My Worst Charts of 2025

Because we don't always get it right!

Last week I shared with you some of my Best Charts of 2025... i.e. the charts and calls that worked really well in either building the picture or presenting a specific idea.

Of course, it’d be incomplete without a look at some of the charts that *didn’t* work (or shall we say the ones that worked “less well!”).

As noted in my previous article, I think it's good to review what worked well -- I believe in learning from success first and foremost. But naturally it's also good to review what didn't work, to see if we can improve processes, thinking, and to make sure we stay humble.

But also it's important to keep the gaze looking forward — some of the themes and ideas listed below might not have worked this year, but they may well become all the more relevant in the months and years ahead.

Hope you find these interesting and informative...

These charts were featured in my just-released 2025 End of Year Special Report - do check it out when you get a chance (free download as a holiday treat!).

n.b. I have updated the charts with the latest data, for your reference. Also on formatting: the italic text is a quote from the report in which the chart originally appeared so you can see what I was thinking at the time.

n.b. be sure to check out our [FREE] Chart Of The Week series.

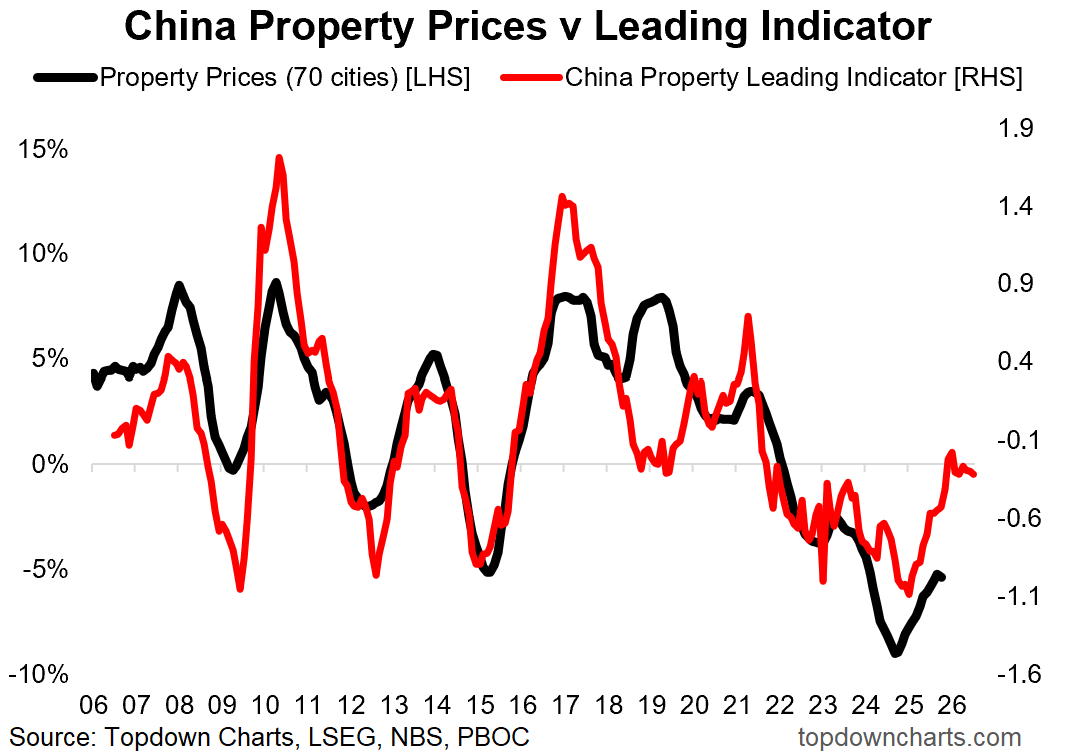

1. Downturn Didn’t Turn: It looked like the property downturn in China was turning around, but we still haven’t seen any let-up in price declines as yet. Very important market to keep tabs on: continuing to monitor this one closely.

