Chart of the Week - Reacceleration 26

This is going to be *the* big macro theme heading into 2026

There’s one big macro theme that’s making its way in from the edges.

And it’s going to touch every market.

I’m talking about global growth reacceleration.

Specifically what we’re talking about here is the idea that growth picks up pace into 2026 — and I call it reacceleration because while some parts of individual economies and some parts of the global economy have gone into recession or significant slowdown …there hasn’t been a Recession (with a capital R). Just a weird churning middle-porridge of growth cooling off but largely muddling along in the aggregate.

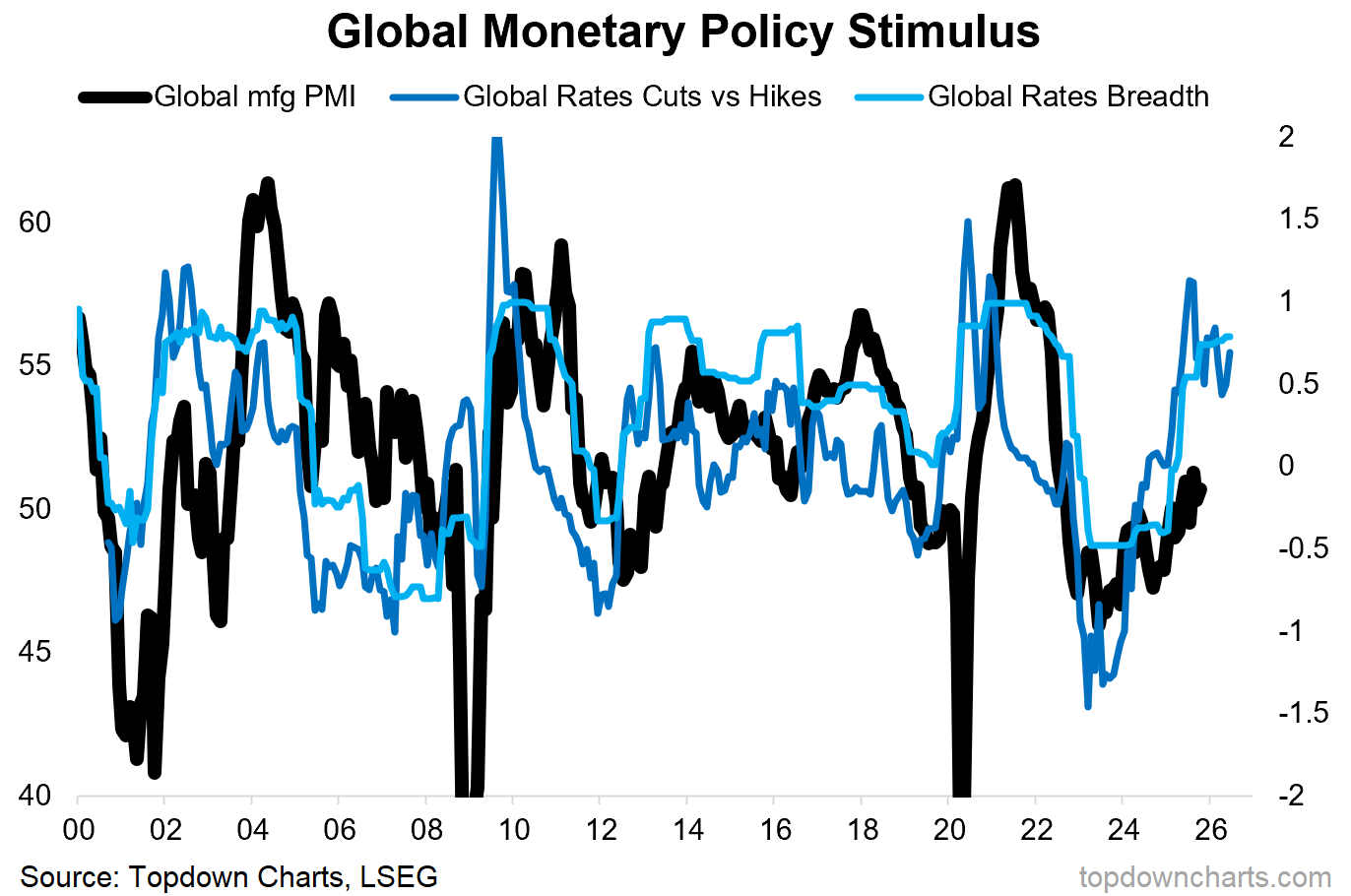

Given the previous peak and decline in inflation rates globally + above-mentioned softening in growth + trade-war risks and wild volatility from earlier this year, we have actually seen a highly significant period of monetary easing around the world.

The breadth and pace of rate cuts globally over the past 2-years has been on a similar scale to that seen during: the early-2000’s dot-com burst/recession; the 2008 financial crisis; and 2020 pandemic. And yet, there hasn’t really been a major crisis or recession this time around, and that’s important…

When you get a non-recessionary-rate-cut-rush like this it can only mean one thing — something glorious is on the horizon.

Global. Growth. Reacceleration.

Key point: The global rate cut rush of the past 2-years means global growth reacceleration is a key scenario heading into 2026.

Like this post so far? :-) Please consider sharing it (e.g. forward to a friend/colleague, share on social media, + feel welcome to use the charts in your own work)

Bonus Chart 1 — Inflation Resurgence

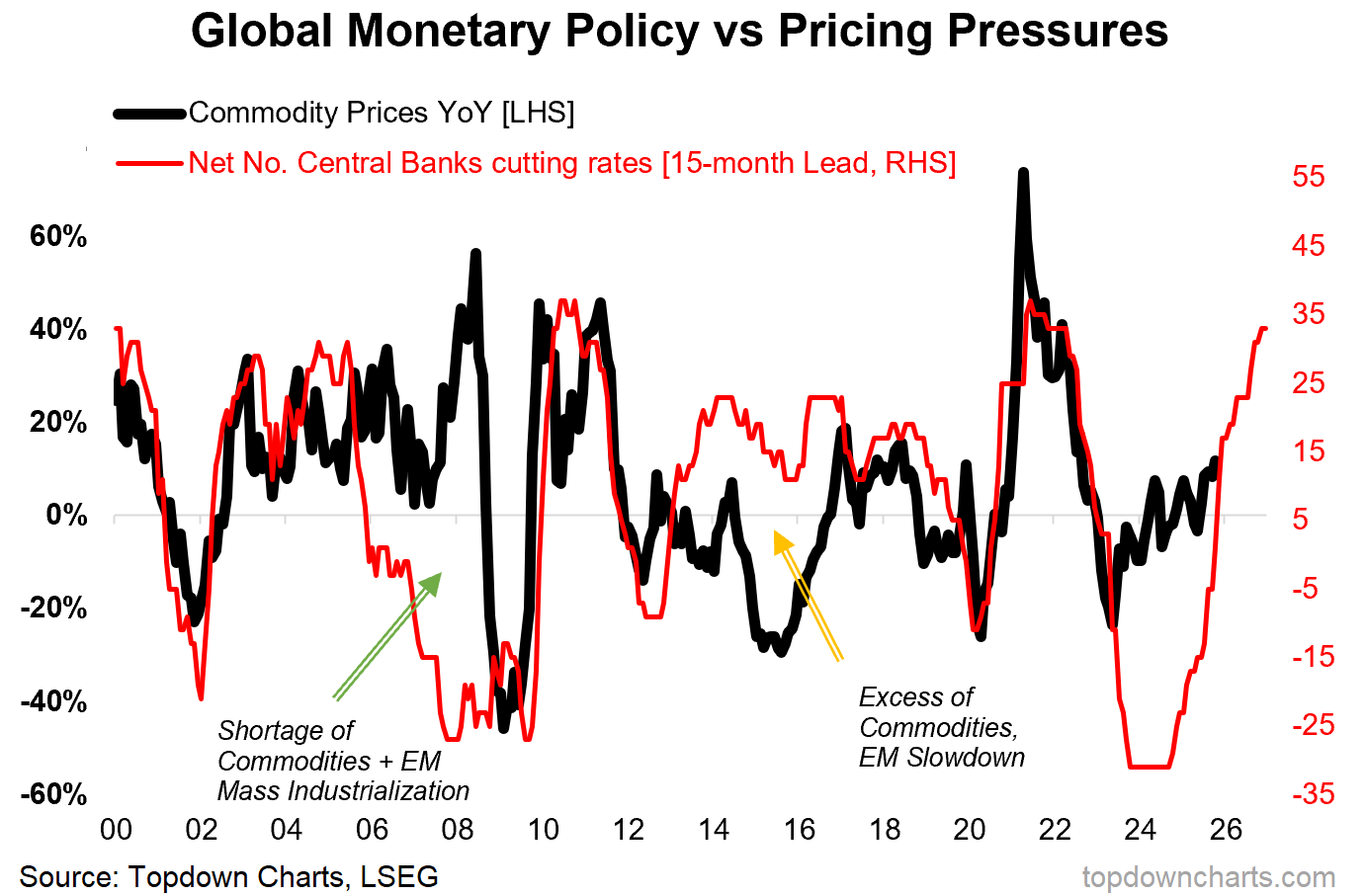

As you can gather from the above, I believe Reacceleration is the big R need to think about for the global economy heading into 2026. But another big R-word we need to factor in is that of Resurgence.

Inflation Resurgence Risk.

When you consider that we are still finding our feet from the biggest inflation shock in decades and that inflation expectations are as a result still very high and sensitive to any renewed pricing pressures… and then consider that supply chains are still in a state of flux, investment in commodity supply has been in a depression, and capacity is still tight in many areas — it’s not hard to imagine a scenario where reacceleration naturally leads into (inflation) resurgence.

And that’s precisely where the policy path is pointing (chart below).

n.b. If you haven’t yet, be sure to subscribe to the [free] Chart Of The Week or better yet: Upgrade to Paid for Premium macro-market Content.

