Weekly Insights - Edition 116

This week: macro/market update, crude oil price outlook, US dollar, gold, China macro and equities, emerging markets, frontier market equities...

Welcome to the Weekly Insights report! The weekly insights report presents some of the key findings from our institutional research service, providing an entrée experience (in terms of price and size).

Global Markets Monitor - notable developments

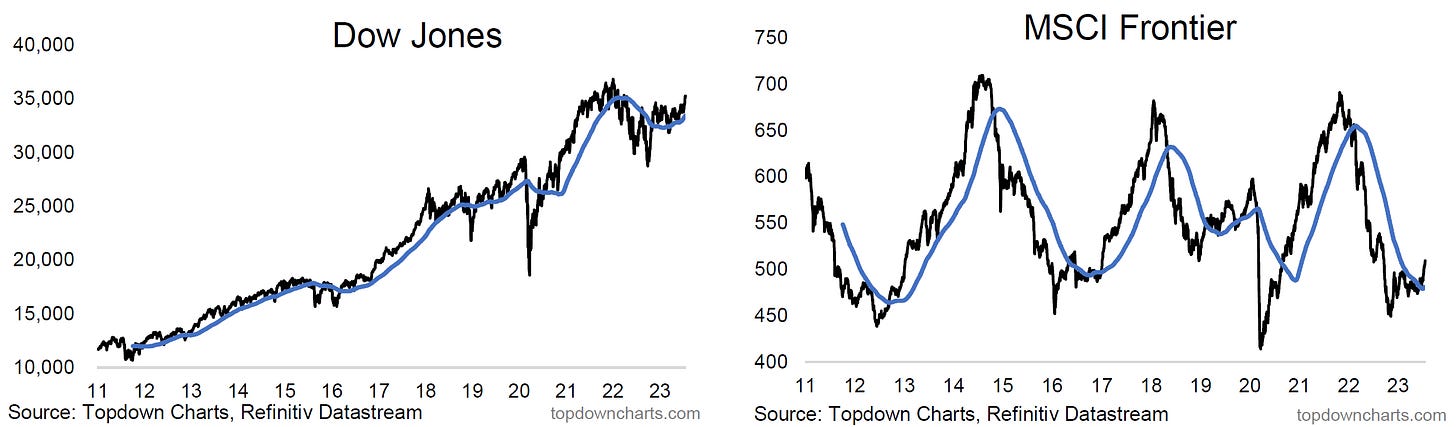

Most major benchmarks are stalling around resistance (notably S&P500 and Nasdaq, also both of which are looking overbought with sentiment now consensus bullish), but a few standouts/exceptions e.g. the Dow Jones breaking out from its trading range, frontier markets breaking higher.