“following the various stimulus measures announced last year, the property price leading indicator has turned the corner; suggesting that the worst might be over for China’s deepest and most prolonged property downturn since records began.” (17 Jan 2025)

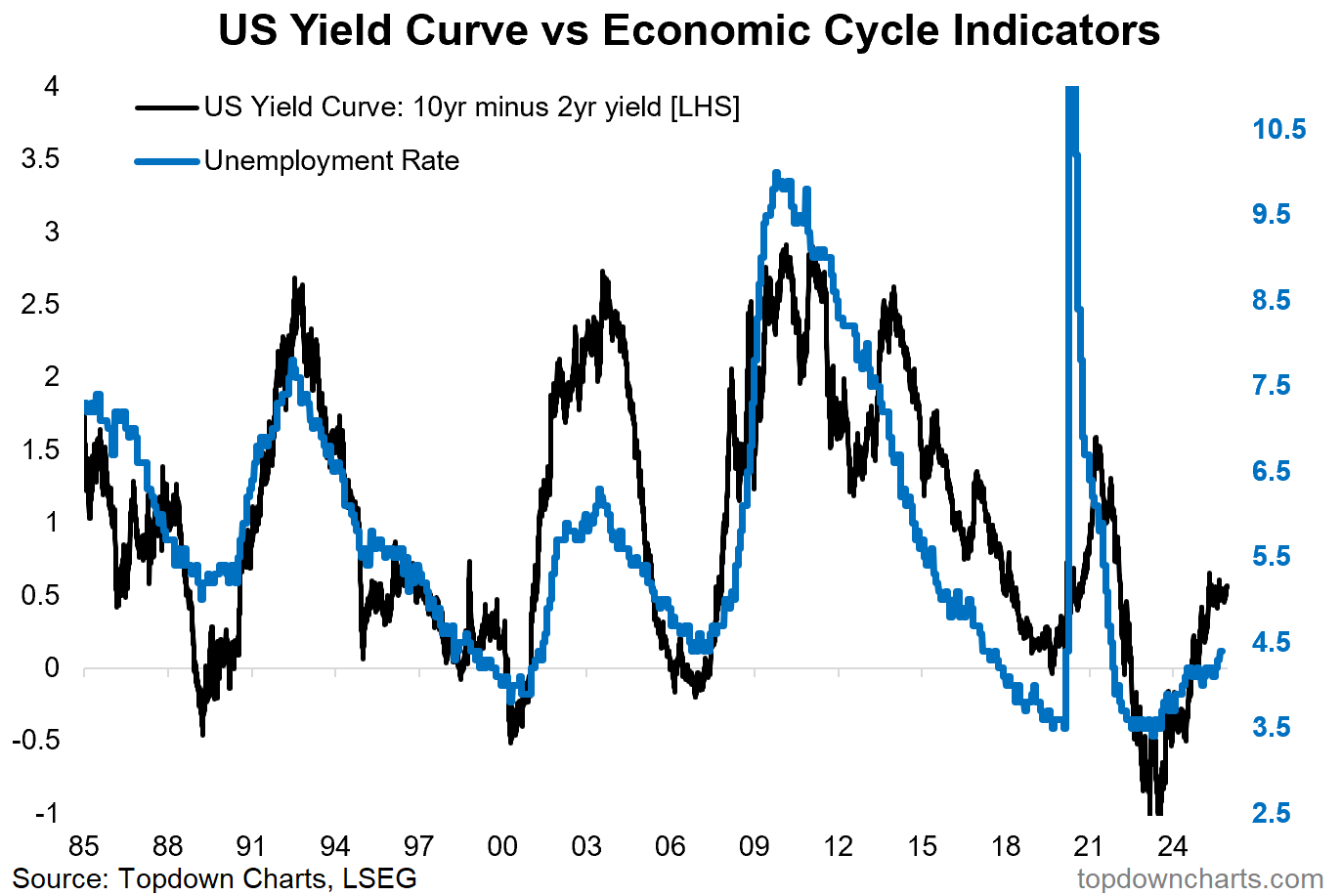

2. No Recession: Worst fears of recession risk back in April were not realized, although some aspects did show clear softening. Calling this one wrong (for now?).

