Chart of the Week - MEEGA Update

Make European Equities Great Again... [here comes the breakout]

Europe has been dismissed and ignored by investors for a long time.

But don’t ignore this big breakout.

As I mentioned earlier this year, there are several factors lining up for “MEEGA“ [Make European Equities Great Again] — still cheap valuations, lingering excess pessimism, monetary tailwinds, political drift to the right/business-friendly governments, reforms program, fiscal stimulus, and the prospect of global growth reacceleration into 2026.

But above all, this week’s chart shows a big beautiful breakout to new All-Time Highs (only took 25 years(!!)).

I’ve recently documented several other big breakouts currently underway (e.g. developed market ex-US equities, emerging markets equal-weighted index, China tech stocks, global commodity stocks, and global renewable energy stocks) — so this one has good company, and I always say when you get a clean clear breakout like this after such a prolonged period of base-building you have to pay attention and it’s anyone’s guess as to how far it goes.

This is the time when you need to think independently, ignore the old consensus narratives & common wisdoms, and pay more attention to what price is telling us and what’s not being talked about…

Key point: European equities have broken out to new all-time highs (after 25 years).

What do you think?

Bonus Chart - Further Perspective…

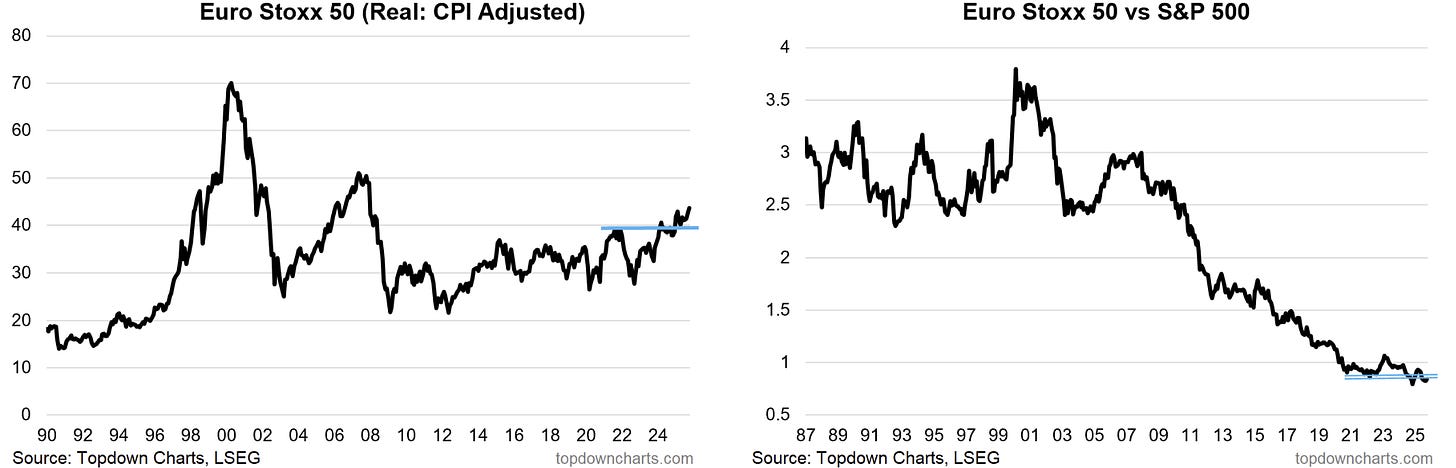

Another interesting angle on it is the CPI adjusted EURO STOXX 50 which —while looking less impressive than the chart above— has likewise undertaken a fairly compelling breakout also (albeit a very long way to go until new ATH on this one).

The Stoxx50 vs SP500 view is less impressive still with the relative strength line still bouncing along the bottom.

Overall, with the CPI adjusted + relative strength picture still looking early, sentiment still middling, and valuations (particularly relative value) still cheap, I would say there is plenty of room to run here in the chart above.

Topics covered in our latest Weekly Insights Report

Aside from the chart above, we looked at a number of other charts and global macro & asset allocation issues in our latest entry-level service weekly report:

Global Markets Update: equities, fixed income, FX, commodities

European Equity Technicals: update on ATH, outlook

Macro Radar: key events and markets to monitor in the week ahead

Monthly Pack: link to monthly asset allocation review

Ideas Inventory: current live (and closed) ideas/views

Subscribe now to get instant access to the latest report so you can check out the details around these themes + gain access to the full archive of reports + flow of New ideas.

For more details on the service check out the following resources:

Getting Started (how to make the most of your subscription)

Reviews (what paid subscribers say about the service)

About (key features and benefits of the service)

But if you have any other questions definitely get in touch.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

Other Services by Topdown Charts

Topdown Charts Professional —[institutional service]

Topdown Charts Entry-Level Service —[entry-level version]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack —[Gold charts]

Australian Market Valuation Book —[Aussie markets]

What did you think of this note?

