12 Charts to Watch in 2024 [Q3 Update]

Key charts and issues to keep track of in Q4 and beyond...

Here’s an update to the 12 Charts to Watch in 2024.

Earlier this year I shared what I thought would be the 12 most important charts to watch for global multi-asset investors in the year ahead (and beyond).

In this article I have updated those charts + provided fresh comments as the outlook continues to shift on multiple fronts.

[Note: I have included the original comments from back at the start of the year, so you can quickly compare what I'm thinking now vs what I said back then]

1. The Monetary Wall: This chart leaves more questions than answers… a key open question is whether or not we really can make it through the most extreme tightening of monetary conditions in recent history unscathed. And maybe we do. Central banks are pivoting to easing, interest rates have peaked, and headwinds are easing —even turning to tailwinds. But take a look at the next few charts…

“Talk of soft landings, mixedcessions, vibecessions, and things of that nature may soon turn to tradcession as looming large monetary headwinds raise the risk of a traditional-recession into 2024. Several upside surprises and spots of resilience ended up warding-off recession risk in 2023, but as motivational and inspirational speakers often tell us: “just because something hasn’t happened for you yet doesn’t mean it won’t”.”

2. Rise of Deflation: Deflation risk briefly came and went. Hyperinflation risk is behind us. Now we’re in an inflation liminal space...

“Adjacent to that, and along with multiple disinflationary drivers, the impact of base effects, and dissipating demand – raises the prospect of technical deflation risk (i.e. the CPI annual rate of change going negative). And it’s not just a vibe, it’s already happening in pockets of the global economy. Deflation was an unthinkable term early last year, but I think by now more people are starting to entertain the idea. It would almost be poetic for a deflation scare to follow the inflation shock and the higher for longer meme.”

3. Resurgence Risk: For a minute there a commodity-driven inflation resurgence looked imminent… but with the pullback in the PMIs commodities have also taken a breather. I don’t know what happens next with the PMIs, but every technical chart I look at on commodities shows a promising picture. That said, we might need a little further washout in commodities, a bit more weakness in the PMIs, and just a little bit of panic rate cuts by central banks to bring this risk back online in earnest (maybe something for 2025).

“Not to hedge the previous comments, but we still can’t rule-out inflation resurgence risk either. A “no-landing” rebound in global growth (especially trade and manufacturing – which have been in recession) would mean commodities up, capacity tight, inflation HFL.”

4. The Story Can Change Quickly: Speaking of recession risk, I’ve remarked on this chart before that things improve slowly and unwind quickly. And do you know what? that blue line… looks kinda unwindy. Not good.

“But back on the downside risks, and to caution on complacency – while labor markets are still tight, consumer strong, wages growing… note the history on this chart. The jobs market goes up the stairs on the way up, and out the window when things turn.”

