Weekly Insights - Edition 120

This week: macro/market pulse check, bond yield breakout, China macro + A-Shares, gold price outlook, Japanese equities, REITs, and Latin American stocks...

Welcome to the Weekly Insights report! The weekly insights report presents some of the key findings from our institutional research service, providing an entrée experience (in terms of price and size).

Global Markets Monitor - notable developments

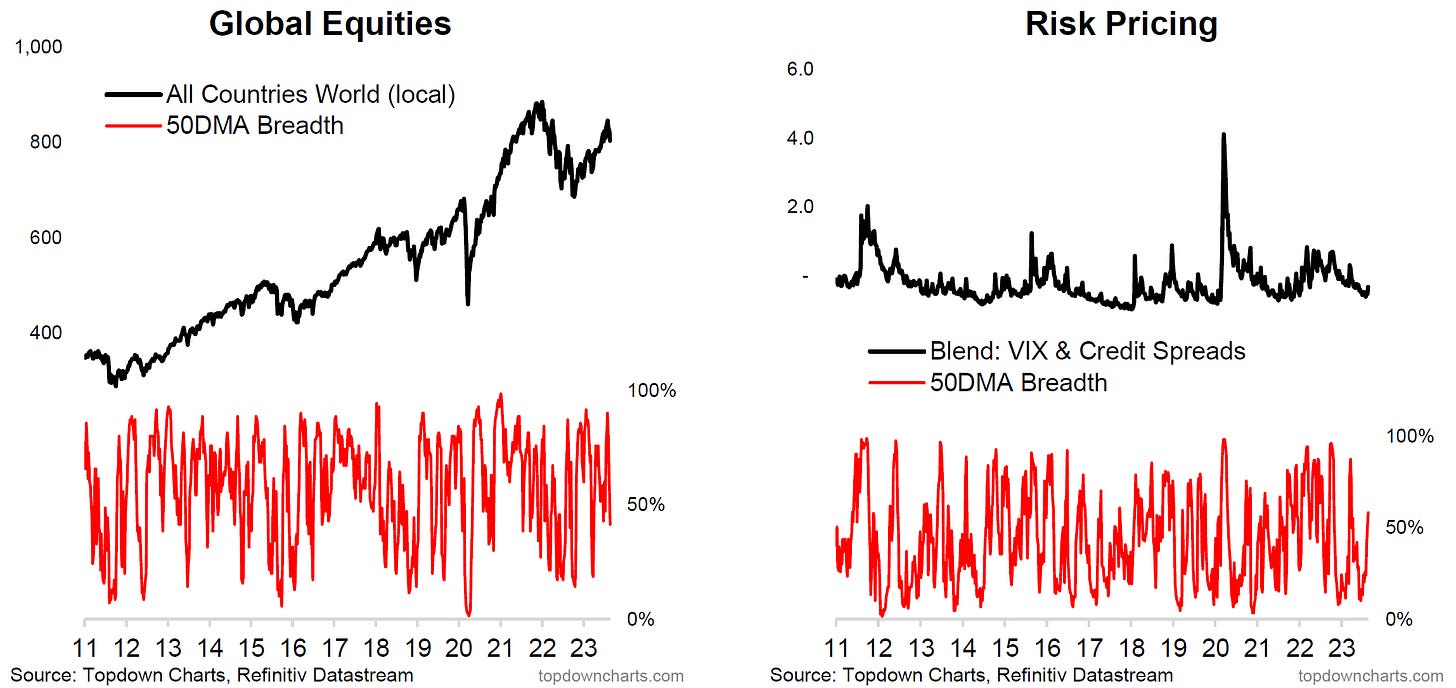

Most equity benchmarks lower on the week as correction sets in globally. Risk pricing ticking higher. On sectors, energy is gaining ground, also defensives healthcare/staples, while tech/discretionaries lower.

Longer-term treasury yields pushing up to new highs, driven by higher real yields, short-term rates also ticking slightly higher. Credit spreads/CDS pricing rebounding off the lows.

US Dollar pushing higher, EMFX slipping to new lows, USDCNY approaching the highs. In commodities, industrial metals and gold weaker, crude oil pulling back slightly from resistance, agri mixed-to-weaker.

Market themes: Developed sovereign yields make or break...