“consistent with the Trump admin policy frenzy and uncertainty shock – and very much consistent with the notion that the Trump admin are embarking on essentially a reform-like policy agenda of cathartic short-term pain for anticipated longer-term gain and restructuring. You also see it in the yield curve and at least the trend in the unemployment rate (which is likely to head 20-50bps higher at least on planned Federal staffing cuts). ” (11 April 2025)

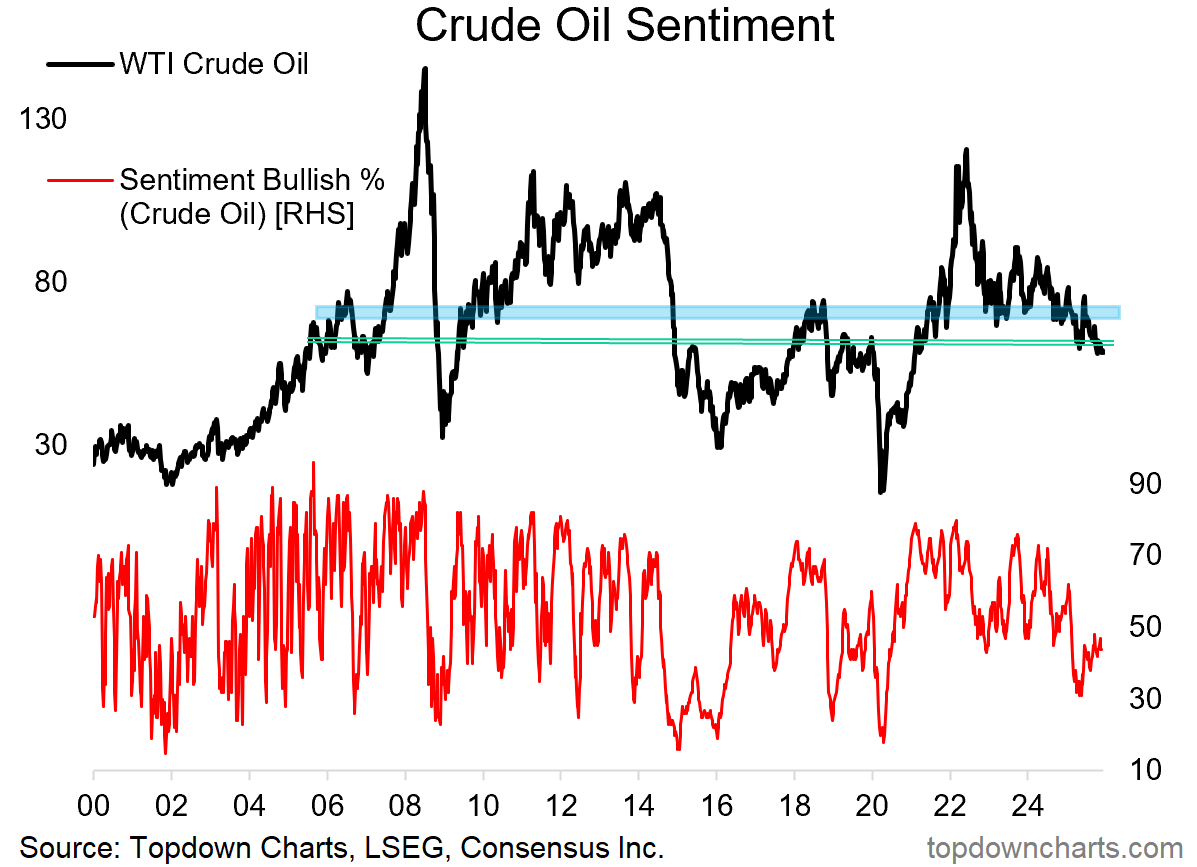

3. Unsupportive for Crude: Well, crude oil had just about every excuse and chance to rally during 2025 given what went on in geopolitics, but every time it did managed a blip up it turned out to be a false dawn. And perhaps to add to the frustration is that while the upper support level did not hold as initially suspected, the breakdown was not particularly decisive either. While neither bulls nor bears really took control this year, I suspect next year could be a bit different. Definitely one to keep on the radar.