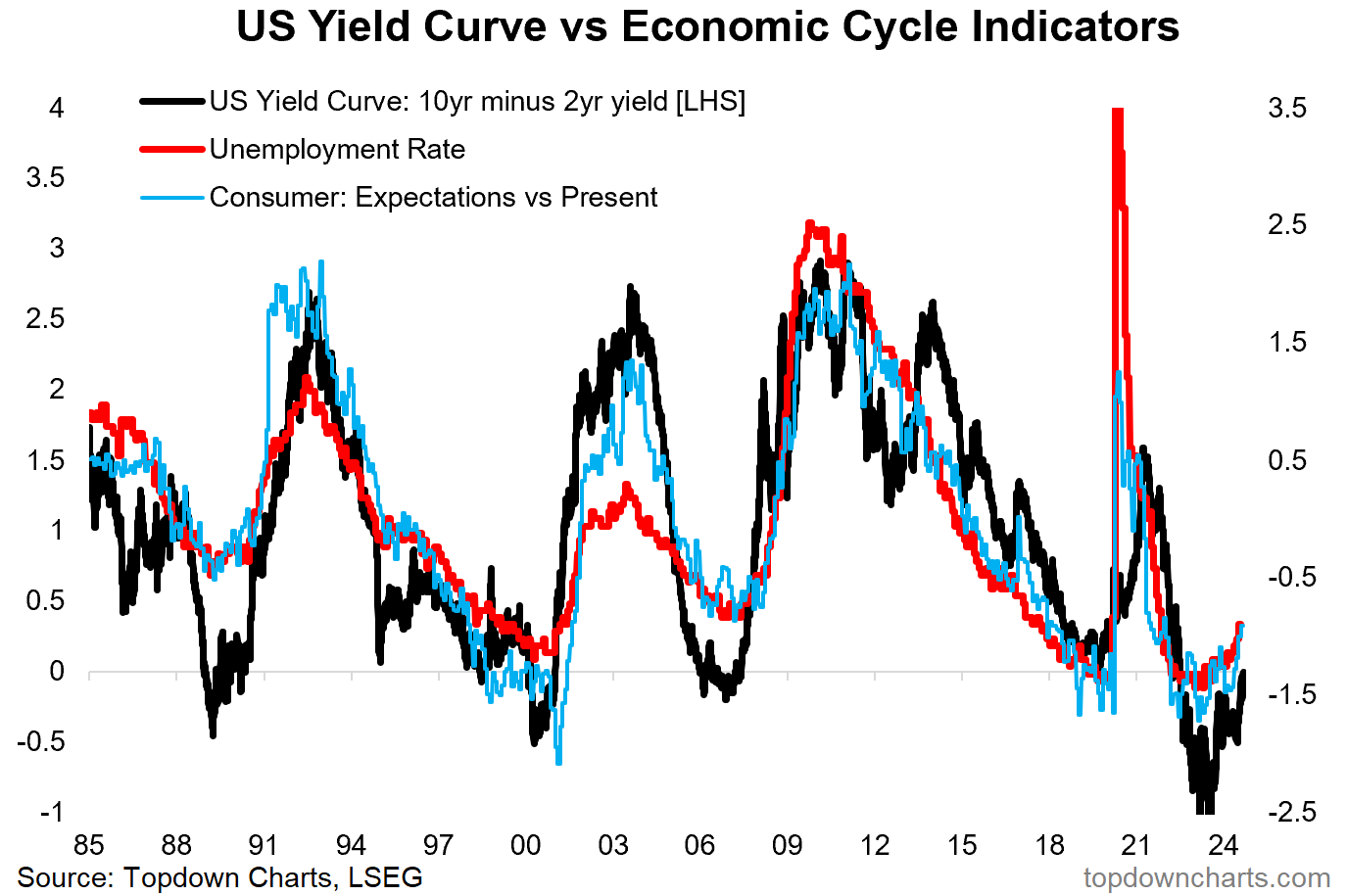

5. Yield Curving: And if you really want to get an eye on recession risk just focus on this one. The consumer expectations gap, the unemployment rate, and of course the yield curve — all 3 coincident measures of the economic cycle, all 3 turning from late-cycle, all 3 whispering loudly that recession risk is rising.

“These 3 lines all measure the same thing – the maturity of the business cycle (**and turning points**). On all 3 counts they say the cycle is long in the tooth, and turning.”

6. Bond Bargain: Bonds are cheap, stocks are not. Prefer bonds to stocks in asset allocations — especially if the 3 wise lines of the previous chart prove correct on their recession prognosis.

“As such, and while things have moved a lot since the brief 5% reading for the US 10-year treasury yield in October last year, government bond valuations are still cheap, and the macro downside risk scenario I outline here is bond bullish. It won’t be a straight line, but bonds likely see further upside in the coming year following one of their worst bear markets in recent history.

Stocks are a different matter though…”

7. Tech Perfection: And one thing that’s going to be in deep stuff if recession comes is tech. Tech stocks are priced for perfection, only got more expensive vs now during the dot com *bubble*, and they haven’t seen a recession since 2008 …meanwhile every man and his dog are all-in on tech (and then some) because of recency bias, peer risk, and hefty heaping helpings of exponential growth Kool Aid — everyone believes the new paradigm during the bull phase but it’s the same thing over and over again, and no one ever seems to see it coming (and well… even those who do usually end up getting trampled by the bulls!).

“Tech stock valuations, while still not quite eclipsing the dot-com heights, have returned to 2021 peak levels. Tech is priced for perfection, and untested by recession.

Indeed, big tech saw its big run from 2009 riding a wave of initial outright undervaluation, mostly accommodative monetary policy (including the ZIRP era), and importantly: a prolonged period of time where there were no recessions (albeit a few near misses, and p.s. the pandemic was a boon and a gift for most in the tech sector: delivering acceleration of existing trends, no real downside, and major monetary and fiscal tailwinds).

Maybe AI hype and exponential acceleration does see tech go on to justify these valuations, and maybe therefore these levels end up as a new normal. But if we want to think in terms of probabilities and risk management, keeping one foot out the door is probably a wise approach here.”

8. The Best and the Worst: Friendly reminder; if tech goes then it’s rotation time.

“Speaking of relative value, if you look at the flipside of big tech (aka US large growth), the best relative value opportunities are small vs large, value vs growth, and global vs US – the chart below basically explains why (a decade+ relative bear market for everything other than big tech).”

9. Defensive Doom: Recession risk and risky tech make defensive stocks all the more interesting. They had a decent blip up during the Aug-bust, and that’s probably just the beginning. They’re cheap vs the market, investors hate them (record low allocations), seasonality is looking up for defensives, and defensive sector technicals are improving. An unloved and undervalued diversifier.

“The roaring rebound in (tech) stocks last year left the boring old defensive sectors behind (healthcare, utilities, staples). As such, investor allocations to defensive equities have dropped to record lows. There is a signal here — contrarians take note.”

10. Real Estate Realism: Remember all the doomsday stories on commercial real estate? Well, prices dropped a bit, but nothing really happened — no credit crisis, no default wave, no mass panic fire sales. And now? The biggest risk to real estate (rising interest rates) is moving into the rearview mirror… sentiment is starting to shift. Even thought REITs are up over 30% off the Oct lows, follow-through on rate cuts could driver further reassessment of this most hated of all asset classes.

“There is also a signal here. Investors hate real estate. The downside risks in the rising rates world (+work from home, cyclical downside risks, credit tightening, etc), are well understood, investors are already on board. That means there are a lot of minds that can change if commercial property merely does OK, and hence an upside case can be made (especially if interest rates drop).”

11. Renewables Renewed: Speaking of hated investments, the bursting of the Biden bubble in renewable energy stocks has actually seen the investment case here …renewed. Indeed as I noted a week ago, renewable energy stocks are in the middle of a major technical setup that could unlock a multi-year move.

“We just lived through yet another boom-bust-bubble cycle in renewable energy. Kicked-off by a steady rise of interest in ESG investing, and then the pandemic stimulus measures, along with a brief traditional energy price spike. But monetary tightening, ESG fatigue and falling commodities have taken the steam out: making valuations for the sector attractive again.”

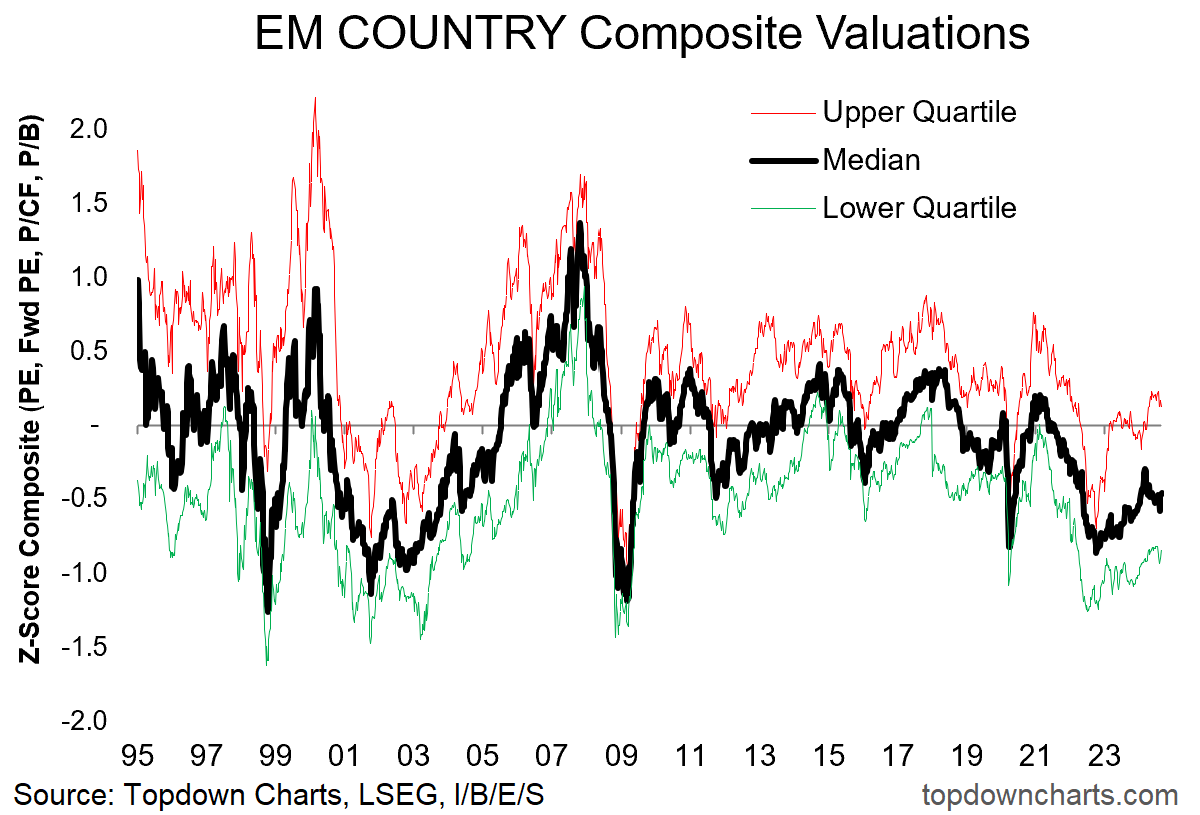

12. EM Again: And if you want to talk technicals, a few weeks back I also noted the Brobdingnagian Breakout in EM ex-China equities — and remember, that is set against a backdrop of cheap valuations across emerging market countries. Right about now I think I can hear you saying “yeah yeah yeah, I’ve heard the EM bull case over and over“ …but that’s precisely the sentiment and moment where folk give up on it, just as things start to get interesting.

“It was every strategist’s favorite place to be at the start of 2023. Naturally folk will be skeptical on it showing up again in outlook pieces like this, and maybe there is a sense of once-bitten, twice-shy. But things are different this time. The value story is still there (especially for China and LatAm/Non-Asia EM), however now we also have a peak in the Fed funds rate (possible easing later), a peak in the US dollar, a pivot by EM central banks from rate hikes to rate cuts, lingering pessimism on EM assets, and promising technicals as an inflection point appears to already be in place.

So as far as I’m concerned it definitely deserves a spot in the charts and themes to watch in the year ahead as multiple trends and macro cross currents come to their logical conclusion.”

Tying it all together…

Monetary headwinds are fading, inflation risk is off the table for now (maybe), and deflation risk seems unlikely(?) as inflation liminal space prevails.

Yet, a few key cycle-tracking indicators say recession risk is rising.

If recession hits: bonds will be well placed to benefit (being cheap), defensives will also do well, but stocks may come unstuck as expensive valuations and untested tech gets a reality check.

But it’s definitely not all doom and gloom: one downside risk is another’s upside risk, and there are clear opportunities there for those willing to look (e.g. REITs, renewable energy, emerging markets, rotation trades, and even bonds).

With the US election still to come, multiple sources of policy and geopolitical uncertainty, seasonality, and who knows what else, the final third of the year will certainly be interesting…

For more charts and insights on the global market outlook +asset allocation implications, check out the forthcoming August Market Cycle Guidebook (or sign up to the entry-level service for the cliff notes version).

—

Thanks for reading!

Charts originally featured in my 2023 End of Year Special Report (free download)

Best regards

Callum Thomas

Head of Research and Founder of Topdown Charts

Twitter: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

For more details on the service check out this post which highlights:

a. What you Get with the service;

b. the Performance of the service (results of ideas and TAA); and

c. What our Clients say about it.

Follow us on:

LinkedIn https://www.linkedin.com/company/topdown-charts

Twitter http://www.twitter.com/topdowncharts

Great charts in here. Especially that tech stock valuation one showing how well below the 2000 highs we are. Not to mention with much stronger tech companies these days.