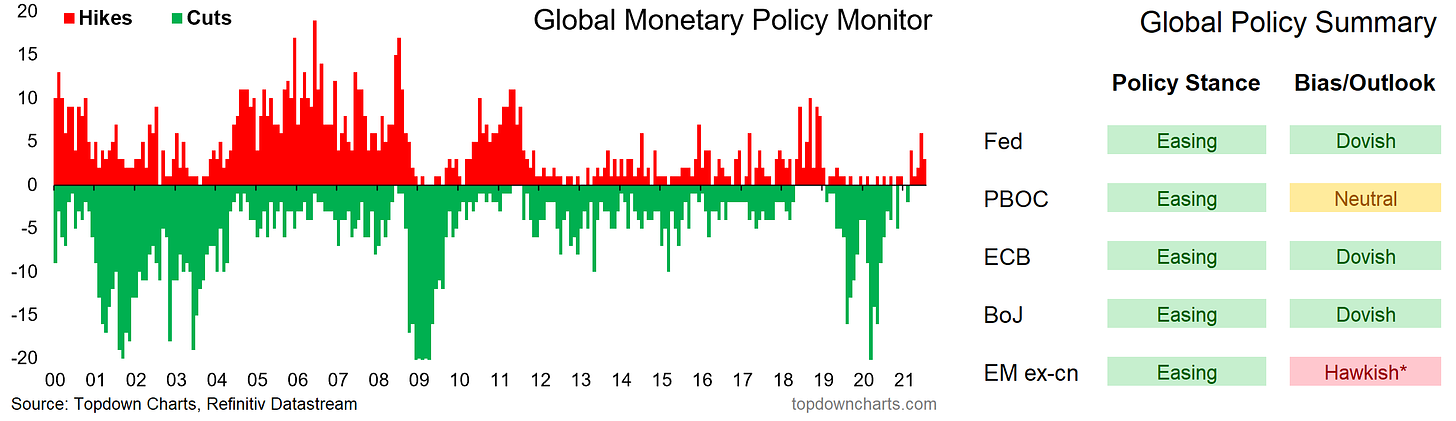

Valuation Snapshot

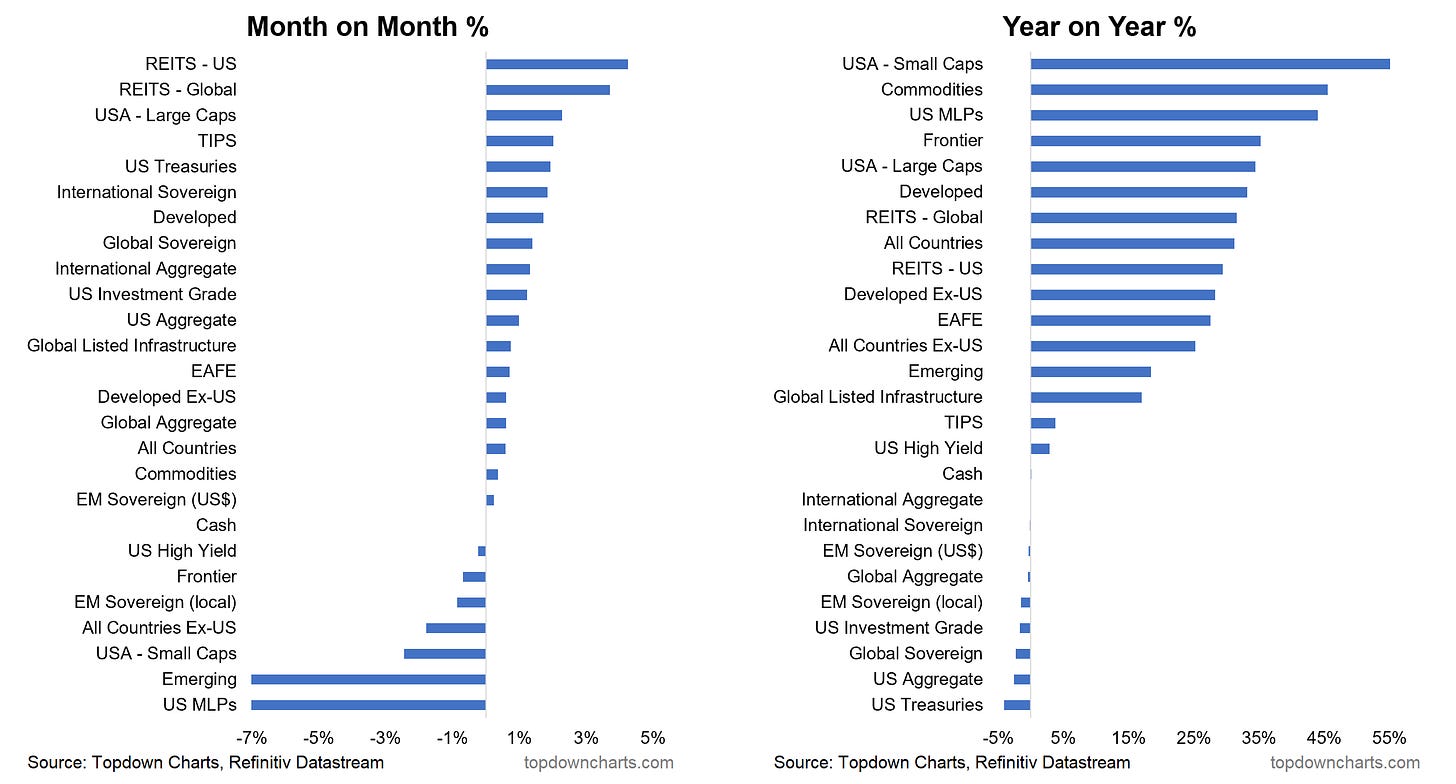

Market Overview -- Month to July: July saw what you might call an “un-rotation” – previous strong spots of EM, small caps, and commodities took a back seat, while treasuries, REITs, and US large caps strode ahead. This un-rotation has driven a significant shakeout and reversal of previous crowded sentiment and positioning as the consensus ideas at the start of the year have been put to the test.

Macro Outlook

Global Economic Outlook: The stimulus/reopening driven global economic recovery continues. Historic stimulus remains in place, yet as inflationary pressures emerge and economic activity begins to normalize policy makers are beginning the process of stepping away from stimulus. Complicating the outlook has been virus resurgences, yet vaccination progress appears to be laying the path to a new normal.

In terms of inflation risks, some of the short-term pressures are likely to fade heading into next year. However, some of the more medium-term/underlying/enduring pressures such as tightening capacity utilization and a prospective secular bull market in commodities (along with a stronger consumer and a capex/investment boom) will likely see a lift in core inflation even as headline inflation begins to taper off.

This will present challenges to policymakers and investors as markets likely will end up underestimating underlying inflation pressures as the crowd lurches from one direction to another.

Risk backdrop: On inflation, the risk is that it starts to show clear signs of not being “transitory”, prompting premature stimulus removal; this is the biggest risk to growth assets. Shorter term of concern is the varying speed of vaccine rollout vs virus mutation, with the delta variant already causing issues. Related: diverging economic prospects could see pressure points exposed e.g. in emerging markets where monetary policy is already being tightened. Geopolitical risk also remains a concern with “Cold War 2.0” sentiment.

