Chart of the Week - New High in New Highs

Global equities are booming, here's why + what to expect next...

No that’s not a typo, we are literally seeing a new high in new highs.

(47 countries just chalked up new highs)

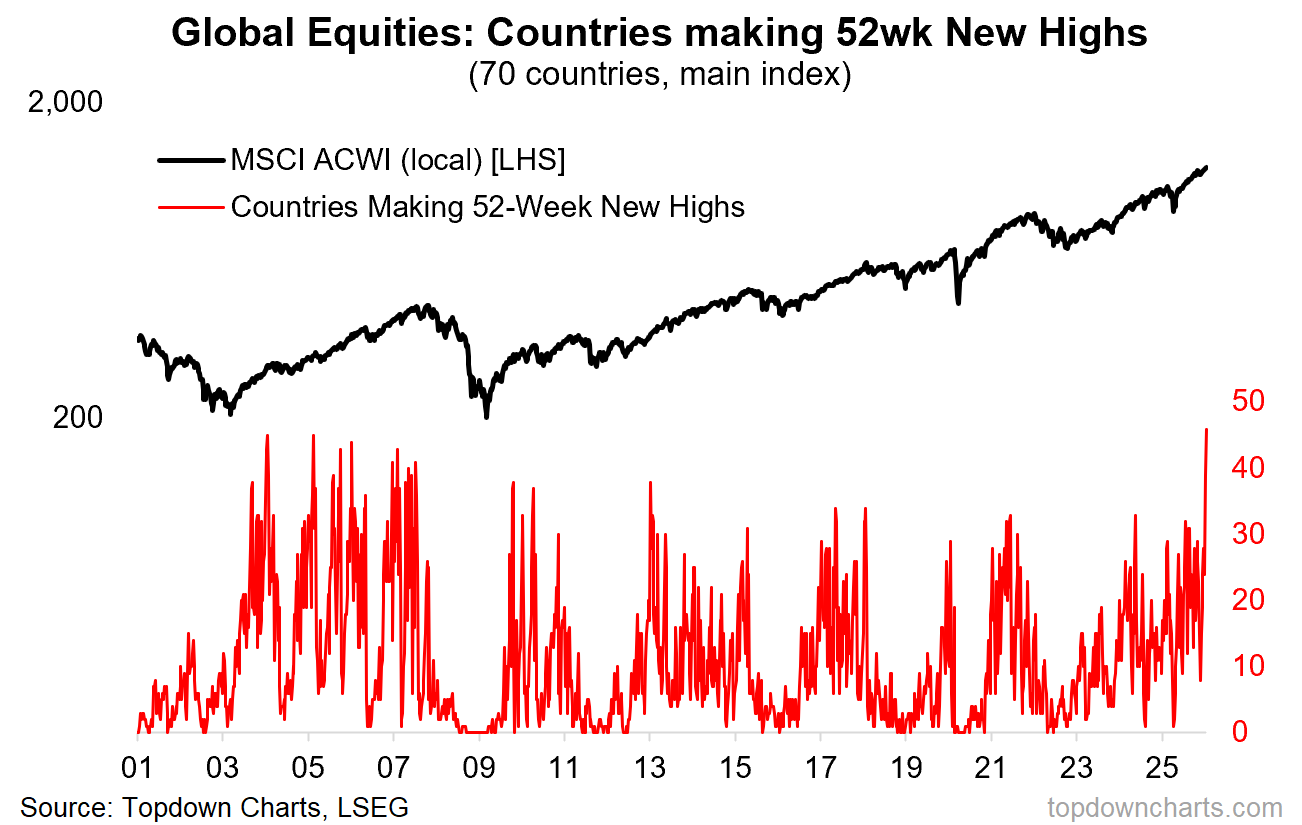

The chart below tracks the weekly count of the 70 countries we track that have closed at their highest point over the trailing 52-week window.

The latest reading is the highest on record, and is comfortably higher than any reading we’ve seen in the post-2008 era.

This is highly significant because the last time we got close to this number (46) was back during the early-2000’s global equity bull market where commodities were booming, emerging markets were making transformative progress, and global stocks were outperforming their US counterparts.

So I would say this latest reading bodes particularly well for global vs US rotation.

Indeed, probably the biggest development of 2025 was the revival of global stocks and inflection point in global vs US relative performance.

And this chart is likely to go down as a harbinger of follow-through on this key theme (bullish global equities and global vs US) as we kick into what is already looking like a very interesting year for macro and markets.

Key point: Global equities are booming (seeing a surge in new highs).

Like this post so far? Please consider sharing it.