(feel free to reply/comment if you had specific feedback or questions)

Hidden Bonus Chart… 👀 🤫

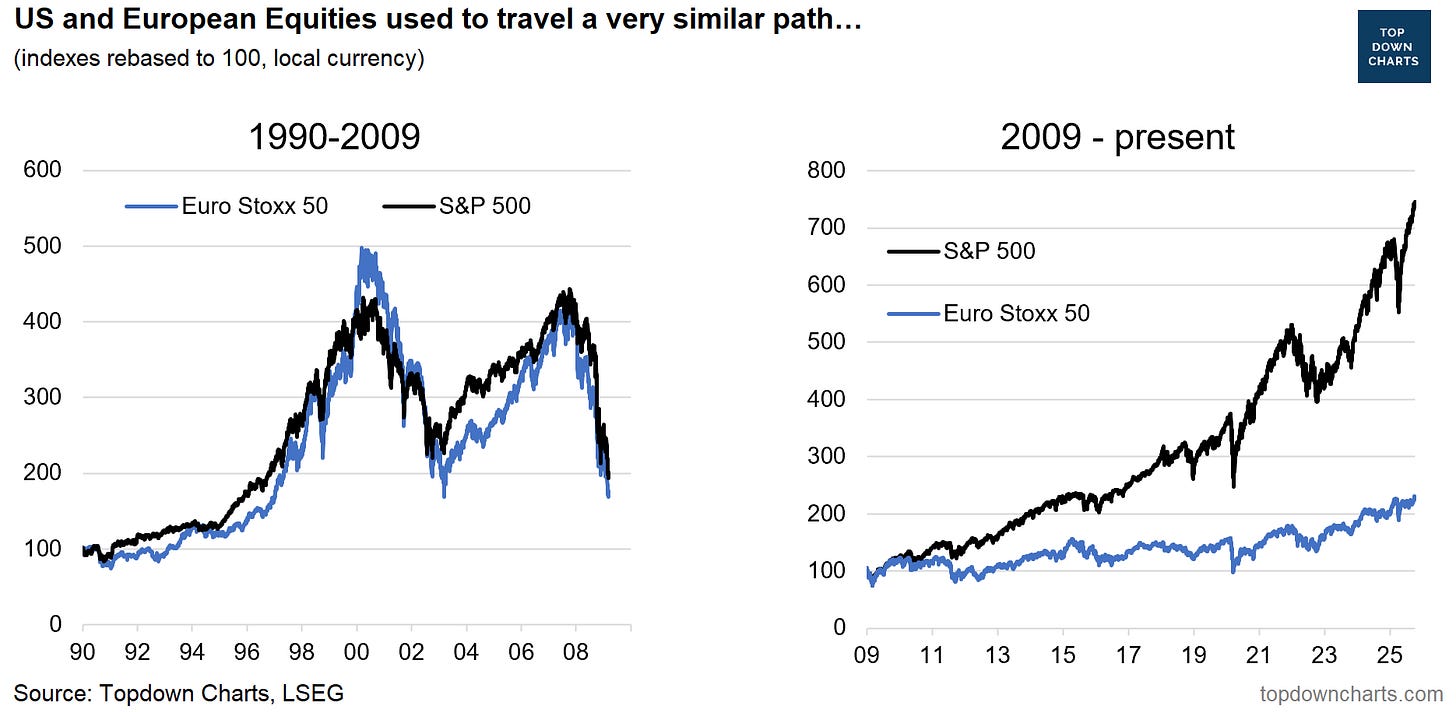

Only for the gentlemen and scholars who scrolled all the way to the end — this last one goes to show that European Equities used to be at least as good as US Equities.

But something(s) changed in 2009.

One issue was that Europe had to deal with the hangover from the credit boom, with rolling sovereign debt crises and structurally lower growth as it digested years of malinvestment and deleveraging.

The USA on the other hand saw a decade+ of super-easy monetary policy + struck “tech stock oil” (and actual oil with the shale boom, and now “AI oil”). While it’s hard to see the USA coming unstuck or Europe striking its own oil, the thing to keep in mind is that the narrative and story usually only becomes obvious after price has moved… (a good final thought to muse on!)

I’m holding some EU ETFs for diversification, so I’d be happy if the breakout plays out. But I don’t expect it.

A couple of quotes from Yardeni’s recent report:

“Stock investors may be hoping that fiscal policies will bolster the Eurozone’s trajectory, but the political momentum behind them remains sluggish.”

“Investors shouldn’t expect much help from monetary policy either. The ECB held rates steady in September for the second consecutive meeting since the June 2025 cut.”

And it’s not only about policies or sentiment. Yes, EU markets have risen. But earnings growth has been small, so valuations already look expensive compared with history. On top of that, Europe’s earnings growth in the 21st century has been cyclical — and right now we’re not just on a plateau, we’re at a peak.

I sincerely hope I’m wrong. It’s better to be rich than right in skepticism. 😄