Monthly Asset Allocation Review - July 2023

Review of markets and succinct guide to risk vs return outlook across asset classes

This email provides a look at some of the key outputs of our Market Cycle Guidebook — giving you a clear snapshot of our thinking on asset allocation.

Specifically, covered in this email is:

Global data pulse, policy monitor, valuation snapshot

Global economy and risk outlook

Core views across asset classes (short + medium term)

Capital market assumptions update (i.e. longer-term)

This email report is aimed at an active asset allocator audience, but should be useful to most investors in terms of providing a big picture perspective on the macro and market outlook.

n.b. Making the Most of Topdown Charts (video on how to read/interpret the reports + how to practically use the insights in your investments)

Monthly Asset Allocation Review - July 2023

Topdown foreword: July was basically a classic risk-on month with risk assets performing well and treasuries at the bottom of the table. But despite the flip in sentiment from consensus bearish to now consensus bullish, it’s not time for “mission-accomplished” complacency. This part of the year has a habit of seeing drawdowns in risk assets and generally higher volatility, not to mention the “monetary wall” facing the economy as the long and variable lags of massive global monetary tightening work their way through the system. Although there are pockets of opportunities on both sides of the table, overall still lean defensive on asset allocation.

Global Business Cycle Macroscope

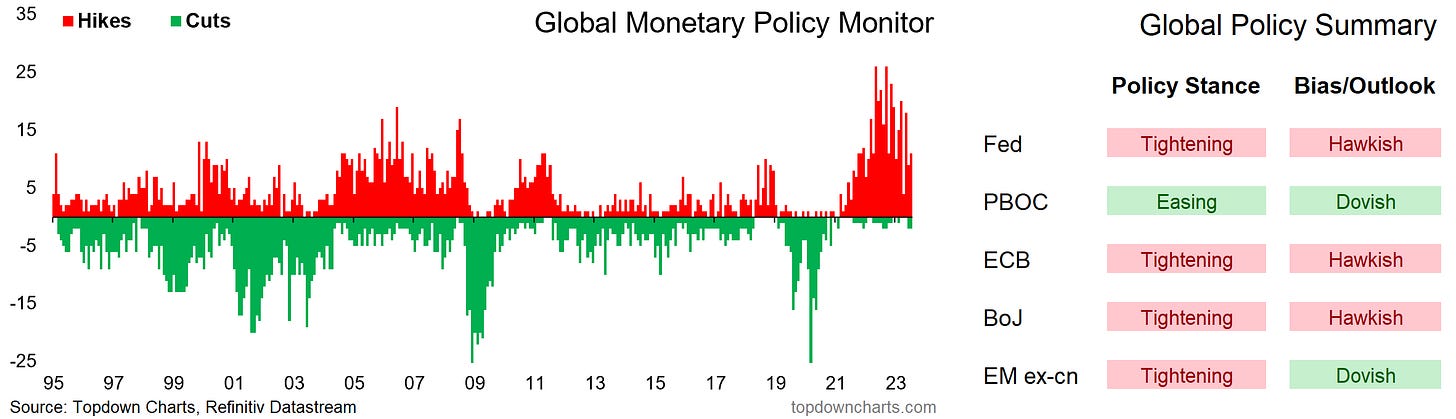

Global Monetary Policy Monitor

Valuation Snapshot

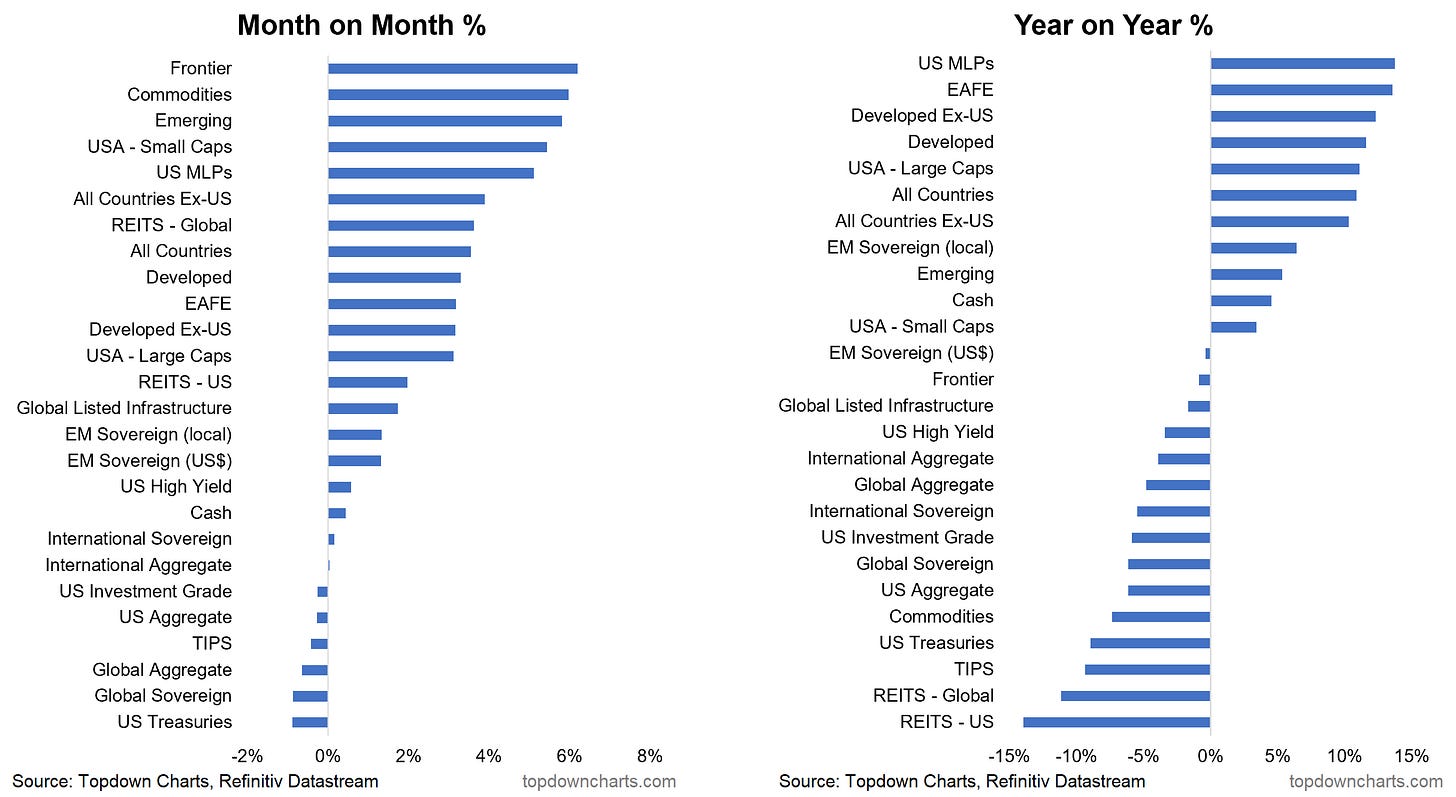

