My Best Charts of 2025

A look at some of our charts and calls that worked particularly well during the year

As we close out the year I thought it would be good to share some of my charts and calls that worked particularly well this year (and don't worry, I will be sharing my worst charts next week... there are always two sides to the coin!!).

These charts were featured in my just-released 2025 End of Year Special Report — check it out when you get a chance (free download as a holiday treat!).

The charts listed below were particularly helpful in developing and updating some of my key calls and recommendations for clients this past year. I find that while I do tell the story around the charts and build the picture with multiple “puzzle pieces“, in many cases a good chart speaks for itself and does much of the heavy lifting in the investment or macro thesis.

It's also a good exercise to go through — to see what worked well. It's conventional wisdom to try and learn from failures, but it's probably more important to try and learn from successes so we can do more of what worked (while also being mindful of hubris, complacency, hindsight bias, and the need to stay humble and trying new things in the quest for innovation).

With that all said, here they are! Hope you find it interesting...

n.b. I have updated the charts with the latest data (in a few cases the original idea has actually come entirely full-circle) —Also on formatting: the italic text is a quote from the specific report in which the chart originally appeared (date of report in brackets).

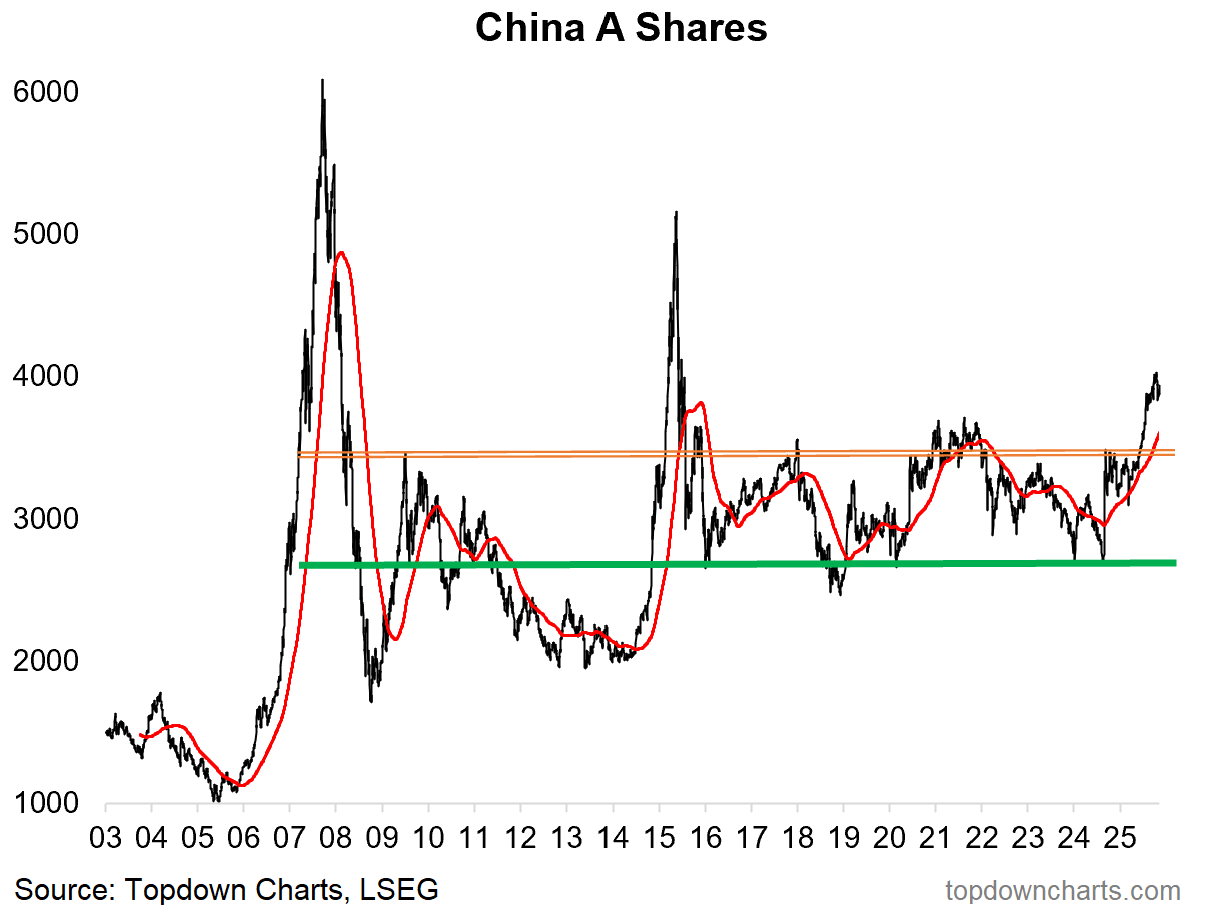

1. Chinese Stocks: This chart and the thinking behind it helped in identifying one of the most underestimated and surprising strong performers in global markets this year. But that wasn’t the only part of the story.

