Weekly Insights - Edition 2

Research insights, macro/market wrap, and selection of charts

Welcome to the Weekly Insights report!

The weekly insights report presents some of the key findings from our institutional research service, providing an entrée experience (in terms of price and size).

Hope you enjoy it. Let me know if you have any feedback, and by all means don’t forget to tell your friends and colleagues to subscribe :-)

Weekly Macro Themes Report - key points

1. Emerging Markets: Still bullish, but with much lower conviction.

The macro/cyclical indicators are strong; a key driver of this next phase of the market cycle, and still see relative value in EM equities.

(but) Sentiment is stretched (extreme optimism), absolute valuations are no longer cheap (but not expensive either), and monetary conditions are turning towards tightening.

Technicals have been mixed recently: market breadth soft, some previous intermarket warnings (e.g. EMFX), but still above key support levels.

2. EM ex-Asia Equities: Within EM Equities prefer non-Asia.

(Referring to Non-Asia EM i.e. LatAm, Middle East, Africa, East Europe.)

EM ex-Asia has seen a recent positive turn in technicals (initial breakout on a relative basis vs EM Asia), and historical correlation with commodities (bullish).

EM ex-Asia valuations are reasonable vs history, and cheap vs EM Asia. Investor allocations to EM ex-Asia are fairly light vs history (bullish contrarian signal).

3. US REITs: Mixed but mildly positive outlook.

REIT/Commercial Real Estate expensive in absolute terms, rents have been crushed, and some uncertainties remain (what does new normal look like?)

Yet, REITs enjoy positive relative value, historically light investor allocations, and non-residential real estate investment is at record lows vs GDP (supply tailwind).

Certain sectors within REITs (e.g. retail, hotels/resorts, healthcare, office) will benefit from reopening and eventual rent recovery.

4. Global Listed Infrastructure: Stay neutral.

Previously shifted to neutral (from bullish last year).

Valuations are not cheap, relative value positive but at the low end of the range, technicals not convincing; still in a relative bear market.

Government infrastructure investment programs may help the sector, at least increase interest, particularly in the US with the Biden infrastructure proposal.

5. UK Equities: Remain bullish - clear upside case in place.

Compelling relative value: at decade lows vs Europe and the World.

Solid equity risk premium, improving earnings momentum and dividend outlook, sentiment turning up from previous bearishness/investor apathy.

Major progress on vaccinations mean there is a light at the end of the covid tunnel, and Brexit now behind us. GBPUSD edging towards a possible major breakout (good for unhedged UK equity exposure).

Global Markets Monitor - notable developments

Price: most notable price development is probably the weakness in tech (and related); specifically, the global tech sector and consumer discretionaries are breaking down in relative terms vs the index. Also of note is the continued rise in inflation expectations, and 2-year highs in European 10-year government bond yields (Swiss & German) - perhaps a sign of things to come for US treasury yields.

Sentiment: of most note in sentiment/positioning, is the slight turn downwards in equity surveyed sentiment (from previous extreme optimism), and slight tick upwards in bond surveyed sentiment (from previous extreme bearishness).

