Topdown Charts Report Card: mostly good, but some surprises...

We surveyed our paid subscribers AND those who unsubscribed -- here's what they had to say (ratings, wish-list, testimonials, reasons to (un)subscribe)...

I recently conducted a survey of our paid subscribers at the Topdown Charts Entry-Level Service here on Substack (as well as those who ended up unsubscribing). I wanted to share with you some of the findings from the results because I think it will be helpful in getting a better sense of what to expect if you’re considering a paid subscription.

What I will cover is:

-how people rate the service

-reasons why people subscribed

-reasons why some subsequently unsubscribed

-what changes (if any) people suggested in the survey

-testimonials and feedback from paid subscribers

Overall, I think it’s probably mostly as you might expect, but maybe some surprises…

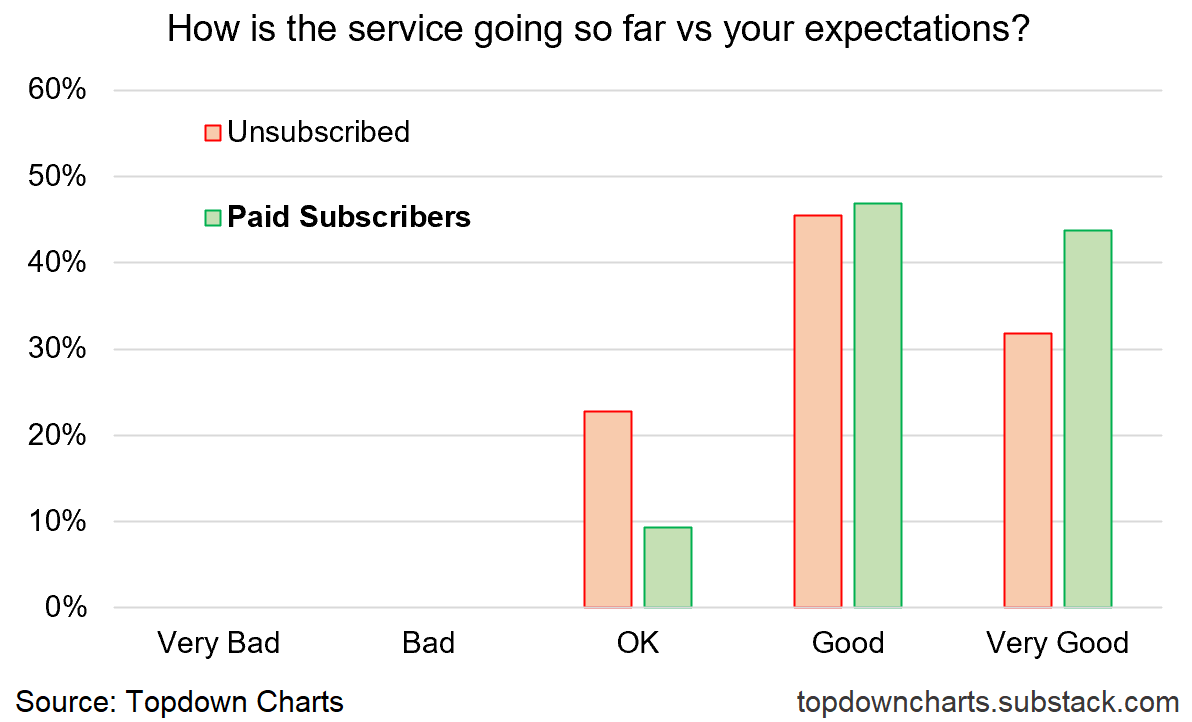

1. Most people said it’s Good or Very Good

I asked paid subscribers what they thought of the service vs their expectations — the chart below shows the results. Out of interest, I have also included the results from a similar survey I conducted in early-2022, interestingly there is a slight uptick in the latest survey of those rating it as “Very Good”. Overall, I would say this is a good vote of confidence.

2. Even those who Unsubscribed said it’s decent

As you would expect, there are more who unsubscribed reporting that it’s merely OK and less saying it’s Very Good in terms of those who unsubscribed – but overall, they mostly still rated the service fairly highly. And at this point you might be thinking: hmm, well if that’s true, why did they unsubscribe then?