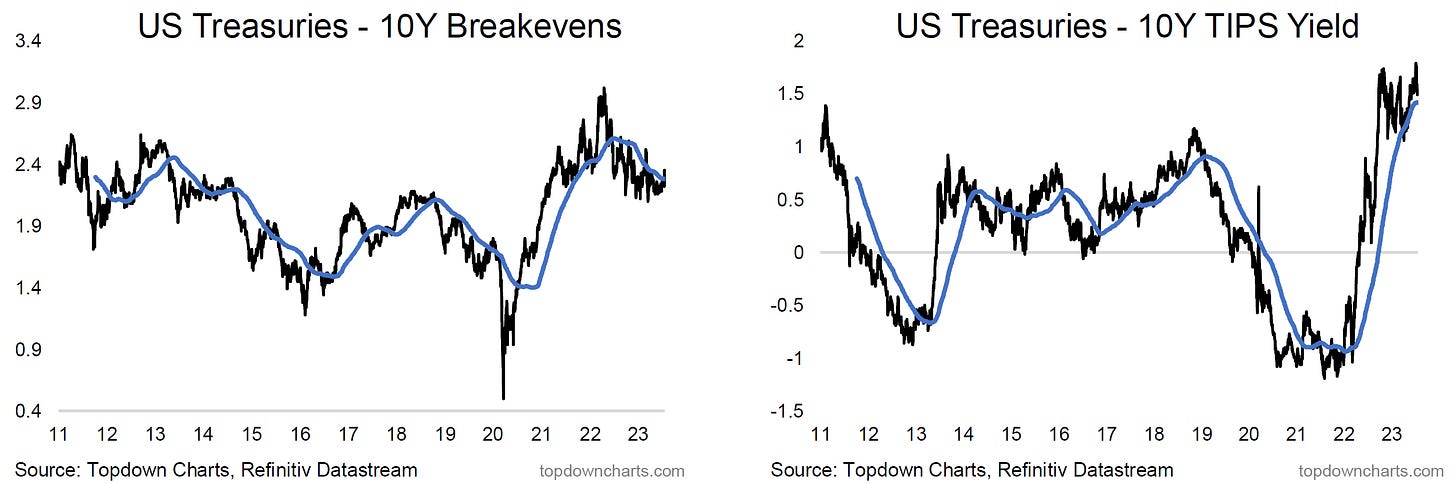

In fixed income bond yields are largely in a holding pattern headed into the FOMC this week, but one standout is the blip up in breakevens as energy prices tick higher, and subsequent tick down in TIPS real yields (which follow a failed break higher). Credit spreads pushing further lower.

In FX the DXY has rebounded back above 100, but still facing overhead resistance -- likely some position squaring ahead of the Fed. EMFX is holding a tight range, and USDCNY paused just shy of the highs. Commodities are ticking higher, with crude oil in particular bouncing off the lows back into its previous trading range zone. Gold also ticking higher.

Market themes: Crude oil prices

-Energy commodities have clearly established a base and put an end to their near-consistent downtrend.

-Crude oil sentiment and positioning indicators are turning up, with ample scope to push higher.

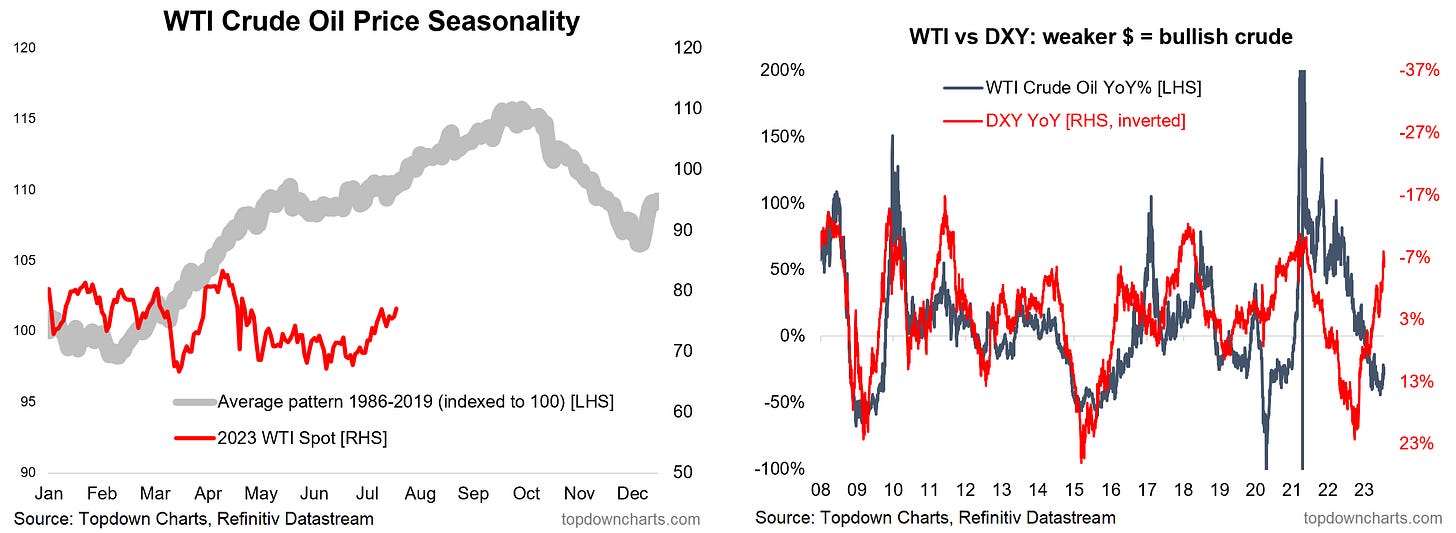

-Seasonality is turning positive for the next few months, and weaker USD is a tailwind.

--Hence, on first glance the technicals for crude oil/energy are looking much improved, and could easily make a push higher.

---this will be important to keep tabs on as it could trigger equity volatility (via higher inflation: more rate hikes, and/or consumer confidence).

Energy commodities have been ticking higher; apparently putting an end to the near-consistent downtrend established since the peak in June 2022 (meanwhile Industrial metals have also paused their decline -- finding a common support line). Crude oil in particular appears to be clawing its way back after an initial break lower.