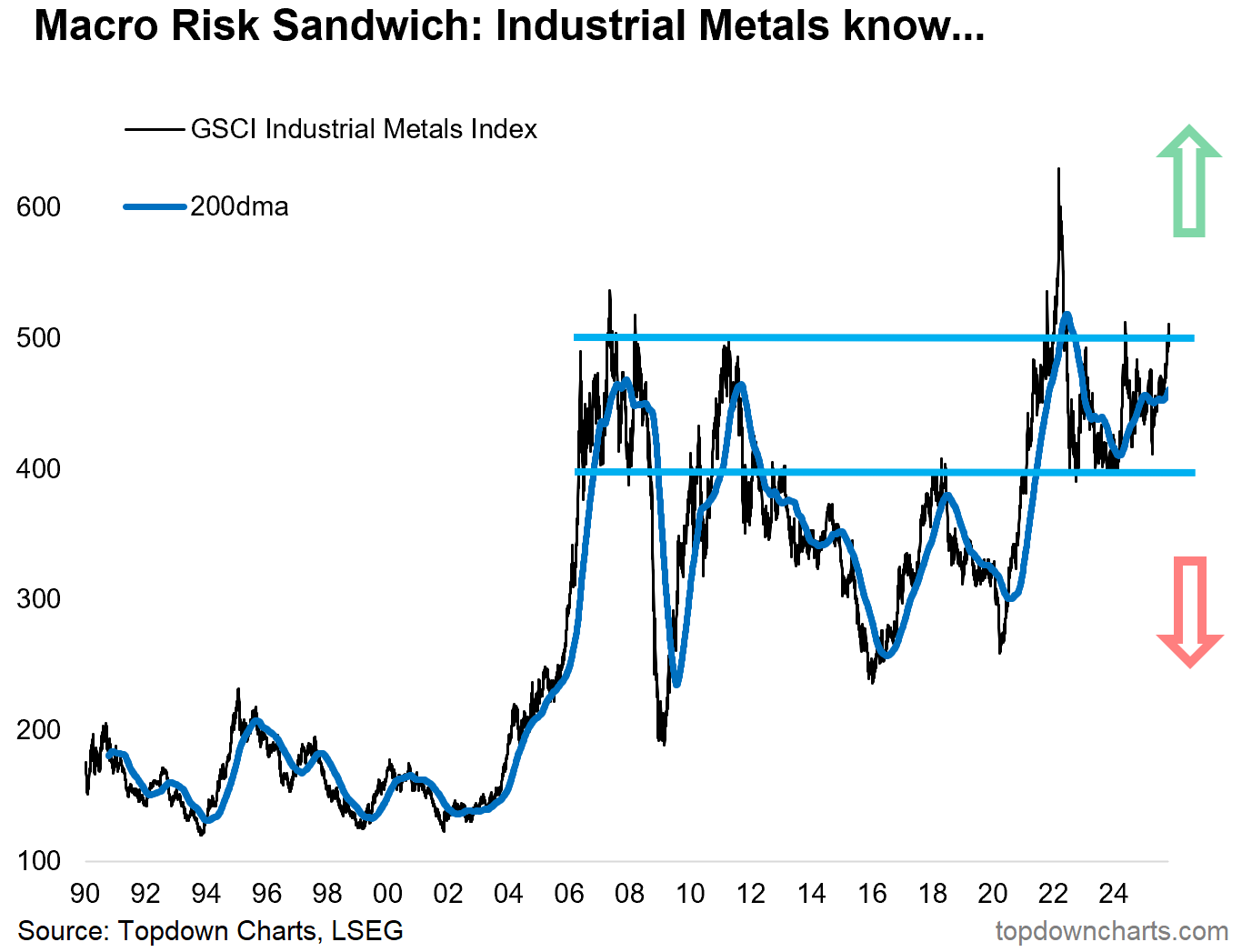

Bonus Chart 2 — The Macro Risk Sandwich

But that’s only one possibility, the other macro edge risk —part of what I call the Macro Risk Sandwich— is recession and deflation (the opposite of reacceleration and resurgence). As things stand I think the risk of recession and deflation is very low; there’s no evidence for it right now, and outside of a shock or downside surprise it’s low probability.

But markets already know — at least with respect to industrial metals.

I highlighted in the “10 Charts to Watch in 2025“ that base metals would be the one to let us know which side of the Macro Risk Sandwich it’s going to be, and much in line with what I talked about above: they’re telling us it’s beginning to look a lot like Reacceleration.

On that note, the market implications of reacceleration (+resurgence) is most likely going to be the following: upside for commodities, traditional cyclical stocks, and global/emerging market equities… while bonds and long-duration growth/tech stocks could get rattled if it all unfolds fast and furious (especially on the inflation front).

So it’s a very interesting and important prospect to ponder.

Global Economic Pathways 2026 — what do you think?

p.s. Not a Paid Subscriber yet?

Be sure to sign up so you can access premium content including exclusive well-rounded ideas spanning risk alerts, investment ideas, and impactful macro insights to help make you a better investor — [ Sign Up Now ]

Topics covered in our latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and dug into some intriguing global macro & asset allocation issues in our latest entry-level service weekly report:

Global Markets Update: global equity technicals, rates, commodities

REITs & CRE: technical update on REITs and the reset in CRE prices

Chinese Stocks: update on A-shares and Chinese tech stocks

US Tech Stocks: pulse check on fundamentals, valuations, technicals

Energy Sector: crude oil price outlook, energy sector equities

Defensives: looking at healthcare, utilities, consumer staples

Subscribe now to get instant access to the report so you can check out the details around these themes + gain access to the full archive of reports + flow of ideas.

For more details on the service check out the following resources:

Getting Started (how to make the most of your subscription)

Reviews (what paid subscribers say about the service)

About (key features and benefits of the service)

But if you have any other questions definitely get in touch.

What did you think of this note?

(feel free to reply/comment if you had specific feedback or questions)

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

NEW: Services by Topdown Charts

Topdown Charts Professional —[institutional service]

Topdown Charts Entry-Level Service —[entry-level version]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack —[Gold charts]

Australian Market Valuation Book —[Aussie markets]

Another thing this raises is the point that once it becomes clear that growth is holding up and even improving (+inflation upside risks surfacing) --- central banks might need to quickly reverse course. So I would look for more and more pauses on easing + eventual outright reversal to rate hikes [but that's likely a later-2026 story].

And yes, that means the Fed is probably done with rate cuts (with today's -25bp cut likely being the last step in this easing cycle).