Chart of the Week - Commodities

"this is *the* key asset class to watch in the coming months and years"

Here’s one key asset class that’s out-of-fashion, overlooked, and undervalued.

(and mostly misunderstood)

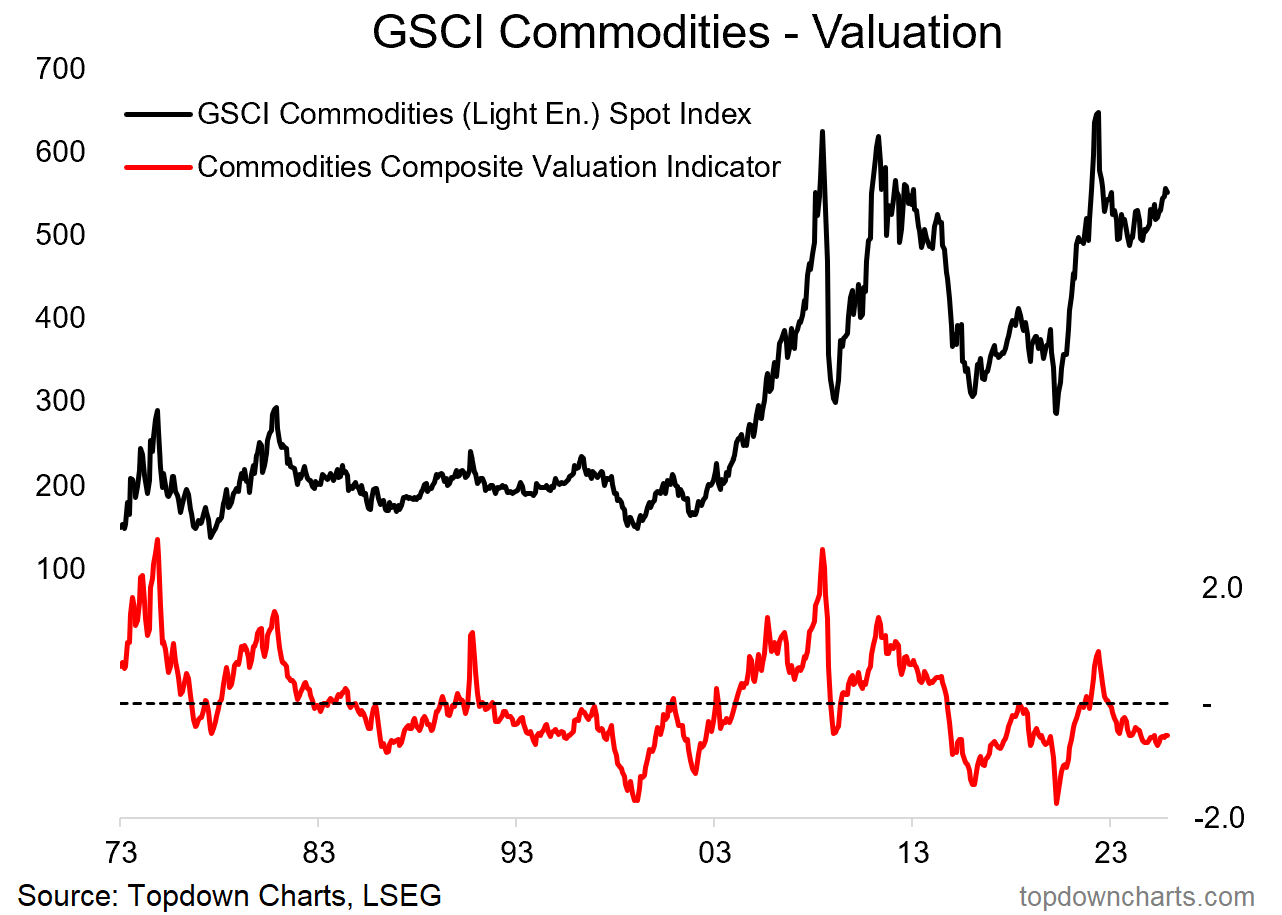

By my metrics, Commodities are cheap [and I mean commodities at the asset class level, or specifically the *diversified* GSCI (Light Energy) Commodities Index].