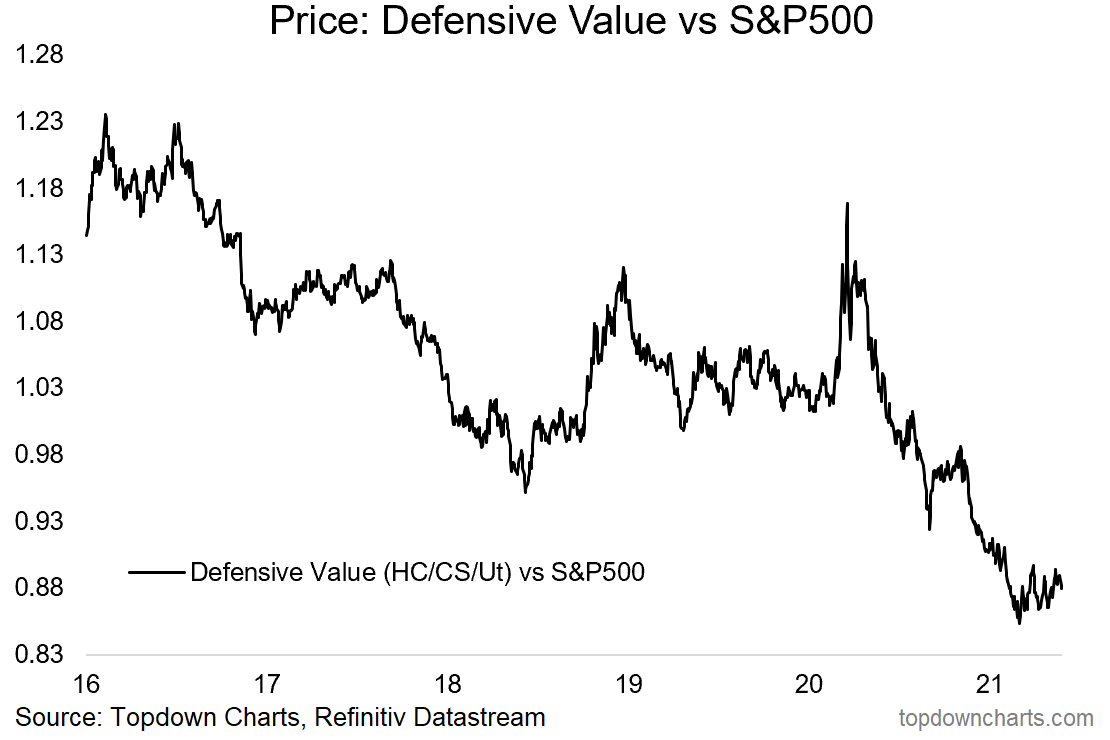

Market Themes: the theme of focus this week was the wobbles in tech — and renewed strength in value vs growth. Growth is heavy in tech and tech related, so this is as much about growth weakness. But as noted below (chart 2), it could well end up with “defensive value“ driving the next leg up for value vs growth.

On the Radar

Macro & Markets: a fair amount of data out this week, but probably the most material (to me at least) will be the flash PMI data for May (a near real time progress check on the recovery across developed economies - could be a catalyst for further upside in bond yields if the data is good). In markets I am very wary that gold, the US dollar, WTI crude, and UST 10-year yields are all chopping around key levels… (open minded, but my guess: WTI/gold/yields break higher, USD lower).

Research Agenda: I will be reviewing the outlook for gold and defensive value this week, and it’s probably about time I take another look at global equities (especially ex-US). Also on my mind is the global tax rate outlook (likely higher).

Top Charts of Topdown

Here’s a selection of charts that I thought were particularly notable.

1. US Government Investment: US government investment levels remain historically low, despite some uptick in recent years. It’s fairly widely documented that US infrastructure needs an upgrade, and as is usual for this sort of thing the government needs to do much of the heavy lifting. Raising requirements in this space is also the desire to move towards, and existing trend of, electronic vehicles (and other climate/green investment initiatives). The Biden administration is keen to do something big on infrastructure, but of course the issue of how to pay for it, and getting bipartisan support is going to be tricky - but infrastructure investment in concept is likely to be where the most common ground is on the fiscal front.

Key point: US infrastructure investment is likely to increase in coming years.

2. Defensive Value: US value stocks are basically split 50/50 in terms of sector overweights to “Defensive Value“ (healthcare, utilities, consumer staples), and “Cyclical Value“ (energy, financials). Defensive Value tends to outperform during selloffs/corrections and bear markets. Defensive value has gone through a period of significant underperformance as the markets have largely been in risk-on/reflation mode. If the relative weakness in tech turns into something deeper and more prolonged, it will be Defensive Value that benefits the most. What’s more, defensive value is trading near record low relative valuations, so it is something I am increasingly looking at.

Key point: defensive value could be due for a turnaround.

3. GBPUSD - Make or Break: As noted in the first section, while UK equities definitely look interesting, what’s also interesting is how the Pound is currently contending with a key overhead resistance level. If I had to guess I would say it probably does breakout as a lot of the things that have been going wrong for the UK are steadily moving towards the rear-view mirror. Although the rally in the GBPUSD has been significant already, there remains some value (still slightly cheap). Of course, best thing would be to wait and see until it actually does breakout, but certainly something to have on the radar.

Key point: GBPUSD is nearing a prospective major breakout.

4. EM Investor Sentiment: My composite sentiment indicator for emerging markets (includes: fund flows, credit spreads, implied volatility, earnings sentiment, data surprises) has pushed up to a record high. It is a massive contrast to early 2020, but although it does show everyone is probably mostly on board with the bullish case for EM, it has yet to turn down in a meaningful fashion. So strictly speaking, buying EM equities is riskier when sentiment is maxed out, but the time to turn bearish is only when sentiment goes extreme-bull *and* then turns down.

Key point: investor sentiment on Emerging Markets is at a record high.

5. EM vs DM Long-Term Perspective: Staying with emerging markets, I thought it would be interesting to check in on this longer term chart. Basically emerging markets have been in about a decade-long relative bear market vs developed markets. There have been a couple of false dawns: notably in 2016/17, and again this year… as the initial rally has failed and is testing the bottom end of the range again. I am paying close attention to the risk outlook for emerging markets: i.e. on the risk radar in the quarterly strategy pack I noted that one of the big traditional risks around a crisis like the pandemic is the possibility of secondary crises (e.g. think about the Eurozone debt crisis that followed the financial crisis). I wouldn’t want to count out EM just yet, but I am willing to let price keep me attuned to the evolving situation [recall: price moves faster than fundamentals].

Key point: after an initial rally, EM vs DM is testing the bottom end of the range.

Ideas Inventory - Updated to 14 May 2021

(Current live Ideas/Themes where an explicit view has been issued)

If you haven’t already, be sure to subscribe to the paid service so that you can receive these reports ongoing (along with full access to the archives and Q&A).

Thanks for your interest. Feedback and thoughts welcome in the comments below.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

Hope you are enjoying the service so far, be sure to reach out if you have any questions