-Developed market 10yr govt yields are attempting a breakout from their trading range (within an ascending wedge - a continuation pattern).

--the kiwi in the coalmine (NZ 10yr govt yield) has already broken out.

-US 10yr treasury yields' push higher has been driven by real yields.

--the BOJ policy tweak was also a key catalyst.

--upcoming Jackson Hole symposium may endorse higher long-term yields.

-Meanwhile the macro remains a tension between growth vs inflation as the main driver (former suggests lower, latter suggests higher).

--overall, still bullish medium-term on treasuries given valuations, sentiment, macro outlook, but wary that the momentum is in one direction right now, with risk of upside overshoot...

Developed market sovereign yields have been ticking further higher, with New Zealand in particular serving as a bit of a canary/kiwi in the coalmine: breaking out of its range trade and making new highs. While false breakouts are always an option, a breakout from a range trade like this often results in a more significant move higher and/or at the very least, a new higher plateau.

Focusing on US treasuries, the attempted breakout to new highs for US 10-year yields has been driven primarily by higher real yields ...with the BOJ move to raise the yield cap serving as the catalyst as JGB yields breakout of their previous mandated range. It brings to mind the emerging speculation around Fed Chair Powell's upcoming speech at Jackson Hole this week -- that he may endorse higher for longer (higher neutral rate, new normal higher long-term yields). This year's J-Hole theme is "Structural Shifts in the Global Economy," -- which could certainly be a scene or theme for considering new normals.

Meanwhile on the macro, across the various models, the macro/intermarket indicators still point to US 10yr yields dropping toward 2% (which to be fair probably requires a dive in macro data (payrolls/consumer), and/or plunge in inflation, Fed finish, to name some catalysts), meanwhile the long-term rate of inflation model points to higher yields yet to come (and potentially higher for longer if inflation doesn't keep calm and carry on with disinflation).

On the Radar

Macro & Markets: This week we get a timely update on the global economic pulse with the August flash PMIs (and German Ifo, Belgian NBB). From the USA there’s UoM Consumer Sentiment, durable goods, lots of Fed speak — culminating with Fed Chair Powell speaking at the somewhat infamous Jackson Hole symposium.

In markets, all eyes are on the US 10yr yields attempting to break out to new highs + DXY pushing higher, meanwhile gold is still clinging onto support above 1900, WTI crude hanging around resistance, and stocks still in correction mode...

Research Agenda: This week keeping tabs on the macro data and fluid situation in markets, but also due to review EM, frontier, global equities, credit, EM bonds.