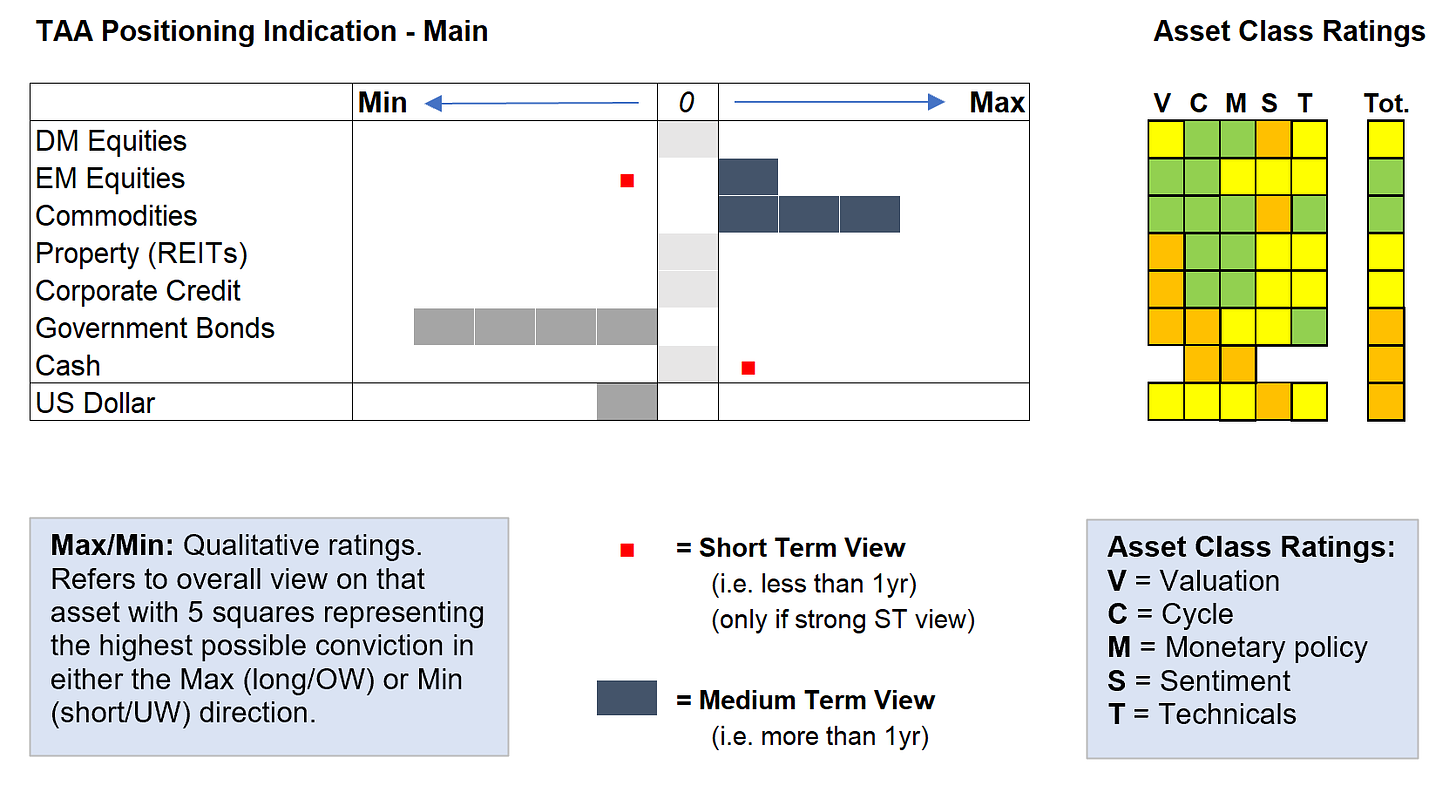

Summary View Across Asset Classes

The below table provides a “cheat-sheet“ summary of our views across the major asset classes. Short-term is typically in the order of months/quarters (less than a year), while medium-term is more a through-the-cycle view (multi-year).

Asset Class Ratings and TAA Guide

As a reminder, we do not manage any money, or provide personal financial advice, nor offer securities. The purpose of the following tables is to provide a high-level positioning indication based on our analysis and indicators across the various asset classes, from an unbiased/generic multi-asset investor perspective. The asset class ratings are quantitatively driven, but judgement is applied.