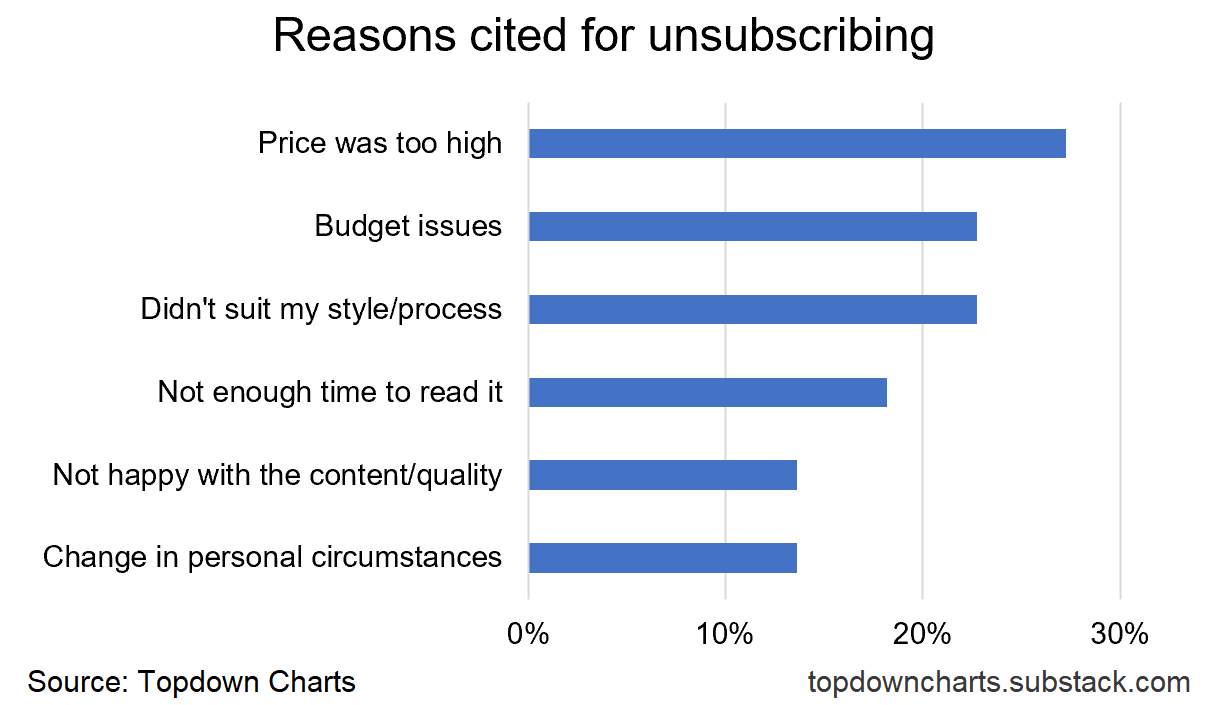

3. Here’s why paying subscribers chose to Unsubscribe

The reality is in the subscription business, people don’t stay subscribed forever — it’s not an annuity as some might tell you, people unsubscribe because things change or because the service doesn’t meet their needs, or even because the economy or markets change. The chart below covers the various reasons cited in the survey.

I would say the budget issues and change in circumstances (35% collectively) would give one clue in terms of people being otherwise happy with the service and rating it highly — but unsubscribing as things outside their or my control change.

On price, for context, the current price of US$350/yr for the Entry-Level Service compares to the Professional Service fees starting at US$3500/yr, so I think it’s reasonable, and aside from maybe offering retiree and student discounts I wouldn’t be rushing to change (in fact I’ve had comments from numerous paid subscribers saying it’s actually really good value, so you could argue it’s maybe even too low).

On not suiting style/process I think that’s fine – I take a medium/longer-term perspective, so it’s naturally going to be less useful for day-traders (but it may still help them in terms of setting background context: e.g. knowing the “tides”, etc).

On the time aspect, I am constantly looking to make it easier and more efficient to read, but then this is one of those things that might also be out of my control (if the person simply has no time for reading research at all). And in terms of quality (n.b. the question also mentioned “better alternatives”) — part of that one had more to do with not suiting style and things of that nature, but also those who wanted more detail on implementation and specifics (more on that later).

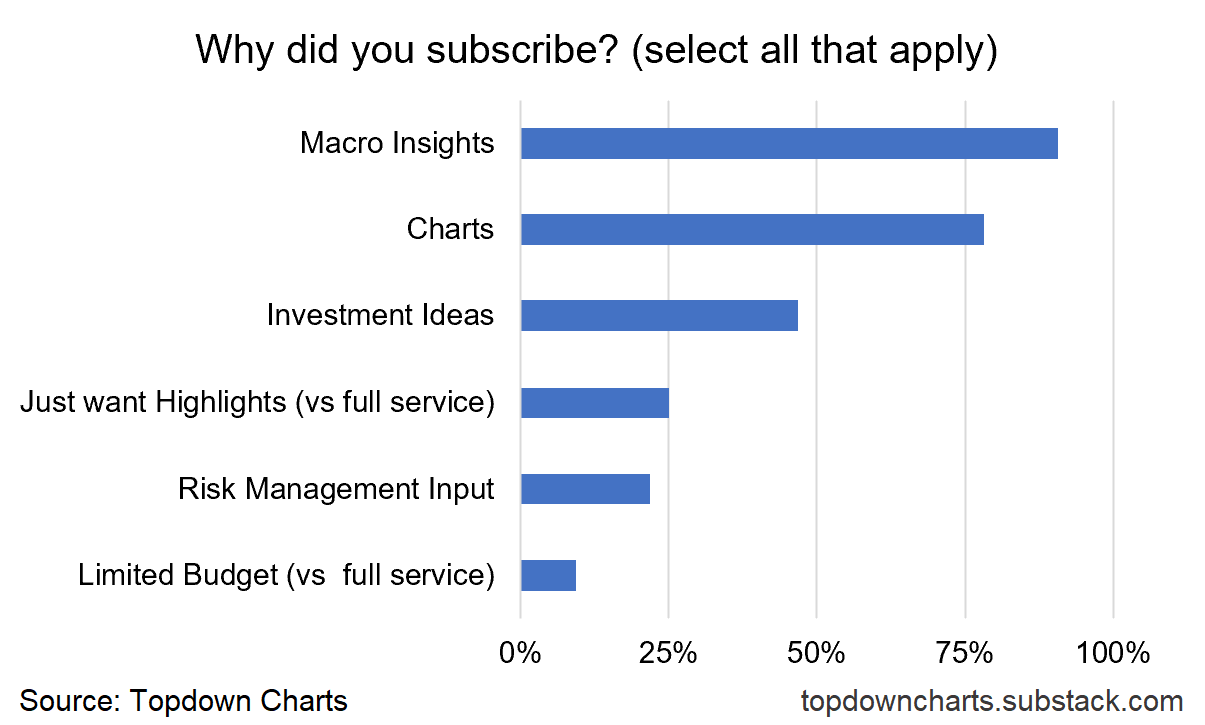

4. Why people signed up for the Entry-Level Service

The most common reason why people subscribed (and n.b. respondents could choose more than one option) was macro insights, followed by charts, and investment ideas (which you might also lump risk management input into, in terms of market insights).

So I would say it’s pretty much all the things you’d expect! Relatively fewer, but a still material amount of people mentioned the specific features of the Entry-Level (vs Full Service) in terms of being more manageable both in terms of size and price.

5. Changes?

For this one I have included the responses from paid subscribers as well as those who unsubscribed. While this service (and the full service) has always been focused on macro and asset-class level insights (leaving the portfolio manager to translate those ideas into specific positions based on their individual constraints, preferences, guidelines/policies, tax regime, jurisdiction, etc) …clearly I need to have a think about this. We’re not involved in product research or securities advice, so it is a little tricky to get too specific on implementation, but I will be consulting with subscribers in terms of scope for more specifics and/or expanding the existing content on the model portfolio and tactical asset allocation front – but it may also be an issue of improving onboarding and education. Watch this space…

On that note, there was also a desire to see some more explanation and education, and I will be doing that. It’s an easy fix to add a little more context and content on that front, but at the same time without getting bogged down and patronizing the more advanced subscribers (and after all, it is an entry-level service, but it is *not* designed for beginners – it was originally designed (with extensive consultation) for advisors, fund managers, and professionals).

Aside from that there were a few who wanted more charts, and I get it, but at the end of the day this is the *entry-level* service, and those who want and need more will need to step up to the professional/institutional service.

Testimonials and Feedback

Again, I think this section will be useful to scan over if you are thinking about a subscription as it gives a good idea of how people think about it…

As a former institutional money manager, I had access to a lot of high-quality, sell-side research before I retired. I find Topdown Charts to be an institutional-level service with an individual investor price tag. My money is well spent and my time is not wasted.

Being a subscriber to the service is very useful to me to get insights about macro and asset allocation. Charts are very friendly and the weekly insights are easy to read. I think your service provides good value for money. Congrats!

Callum does a great job in helping us navigate the twists and turns of the economies and the markets. We certainly appreciate the help in simplifying all the market "noise". The research is invaluable!

I have been subscribing to Top Down Charts for about a year. We have found the weekly package to be a fantastic complement to our other sources of market info. The charts are well chosen with detailed descriptions. We utilize the info as a component of our monthly macro outlook, often using the info from 1-3 charts per month into our outlook.

has stopped me investing/selling too early

Helps with perspective and brings out some interesting new perspectives that I had not considered or looked at in a particular way.

I really enjoy your asset allocation section

Thanks! I find your material invaluable. I really like investment ideas, and the tactical asset allocation chart. It really keeps me from making mistakes or getting too out of line with my asset allocation.

Thank you very much for your work.

The service helps me to gather enough information to understand the macro picture.

The weekly ideas inventory table and the monthly asset allocation review are my favorites

You remind of conditions (facts technical or fundamental) that I have neglected to my personal embarrassment.

Summary and Conclusions

Overall I would have to say I am relatively pleased with the results. People have overwhelmingly good things to say about the service. People are subscribing for the right reasons, and I would say there are no major red-flags from those unsubscribing. Meanwhile, it has given me a few ideas for things to work on as I constantly improve and evolve the service.

I think overall the results and the testimonials should also be quite useful for those who are considering a subscription as collectively it is a good vote of confidence and some good “proof“ from existing paid subscribers that it is worthwhile and good.

So naturally, this is the part where I remind you to subscribe :-)

But either way, I appreciate your ongoing interest and support.

Best regards,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter(/X)

Connect on LinkedIn

Hi Callum , would be interesting in a retiree rate when you consider offering it . Thanks and regards