My Worst Charts of 2023

Because we don't always get it right!

Last week I shared with you some of my Best Charts of 2023... i.e. the charts and calls that worked really well in either building the picture or presenting a specific idea.

Of course, it wouldn’t be complete without a look at some of the charts that *didn’t* work (or shall we say the ones that worked “less well!”).

As noted in my previous article, I think it's good to review what worked well -- I believe in learning from success. But naturally it's also good to review what didn't work, to see if we can improve processes, thinking, and to make sure we stay humble.

But also it's important to keep the gaze looking forward: some of the themes and ideas listed below might not have worked this year, but they may well become all the more relevant in the months and years ahead.

Hope you find these interesting and informative...

These charts were featured in my just-released 2023 End of Year Special Report - do check it out when you get a chance (free download as a holiday treat!).

n.b. I have updated the charts with the latest data, for your reference. Also on formatting: the italic text is a quote from the report in which the chart originally appeared so you can see what I was thinking at the time.

n.b. be sure to check out our [FREE] Chart Of The Week series.

1. No recession: well at least not in the hard data – the PMI did come down, but did not follow the leading indicators to the implied depths of doom.

“it was justified for the Fed to cut rates into the pandemic… and they should have removed the emergency measures shortly after – but again, they opted for the risk of overcooking growth/inflation/risk-taking vs the risk of tightening too early. And one consequence of all this and everything else that’s gone on is the various leading indicators for the US economy have now plunged to record lows (high recession risk).” (24 Mar 2023)

2. Stocks vs Bonds: and as a result, stocks beat bonds – against my expectations, and against the leading indicators.

“Ultimately, it’s going to come down to the economic outlook – if a traditional disinflationary (or even transitory deflationary) recession comes into play (which does seem likely based on the evidence presented in the first topic), then we likely see stocks underperforming treasuries – and that’s likely going to be the type of scenario where treasuries turn in positive absolute performance.” (10 Feb 2023)

3. Global Equities vs the Macro: following on from some of the themes of the best charts section, basically it was a year where if you focused on the macro indicators you probably would have leaned defensive, bonds over stocks; bearish. This is not to say that macro inputs are meaningless – quantitatively we know that over the long-run, through cycles, it pays to take notice of the changing tides of the business cycle. And being evidence-based is better than the alternative. But in 2023, giving technicals a stronger vote amongst the puzzle pieces was key to navigating the risk of being wrong.

“even if we get a pause in policy tightening, the damage is arguably already done in terms of how that’s going to impact the economy (reminder: all leading indicators say recession, and as the chart below shows the soft data is awful, and the hard data is fading fast). So basically, while the technicals look better, the macro is not lining up” (27 Jan 2023)

4. Bond Value: this chart was excellent if you used its very strong signal in October (when it lit-up as extreme cheap), but as I did – focusing on the minor cheap signal earlier in the year was a key part of being *early* on the bond bull run.

“the price action of the past two years has brought US 10-year treasury valuations back to cheap levels (on par with what was seen in early-2019, just before bonds had their last bull run)” (10 Feb 2023)

5. Credit Spread Slumber: this was among a few charts I was tracking since early-2022 which flagged upside risk for credit spreads. That (brief and minor) upside came and went, and much like equities, the market decided to ignore the macro – and with good cause, as no recession came, no widespread credit stress eventuated, and the brief bank bust earlier in the year was rapidly and resolutely ring-fenced by the Fed.

“Meanwhile, banks have been tightening up on lending standards as higher rates put borrowers under pressure, not to mention rising costs and the prospect of weaker growth ahead… this has left us with a significant divergence.” (10 Feb 2023)