But we all know that cheap can stay cheap, get cheaper, and the usual quip that it might just be cheap for a reason…

So here’s a few reasons why commodities might be one of the most important asset classes to watch into 2026, and why valuations may be more relevant now:

Valuations: as noted, commodities are cheap by my indicators, and most importantly; the indicator has gone to cheap levels and ticked up off the lows.

Technicals: the index I mentioned has started to make an initial move on breaking out of its big trading range, off a cyclical base building process, and with bullish breadth divergence.

Sentiment: aside from gold, investors are still pretty bearish, lightly allocated, and largely unenthusiastic on commodities in general.

Supply: we have just been through what can only be described as a commodity capex depression, following the big boom-bust super cycle of the 2000’s there was a glut of supply and big drop-off of investment in new supply.

Thematic Demand: with things like the energy transition, rise of AI and robotics, infrastructure (re)building, space, and geopolitics; there is set to be tremendous demand for industrial metals and energy in the coming years.

Monetary Conditions: successive global waves of monetary easing present upside risk to cyclical demand + asset prices in general …but also a weaker dollar (bear market in US$ = my view) will help commodities priced in USD.

Cyclical Demand: as previously outlined, I think there is a good chance we see a global economic reacceleration on the horizon and that’s going to float all boats in the commodity space.

Inflation Protection: (but) reaccelerating global growth is therefore likely to lead to inflation resurgence, and commodities are intimately interlinked with the inflation story [and provide a direct hedge against inflation risk].

So whether it’s from a macro point of view, an upside opportunity point of view, or even a defensive standpoint — commodities are going to be perhaps *the* key asset class to watch both now and especially into 2026.

Key point: Commodities are undervalued (with underappreciated upside).

ALERT: 2026 Big Ideas Outlook Webinar

This week Head of Research & Founder of Topdown Charts, Callum Thomas will take you through some of his big charts and big ideas for the global macro/market outlook that are either already in progress or set to become major risks + opportunities into 2026… —[ Register Now ]

[Webinar is scheduled for EST 2pm Wednesday the 12th of November 2025]

Topdown Around the Web — Other notable charts…

ICYMI, here’s a couple of other interesting charts to check out.