“2025 Surprise? Consensus does not see the possibility that Trade War 2.0 results in accelerated stimulus to counter headwinds –and a subsequent surge in domestic Chinese stocks (and the prospect that the disruptive new reformative policies potentially rattle expensive US stocks). While Chinese stocks are not without downside risk, there does appear to be an opportunity here.” (10 Jan 2025)

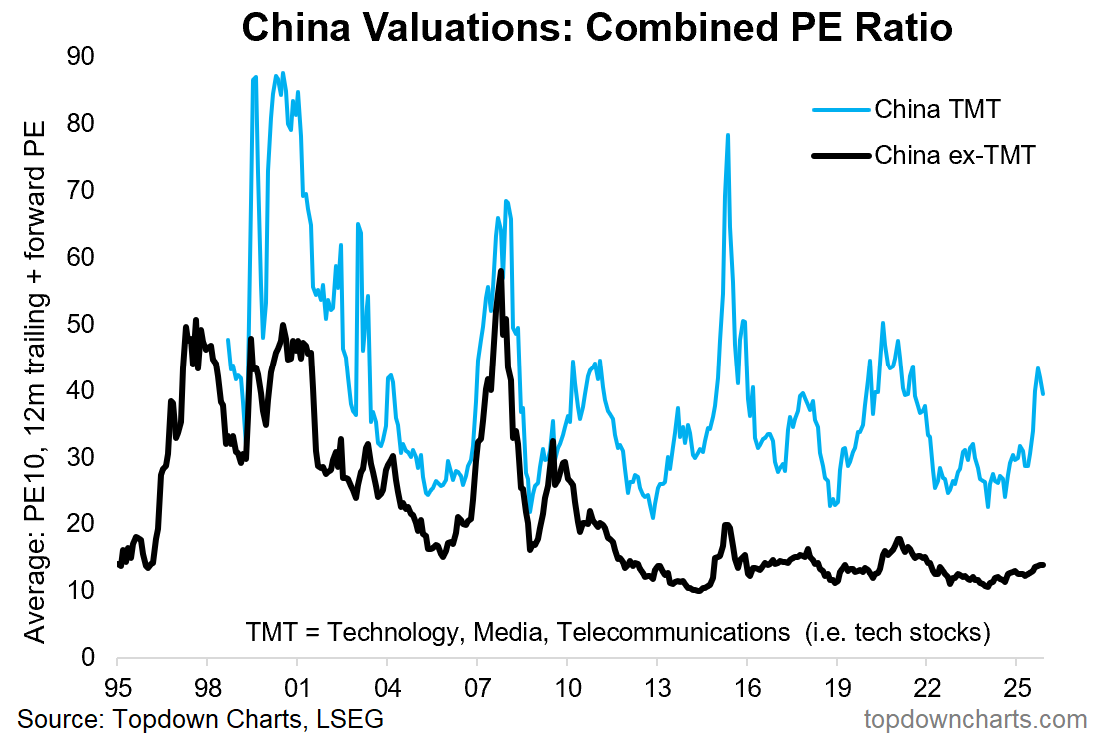

2. China Tech: Chinese tech stocks staged a magnificent rally from significantly undervalued & underestimated levels. It was one of those classic contrarian setups, but also a major development from a geopolitical/global-order standpoint, as the launch of DeepSeek AI challenged the previous notion of China as an imitator vs rising innovator. Which is another reminder to keep those narratives refreshed and sources current (those who rely on stale insights will always be surprised).