Bonus Chart 1 — Monetary Tailwinds

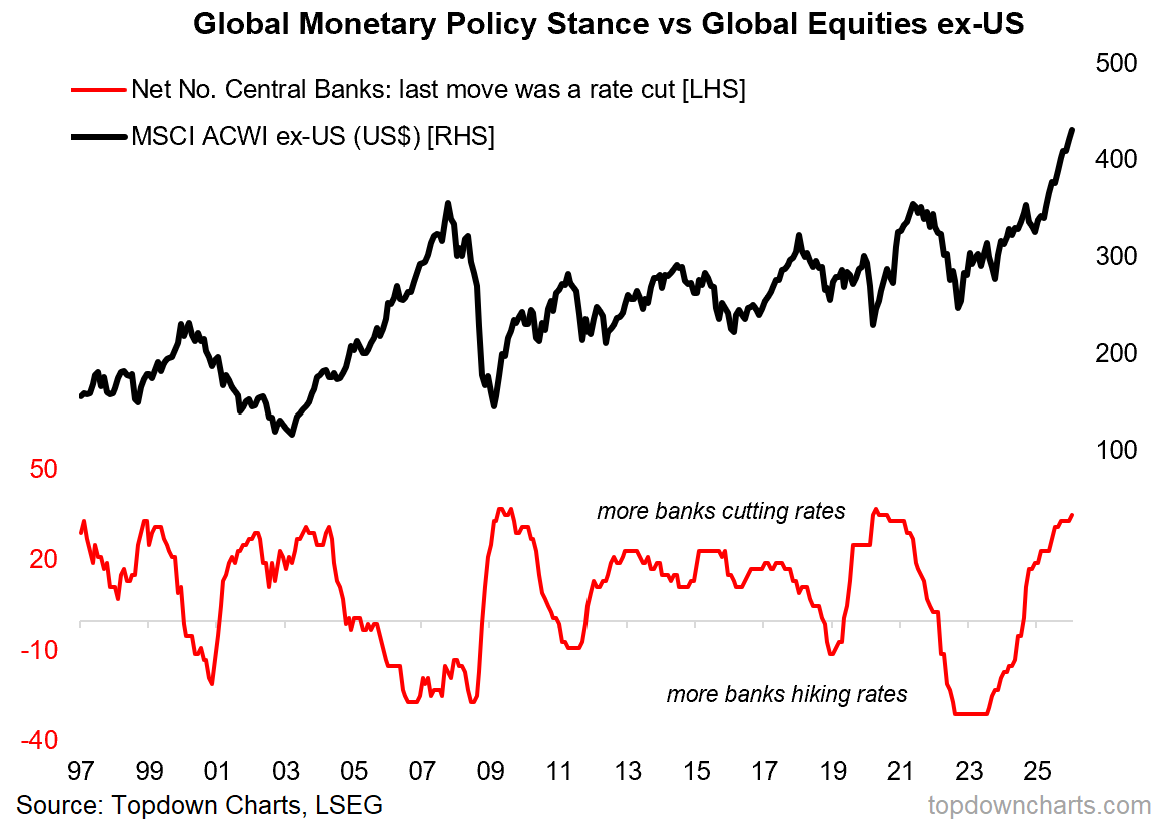

For those who are wondering what’s behind the moves in the chart above, or for those who may be skeptical on technicals, this next chart provides some critical context on what has been a major driver of the global equity bull market.

Aside from global stocks coming off of very cheap valuations (vs their own history and vs US), we have seen a major pivot in global macroeconomic policy settings.

Heading into 2025 there was already a shift towards easing, and then the chaos of H1 (tariff tantrum) triggered a wave of precautionary stimulus in response. This along with a weakening US dollar, rotation flows, and improving macro/earnings pulse has given a firm macro-fundamental backing to the technical developments which I laid out above. This is where you see the most interesting moves in markets: when the technicals, valuations, and macro/fundamentals align. Bullish global equities.

n.b. If you haven’t yet, be sure to subscribe to the [free] Chart Of The Week series or better yet: Upgrade to Paid for Premium macro-market Content.

Global Equities in 2026 — What do you think?

(/how are you positioned? And please feel welcome to add your comments, context, or questions in the comment section…)

(n.b. for those curious, a complete country listing for each basket above can be found here — MSCI Country Classifications) ALSO: n.b. “ex-US = excluding USA“

Be sure to sign up so you can access premium content including exclusive well-rounded ideas spanning risk alerts, investment ideas, and impactful macro insights to help make you a better investor — [ Sign Up Now ]

Topics covered in our latest Weekly Insights Report

Aside from the chart above, we looked at several other charts, and dug into some intriguing global macro & asset allocation issues in our latest entry-level service weekly report:

Global Markets Update: global equities, fixed income, FX, commodities

Global Equity Technicals: rotation in play, upside for global equities (ex-US)

Macro Radar: key events and technical triggers to monitor

Monthly Asset Allocation Review: link to the latest monthly pack

Ideas Inventory: all current live/open ideas and views

Subscribe now to get instant access to the report so you can check out the details around these themes + gain access to the full archive of reports + flow of ideas.

For more details on the service check out the following resources:

Getting Started (how to make the most of your subscription)

Reviews (what paid subscribers say about the service)

About (key features and benefits of the service)

But if you have any other questions definitely get in touch.

What did you think of this note?

(feel free to reply/comment if you had specific feedback or questions)

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

NEW: Services by Topdown Charts

Topdown Charts Professional —[institutional multi-asset research]

Topdown Charts Entry-Level Service —[entry-level version]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Australian Market Valuation Book —[Aussie markets]

Monthly Gold Market Pack —[Gold charts]