My Best Charts of 2022

A look at some of our charts and calls that worked particularly well during the year

As we close out the year I thought it would be good to share some of my charts and calls that worked particularly well this year (and don't worry, I will be sharing my worst charts next week... there are always two sides to the coin!!).

These charts were featured in my just-released 2022 End of Year Special Report — check it out when you get a chance (free download as a holiday treat!).

The charts listed below were particularly helpful in arriving at some of my key calls and recommendations for clients this past year. I often find that while I do tell the story around the charts and build the puzzle picture up with multiple “puzzle pieces“, in many cases a good chart speaks for itself and does much of the heavy lifting in the investment thesis.

It's also a good exercise to go through — to see what worked well. It's conventional wisdom to try and learn from failures, but it's also important to try and learn from successes (albeit while also being mindful of hubris, complacency, hindsight, and the need to stay humble).

With that all said, here they are! Hope you find it interesting...

n.b. I have updated the charts with the latest data (in a few cases the original idea has actually come entirely full-circle). Also on formatting: the italic text is a quote from the specific report in which the chart originally appeared.

n.b. be sure to check out our [FREE] Chart Of The Week series.

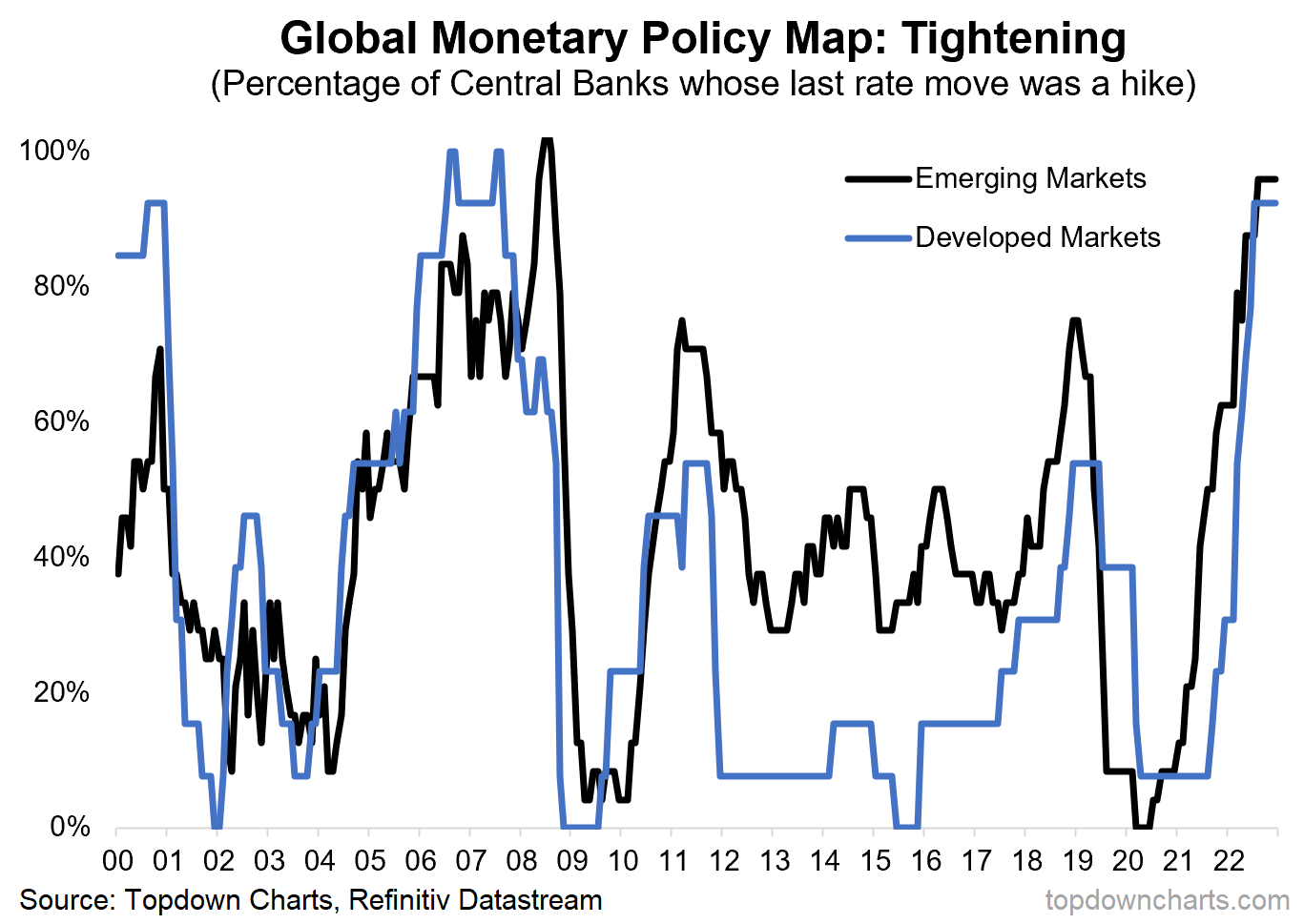

1. Policy Panic: I was early on the trail of the original pivot – the pivot to tightening. In the end we saw what basically amounted to a transition from panic rate cuts in 2020 to panic rate hikes in 2022. This of course set the tone across asset classes.

“The Path to Policy Normalization: Last year I counted 123 rate hikes across 41 central banks, 2021 was the year of rate-hike lift-off… but mostly for EM. This (and covid) caused some indigestion across EM assets (therefore EM arguably has already taken its medicine to a certain degree). This year expect DM to be the main actor – specifically the Fed (rate hikes & QT on the table).” (15 Jan 2022)