“Another potential ripple effect from DeepSeek is a challenging of the consensus Western media thinking that China can only imitate rather than innovate, …A rethinking here could see cheaper (valuations near bottom end of historical range) Chinese tech stocks re-rated up” (31 Jan 2025)

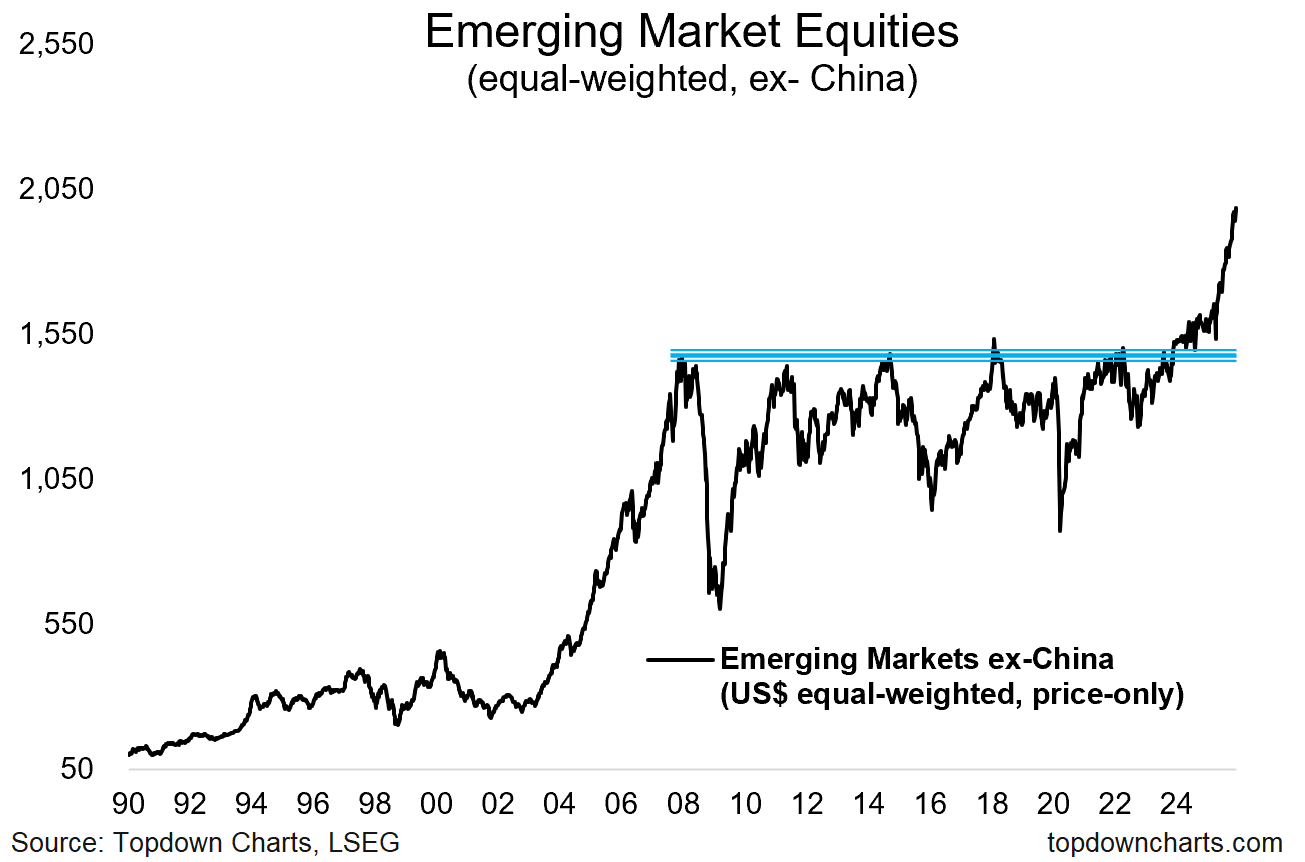

3. Emerging Markets: Probably one of my most favourite charts of the past couple of years is this textbook “Brobdingnagian breakout” of Emerging Markets (equal-weighted, USD terms). This was a key chart for building bullish conviction on EM equities and most likely represents a harbinger of a major inflection point (measured in years).

“EM ex-China stocks have undertaken a promising major breakout, and the MSCI EM index continues to trace an upward trending path... Key point: on balance bullish EM as momentum + tailwinds outweigh prospective headwinds/risks.” (10 Jan 2025)

4. EM ex-Asia: Another one in the EM space was the re-awakening of Emerging Markets excluding-Asia. This index also undertook a major bullish technical manoeuvre in breaking out of its multi-year range trade – and was closely interlinked with the bullish developments in commodities. And for charts like this the insights go a little both-ways; bullish price action in one line can be helpful in confirming bullish developments in the other market…

“EM ex-Asia is still significantly cheap, and could well help the case for EM if that side of things begins to pull its weight. The outlook for commodities will be a key swing factor here, as historically stronger commodities has helped EM ex-Asia.” (24 Jan 2025)

