Reasons to Unsubscribe

A data-driven look at why people unsubscribe from our paid service

It’s never easy to say goodbye — especially to a paying customer!

But optimists and pragmatists can find silver linings in all things, and importantly: lessons in the unpleasant.

This post looks at why people chose to *unsubscribe* from our Substack.

See Also: “Reasons Why People Subscribed (and how they rate us)“

Being a believer in data, analysis and seeing the bigger picture I decided to take a foray away from the usual macro/market analysis and deploy my analytical skills to take a look at the reasons why folk have unsubscribed from our entry-level service.

I wanted to share this analysis for a few reasons:

To help understand if the service might vs might not be right for you

To get a greater sense for what we’re doing with our Substack service

To explain what I am going to do about the findings

Hope you find this analysis interesting and useful — especially if you are considering a subscription. As always, very much open to feedback.

The Main Reasons for Unsubscribing

You know I’m going to use a chart!

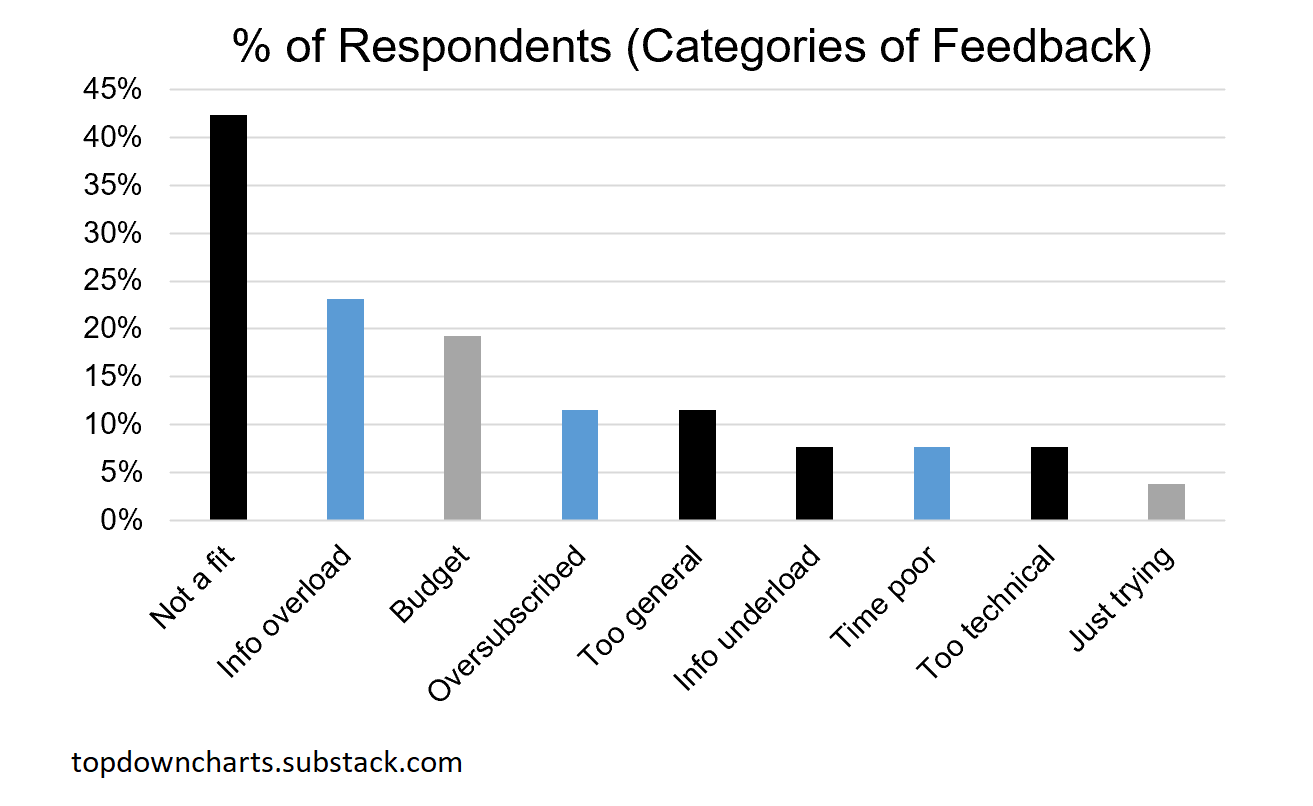

Of those who responded to requests for feedback (and/or those who gave unsolicited feedback when unsubscribing [FYI: Substack has a feature for giving feedback, but not all people will provide feedback]) we classified their feedback into a maximum of 2 categories of reasons (and there are usually only 1 or 2 — at max underlying reasons).

The chart below shows the prevalence of each category of reason.

We can basically clump these into 3 super-categories (as color-coded).

Black = Not the intended client/market/niche

Blue = Not enough time/too much info (either from us or in general)

Grey = Not enough budget/cost cutting/cost conscious

These should be fairly self-explanatory, but let’s go through and add a bit more color and context around this.

“Not the right client/market/niche”

So for context, the service is aimed at active asset allocators — mostly in a professional or sophisticated (non-beginner) context. We take a top-down approach, and basically stick to the asset-class/sub-asset-class view, and operate on a timeframe consistent with best practice in active global multi-asset investing [so no individual stock picks + many of the views are minimum 3-6 months, but up to 3-5 years+].

That means it’s basically not for beginners. It’s also not designed for short-term traders or stock pickers (however, we do have some subs in that space because the longer-term top-down perspectives can still be useful in setting directional bias and adding risk management/macro context).

In that respect, these types of unsubscribes could be described as a false negative i.e. they are outside of my niche, and therefore it should not be surprising to see them unsubscribe as such. Of course I’m going to pay attention to it, but as I’ll note in the “so what“ section, I think it’s equally important to “own” your niche.

“Not enough time/too much info (either from us or in general)”

This one did carry some nuance. In some cases people just had general time pressures or a change in circumstances. In others there was an element of basically oversubscribing i.e. too many different newsletters and emails coming in.

But there were also a couple of people citing the reports being (too?) long. Though not widely prevalent this did make me think about some possible changes/improvements, but we’ll get to that shortly.

For context though, I have designed the reports in a way that makes them very visual, concise, and to-the-point — basically try to maximize the info-to-words ratio.

>> To that end, I do wonder if the responses in this category are lower than they might otherwise be as a result of those efforts, but it is definitely something that is front of mind for me as a researcher.

Time vs insight vs volume of info is clearly also a key issue for investors/consumers of this type of service as there is a lot of info out there in varied forms and formats. But this is one aspect where I believe paying for research vs taking free services is worthwhile …even if as a minimum the point that sunk costs tend to compel you to make greater use of the thing — and of course there is a direct incentive for the provider to deliver quality and service (both of which I take very seriously).

“Not enough budget/cost cutting/cost conscious”

So again, for some context, pricing is $50/month or $350/year. It’s not cheap, but as noted it’s for professionals (who can expense it) or sophisticated investors (who have the scale that allows them not to care about such minor expenses). But even with those groups, it’s not nothing, and if folk go into cost cutting mode then all things are up for review.

Another aspect is that I haven’t historically offered free trials (in my experience it tends to create more problems than it solves), so there will always be some unsubs from people who take-up a monthly subscription just to have a nosey. Or those who are cost sensitive and don’t want to to commit the annual fee so they try it out on the monthly fee (which of course lets them scroll through ALL of the past reports, receive new reports in real time, get a sense for the value, usefulness).

On that note (trying it out), I think there could be an element of underlying/real reasons in this category. I mean budget is a real thing and cost sensitivity can change quickly based on specific/macro issues… but at the same time, if they are actually in the target market, and the reports are actually good and met their needs then any quibbles about cost should be overshadowed.

How Long does it take to Decide to Unsubscribe?

The majority of folk made their decision to unsubscribe within 3 months - typically those who took longer saw a change in circumstances e.g. budget, time, etc.

I think this makes sense given what we just talked about, you probably need to consume the material for at least 1-3 months to get a real sense for how useful it’s going to be... some might say longer e.g. to gauge performance, how the views change with the cycle. But in terms of the high-level fitness for purpose, it shouldn’t take very long to get a good feel either way.

Interestingly enough this also basically lines up with my initial findings on overall retention rates, which from preliminary results (after 10 months of operating the entry-level service) looks to stabilize just over 70% after 6 months - with most of the drop-offs happening within the first 3-4 months.

So What am I going to Do about all this?

I’m a big believer in being receptive to feedback in general, but especially in business. However, I also think it’s important to put in stake in the ground at times. You should be everything to the people that matter, but you shouldn’t try to be all things to all people — there is a risk of getting lost. You have to know your purpose, what you are trying to do, and for who. And that should color the way you look at the data, and what you do with exercises like this.

So then in terms of what I’m going to do (or not do) about this:

Own my niche:

I’m not going to try and educate complete beginners (I believe there are plenty of resources out there for that). That said, I will be doing more intermediate+ level explanations of core concepts e.g. expanding on the details of our process and philosophy.

I’m not going to try and offer short-term trade ideas and specific stock picks for the day traders (it’s out of scope of my core competency — and it’s not what my core niche is interested in).

I will try to make the intended audience more clear in marketing documents to lower the odds of non-target-market users subscribing in the first place, or at least prepare them for what they are getting themselves into with my service.

Think about time:

I’m already always intently seeking to tilt the scales towards more insight with fewer words: i.e. maximize the ease of assimilating insights. As a guess I would say I’m 80% there, so it’s probably about spending you know as they say the 80% of time to get that last 20% of improvement.

Pricing/budgets — stay the course:

I’m actually going in the opposite direction. I plan to increase prices over time in a systematic fashion: I believe this helps reward early adopters, maintain a degree of exclusivity, and incentivize quality elevation over time. I don’t believe in discounting or racing to the bottom on fees, especially when it comes to high quality professional service.

Re-think onboarding:

Looking at my retention rates the “danger zone” where most drop-off is the first 3-4 months, so I will look to see if I can leverage team/videos/user guides to provide context and tips on how to get the most out of the reports. I don’t anticipate this having a big impact e.g. on those who are non-target, but it might sway those who are a bit closer to neutral - who are at the edge of the target market, but could still benefit (but just might need some pointers).

This has hopefully been interesting, and probably somewhat eye-opening with regards to the research business, but I hope it has also helped some of you figure out if a paid subscription is something worth considering (or not!).

Personally, this has been a valuable exercise, and I clearly have some projects to start tinkering on. But another item on my agenda is to also go through and collect feedback from paid subscribers about what they love about the service, why the signed up, and what they value the most…

i.e. another blog post: Reasons for Subscribing!

Best regards,

Callum Thomas

Head of Research & Founder at Topdown Charts

Twitter: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/