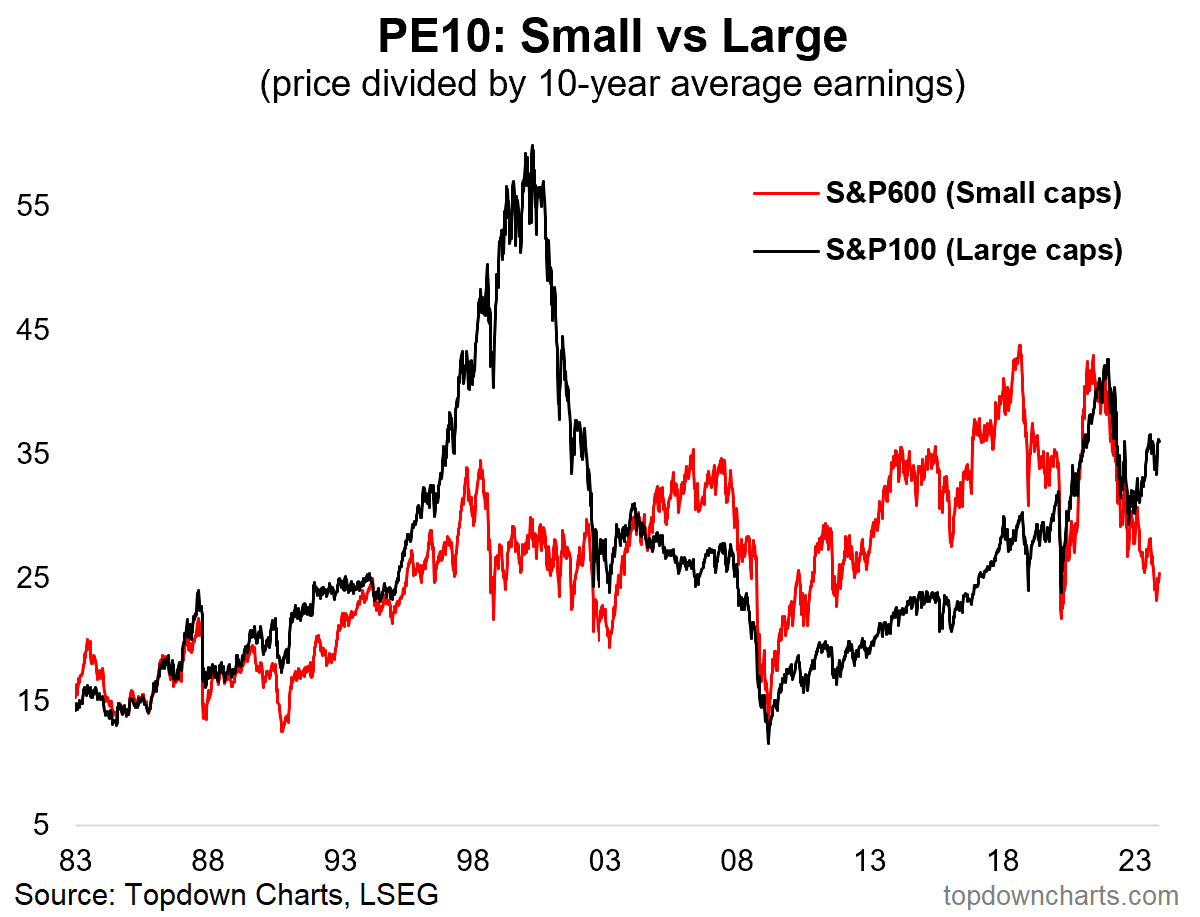

6. Small Cap Stocks: were a big disappointment – the absolute and relative value case for small caps became even more compelling as the year went on! This led me to quip later in the year that big tech is basically priced for perfection, while small caps are basically priced for recession. And that raises a point of how 2023 definitely was a year of clear winners and losers (especially winners and losers of rising rates and the very real underlying macro trends impacting traditional industries).

“small caps have the valuation edge with the relative value indicator still extreme cheap, and small cap PE10 ratios below that of their large cap peers, and dropping to levels that look cheap relative to recent years.” (27 Jan 2023)

7. Stimu-Late: speaking of disappointments, despite what I outlined and highlighted as a textbook case for monetary easing (entrenched disinflation, property deflation/downturn, cyclical downdrafts, weakening global trade), there would be no big bang stimulus from China. There were some stimulus measures, but it was more of a piecemeal and finetuning approach vs the more forceful episodes seen in previous years. It goes to show, sometimes even when you think policy makers should, doesn’t mean they will.

“The direction of the inflation indicator (disinflation/deflation), sharp deterioration in the economy… opens the door to more forthright monetary easing.” (20 Jan 2023)

8. Chinese Stocks: as such, the absence of stimulus — a key prospective catalyst for the still very compelling upside case for Chinese equities, it meant a year of patience on this front. As things stand, the value case still makes sense, but we are still awaiting technical confirmation (which is not at all apparent yet – almost the opposite), and still awaiting a macro catalyst.

“The strong technicals and contrarian bullish sentiment picture are set against a backdrop of cheap valuations both on a trailing PE and forward PE ratio basis, and with the equity risk premium still close to record highs. So it looks like a solid value setup, technically primed, and with viable catalysts to drive follow through and further upside.” (20 Jan 2023)

So an interesting set of charts and lessons (caution on confounding factors to quantitative indicators, caution on listening to price as much as macro, caution on being early, having patience, and flexibility in thinking). But also some interesting clues and snippets for the year ahead (and p.s. stay tuned for the “Charts to Watch in 2024” blog coming soon…!)

—

Thanks for reading!

Check out the Full Report here (free download)

Best regards

Callum Thomas

Head of Research and Founder of Topdown Charts

Twitter: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

For more details on the service check out this post which highlights:

a. What you Get with the service;

b. the Performance of the service (results of ideas and TAA); and

c. What our Clients say about it.

Follow us on:

LinkedIn https://www.linkedin.com/company/topdown-charts

Twitter http://www.twitter.com/topdowncharts

Thanks for this! When I am mentoring young analysts I always warn them that sometimes a relationship will breakdown at the worst possible moment. You can have the “correlation/causation” discussion but your layout here really shows it well.