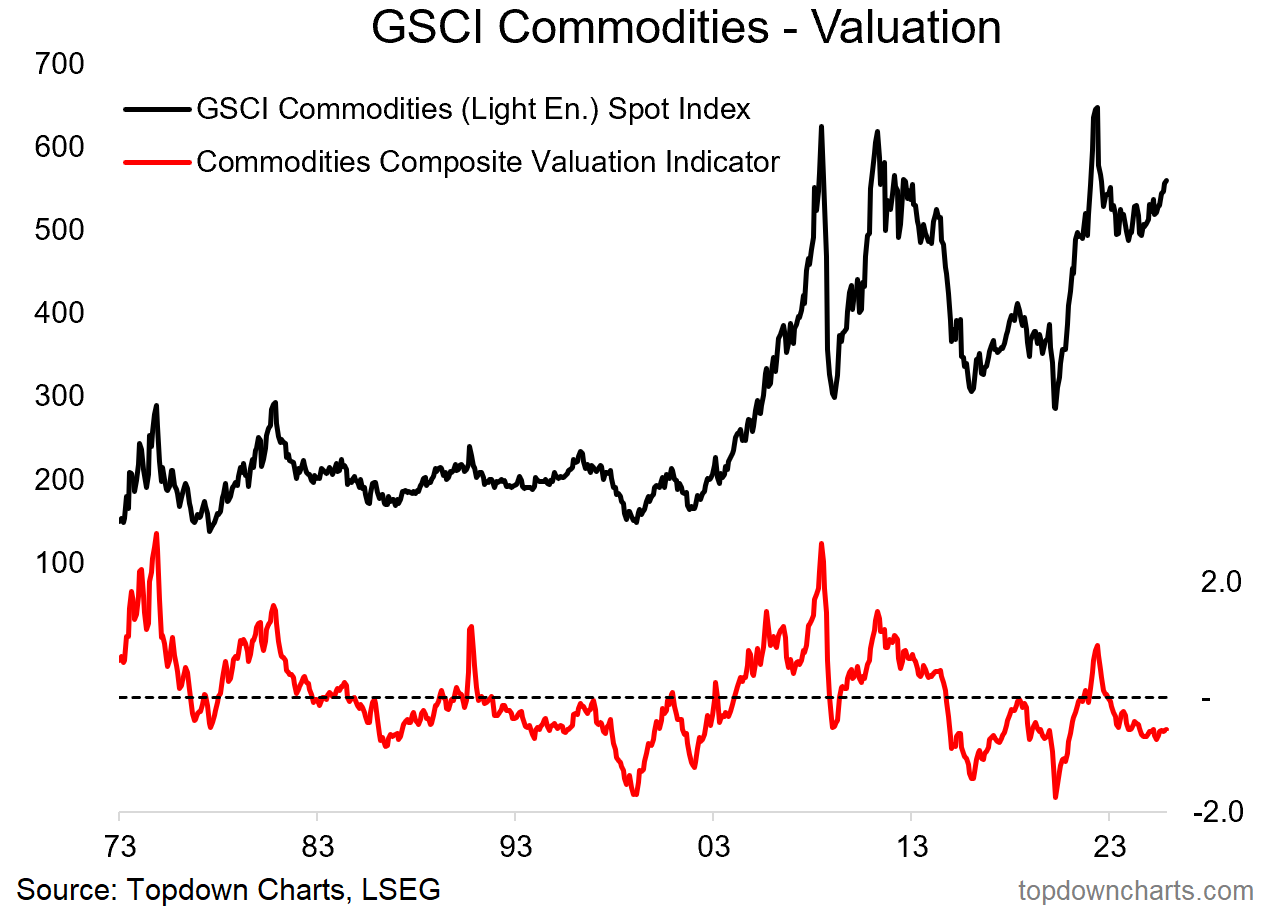

5. Commodities: Speaking of commodities, this chart (along with several others I always have up my sleeve) helped identify the end of the cyclical bear market in commodities and the now emerging cyclical bull market. Something that has started to come into play this year and will be tremendously important heading into 2026.

“Lastly, this is all set against a backdrop of cheap valuations, and a tendency for commodities to undergo larger cycles; a new upcycle appears to be in progress; suggesting a bullish bias.” (17 Jan 2025)

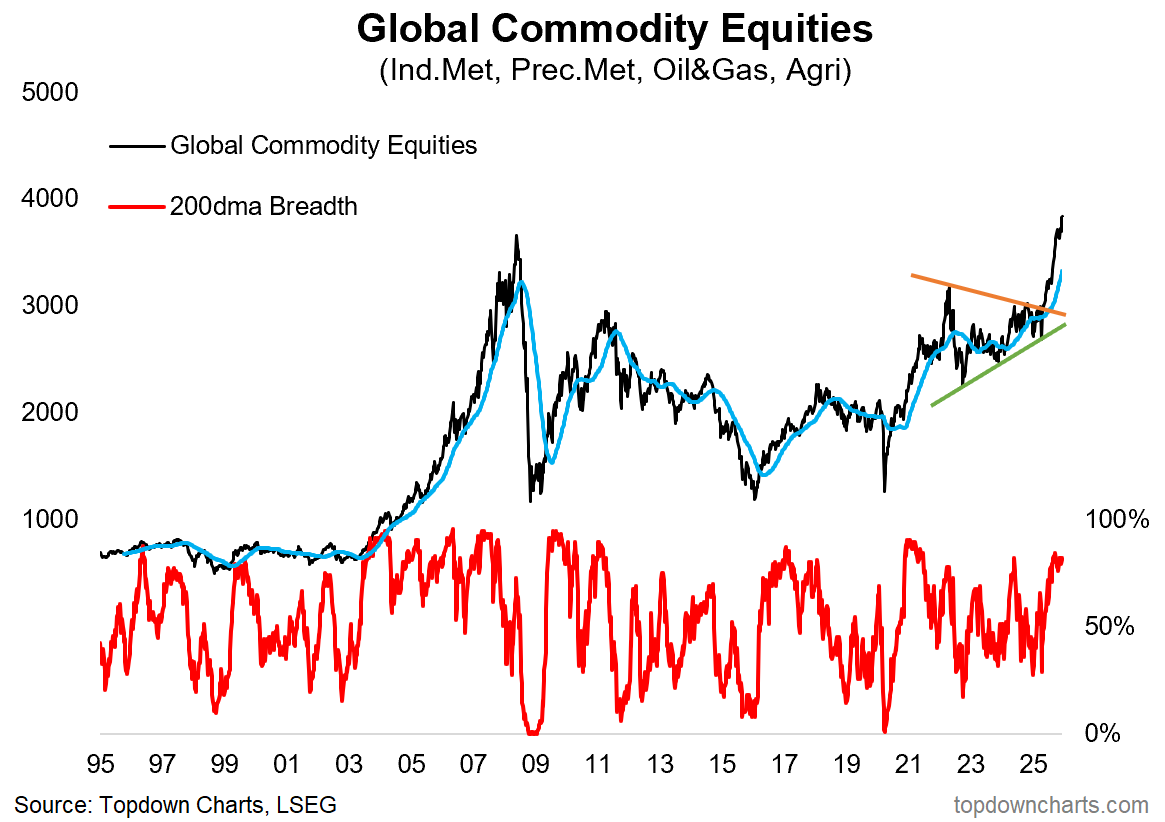

6. Commodity Stocks: And it’s not just the commodity prices, but also the companies that produce the commodities. Global commodity stocks undertook a major upside breakout this year, and this chart (+ a few others) helped me + my clients get onto this – but again, also helped in confirming the strength in commodity prices themselves.

“Global commodity equities are ticking up following a notable correction; with breadth ticking up from oversold, and price rebounding from a logical short-term support level. With the 200-day average still strongly upsloping and the outlook for commodity prices improving (which has a huge bearing on things here), the technical outlook for global commodity equities looks good.” (17 Jan 2025)

