Charts of 2023 - Honorable Mentions

6 Charts worthy of mention that didn't quite fit in the other sections...

Recently I shared with you some of my Best Charts of 2023 (charts and calls that worked really well) and then my Worst Charts of 2023 (ones that didn’t work!), and of course my Favorite Charts of 2023 (new, interesting, useful charts), as well as Charts to Watch in 2024.

This week it's a look at the Honorable Mentions — charts that may have also been useful, helpful, and interesting, but didn’t quite make it into those other sections… but really an excuse to dive into another set of charts! Charts! :-)

Be sure to follow us for more charty goodness in the year ahead.

1. Regional Bank Stocks: Remember the regional bank crisis? Regional bank stocks do, but things are turning up there.

2. REIT Allocation: Retail hates REITs – implied allocations have fallen to record lows, makes it worth watching.

3. ESG Fatigue: Search interest in ESG investing has dropped off significantly as investors become disillusioned (reinforced by disappointing price action, tighter monetary conditions, and somewhat of a backlash against ESG investing in general… +general hype and arguably a fair bit of miss-selling/greenwashing).

4. Japan GDP Breakout: Most noticed Japanese equities breakout to new highs, few saw this fundamental breakout.

5. Global Population Growth Trends: Highest in the poorest, slowest in the richest, and overall on a slowing trend: this has meaningful implications for investing and (geo)politics. One to have pinned on the wall as important background context.

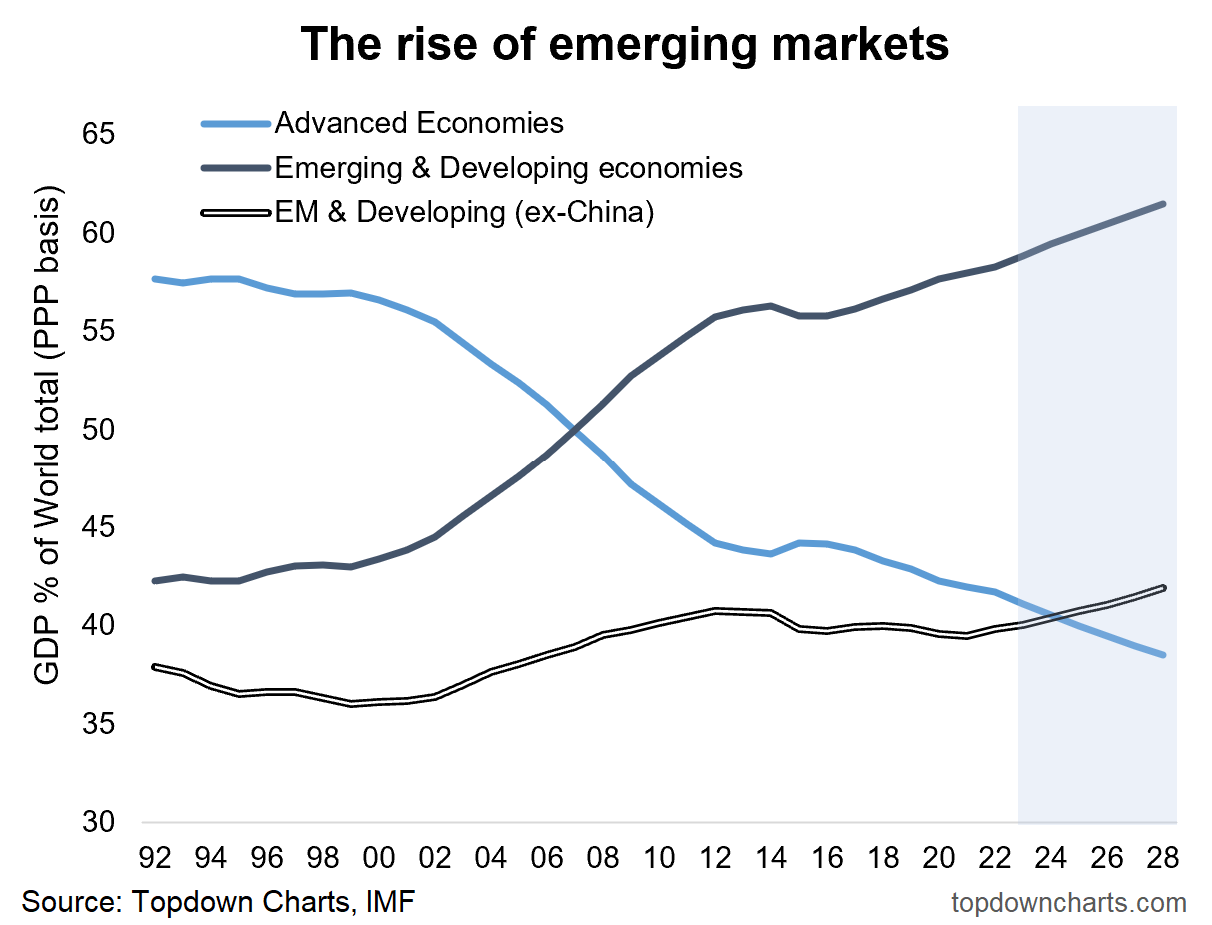

6. Rise of EM: Emerging Markets *including China* eclipsed developed economies over a decade ago, but are only just set to economically out-gun them on an ex-China basis maybe sometime this year. This is also (and closely interlinked with the previous chart) a key chart for investing and (geo)politics.

—

Thanks for reading!

Charts from the 2023 End of Year Special Report (free download)

Best regards

Callum Thomas

Head of Research and Founder of Topdown Charts

Twitter: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

For more details on the service check out this post which highlights:

a. What you Get with the service;

b. the Performance of the service (results of ideas and TAA); and

c. What our Clients say about it.

Follow us on:

LinkedIn https://www.linkedin.com/company/topdown-charts

Twitter http://www.twitter.com/topdowncharts