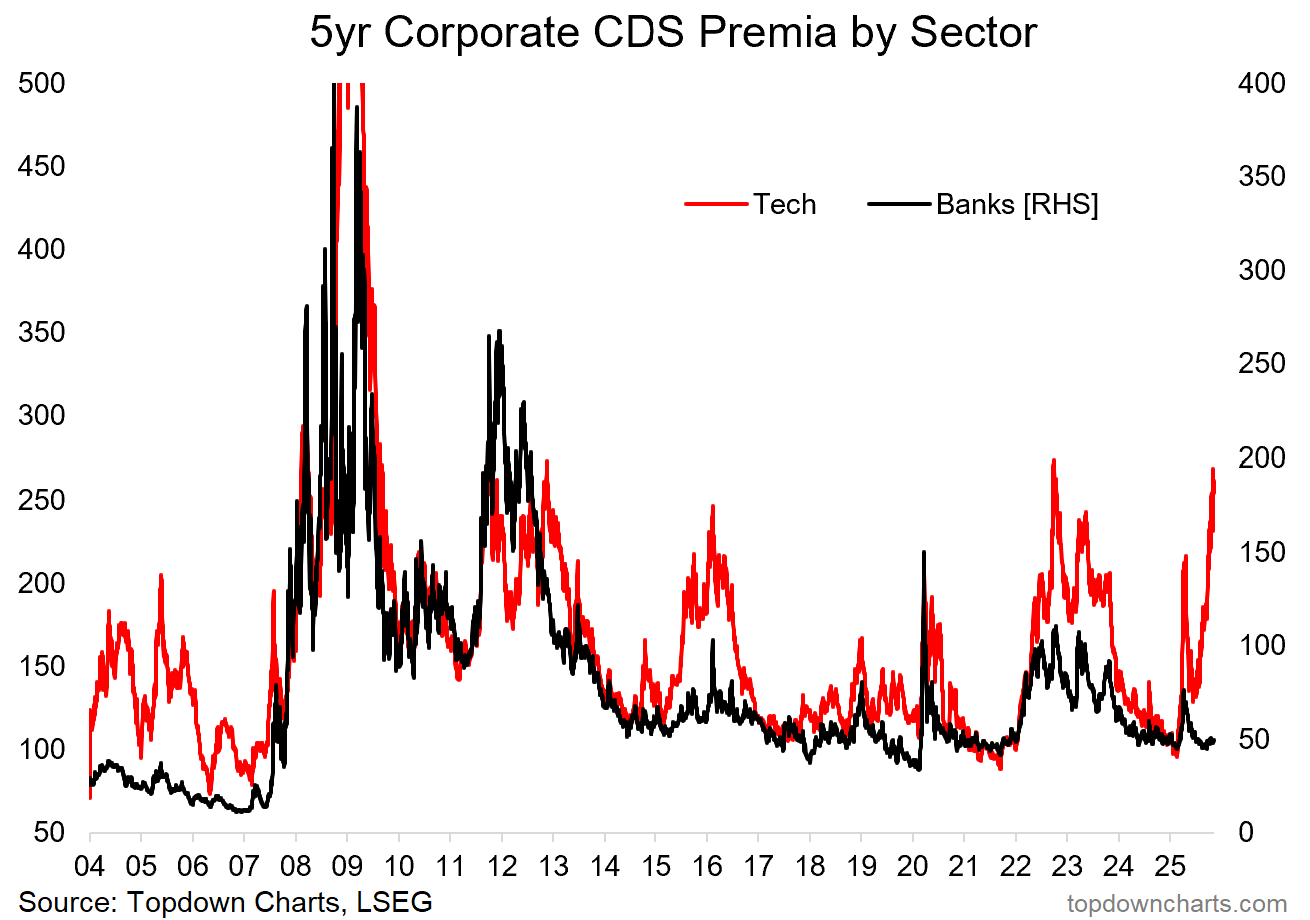

The Weekly S&P500 ChartStorm: the latest Weekly ChartStorm looked at some key developments in the US stockmarket especially around the AI boom. Of particular note was the rise in semiconductors’ market cap weight, an emerging AI credit boom (and curious rise in Tech Sector CDS pricing as depicted below), euphoric investor sentiment across multiple indicators and data-types, and yet a few points of concern to keep track of…

