Weekly Insights - Edition 39

This week: Stock/Bond Ratio review, Treasuries tactics, Value vs Growth, Global Banks, Energy Sector, Macro sentiment, US dollar technicals

Welcome to the Weekly Insights report!

The weekly insights report presents some of the key findings from our institutional research service, providing an entrée experience (in terms of price and size).

Let me know if you have any feedback, and by all means don’t forget to tell your friends and colleagues to subscribe! :-)

Weekly Macro Themes Report - key points

1. Stock/Bond Ratio: stocks to lose ground vs treasuries over the next 6-18 months.

As of the time of writing, stocks were down almost -10% from the high, and treasuries are also down just over -8% from the high.

That means the stock/bond ratio has rolled over, but it also gives reference to the point that both stocks and bonds are historically very expensive.

Relative sentiment, allocations, momentum, and detrended price series are presenting a bearish hue on the outlook for the stock/bond ratio.

Meanwhile, the monetary and economic leading indicators are also pointing to stocks losing ground relative to bonds.

This is consistent with the “growth scare” thesis which I outlined last week.

2. Treasuries: technicals/valuations/sentiment point to a window of weakness.

The technical picture remains bearish for treasuries with the break out in yields still in play, clear bearish momentum across developed markets, and an example being set by EM.

The bearish technical picture takes on more meaning when you factor in still very much expensive valuations for treasuries and DM sovereign bonds.

Sentiment is increasingly bearish, but has yet to match some of the previous historical extremes and is yet to reverse from the extreme (so no true contrarian signal yet).

The macro/market model still points to upside in yields, and some of the 6

components even suggest yields head towards 3%.

...(but) the leading indicators suggest the macro/market model will taper off further, and the growth scare scenario could see bonds actually rally.

Thus there appears to be a window for further bond weakness.

3. Value vs Growth: a major turning point in value vs growth is underway.

Across global equities, value is holding ground while growth stocks are being punished (something we see as widespread across countries/regions).

As such global value vs growth is breaking out, lead by China/EM, but also evident in the USA and developed ex-US. So far it is “cyclical value” that is leading the charge.

Looking specifically at the US, all the conditions are in place for a medium/longer-term turning point, e.g. extremes in relative valuations, excesses in growth stocks, and an all-time low point in value vs growth relative performance (which is turning up).

As with global, in the US it is cyclical value that is doing the heavy lifting: the relative performance line is up more than 40% off the low point.

While there have been numerous false dawns, there is a real prospect that it is different this time, and this may be *the* turning point in value vs growth globally.

4. Global Banks: banks are gaining ground on macro/technicals/valuations.

US financials have been gaining ground in relative terms as treasury yields tick higher, this comes off extremely cheap relative valuations.