2. Fed Playing Catch-Up: This chart was extremely useful in framing the impending risks relating to Fed tightening, it was a frequent feature on the “risk-radar” slide in my quarterly report, and turned out to be perhaps the most important chart from a macro risk management perspective. The clues were clearly there for those who wanted to look for them, and as noted in the quote below, it was very much a logical and natural conclusion of the decisions and risks that the Fed chose during 2020-21.

“the Fed is behind the curve on rate hikes – and this is no accident: they did not want to risk hiking too early and scuttling the nascent recovery. However there are always trade-offs when it comes to risk management, and thus they now find themselves facing the risk that they need to play catch up.” (11 Feb 2022)

3. Bond Bloodbath: On the theme of looking for macro/market clues, one of the most extreme moves in the year was the double-digit losses facing fixed income investments — assets which are typically thought of as conservative, safe, defensive.

It must be acknowledged that this year did see a geopolitical shock, but that shock was set against a backdrop, a context, of extreme expensive valuations for bonds. Faced with that background context, it was always going to be a matter of time before something showed up to trigger a reset.

“treasuries are still showing up extreme expensive, and while the macro/market model has come down some – it is still pointing to 10-year yields above 2.0% (and a few other indicators suggest higher). So I would say there remains clear runway/upside risk for bond yields.” (15 Jan 2022)

4. Inflation Shock: And something did show up! The inflationary shock was the catalyst for bonds, and again – there were clues in the charts: intriguingly on this one the chart was literally telling us that bond yields could head up as high as 4%. Something to take note of when you look at the charts to watch in 2023…

“From the chart below, you might say that bonds are paying more attention to inflation… and in that case, if we take the left chart literally then 10-year yields could be on a path to 4%” (8 Apr 2022)

5. Everything Was Expensive: But what really made this year was the fact that we saw max drawdowns in excess of -20% for both stocks and bonds. There was basically nowhere to hide (except cash and commodities!). And again, there were clues — at the end of 2021 both stocks and bonds were trading at extremely expensive valuations. Could those valuations have gone even higher? Sure. But it’s a risky game trying to justify or argue or bet against using valuations when valuation signals were screaming at us to be careful.