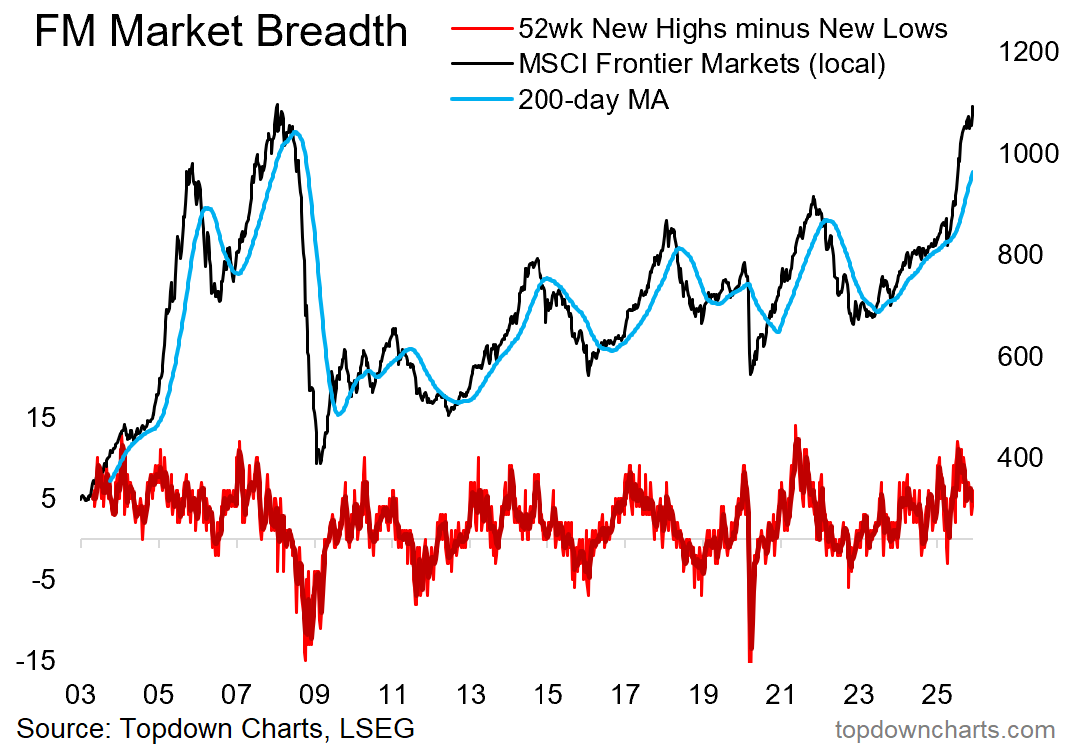

7. Frontier Markets: While the case for frontier markets was supported by a broader setup (valuations, macro, strategic considerations), this technical chart helped in building conviction with the bullish breakout. It’s always particularly satisfying to nail the call for asset classes and markets that are outside of the mainstream and under-covered like this one; so a good chart indeed.

“Over to frontier markets, things have begun to pickup again after a period of consolidation. FM equities in local currency terms in particular look strong with a clear upside breakout and surge in 52-week new highs vs lows market breadth” (24 Jan 2025)