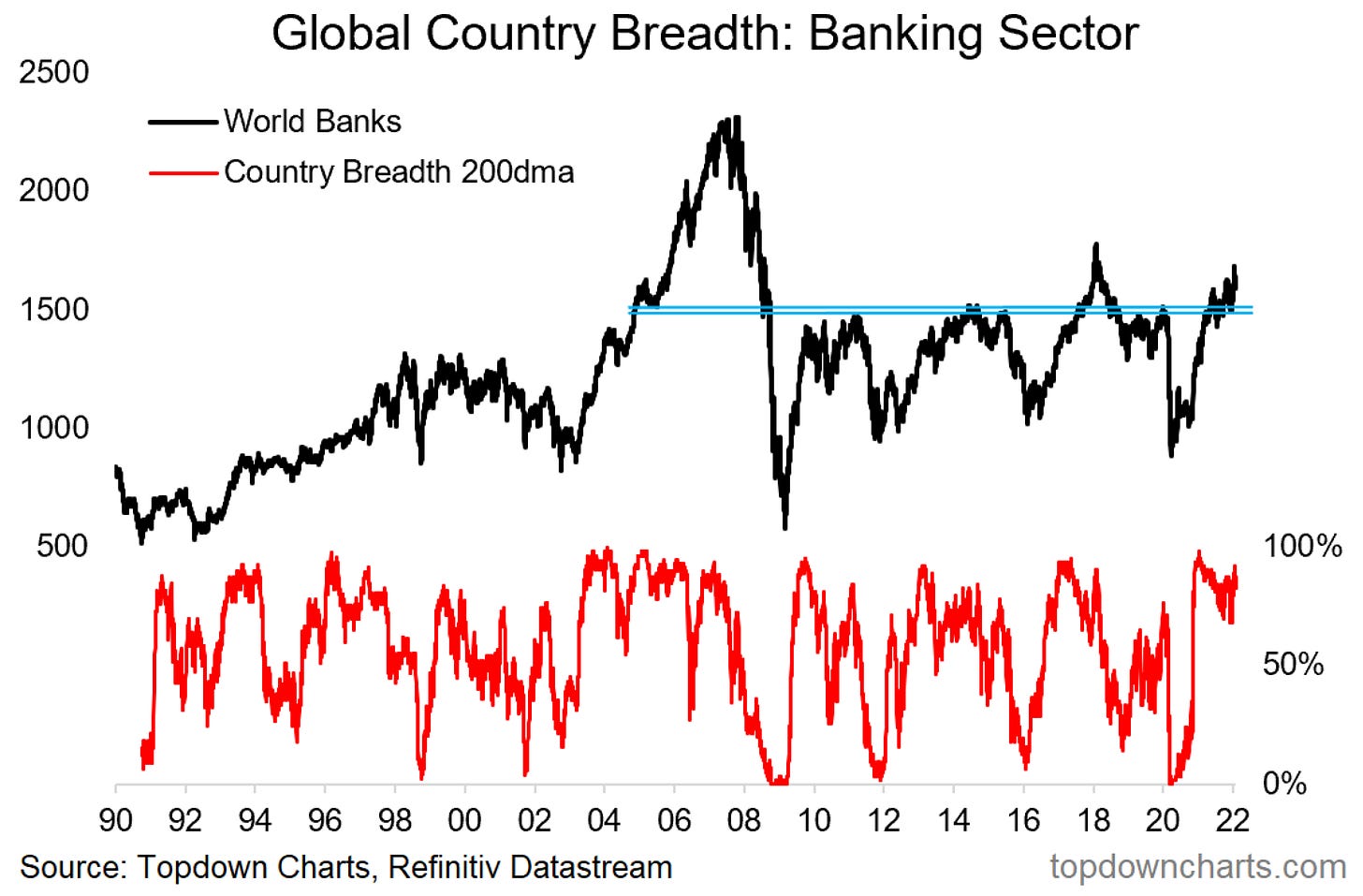

The global bank index meanwhile has broken out from a 10-year trading range, with strong breadth across countries. Across regions, we are seeing banks clawing their way back in relative terms.

Globally, the banking sector is trading at reasonable valuations in absolute terms, and extremely low valuations in relative terms.

Global ex-US banks have been in a decade-long relative bear market vs US banks and hence find themselves trading at a near-record low valuation discount.

The constructive view on global banks is consistent with the bullish view on value vs growth outlined in the previous topic.

5. Energy Sector: bullish on valuations/fundamentals/sentiment/technicals.

Oil has been going from strength to strength following its brief “healthy correction” late last year. Supply growth has been severely stunted, and demand is set to recover further as post-pandemic normalization remains just around the corner.

As such energy sector equities have had a very strong run, but remain reasonable in terms of absolute valuations, and cheap on a relative basis.

The rebound in energy sector share/contribution to S&P500 earnings is a critical fundamental support to the turnaround in energy sector equities.

Sentiment is clearly shifting, but allocations are still light vs history.

Renewable energy has lost substantial ground vs fossil fuel stocks, unwinding the previous excesses in flows, relative valuations, and price.

Global Markets Monitor - notable developments

Price: US dollar breadth was notably stronger last week, while global equities breadth finished up slightly, and commodities/EMFX saw weaker breadth. Equity markets underwent a sharp sell-off last week with the Nikkei 225 and Euro STOXX notably weaker. EM equities were mixed; mostly weaker, while US value vs growth continued recent strength to move higher. Equity sectors saw continued rotation from growth (discretionaries/tech/telecoms) to value (energy/materials/financials/staples/utilities).

Longer-term Treasury yields (such as 10-year and 30-year) were basically flat on the week, while shorter-term yields pushed higher: flattening the yield curve somewhat. US CDS spreads ticked higher again, with US IG/HY spreads slightly higher as well. Europe HY finished up, with EM spreads relatively flat.

On the FX front, the DXY had a strong rally off the lows closing the week above the 97 level, it’s currently pulled back to the mid-96 range, however. Elsewhere, EMFX is stumbling after the rally in the DXY, the NZDUSD has been falling sharply, and the RUB has been stabilizing. Commodities are broadly stronger again, with WTI crude breaking higher and strength in Agri-commodities. Gold and Silver both fell from resistance, back to lower support levels.

Sentiment: Macro/Reflation sentiment and positioning indicators are moving higher again after a previous material reset. Driving the rebound is a sell off in bonds along with commodities catching a second wave of strength.

Elsewhere, surveyed equity sentiment is mostly lower following the January correction: still predominantly bearish. Emerging markets sentiment is ticking higher from the lows, but still about middle of the range with plenty of room to the upside.

Market Themes: Following the Fed confirming its hawkish stance last week the DXY has rallied sharply off the lows with broad based strength vs G10 FX.

As such folk are increasingly onboard with this and are clearly chasing the momentum: futures positioning is crowded to the long side and sentiment is increasingly bullish. From my point of view, the surge in the DXY has me close to capitulation on the bearish USD view. That said, the medium/longer-term point case still stacks up in my view for a few key reasons, but clearly, the short-term technicals look bullish for now.

On the Radar

Macro & Markets: On the radar, this week is the January PMI data from all countries, which will present a timely check on the macro pulse. On the central banking front, announcements are due from Australia, UK, and Europe. The other big data announcement will be the payrolls due out later this week — there have been a few mentions by officials that it could be weak based on Omicron related issues, so possibly a disappointing number on the cards.

In markets, the DXY is attempting to breakout. 10-year yields are stumbling at resistance after running out of steam. Gold rally hopes were dashed as it smashed back to the bottom of the range. Elsewhere WTI crude continues to edge higher, while stocks are bouncing from oversold off support. Notably Chinese markets are closed this week with basically the whole country on holiday to celebrate the Chinese New Year (year of the tiger).

Research Agenda: Big thing on the agenda this week is monthly stuff! I will be sending the monthly report out later this week, and of course as part of that taking a closer look and think around tactical asset allocation mix. Aside from that commodities, EM ex-Asia, credit, and inflation are on the agenda.

Top Charts of Topdown

Here’s a selection of charts that I thought were particularly notable.

1. Stocks vs Bonds Relative Performance Outlook: The OECD leading indicator diffusion index is pointing to stocks losing ground vs bonds later this year (this is also confirmed by the developed markets monetary conditions indicator which also points to the same conclusion over the next 12-18 months). This is consistent with the 2022 growth scare thesis which I highlighted last week.

It also lines up with some of the other indicators I’ve been looking at on the US stock/bond ratio. As a point to note, stocks could lose ground vs bonds by still being positive but with bonds outperforming, or likewise with *both* negative but stocks falling further. But if this scenario precipitates because of a growth scare then it’s likely a result of stocks falling and bonds rallying.

Key point: Stocks look set to underperform bonds over the next 6-18 months.

2. Stocks & Bonds Expensive: One of the most common forms of pushback against the observation that US equities appear to be extreme expensive vs history is that bond yields are much lower — especially compared to the dot com bubble. However, as the chart below shows bonds are also extremely expensive. Hence my comments above that both bonds and stocks could fall together (and that is precisely what has happened so far this year).

Key point: US stocks and treasuries remain significantly expensive vs history.

3. Bond Macro/Market Model: My 6-factor macro/market composite model still suggests further upside for bond yields (at least into the 2%’s), and some of the components are pointing even higher.

That said, it is worth noting that the macro model has come down from levels seen earlier last year, and the leading indicators suggest further falls in the months ahead. Hence I think there is a narrow window of further weakness for bonds.

Key point: There remains credible upside risk to bond yields.

4. Value vs Growth — Cyclical vs Defensive Value: As noted, the worm seems to be turning for global value vs growth stocks. This chart helps provide visibility on the drivers of the turn in relative performance. If we look at the sector weightings of value vs growth we can find the sector skews in value basically clustered into “Cyclical Value“ (energy and financials), and “Defensive Value“ (staples, utilities, healthcare). While defensive value has gained ground through the correction, it is cyclical value that really stands out.

I would say that the macro backdrop disproportionately favors cyclical value in that those sectors are more directly geared to reopening, higher yields, and elevated commodity prices. Meanwhile tech/growth earnings likely level-off following the big one-off gain in growth that the pandemic gifted many of those companies. So I am looking to this chart to help lay out the playbook for further follow-through in what looks like a key turning point for value vs growth equities globally.

Key point: Cyclical value is pulling ahead and helping value vs growth turn the corner.

5. Global Banking Stocks: This sector has been counted out and dismissed by many investors — partly due to thematic narratives e.g. the rise of crypto/defi (decentralized finance), booming VC investment into FinTech, and social/political/regulatory crackdowns on the banking sector following the global financial crisis. And to be fair, global banks have been a big fat range trade since 2008.

But something is brewing in the banking sector. The global bank stock index is in the process of undertaking what may well be a major breakout. Aside from the interesting price action in the index, if we look across countries the strength has been widespread with 90% of countries’ bank stock indexes tracking above their respective 200-day moving average (by contrast, just over 50% of the S&P500 is tracking *below* their 200dma).

Supporting the bullish technicals is an attractive valuation setup (global banks are cheap vs history, cheap vs the rest of the market, and global ex-US banks are cheap vs US banks). Also of note is the macro outlook: the banking sector is here to stay, certainly at least in the immediate term, and will benefit from higher yields, strong housing markets, and recovering real activity as reopening resumes.

Key point: global banking stocks are breaking out.

Ideas Inventory - Updated to 28 January 2022

(Current live Ideas/Themes where an explicit view has been issued)

If you haven’t already, be sure to subscribe to this paid service so that you can receive these reports ongoing (along with full access to the archives and Q&A).

Thanks for your interest. Feedback and thoughts welcome in the comments below.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn