10 Charts to Watch in 2025 [Half-Time Update]

Key charts and issues to keep track of in H2 and beyond...

Here’s an update to the 10 Charts to Watch in 2025 as we head into the second half of the year (…where did the first half go??!)

In my original post from earlier this year I shared what I thought would be the 10 most important charts to watch for investors in the year ahead (and beyond).

In this article I have updated those 10 charts + provided fresh comments.

[Note: I have included the original comments from back at the start of the year, so you can quickly compare what I'm thinking now vs what I said back then]

1. Recession or Resurgence? It’s basically a case of mixed signals. But I can say this: despite all the market volatility, policy uncertainty, and geopolitical developments so far this year, the data has held up relatively OK. As things currently stand, for now we can rule out recession. But that leaves an open question on the other big macro risk…

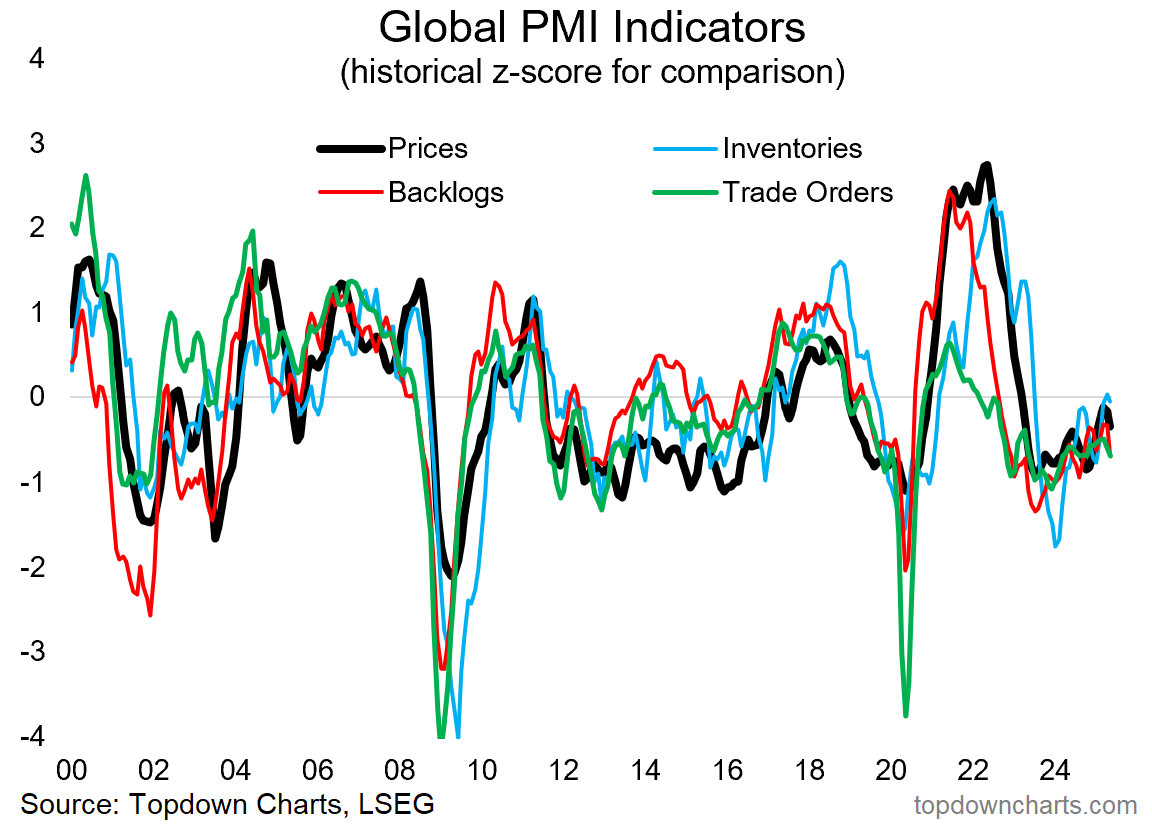

“This is really the big macro question for 2025; do the various weak spots spread and combine with (geo)politics + the long and variable lags of monetary tightening + fiscal reforms —to result in full blown recession?

Or does an inventory (restocking) cycle + global monetary easing tailwinds + China stimulus — combine to trigger an economic reacceleration (+inflation resurgence)?

This chart sets the scene on both respects (it represents both current weakness and potential strength), and will play a key part in ongoing real-time monitoring.”

2. The Macro Risk Sandwich: Resurgence risk remains well on the table with stepped up stimulus (58 central bank interest rate cuts globally this year, 130 over the past 12-months) and no smoking gun recession signs. Meanwhile, labor market capacity remains tight, and after 2 years of slowdown manufacturing is starting to show signs of life again. Is it time to start thinking about inflation resurgence?

“This chart also puts the “macro-risk-sandwich” of recession vs resurgence on display; this time showing the strength and tight capacity in labor markets [blue line] vs excess capacity and weakness in industry (global trade and manufacturing) [black line].

The open question here is will the blue line catch down (recession) or the black line catch up (resurgence)?”

3. Industrial Metals will let us Know: This one kind of says it all, we had the initial move higher in base metals earlier this year, followed by a slump during the tariff tantrum, and now it’s right in the middle of support vs resistance. That tells us that as far as markets are concerned it’s still an open question on both the upside or the downside of the macro risk sandwich. Again, I think this chart is going to be the key indicator to monitor for recession vs resurgence risk.

“We can try to form a view on whether it’s going to be one or the other or something in between, or we could just watch industrial metals —as they will be the first to know.

Breakout = resurgence. Breakdown = recession.

The battle lines are drawn.”

4. Normal no Longer? Short-term policy rates are trending lower, but the bond market is not buying it. With the prospect of global growth reacceleration and inflation resurgence, bond yields are happy to just stay in the range, and indeed, the more rate cuts we see the more likely it is we get higher growth/inflation (and higher for longer bond yields).

“Policy rates have peaked as central banks pivoted to rate cuts. Bond yields also peaked —initially; but that’s changing. Both lines in this chart are going to be at the mercy of the macro-risk-sandwich (a binary prospect: recession = down, reacceleration + inflation resurgence = up).

For a market hooked on rate cuts, 2025 could present a wake-up call; we may need to be prepared for pauses and “unpivots” instead of just consensus cuts.”

5. No Equity Risk Premium: One complication for investors though is that while bonds are still stuck in the range, the prospective forward looking equity risk premium for US equities is still negative. This means investors either simply don’t care/don’t know about the risk they are taking, or they are simply fixated on the growth story. Better hope the growth story keeps delivering!

“Speaking of bonds, there will be *no* risk premium for equity investors over-and-above bonds in the coming years (based on forward-looking expected returns).”

6. No Credit Risk Premium: And credit markets aren’t much better, after a very short-lived spiked in Q2, US high yield credit spreads are back towards multi-decade lows — basically expensive, very little margin for error here.

“There’s also very little risk-cushion on offer in credit — credit spreads and Stockmarket valuations are pretty much priced for perfection. Do you believe in perfect? (you better believe if you are all-in on risk assets!)”

7. Defensives Deep Discount a Premium Deal: On the other hand, defensive equities look cheap. It’s interesting actually, I’m noticing a lot of defensive or diversifier/hedging assets are showing up cheap. In other words, it’s looking much cheaper than usual to get exposure to downside protection and diversifiers than usual — good news for those with an eye on downside risks.

“But it’s not all gloom and risk, there are some extremely attractive relative value opportunities that have opened up. One is in defensive sectors (albeit, please n.b. the parallels with 2000(!) i.e. contrarian risk flag waving here). Defensives are unloved, underowned, and undervalued.”

8. Ditto the Relative Value Trinity: There’s also some very compelling pockets of relative value out there — for those with longer timeframes, take heed of this chart. The big opportunities in the coming decade are likely to be found globally vs in the US, more on the small side than the large side, and more in the neglected value space vs overhyped growth space.

It probably doesn’t seem likely at this point, and it’s a very counter-narrative/non-consensus assessment, but history shows us time and again that the story and narrative only becomes obvious with things like this after the fact (investors as a group tend to be very focused on the recent observables vs what may come next).

“Bigger picture across global equities; small caps are cheap vs large caps, value is cheaper than usual vs growth, and global is at record cheap levels vs US. Will 2025 be the year where the elusive turning point is found for a multi-year move here?”

9. Know thy Dollar: Closely tied in with the global vs US theme is the US dollar, and it might be even more closely tied in than you think. Global investor flows have been a major tailwind behind US large cap growth stocks over the past decade — and thus also a big tailwind behind the US dollar.

The problem with heightened policy uncertainty and (geo)political risk in the USA this year is that it damages credibility at a time when US markets are priced for perfection (overhyped and overowned by investors). The risk case is you get rotation out of US into global stocks, selling of US stocks and USD… and an unwind or reversal of those past tailwinds for US large caps and USD. Something to be aware of, and something we can track at least in part with this chart.

“One key clue in the global vs US market relative performance debate will be the US dollar. It plays a direct (currency translation effects), and indirect role (as it reflects relative macro strength, and impacts the world through financial conditions effects). We can see this playing out clearly in the chart below; a stronger dollar is consistent with US outperforming vs global.

It's an important chart because we need to keep track of the USD (being particularly on watch in case of upside breakout, which it is currently in the process of doing!), but also because of the black line and what it means for both global and domestic investors.”

10. US Asset Valuation Exceptionalism: And that brings us to this last and perhaps most important chart for asset allocators. After the nightmare of 2008, US assets had a 15-year dream run, and now valuations are in dreamland.

The rest of the world however has been in a coma, and are just starting to wake-up, and those who see past the narrative parroting and consensus crowding can see that US assets are priced for perfection and global assets are priced for imperfection. This tells us a lot about the forward looking risk vs return landscape, and while it may not matter in months it will surely set the tone for investors in the coming years.

“Last but not least, call it the US Asset Premium — US assets (stocks, US dollar, housing market, credit spreads inverted, and US treasuries valuation inverted) are trading at their combined most expensive level on record. This is well beyond what we saw in 2021, and even handily eclipses the dot com and pre-GFC peaks. Meanwhile global assets are cheap (DM/EM/FM equities, EMFX, and EM bonds).

The level of US assets by itself is stark, but the spread or premium is even more significant. I’ll tell you what this looks like to me: this is either a generationally risky point in markets, or a generational opportunity …and probably both.

Keep this one high on the watch-list!”

For more on the macro/market outlook in 2025 (particularly as it relates to Asset Allocation and top-down Global Investment Strategy), check out our forthcoming Quarterly Strategy Pack + Sign up as a client of the Topdown Charts institutional service to join the next Quarterly Strategy call in early-July!

—

Thanks for reading, check out my 2024 End of Year Special Report, in which these charts were originally featured (free download)

Best regards,

Callum Thomas

Head of Research and Founder of Topdown Charts

Twitter/X: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

For more details on our Entry-Level service check out the following resources:

Getting Started (how to make the most of your subscription)

Reviews (what paid subscribers say about the service)

About (key features and benefits of the service)

But if you have any other questions definitely get in touch.

NOTE: Other Services by Topdown Charts

Topdown Charts Professional —[institutional research service]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack —[Gold charts]

Australian Market Valuation Book —[Aussie markets]

Excellent post. Thank you. Will definitely look into a short hyg credit position now that it’s back to lows. It has to widen! Eventually. Right? 😅 also relative value. Need to give them some love.

What's your favorite chart from this pack?