“to pick up on the fact we are seeing stocks and bonds correcting, it’s timely to reflect on the valuations chart which shows both stocks and bonds almost 2 S.D. expensive vs history (thereby making it harder to maintain credibility around arguments that stocks look cheap vs bonds).” (28 Jan 2022)

6. Bubble Bursting: Aside from the unwind in expensive equity valuations, there was the unwinding of a series of bubbles that blew in the wake of the pandemic stimulus. This and a few other charts helped make the downside risk in equities clear.

“growth/momentum basically had a parabolic run in the wake of *historical* stimulus, but these previous sources of strength are now a source of weakness. The key risk to global equities is that the initial unwind that kicked off earlier this year fully runs its course and takes the market from correction to bear market.” (11 Mar 2022)

7. Commodities Up: But one of the other big moves and big things to get right this year was commodities. Again, yes the geopolitical shock was the catalyst that did it, but I always say that geopolitics is tricky to practically use, it’s almost always a boondoggle (many shadows to jump at), and in the end what is best to do is to focus on understanding the background context – to get the main picture. In that sense, commodities were “ready” to rally.

“Shorter-term on commodities, there has been what I would term a healthy consolidation, with the index holding onto a key support (former resistance) level, and with a recent decent reset in market breadth and sentiment (bullishness back to long-term average from about 2 S.D. stretched to the upside). All up, I would say there remains credible upside for commodities.” (15 Jan 2022)

8. Oil Up: Similarly, and specifically for crude oil, the oil & gas sector “capex depression” set the scene for the spike in energy prices. Metaphorically: when the grass is dry enough it only takes a spark.

“Crude oil supply remains severely constrained (shifting social/political preferences, elevated funding risk premia, lingering pandemic uncertainty, and logistics/supply chain issues) – rig counts remain near record low, and global oil & gas sector capex rates are at a record low. Reopening progress and the investment boom thesis would likely see a surge in demand.” (15 Jan 2022)

9. Commodities Down: Staying with commodities, you never want to end up overstaying your welcome on an asset class call or macro theme. So when all the clues started pointing to a peak in commodities, I was quick to abandon the bullish view and switch all the way over to bearish on commodities as numerous technical and macro risk signals began to light up.

“200dma breadth has rolled over from overbought, and another breadth metric (proportion of commodities positive on a YoY basis) has turned down, with a familiar and ominously bearish pattern appearing.” (13 May 2022)

10. Defensive Value: Last but not least, in a year where traditional defensive assets like bonds, did not work (and cash turned in negative *real returns*) investors had to get more creative in finding defensive assets, and the “defensive value” basket worked well as an undervalued and underappreciated hedging idea, strongly outperforming the index.

“the “defensive value” basket enjoys very cheap relative valuations, and remains out of favour after a long period of dismal performance (with allocations and sector weightings near record lows). This basket (Healthcare, Consumer Staples, Utilities) stands on its own merits in terms of the charts/indicators, but it also has the unique characteristic of outperforming the rest of the market during bear markets/major corrections.” (15 Jan 2022)

—

Thanks for reading!

Check out the Full Report here (free download)

Best regards

Callum Thomas

Head of Research and Founder of Topdown Charts

For more details on the service check out this recent post which highlights: a. What you Get with the service; b. the Performance of the service (results of ideas and TAA); and c. What our Clients say about it.

Follow us on:

LinkedIn https://www.linkedin.com/company/topdown-charts

Twitter http://www.twitter.com/topdowncharts

Hi CT, thank you for yr charts, these are the normal times we live in,

and i have tried to calm friends, or explain why, but they just shake their heads in disbelief,

and laugh. But thats ok.

I love these times, and no, im not a masochist, im a thru and thru optimist, always have been

and when i mention to friends i wish it would last longer, they normally want to throttle me. lol.

I just wish I could buy more. Last Friday nite I made my 96th stock buy since July 15th.

My income can't keep up with my spending...lol ;)

all the best for new yr 23.

Thanks again.

chrs kev

Also be sure to check out the companion article "My WORST Charts of 2022" https://topdowncharts.substack.com/p/my-worst-charts-of-2022