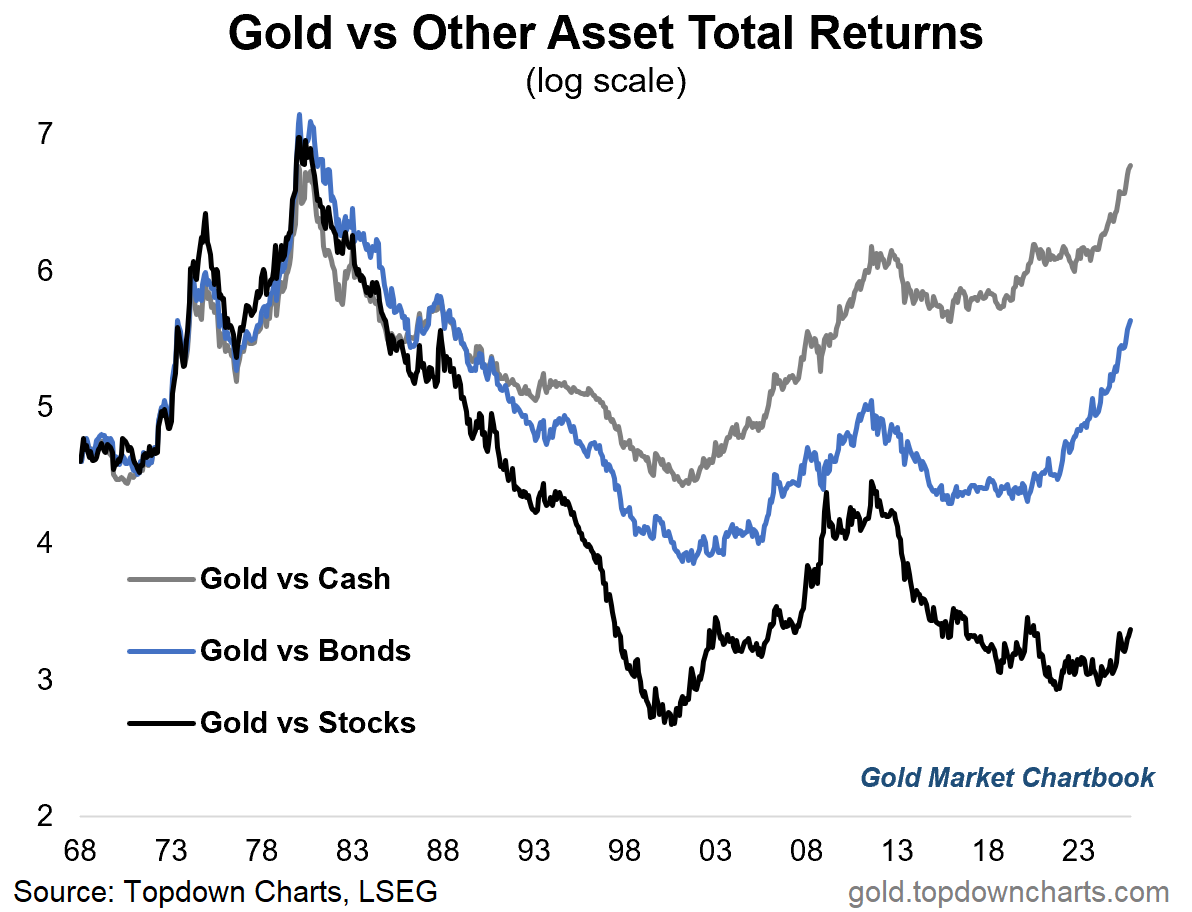

The GoldNuggets Digest: the latest edition took a progress check on the gold bull markets, but in particular a focus on gold vs stocks. The chart below tracks the relative return procession —and probably the most interesting development has been the upturn in the gold/stock ratio (key implications for asset allocators given what’s driven some of the past big moves in that line).

Topics covered in our latest Weekly Insights Report

Here’s what was covered in the latest entry-level Premium report:

Global Markets Update: risk assets, fixed income, FX, commodities

Renewable Energy Stocks: update on the big breakout, outlook

ESG Investing & Carbon Prices: tracking key trends in this space

Macro Risk Radar: key events, technicals in the week ahead

Monthly Pack: link to the latest monthly Asset Allocation Review

Ideas Inventory: latest live ideas and views (+closed ideas performance)

Subscribe now to get instant access to the latest Premium Report so you can check out the details around these themes + gain access to the full archive of reports AND flow of future ideas…

What did you think of this note?

(feel free to reply/comment if you had specific feedback or questions)

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

NEW: Services by Topdown Charts

Topdown Charts Professional —[institutional service]

Topdown Charts Entry-Level Service —[entry-level version]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack —[Gold charts]

Australian Market Valuation Book —[Aussie markets]

I am very bullish on commodity sector. Easy conservative way of participating is to own DBC

For those who might be wondering, here's some notes on the methodology behind this valuation indicator (and general principles for indicator design): https://entrylevel.topdowncharts.com/p/detecting-opportunities-in-commodities