“WTI crude has begun a significant rally off a major long-term support level, with sentiment turning up from about neutral (bottom end of the range).” (17 Jan 2025)

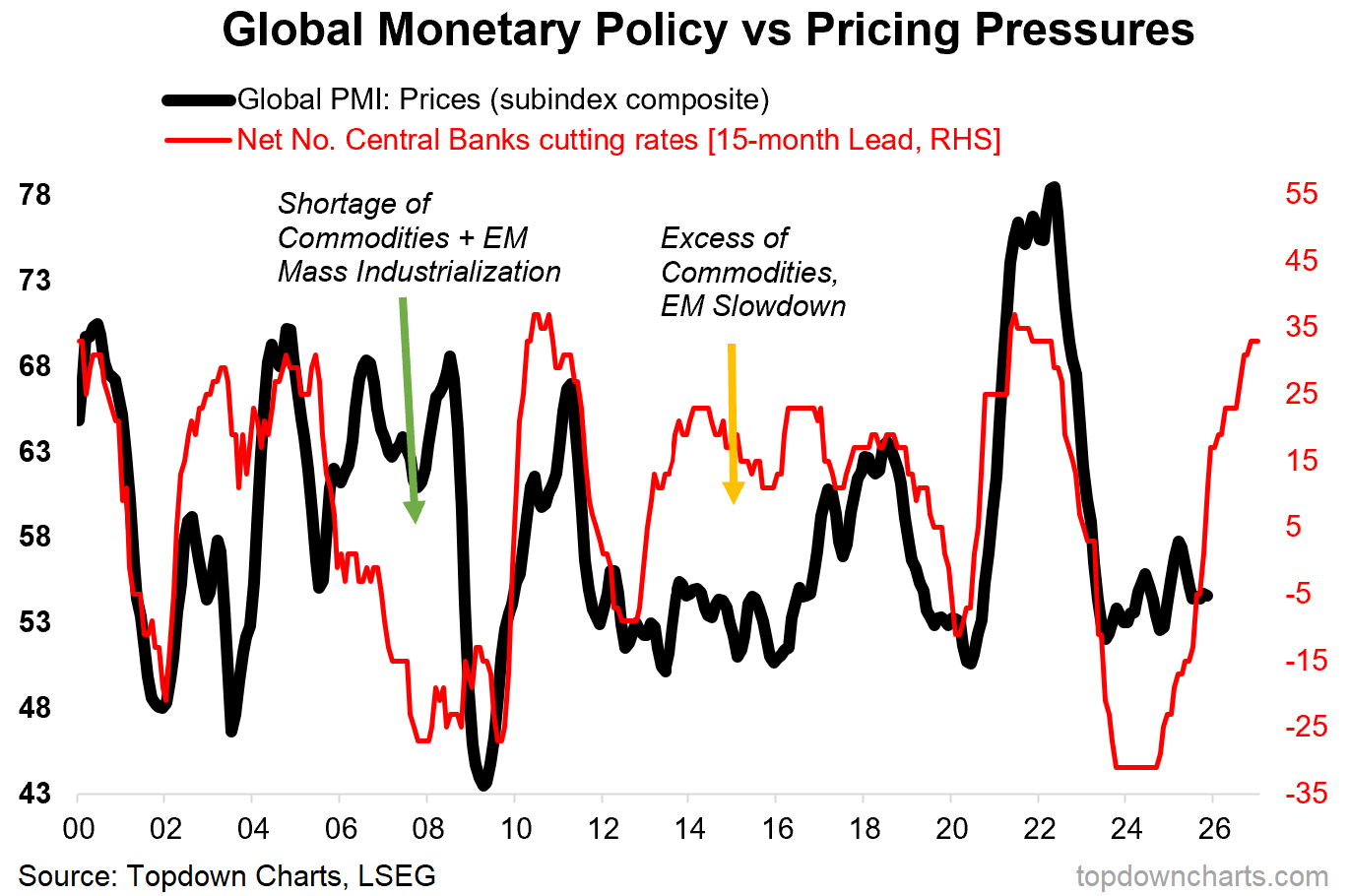

4. Inflation Contained: Closely related, with global growth kind of just muddling along in 2025 (thanks to the ups & downs of H1) there was no major upside for oil or inflation in general. It might well be that the tariffs ended up kicking this can down the road + accentuating it by forcing more stimulus in response to the tariff shock.

“I think you can still get an inflation uptick at a global level even with a minor slowdown or growth scare in the US, but a big part of that will hinge on commodities (which in my view have a bullish outlook). The key point to note is inflation expectations remain elevated, so any uptick in growth is going to fuel an inflation resurgence; this is basically the base case now. Key point: the conditions are ripe for an inflation resurgence. ” (28 Mar 2025)

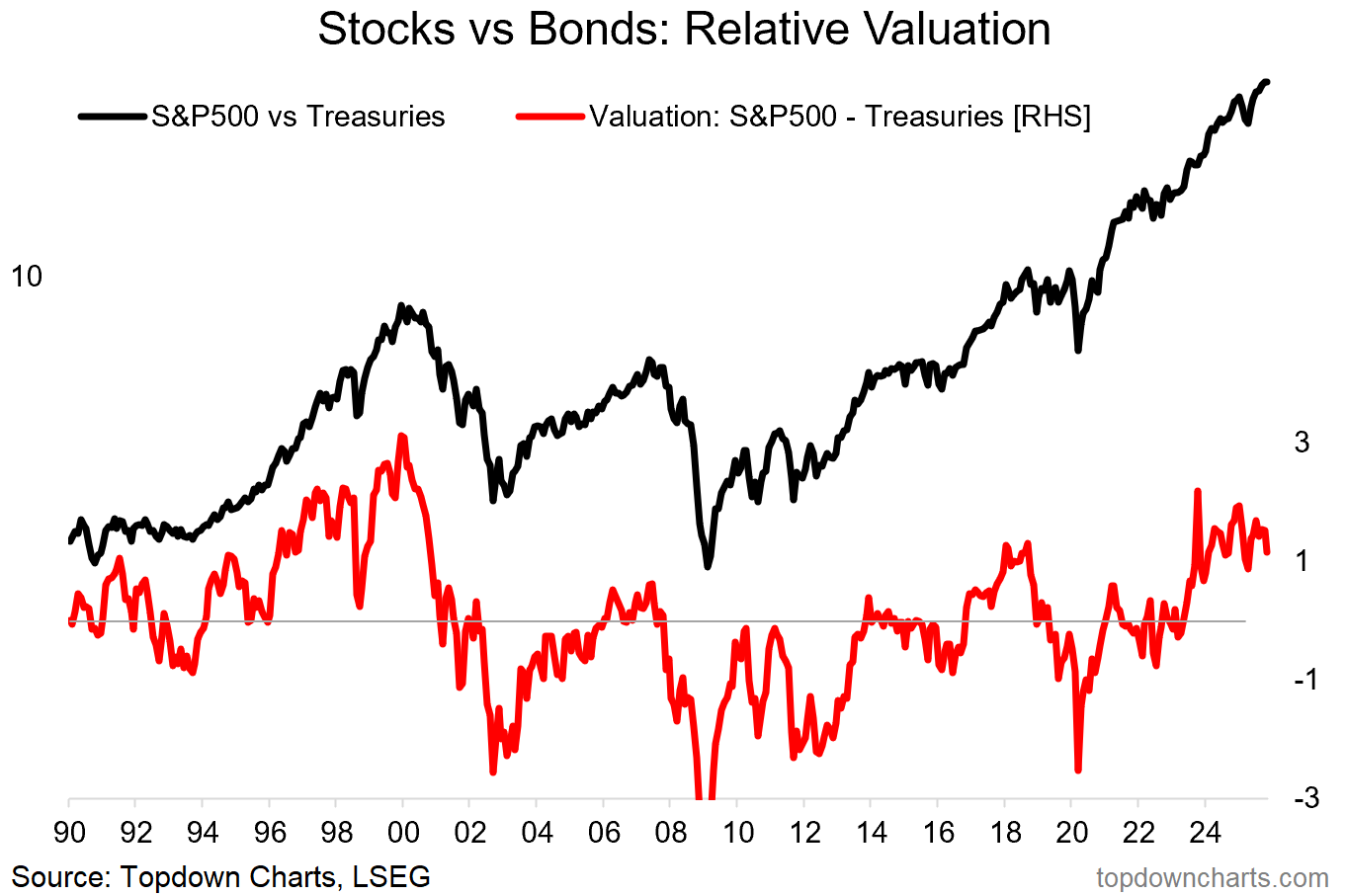

5. Stock-Bond Unbothered: Despite the relative value indicator reaching the most expensive levels since dot-com, and with stocks expensive and bonds cheap, it was not meant to be to see stocks lose ground vs bonds this year (except briefly during the tariff tantrum).

“Around the turn of the year the stocks vs bonds relative valuation indicator reached a new post-dot com high; even surpassing the mid/late-90’s levels (i.e. on par with the reading seen around the peak). And the underlying signals are consistent: stocks are expensive, bonds are cheap.” (31 Jan 2025)

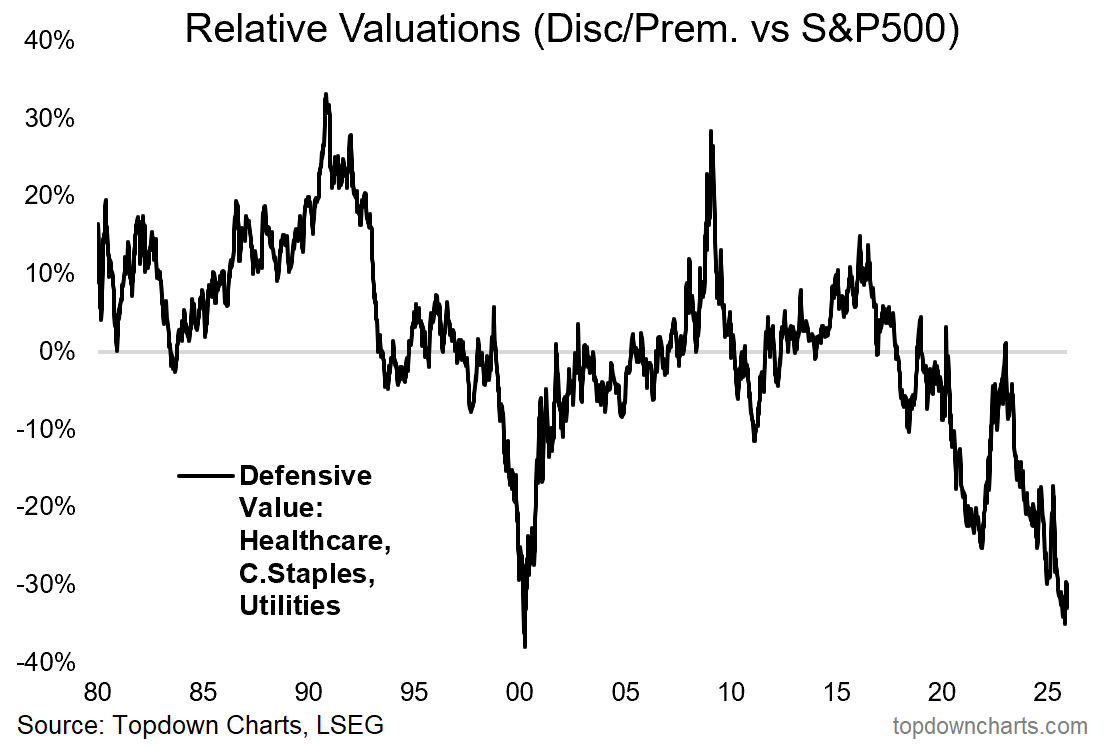

6. Not Yet Defense: And basically an alternative version of the above, defensive stocks (healthcare, utilities, consumer staples) despite reaching the most extreme relative value readings since the very peak of the dot com bubble –did not (yet) manage to move much. I suspect with both the below and the above charts that it is probably more of a matter of when than if, but again it goes to show that the big puzzle picture needs all of the pieces in alignment to really work. These both lacked the tactical element in 2025.

“Similarly, the defensive sector basket relative value score is great – as cheap as dot com, and that’s not good. The time when defensives are most hated is when the bull market is most extended e.g. 2000, 2021. I view this basket as both an interesting alternative hedge and a contrarian signal.” (10 Jan 2025)

So an interesting set of charts and lessons, but also some interesting clues and snippets for the year ahead (and p.s. stay tuned for the “Charts to Watch in 2026” blog coming soon…!)

—

Thanks for reading!

Check out the Full Report here (free download)

Best regards

Callum Thomas

Head of Research and Founder of Topdown Charts

Twitter: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

For more details on the entry-level service check out the following resources:

Getting Started (how to make the most of your subscription)

Reviews (what paid subscribers say about the service)

About (key features and benefits of the service)

But if you have any other questions definitely get in touch.

NEW: All Services by Topdown Charts

Topdown Charts Professional —[institutional research service]

Topdown Charts Entry-Level Service —[entry-level version]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack —[Gold charts]

Australian Market Valuation Book —[Aussie markets]