Weekly Macro Themes Report - key points

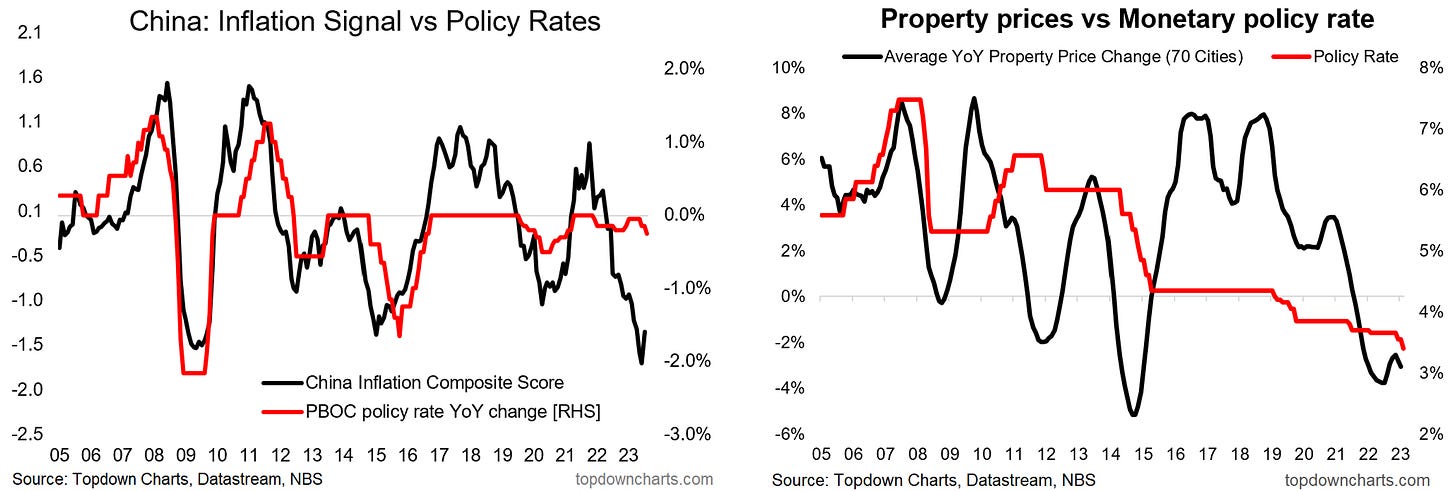

1. China Macro: clear case for stimulus, stocks still in standoff…

The most reliable data series from China (property prices), continue to show a deepening downturn, with leading indicators pointing to ongoing trouble in absence of any meaningful intervention.

This is dampening confidence, reinforcing disinflation (and deflation risk), and macro downdrafts – while the covid reopening bounce has been and gone and global growth remains at risk.

Hence the PBOC has edged further into stimulus mode, cutting the MLF rate by 15bps (and also just cut the benchmark LPR rate by 10bps), but will need to do more, and has ample justification in this context.

USDCNY may be one constraint, and raises the odds of more fiscal and focused monetary easing to boost the consumer (which would be less impactful on commodities, and more beneficial to Chinese A-shares).

At the moment the stocks are in a standoff, caught between hope of stimulus vs macro downdrafts. Valuations remain compelling cheap, but a catalyst is required, and conventional economic wisdom would say that one should soon arrive in the form of stimulus should China seek to avoid a deeper downturn.

Bottom line: As the downturn deepens, the case for stimulus becomes clearer, and a catalyst looks close for cheap Chinese stocks.

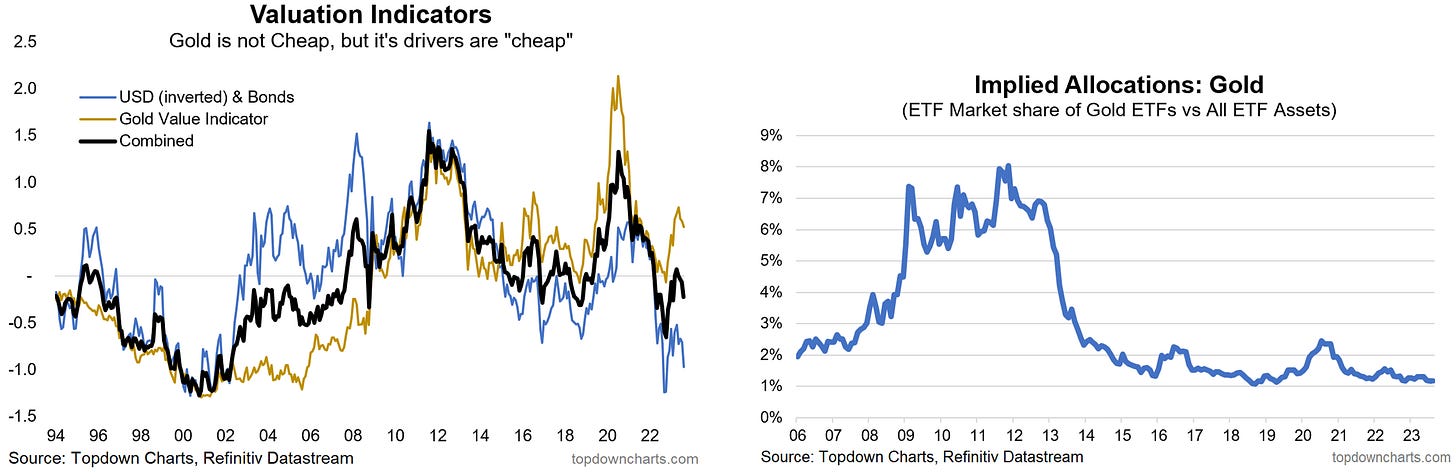

2. Gold: ground-down by rebounding yields and USD…

The rebound in the USD from oversold levels and breakout in real yields presents real headwind for the gold price.

Technically it looks tenuous, but is still holding on to the key 1900 support level (and its 200-day moving average) and gold FX breadth is slightly oversold.