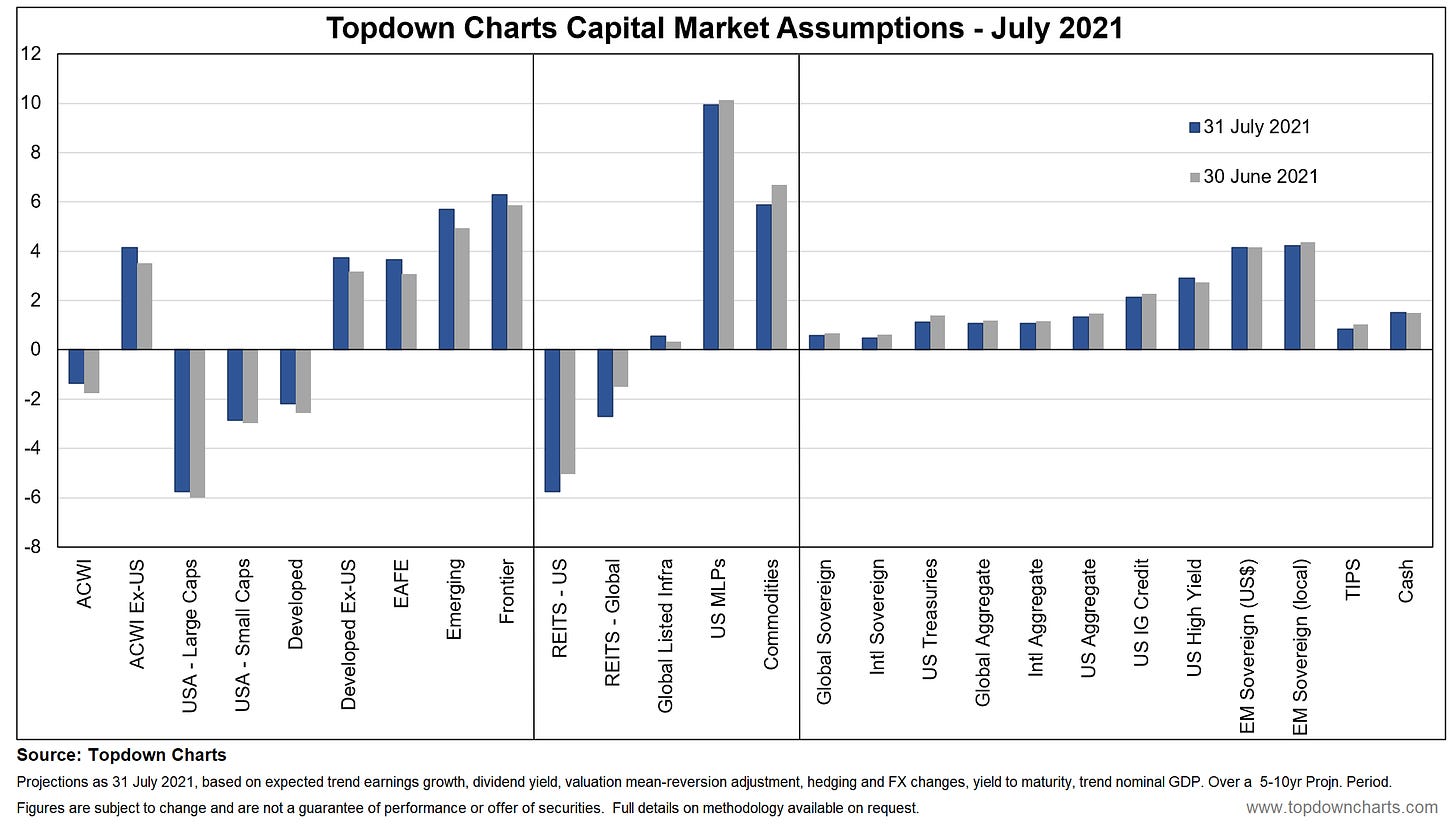

Capital Market Assumptions (Long-Term View)

The following is an extract from our capital market assumptions dataset. These represent a 5-10 Year forecast based largely on quantitative inputs. They are presented in nominal terms, on an annualized basis, and are stated from the perspective of a US dollar denominated investor.

July Update: Expected returns edged slightly higher across global equities in July vs June as valuations fell slightly (improved earnings), whereas expected returns for fixed income, REITs, and commodities fell as valuations rose and bond yields fell.

If you haven’t already, be sure to subscribe to this paid service so that you can receive these reports ongoing (along with full access to the archives and Q&A).

Thanks for your interest. Feedback and thoughts welcome in the comments below.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn