Chart of the Week - Expensive USD

Almost every currency is cheap vs the US Dollar (aka the USD is extreme expensive)

In my latest weekly report I highlighted how the US dollar is currently well-progressed into a compression trade — making higher lows, lower highs, coiling into a tightening range and with a crunch in FX market implied volatility to multi-year lows.

This is one of those calm-before-the-storm moments for the US Dollar.

But one thing a compression trade does not tell you in and of itself is what direction it resolves in… and by the way, compression trades usually resolve explosively with a big move and usually see a major trend change.

That brings us to this week’s chart — FX market valuations.

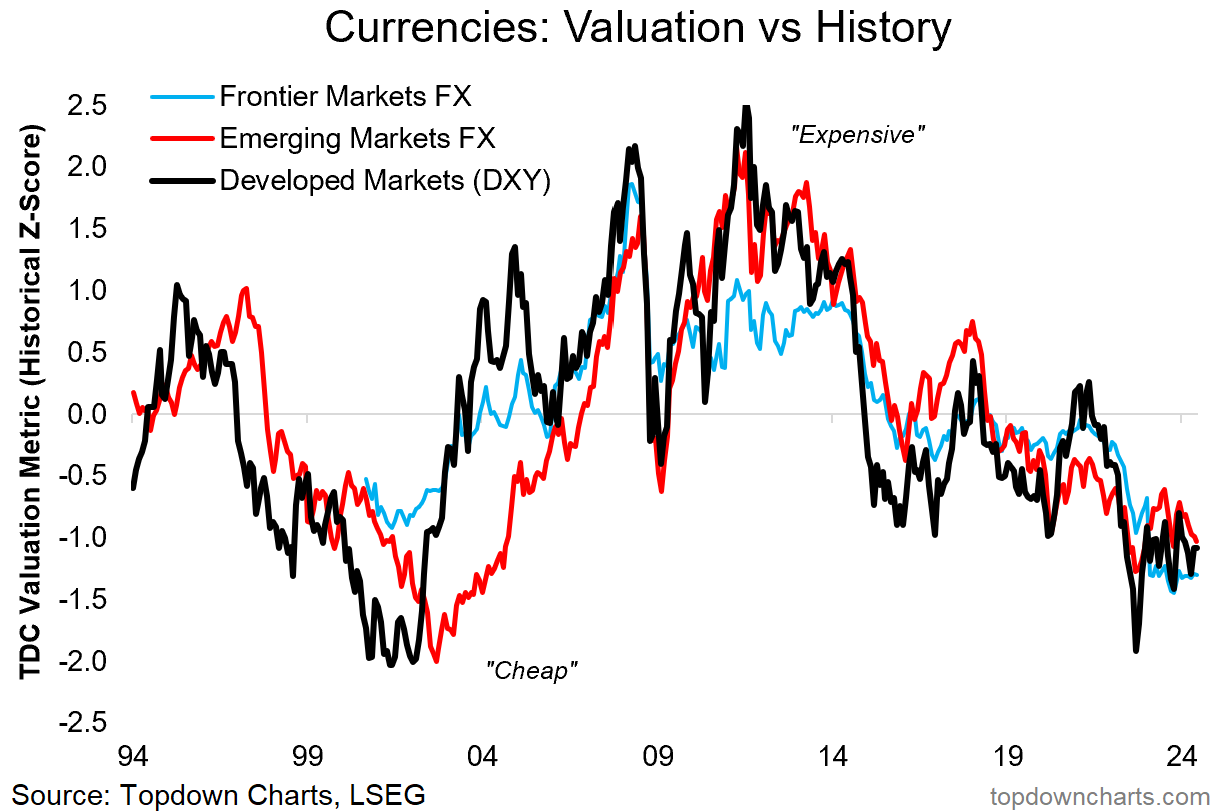

The chart below shows my composite valuation indicators for Frontier, Emerging, and Developed market currencies (all vs the US Dollar). On all 3 counts, they are showing up as cheap vs USD… or put differently, the US dollar is significantly expensive against just about every other currency (just like US big tech!).

That right there helps set our directional bias — we should expect the USD to weaken over the medium-term given expensive starting point valuations.

It also happens that the USD has seen fading yield support, a deteriorating fiscal outlook, major topping patterns (long-term cycles), softening breadth, and right now is facing negative seasonality.

So I would be looking cautiously at US Dollar exposure, and taking the opportunity to diversify globally. This is also a key factor in the US vs global stocks relative performance outlook — a weaker USD (stronger global currencies) helps US$ denominated returns for non-US assets, and tends to have an easing financial conditions effect (especially for EM).

Indeed, this may well be one of the most important charts for global-minded active investors in the coming years…

Key point: The US Dollar is extreme expensive vs just about every other currency.

Topics covered in our latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and dug into some critical global macro & asset allocation issues on our radar right now:

Global Equity Technicals: **a number of important signals activated**

China Stocks & Property: increasing risks (and opportunities)

US Dollar Outlook: the compression trade and what’s next

Crude Oil Prices: technicals, demand, supply, risk outlook

Energy Stocks: looking at the setup in oil & gas sector stocks

Renewable Energy Sector: valuations and technicals

Carbon Prices: update on technicals, sentiment

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service *check out this recent post* which highlights:

a. What you Get with the service;

b. the Performance of the service (results of ideas and TAA); and

c. What our Clients say about it.

But if you have any other questions on our services definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

I have travelled extensively in England and France and Italy recently. On a purchasing power parity basis, for consumers and for investors in real estate, I can report that the dollar is fairly reasonably valued versus the euro and the pound. I disagree with the idea that the dollar is overvalued at this point.