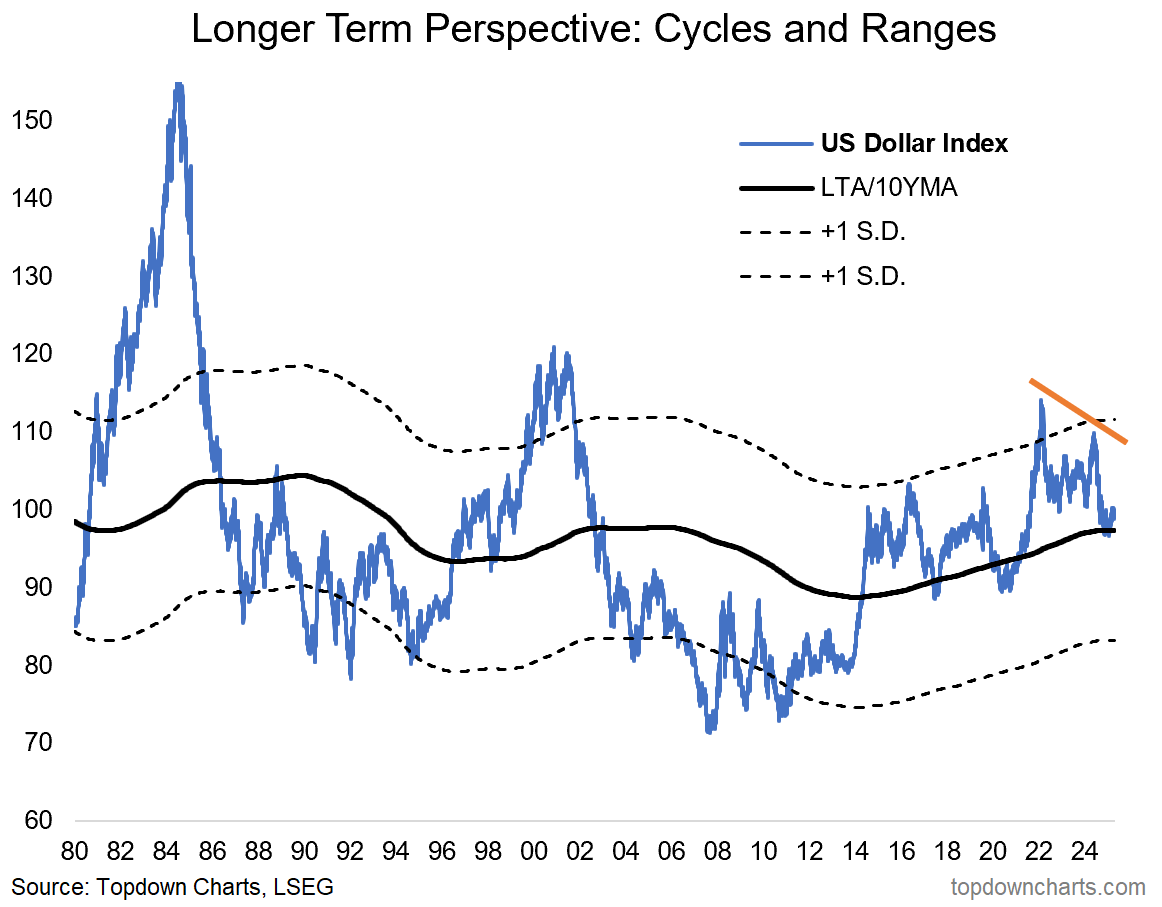

8. US Dollar: If in doubt, just zoom out. And in zooming out for the US dollar, the pattern of price action becomes clear; it looks like a bear.

“Zooming out, the US dollar looks to be progressing through the long-term cycle; likely pushing lower as it runs its course. In the short-term with regards to the prospect of a major breakdown, sentiment is still middle of the road after turning down from previous consensus bullish, and positioning likewise has ample room to move to the downside – in other words, there are plenty of minds still left to change to the bearish side for the US dollar. ” (11 April 2025)

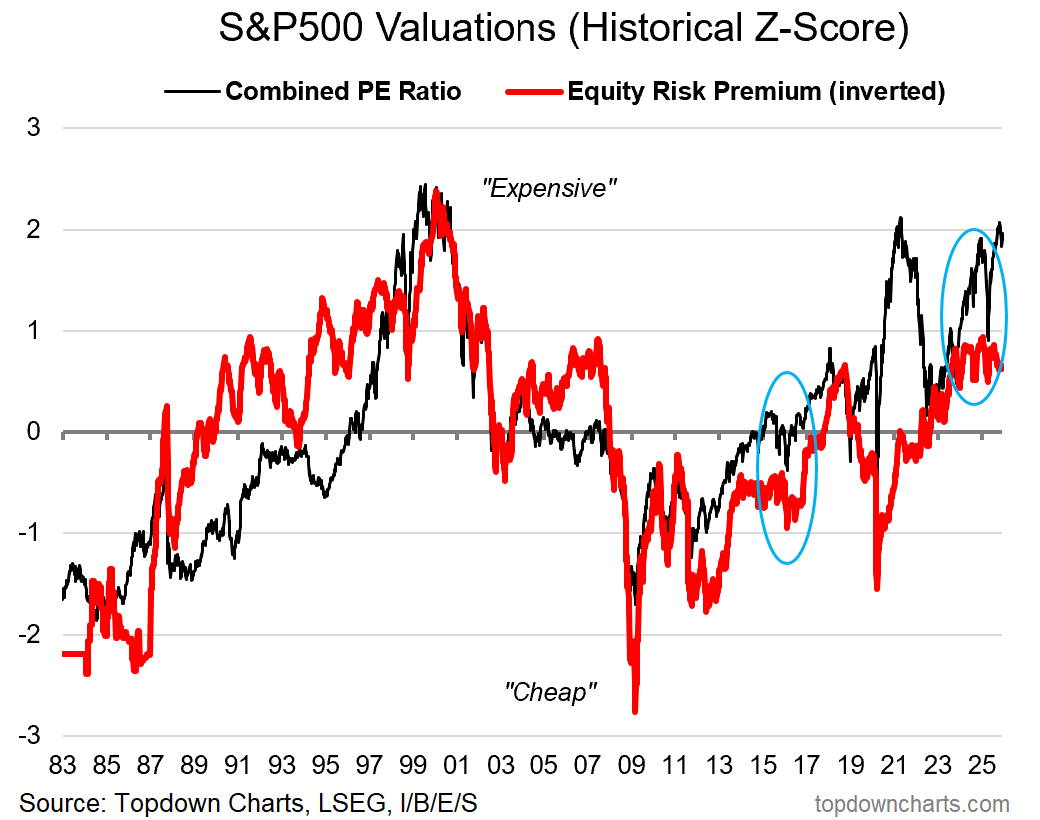

9. US Markets: So this one was part of a comparative analysis of the backdrop of Trump 1.0 vs 2.0 – the key point being that this time around was an entirely different setup with a different policy agenda. This helped in getting on the right side of the chaos that characterized the first half of the year.