Market Overview -- Month to July: Some of the most out of flavor assets had the strongest returns in July, with Frontier markets, commodities, small caps, REITs, and EM topping the table, while sovereign bonds filled the bottom end of the table in what was basically a classic risk-on month.

Macro Outlook

Global Economic Outlook: We are faced with a situation of high but falling inflation, steadily weakening growth rates for hard data, recessionary soft-data indicators, and unanimous recession signals from the various leading indicators. Most central banks are still in full-blown tightening mode as they correct the over-easing policy mistake, but now risk making a possible new policy mistake of over-tightening.

However we are seeing signs of a pause among some of the mainstream central banks, and pivot by the fringe/developing country central banks. Hence, it is fair to say that the bulk of tightening is probably behind us, but paradoxically if we don’t get recession and growth regains momentum, then inflation likely rebounds too along with growth, and central banks may need to push on further with tightening. No easy path!

Risk backdrop: As noted, the majority of leading indicators we track are pointing to recession. Inflation risks are waning, but there is still the issue of how far and fast inflation drops. At a certain point deflation risk may start to come back into focus if recession does occur. Meanwhile geopolitical risk remains critical, with the current tense backdrop likely lingering for longer, and flare-ups/trigger-points ever-present. On the upside would be a possible pivot in China to more stimulus (some signs), or a rapid pivot by central banks en masse to easing (and/or a much weaker USD and lower bond yields (not yet!)).

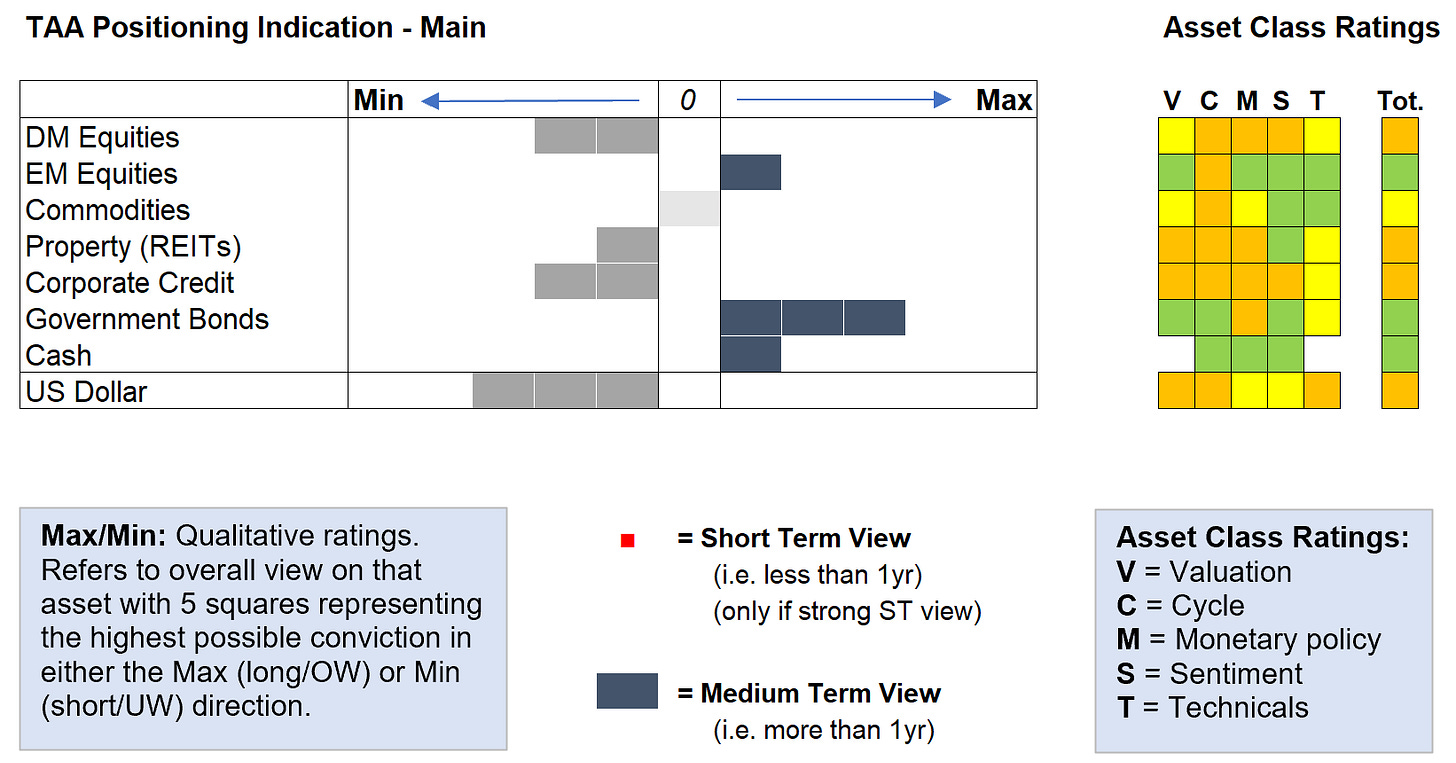

Summary View Across Asset Classes

The below table provides a “cheat-sheet“ summary of our views across the major asset classes. Short-term is typically in the order of months/quarters (less than a year), while medium-term is more a through-the-cycle view (multi-year).

Asset Class Ratings and TAA Guide

As a reminder, we do not manage any money, or provide personal financial advice, nor offer securities. The purpose of the following tables is to provide a high-level positioning indication based on our analysis and indicators across the various asset classes, from an unbiased/generic multi-asset investor perspective. The asset class ratings are quantitatively driven, but judgement is applied.

Capital Market Assumptions (Long-Term View)

The following is an extract from our capital market assumptions dataset. These represent a 5-10 Year forecast based largely on quantitative inputs. They are presented in nominal terms, on an annualized basis, and are stated from the perspective of a US dollar denominated investor.

July Update: Expected returns edged lower across risk assets as valuations ticked higher, fixed income mixed/slightly higher. US forward looking ERP now materially negative (equities vs treasuries).

Over the longer horizon, the best returns are likely to come from what has traditionally been considered the riskier end of the spectrum given the moves in valuations and where things sit on the yield front (i.e. global ex-US equities, EM, frontier, EM debt, high yield credit). That said, it must be noted these are longer-term perspectives.

If you haven’t already, be sure to subscribe to this paid service so that you can receive these reports ongoing (along with full access to the archives and Q&A).

Alternatively, if you are already a happy paying subscriber, why not consider the option of gifting a subscription to a friend/colleague/client/family member using the button below?

Thanks for your interest. Feedback and thoughts welcome in the comments below.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

Thanks Callum. It's very valuable to have a systematic review like this for various asset classes.

A couple of comments if I may, while acknowledging that they may be difficult to incorporate into your frame work:

1) Gold is an obvious omission from some charts/ tables given it's well accepted diversification role in a portfolio.

2) While I tend to agree that US Treasuries will have their day once something serious breaks, there is a risk that pro-cyclical fiscal largess by US Govt, the BoJ changes to YCC and US sanctions on Russian FX reserves are shifting the longer term role of US Treasuries. I don't know how this can be incorporated into a broad asset allocation assessment other than to acknowledge the seeming significance of these moves and the risks they pose to the traditional valuation metrics.

thanks and regards

Bruce