Indeed, the rebound in WTI crude comes off a logical zone of support, and also comes off a higher low in sentiment (which is still around 50/50 bulls vs bears). Similarly, speculative futures positioning is ticking higher from decade-lows. So there is certainly scope for upside in terms of sentiment and positioning.

Meanwhile, seasonality is turning positive for crude oil (from now through Oct/Nov), and the US dollar weakness also is increasingly a tailwind for crude oil prices.

On the Radar

Macro & Markets: This week there’s a timely update on the economic pulse with the July flash PMIs, also on the data front is US house prices, consumer confidence, and German Ifo. Of course the main event will be the FOMC with a possible (last?) 25bp hike to 5.50%, but also ECB and BOJ keeping things interesting.

In markets, US 10yr yields are chopping around 3.8% after a failed break higher, the DXY has bounced to 101 resistance after brief breakdown below 100, gold currently paused at resistance, WTI broken through lower resistance back into it's trading range, meanwhile stocks are stumbling at resistance (and overbought conditions).

Research Agenda: Definitely will be spending time digesting the various events and data due out this week, but also revisiting Japan, the global policy pulse, treasuries, and global equities.

Weekly Macro Themes Report - key points

1. US Dollar: a bumpy breakdown in a USD bear market…

The initial breakdown in the DXY through a key medium-term support level is likely to be a bumpy path given oversold conditions and already somewhat consensus bearishness.

But positioning is not yet aligned with sentiment (potential selling power), seasonality is negative over the next few months, and the medium/longer-term technicals picture is one of clear bear market, which biases expected direction to the downside over the medium-term.

The bearish tone sits within the larger framework of longer-term cycles.

On the fundamental front, policy convergence/divergence is helping the case as the Fed finishes hikes and the rest of DM catch-up, and previous valuation excesses for the USD get corrected.

Bottom line: Remain bearish given medium/longer-term technicals, policy divergence, valuations, and longer-term cycles.

2. Gold: promising technicals for this internally consistent compound bet…

The weaker USD has been a short-term tailwind for gold, and has helped a clear improvement in technicals (gold fx breadth turning up from oversold, gold itself notching a higher low, upward sloping 200dma).

This comes as seasonality is turning particularly bullish for gold (Aug-Oct).

Meanwhile sentiment/flows/positioning remain mixed and overall present a picture of non-committal sceptical optimism (traders are ready to be bullish gold, but quick to abandon at the slightest sign of weakness).

And we do still need the trinity of breaks if gold is to leave its 3-yr trading range and start a bull market: gold itself needs to breakout to a new high, the USD needs to break down, and real yields also need to break lower.

Thus in some respects gold is a compound bet on bearish USD + bullish treasuries, which are 2 views that I do get to independently, so there is some internal consistency across ideas there.

But also required as part of all that is a peak or pivot in monetary headwinds, which remain considerable (and likely turn in a downturn, hence gold = recession hedge.

Bottom line: Remain bullish gold as technicals improve, but still need to see the 3x breaks to raise conviction on this otherwise internally consistent idea.

3. China: deflationary downdrafts in full force, waiting for stimulus…

Deflationary downdrafts are in full swing in China as the reopening bounce fades, inflation data push further lower, and downside risks loom.

The property market downturn remains a constant, with the reopening spike swiftly unwinding, and leading indicator pointing to ongoing downturn – this reinforces deflationary downdrafts, overall downside risks, and raises the stimulus imperative.

Stimulus has been limited, piecemeal, and targeted so far. It’s likely that further downside is needed to trigger more forceful stimulus.

As such, Chinese equities have fizzled further from the reopening rally. Both China A-shares and MSCI China are facing key technical tests, and require bullish macro catalysts to avoid a run at lower support levels.

Meanwhile though, the valuation picture remains attractive, but again, the deflationary downdrafts are weighing on the earnings pulse.

Bottom line: Deflationary downdrafts (reinforced by entrenched property market downturn) are dampening earnings/sentiment, and more forceful stimulus is required.

4. Emerging Markets: monetary headwinds are shifting to tailwinds for EM…

The weakness in the US dollar is a key bullish development for EM equities, and helps offset some of the domestic monetary headwinds (which are already reducing).

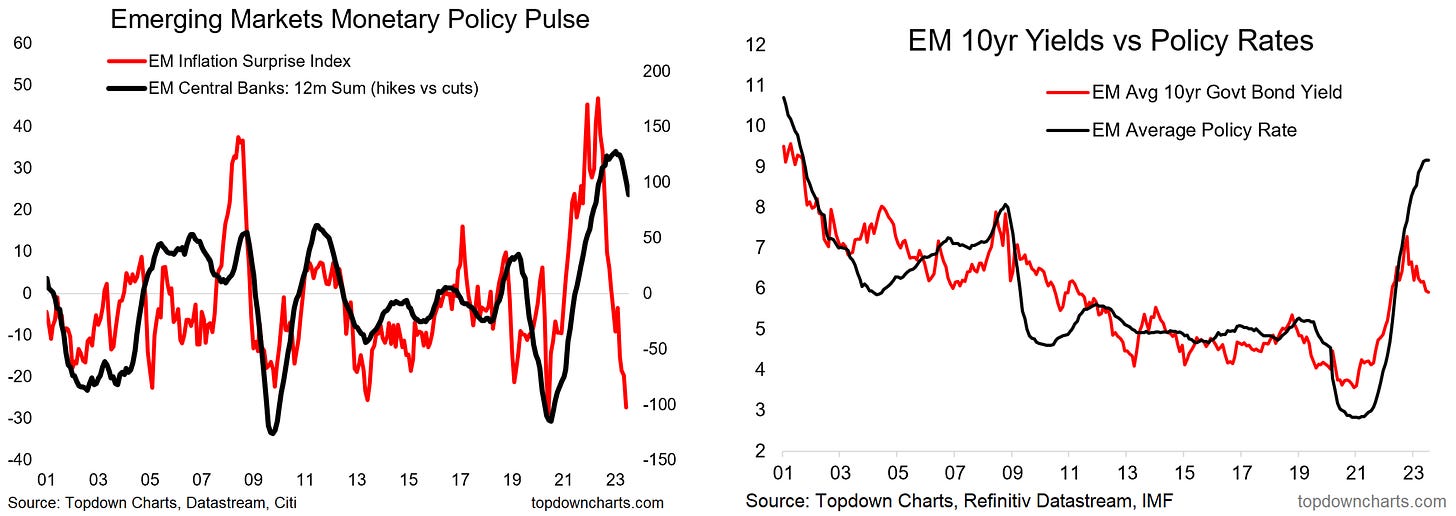

Indeed, with inflation increasingly surprising to the downside, EM central banks are beginning to turn the corner. The pace of hikes has peaked, and even seeing signs of a peak in policy rates for EM central banks (which echoes from the peak in EM sovereign yields).

As EM central banks were first to pivot to hiking, they also look set to be first to pivot to easing. Hence monetary headwinds and now turning to tailwinds for EM.

This is set against a backdrop of valuations and sentiment turning up from cheap and excess pessimism levels. Looks good.

Bottom line: Remain bullish EM equities as a weaker USD and peak in policy rates mean monetary headwinds turn to tailwinds (aligning with bullish sentiment/valuation signals).

5. REITs: risks remain, but improved technicals and deep contrarian setup…

REIT technicals have been improving (ETF flows turning up from persistent outflows, global REIT breadth turning up from oversold).

Sentiment is deeply pessimistic: Sentix survey asset class sentiment far worse than the depths of the financial crisis, ETF allocations at record lows (also half that of the lowest point in 08/09). So while there are clearly (well-understood) risks, this is by itself a clear contrarian setup (everyone is already bearish).

Yet, absolute valuations are not cheap, at best: at the bottom of the range of the past decade, but still above long-term average. Optimistic take is that at least they have reset significantly (1.5 S.D.) and are no longer expensive.

Relative value is also tricky: some relative value vs equities in general, and the REIT vs CRE indicator is at cheap levels (albeit CRE is a moving target), yet there is no relative value vs treasuries or credit (expensive vs credit).

That last point however speaks to the point that one upside catalyst for REITs would be lower bond yields, and they probably either need much lower yields or much better earnings (but without inflation triggering renewed rises in yields). But as a minimum the absence of disaster may mean REITs rise from excess pessimism.

Bottom line: Low conviction short-term bullish on REITs as technicals turn bullish while sentiment and positioning are at the most extreme bearish on record (contrarian bullish).

Ideas Inventory - Updated to 24 July 2023

(Current live Ideas/Themes where an explicit view has been issued)

(Closed/Past themes and ideas)

If you haven’t already, be sure to subscribe to this paid service so that you can receive these reports ongoing (along with full access to the archives and Q&A).

Thanks for your interest. Feedback and thoughts welcome in the comments below.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

Thanks Callum. Much appreciated.