“Comparing 2016/17 vs 2024/25, valuations are now expensive vs cheap back then, earnings expectations are running hot vs cold back then, effective corporate tax rates have already come down a lot (hard to repeat that) – meanwhile the policy outlook under the red wave victory is likely to be reform-like (tariffs, deportations, fiscal repair/government efficiency), with some of the intended long-term gains likely to face short-term uncertainty + difficulty. At best markets go sideways, maybe rotation, but most likely more volatility and probably correction(s).” (10 Jan 2025)

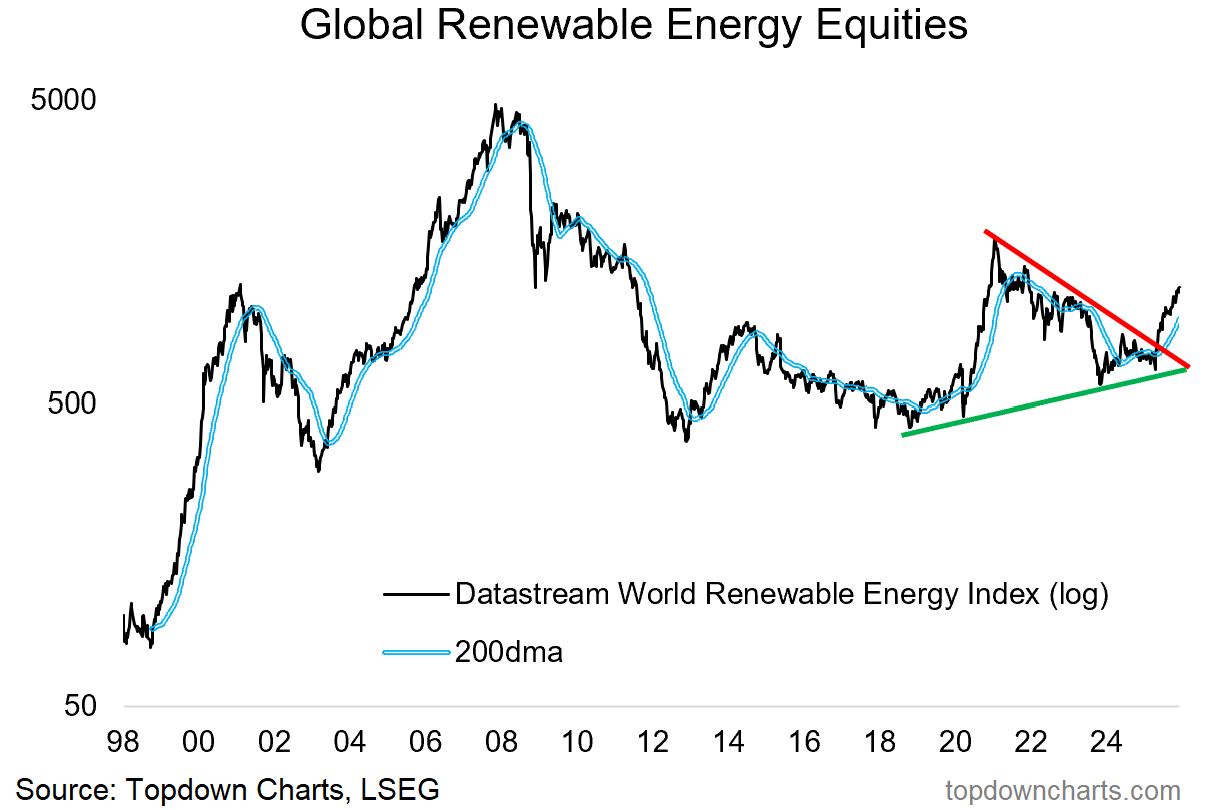

10. Renewable Energy Stocks: Last but not least, the renewal of renewables.

“After the boom and the bust – a new breakout in renewable energy stocks. Global renewable energy equities have broken out after an extended period of range trading following a bursting of the 2020 bubble. Over that time investors have steadily exited clean energy ETFs, with AUM now a fraction of where it once stood… a good contrarian signal, and sign it could have room to run.” (18 July 2025)

—

Thanks for reading!

Check out the Full Report here (free download)

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

For more details on the entry-level service check out the following resources:

Getting Started (how to make the most of your subscription)

Reviews (what paid subscribers say about the service)

About (key features and benefits of the service)

But if you have any other questions definitely get in touch.

NEW: All Services by Topdown Charts

Topdown Charts Professional —[institutional research service]

Topdown Charts Entry-Level Service —[entry-level version]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack —[Gold charts]

Australian Market Valuation Book —[Aussie markets]