Chart of the Week - US Small Caps

This chart provides a unique angle on *both* the Biggest Risk & Opportunity in US markets right now...

“Big opportunity in Small Caps?”

That’s what many are starting to argue, and some of you asked me what I reckon so here’s a couple of charts + things to consider.

The main thing is US small cap stocks as a group look cheap vs history, cheap vs large caps, under-owned, underrepresented, underappreciated, and undergoing some very interesting tactical developments recently…

Here’s what I’m looking at on the bull case:

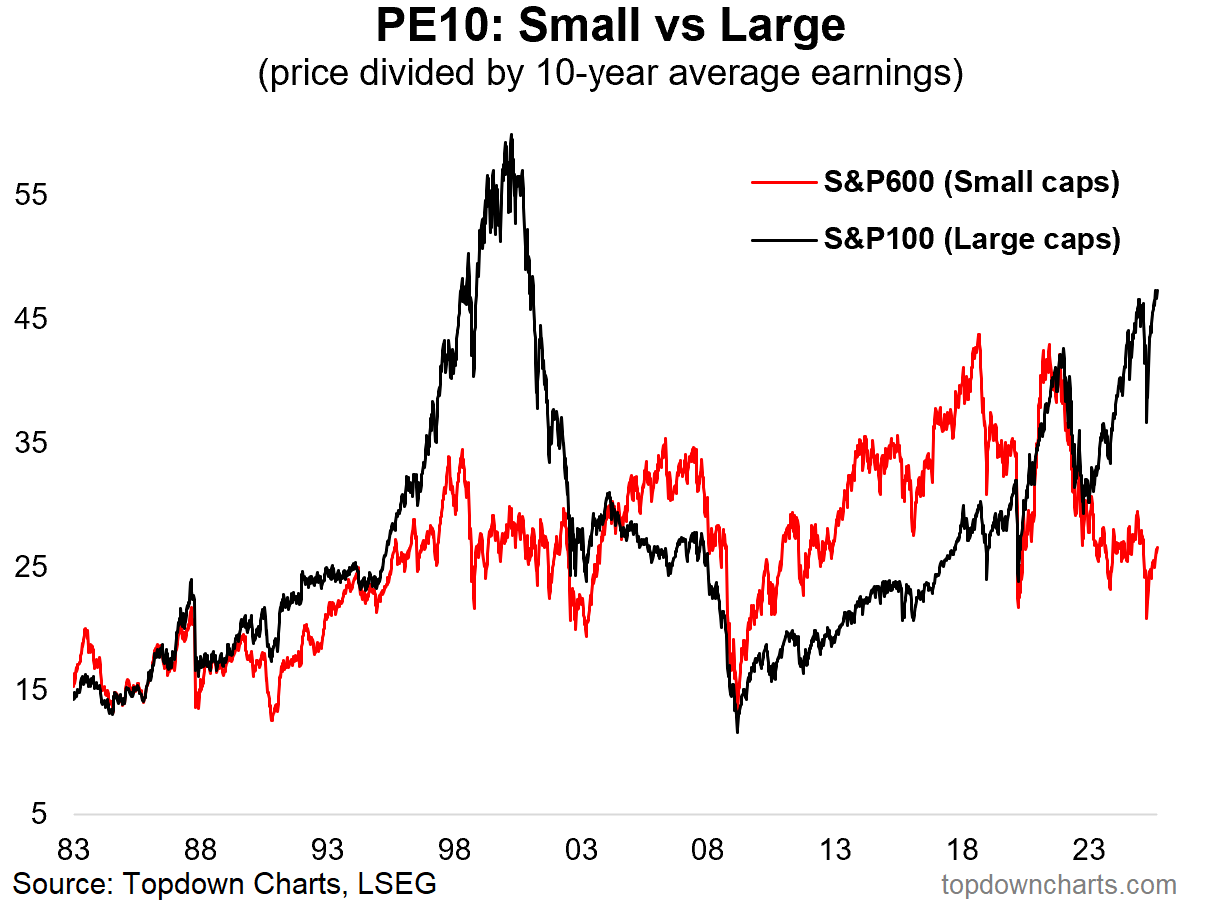

Valuations: small caps are cheap vs large caps (see chart below), cheap vs history (currently rebounding off levels lower than the 2020 trough), and cheap vs bonds (small caps Equity Risk Premium is still at healthy levels).

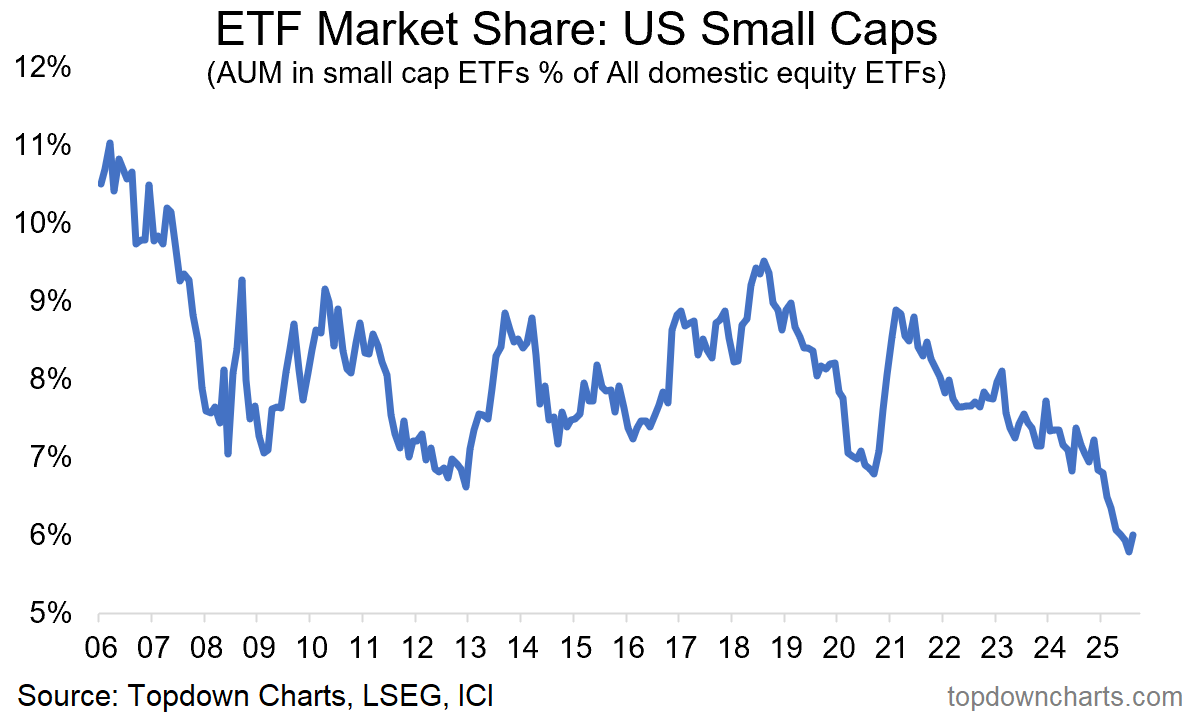

Sentiment: despite the recent interest, this year has seen massive outflows from small cap equity funds (+very low allocations) and near-record short futures positioning (short squeeze anyone?).

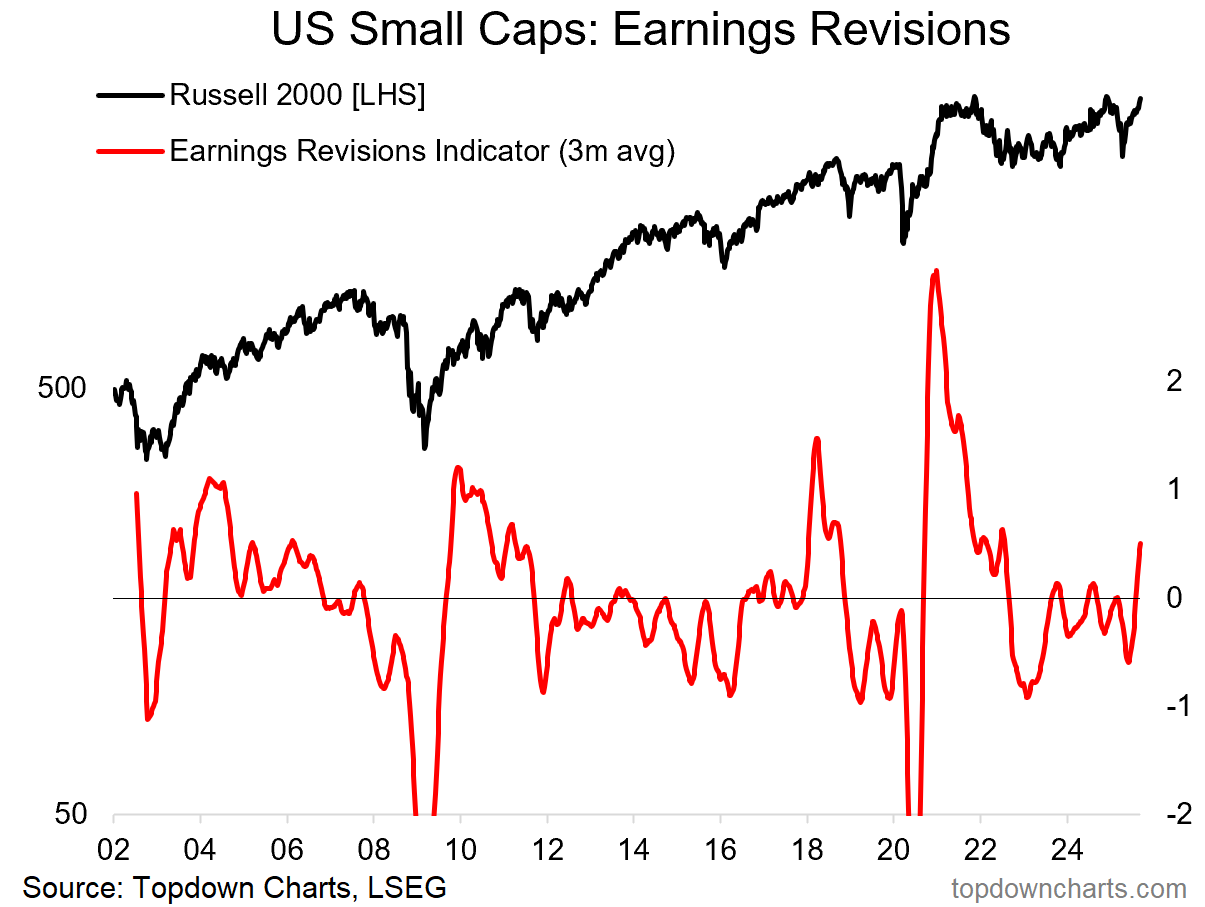

Macro: small caps are likely to benefit from lower interest rates (Fed set to kick-off a second round of rate cuts next week), but also ironically a global growth reacceleration would also help (small cap stock indexes have more traditional cyclicals, less tech vs large cap stock indexes), and as shown further below: small cap earnings revisions have been surging recently.

Technicals: small caps have seen improving breadth, established a solid uptrend off the April tariff-tantrum lows, and are currently making a run on a major overhead resistance point (it will be Big if Small caps break through!).

So it’s a fairly compelling setup.

The key risks would be a possible recession in the USA, but if it ends up being short and shallow and features significant rate cuts and fiscal stimulus it could turn out to be net-positive.

That said, a deeper recession and equity bear market would be problematic for absolute returns… but given the stretched valuations and froth in large caps (notably big tech and the AI hype); you might see large caps fall further and faster —and small caps outperforming on a relative basis (albeit maybe by simply falling less than their large cap peers).

The key things to watch in the immediate term will be: follow-through in earnings revisions momentum, technicals (breakout = big bulls, however failure to breakout will be problematic), and macro (rate cuts support vs recession downside risk …and reacceleration risk on the upside).

But this is not the only interesting chart, the next chart shows another element in the strategic bull case for small caps… (scroll down)

Key point: Small caps look cheap, under-owned, and tactically attractive.

Liking this post so far? Please consider sharing: e.g. forward this email to a friend/colleague, share the web post/charts on social media, + feel welcome to use the charts in your own work... Thank you! :-)

Bonus Chart 1 — Investor Allocations

This chart shows just how far out of favor small caps are.

Through a combination of portfolio drift (market movements) and active allocations (fund flows), US investors are running record low allocations to small cap ETFs.

But here’s the kicker: it just ticked up.

As far as contrarian signals go, that’s as good as it gets. When you see a sentiment/positioning indicator go to an extreme and then tick up, that’s the most powerful signal you can get. So another support to the bull case here.

Bonus Chart 2 — The Tactical Element

And as mentioned earlier, another key component of the tactical outlook has been the resurgent earnings revisions indicator (which combines the smoothed signal from changes in aggregate forward earnings estimates and the breadth of positive vs negative earnings revisions).

Again, this is an excellent shape.

Seeing an indicator like this plunge (back in April during the depths of tariff despair), and then turn back up again and go positive is a strong bullish signal.

SURVEY …what do you reckon?

Looking for more insights & ideas — why not upgrade to paid?

p.s. Scroll Down to see what else we’ve been working on…

Topics covered in our latest Weekly Insights Report

Here’s a brief snapshot of what we covered in the latest Premium Content report for subscribers of the Topdown Charts Entry-Level service:

Global Markets Update: global equities, rates, FX, commodities

Treasuries in Focus: update on technicals for US + global govt bonds

Macro Radar: key events and technicals to note in the week ahead

Monthly Pack: link to monthly Asset Allocation Review

Ideas Inventory: listing of latest/live ideas, views, recommendations

Subscribe now to get instant access to the report so you can check out the details + gain access to the full archive of reports + flow of ideas.

For more info on the service check out the following resources:

Getting Started (how to make the most of your subscription)

Reviews (what paid subscribers say about the service)

About (key features and benefits of the service)

But if you have any other questions definitely get in touch.

Other free research notes by Topdown Charts

Check out these other recent free reports & charts we published this week.

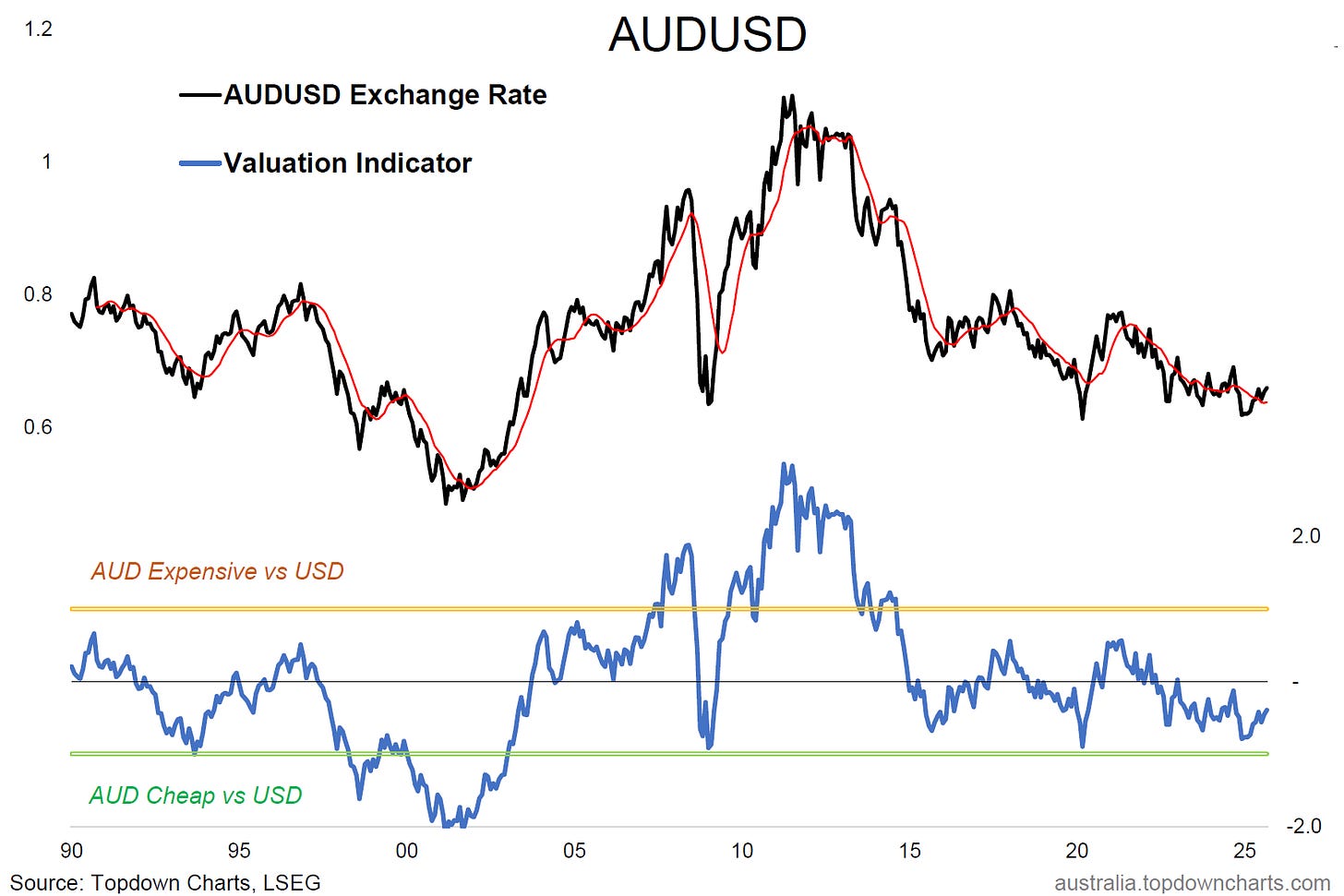

Chart: AUDUSD Next Steps

Considering the overlooked upside case for the Aussie dollar… [Read More]

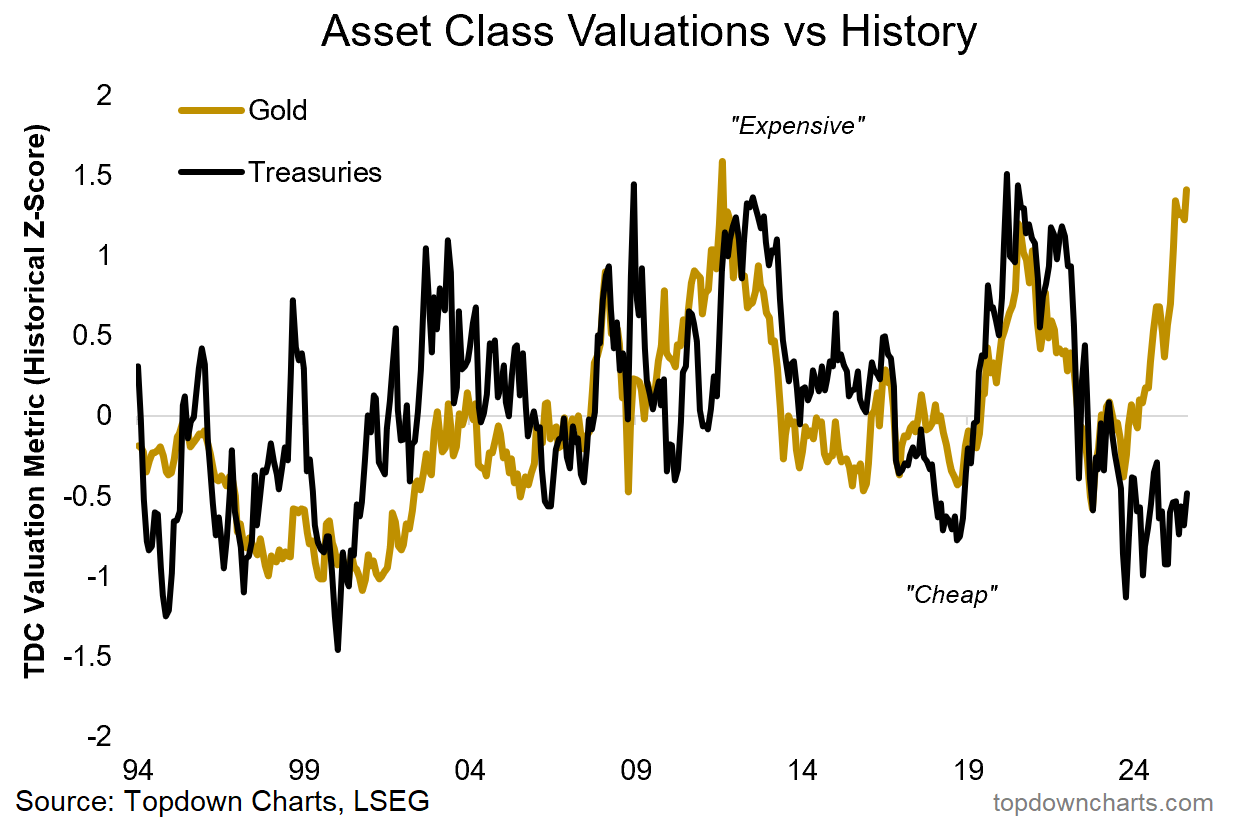

The GoldNuggets Digest — Gold, Fiscal, Bonds

Documenting the global gold breakout, coiling spring in commodities, fiscal tailwinds for gold, gold vs bonds (price), gold vs bonds (valuations)… [Read More]

Also, on a closely related note to this week’s chart, ICYMI check out the Chart Of The Week post from a few weeks ago…

Chart of the Week - The Best vs Worst

The “Relative Value Trinity” in global equities… [read more]

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

NEW: Services by Topdown Charts

Topdown Charts Professional —[institutional service]

Topdown Charts Entry-Level Service —[entry-level version]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack —[Gold charts]

Australian Market Valuation Book —[Aussie markets]

What did you think of this note?

(feel free to reply/comment if you had specific feedback or questions)

The whole S&P will sell off in unison, possibly severely, when the over-valuation (i.e. buffet indicator) is corrected due to the prevalence of passive investing ETF's. There will be no hiding place, and fundamentals won't mean anything until after the rug pull is past. This is a time for caution, not temptation.