The gold price correction and flareup in gold intermarket indicators has shaken flows and sentiment; driving out some of the weak hands (which could be considered a consolation to the weakness in gold).

The push higher in yields and USD has driven the gold-driver value indicator back to the lows (i.e. USD becoming more expensive, and bonds becoming cheaper), which represents a sort of coiled spring for gold prices. Meanwhile investor allocations to gold remain near record lows.

So there is still some hope for gold, but realistically what is required at this point for significant and sustained performance would probably be a (US) recession (where yields drop, Fed finishes (maybe even eases), and USD weakens – so gold would be a recession hedge).

Bottom line: Higher real yields and stronger dollar have pushed gold into correction mode, but there is still some cause for optimism on gold (particularly as a diversifier/hedge).

3. Japan: strangely compelling setup for Japanese equities…

The Q2 GDP report showed that the breakout in nominal GDP was not only not just a one-off blip, but saw further upside follow-through – this key fundamental breakout backs the technical breakout in price.

The upshift in longer-term GDP growth rate arguably justifies a higher forward PE ratio than that which prevailed through the past couple decades of stagnation.

The push higher in GDP is supported by structural reforms of previous years which have helped lift labour force participation rates (offsetting at least temporarily some of the demographic downdrafts on potential growth). Improved governance has also seen improved profitability and steps to increase buybacks.

This is all set against a backdrop of compelling relative value, with Japanese equities still trading near record/cycle lows vs global equity peers, and global investors still sceptical/sleeping on Japanese equities – with implied allocations by US retail investors still near record lows.

Bottom line: Remain bullish on Japanese equities as previous reforms help enable a fundamental breakout to back the price breakout vs a backdrop of cheap valuations.

4. REITs: extreme pessimism, mixed technicals, mixed value signals…

Technical indicators remain consistent with a bottoming pattern for REITs, albeit the current market correction puts that at risk with revisiting of support.

Sentiment is extremely pessimistic:

Surveyed sentiment (Sentix) is ticking up from record bearish levels.

Fund manager surveys (BofA) show capitulation to 2008-level underweights.

ETF market share points to record low allocations by retail investors.

Hence while there are real challenges and headwinds for REITs/CRE, sentiment and positioning already more than reflects this, and so it could be that even a benign fundamental outcome could trigger an upturn for REITs.

In terms of valuations:

REIT prices relative to commercial real estate look cheap.

REIT dividend yields trade at an attractive premium vs equities.

Absolute valuations have reset significantly (albeit only to neutral/long-term average).

(but) dividend yield spread vs credit/treasuries is in line with 2007 levels (expensive).

So there is an emerging case for REITs, but it is not without risk, and likely requires a move lower in bond yields as a catalyst (or better/benign fundamentals).

Bottom line: Remain low conviction cautiously optimistic on REITs given how extreme sentiment and positioning have become.

5. LatAm: promising on deep value and policy pivot, but wait for technicals…

Clear and compelling value, e.g. PE10 near record lows (eclipsing 2020, 2008, and early-2000’s lows). FX is also cheap (stronger FX would help US$ returns, while weaker USD vs LatAm FX would also be helpful indirectly).

LatAm central banks are beginning to pivot to rate cuts; as a group they were first to pivot to hikes and aggressively-so, and now are first to pivot cuts. Follow-through on rate cuts and more widespread rate cuts, potentially paired with weaker USD and stable commodities would be helpful from a macro standpoint.

The key ingredient from a timing standpoint though is a technical trigger. This would come from a breakout vs the long-term downtrend resistance line (not yet, and currently turning down from that line). But there are some promising signs on the technicals e.g. price above 200-day moving average (which itself is turning up), and short-term uptrend line off the 2021/22 lows remains intact.

Bottom line: Promising setup given extreme cheap valuations, policy pivot in progress to rate cuts after an aggressive hiking cycle, but waiting for technical triggers.

Ideas Inventory - Updated to 21 August 2023

(Current live Ideas/Themes where an explicit view has been issued)

(Closed/Past themes and ideas)

If you haven’t already, be sure to subscribe to this paid service so that you can receive these reports ongoing (along with full access to the archives and Q&A).

Thanks for your interest. Feedback and thoughts welcome in the comments below.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn