Weekly Insights - Edition 41

This week: Fed Thoughts, Credit risk-watch, EM ex-Asia equities, US Small Caps, Global Small Caps, Bond fund flows, EMFX check

Welcome to the Weekly Insights report

The weekly insights report presents some of the key findings from our institutional research service, providing an entrée experience (in terms of price and detail).

Hope you enjoy it. Let me know if you have any feedback/questions, and be sure to tell your friends and colleagues to subscribe! :-)

Weekly Macro Themes Report - key points

1. Fed Thoughts: The fed now faces its *chosen* risk of hiking rates too late.

The Fed sought to avoid the risk of hiking rates too early, and now faces the realized risk of having to play catch up on rate hikes.

The latest CPI data (and a variety of inflation metrics) shows the Fed is behind the curve on managing inflation expectations.

The other aspect of the Fed’s dual mandate, the labor market, is also running hot (tight capacity + accelerating wage growth).

Hence there is growing speculation of an inter-meeting rate hike (or at least an early end to QE), and consensus has been steadily ratcheting up rate hike forecasts for 2022.

The market likely can sustain multiple rate hikes without turning down.

(but) wary that valuations are elevated, and that the Fed may have left it too late to start stimulus removal.

2. Credit: Place on risk-watch (based on risk flags, valuations, macro outlook).

The Fed rate-hike catch-up risk-scenario seems increasingly likely, and hence credit is on borrowed time; particularly in the context of very light risk premia (especially at the lower end of the credit quality spectrum).

Short-term risk flags include: weakening technicals, initial widening of spreads/CDS, deterioration of the CMI indicators, and divergence vs bond + equity market volatility.

That said, macro indicators e.g. bank lending standards, TIPS breakevens, cycle indicator are consistent with the current ultra-low level of spreads – yet, on all 3 counts these indicators have already retreated from their strongest point.

Thus continue to lean bearish, wary of emerging risk indicators vs context of expensive valuations: hence time to put it on risk-watch in the first instance.

3. EM ex-Asia: Remain bullish EM ex-Asia (technicals, valuations, positioning).

EM excluding-Asia equities have been outperforming vs EM Asia since bottoming in early 2021, and in the process have cleared a number of key technical hurdles.

The renewed strength in commodity prices bodes well for EM ex-Asia equities.

The strategic case remains strong: attractive valuations vs history and vs EM Asia peers, and investor allocations remain particularly light vs history.

EM ex-Asia FX also looks attractive vs history and vs EM Asia with valuations at decade+ lows, and stabilization in FX rates after previous weakness.

Latin American Equities in particular are the most attractive region within EM ex-Asia given particularly low valuations vs history for both FX and equities, and with their central banks far further along in the policy normalization process, not to mention also very light allocations vs history.

4. US Small Caps: Bullish small vs large caps on relative value, technicals, sectors.

The extended weakness in small caps vs large caps has resulted in a significant further improvement in the relative value indicator (cheapest since early 2000’s).

Meanwhile the technicals have improved in recent weeks for small vs large relative performance with bullish RSI divergence, and intermarket bullish divergence (vs bond yields).

Pessimism on small caps continues to dominate with heavy outflows from small cap funds, and small caps tracking near multi-decade low market cap weightings.

Yet, absolute valuations do remain elevated, thus favor small caps in relative terms (vs large caps).

Relative sector skews (i.e. old cyclical sectors vs tech-related sectors) likely disproportionately favor small caps going forward (i.e. given expected higher commodity prices, greater capex, higher interest rates, real activity).

5. Global Small Caps: Global small vs large likewise looks oversold and undervalued.

Globally, we see significant variation in relative performance paths across the major chunks of global equities (e.g. EM & Asia have had a very strong rebound, while US and DM ex-US have seen small caps lose ground).

The breadth of relative performance for small vs large across countries has plunged, and is arguably starting to look oversold.

Much like value vs growth, small caps vs large caps enjoy attractive relative value and share a number of similarities, that said the relative valuation indicator shows a steeper discount for value vs growth.

Global Markets Monitor - notable developments

Price: Last week saw broad weakness in global government bonds, strength in commodities, and stabilization for global equities. Equity markets were volatile, with many benchmarks ranging. Late last week equity markets turned weaker as uncertainty over Fed rate hikes and geopolitical risk (Russia/Ukraine in particular) weighed on the market. Rotation remained a key theme in global equity sectors with c. staples/industrials/telecoms drifting weaker, while tech consolidated and financials broke higher.

Treasuries saw a sharp move higher in bond yields, with the US 10-yr briefly breaching the 2% mark. Shorter-term yields moved higher as well, with real yields moving up, and the yield curve coming down. In credit markets, European HY spreads moved sharply higher, while sovereign bond yields too moved higher across developed markets. On the FX front, the DXY has been ranging, EMFX slightly stronger, and BRL making further gains.

The GSCI commodities index was positive last week, supported by moves higher in industrial metals and agriculture. Elsewhere, WTI crude has moved stronger on geopolitics, with gold also pushing higher.

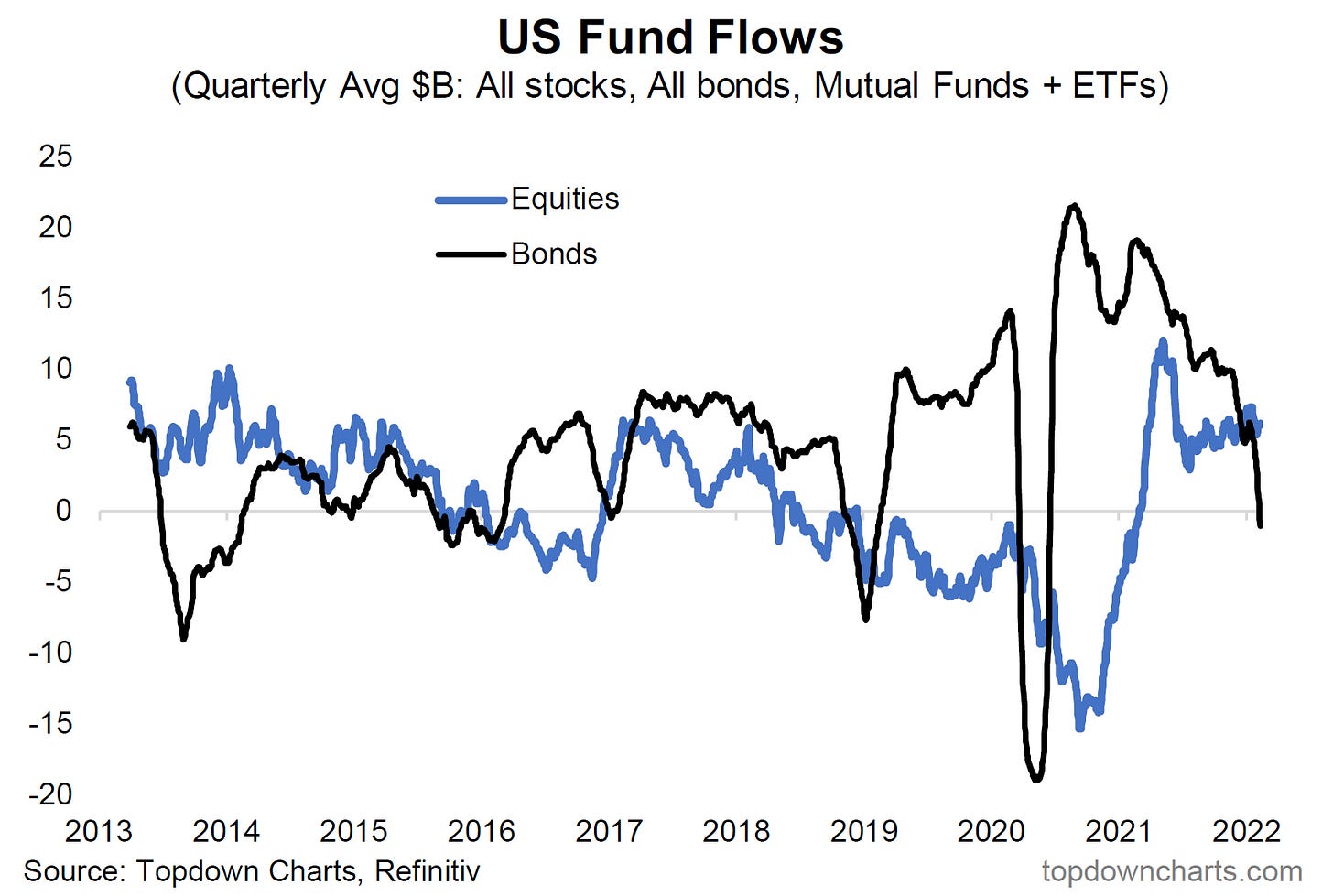

Sentiment: Bond fund outflows have been accelerating as the bond breakdown intensifies. Similarly, bond sentiment is moving further bearish. Elsewhere gold ETF flows have been ticking higher.

Market Themes: The 25-currencies equal-weighted EMFX index has quietly been clawing its way back since bottoming in mid-December. The rebound has come on the back of broadening strength, and a bullish divergence vs 50-day moving average breadth. The second wave of commodities is lending a hand, yet EMFX continues to lag well behind - so perhaps some scope for catch-up by EMFX.

The stabilization in EMFX is a positive sign for EM equities and adds to the tick up in sentiment following the major reset in 2021. Hence the tactical outlook for emerging markets is incrementally improving.

On the Radar

Macro & Markets: On the radar this week from the US will be the FOMC minutes and more Fed speak. Meanwhile China has inflation numbers due out. Elsewhere of course the big issue is geopolitics — with conflicting reports, but warnings/speculation that a major escalation could be coming this week.

In markets, the US 10-year yield made an initial failed break above 2%. The DXY has been ranging - attempting to rally, while WTI crude has been raging: pushing into the mid-$90 range with clear intent on having a go at the $100/barrel level.

Gold is making a run on the $1870 level as of the time of writing: a breakout will clear the path higher. Stocks meanwhile are making an initial break lower.

Research Agenda: This week the plan is to review the capex and fiscal/tax outlook, while also taking another look at European/UK equities and gold miners.

Top Charts of Topdown

Here’s a selection of charts that I thought were particularly notable.

1. Fed Sweet Spot Indicator: Rate hikes, all else equal, tend to be bad for risk assets in that it incrementally removes monetary tailwinds, raises the discount rate, reduces the equity risk premium, and raises the odds of a recession.

But context matters: rapid wage growth provides some offset, and based on recent history it looks like the Fed could hike multiple times before pushing the market over. Indeed, the gap between the Fed funds rate and wage growth has only widened further in recent months.

To be sure there is an element of the market waking up to the reality that monetary policy will eventually be tightened, and valuations are certainly elevated at this point, so we are fairly high up the mountain at this point.

Key point: The Fed might be able to hike multiple times before sinking stocks.

2. Credit warning: We have already seen a divergence in the correlation between credit and equity/bond volatility (credit spreads have been relatively contained so far vs rising volatility). But another gap has opened up between US HY spreads and the credit managers index (CMI). The CMI is a similar indicator to the PMI (purchasing managers index) in that it takes responses from managers in order to give a reading of the relevant conditions, with the CMI indicating credit conditions.

We can see from the chart that credit conditions as measured by the bankruptcies + collections sub-indexes of the CMI have deteriorated somewhat, opening up a divergence from US HY credit spreads. Taken together these divergences in indicators present yellow flags as warnings on the risk outlook for credit.

Key point: Risk flags are emerging in credit land.

3. EM ex-Asia and Commodities: As noted, the outlook for Emerging Markets outside of Asia looks very compelling. Valuations are cheap vs history and vs EM Asia, investor allocations to EM ex-Asia are at 7-year lows, and as noted the technicals look good. The FX side of things looks promising too with EM ex-Asia FX at extreme cheap levels. But perhaps one of the most interesting aspects is the chart below. EM ex-Asia equities (we’re talking Africa, Middle East, East-Europe, LatAm) tend to do well when commodities are doing well. With commodities gaining a second wind, maybe it’s high time for some catch-up by EM ex-Asian equities.

Key point: EM ex-Asia faces a compelling medium-term setup (esp. vs EM Asia).

4. US Small vs Large — Deep Relative Value: Following a further round of relative weakness, the US Small vs Large relative valuation indicator has reached the cheapest levels since the early 2000’s. This is a very interesting development, and along side a couple of interesting macro catalysts (rising yields), promising technicals, and sector skews that are well aligned with the macro outlook, set in place the ingredients for a change in prospects going forward.

Key point: Small caps like outperform large on relative value, macro catalysts.

5. Global Equities — Small vs Large: This chart tracks the proportion of countries whose small cap indexes are outperforming their respective large cap indexes. As you can see it has taken quite the precipitous decline, and frankly at this point is starting to look oversold. Similar to US small caps, we find global small caps trade at a decent discount to global large caps. That said, like many technical indicators we would prefer to see this one bottom out and turn up again. But for now, one to keep on the radar as the case develops.

Key point: Global small vs large cap market breadth has collapsed.

Ideas Inventory - Updated to 11 February 2021

(Current live Ideas/Themes where an explicit view has been issued)

If you haven’t already, be sure to subscribe to this paid service so that you can receive these reports ongoing (along with full access to the archives and Q&A).

Thanks for your interest. Feedback and thoughts welcome in the comments below.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn