Charts of 2025 - Honorable Mentions

6 Charts worthy of mention that didn't quite fit in the other sections...

Recently I shared with you some of my Best Charts of 2025 (charts and calls that worked really well) and then my Worst Charts of 2025 (ones that didn’t work!), my Favorite Charts of 2025 (new, interesting, useful charts), and of course the 10 Charts to Watch in 2026!

This week it's a look at the Honorable Mentions — charts that may have also been useful, helpful, and interesting, but didn’t quite make it into those other sections… but really an excuse to dive into yet another set of charts! Charts! :-)

Be sure to follow us for more charty goodness in the year ahead.

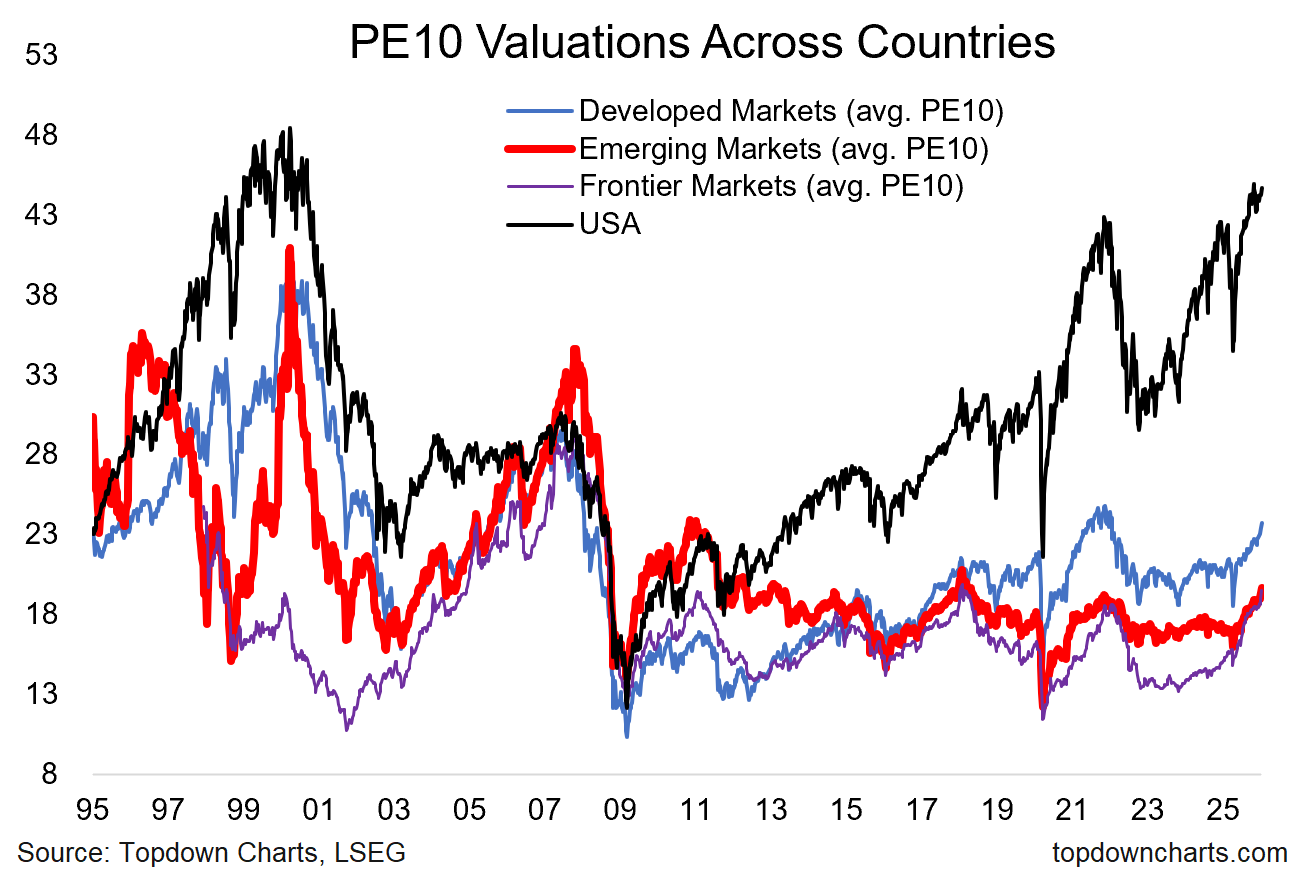

1. Clues of catch-up: this chart shows how far the US has diverged from global equity valuations, but also the nascent catch-up trade clearly underway.

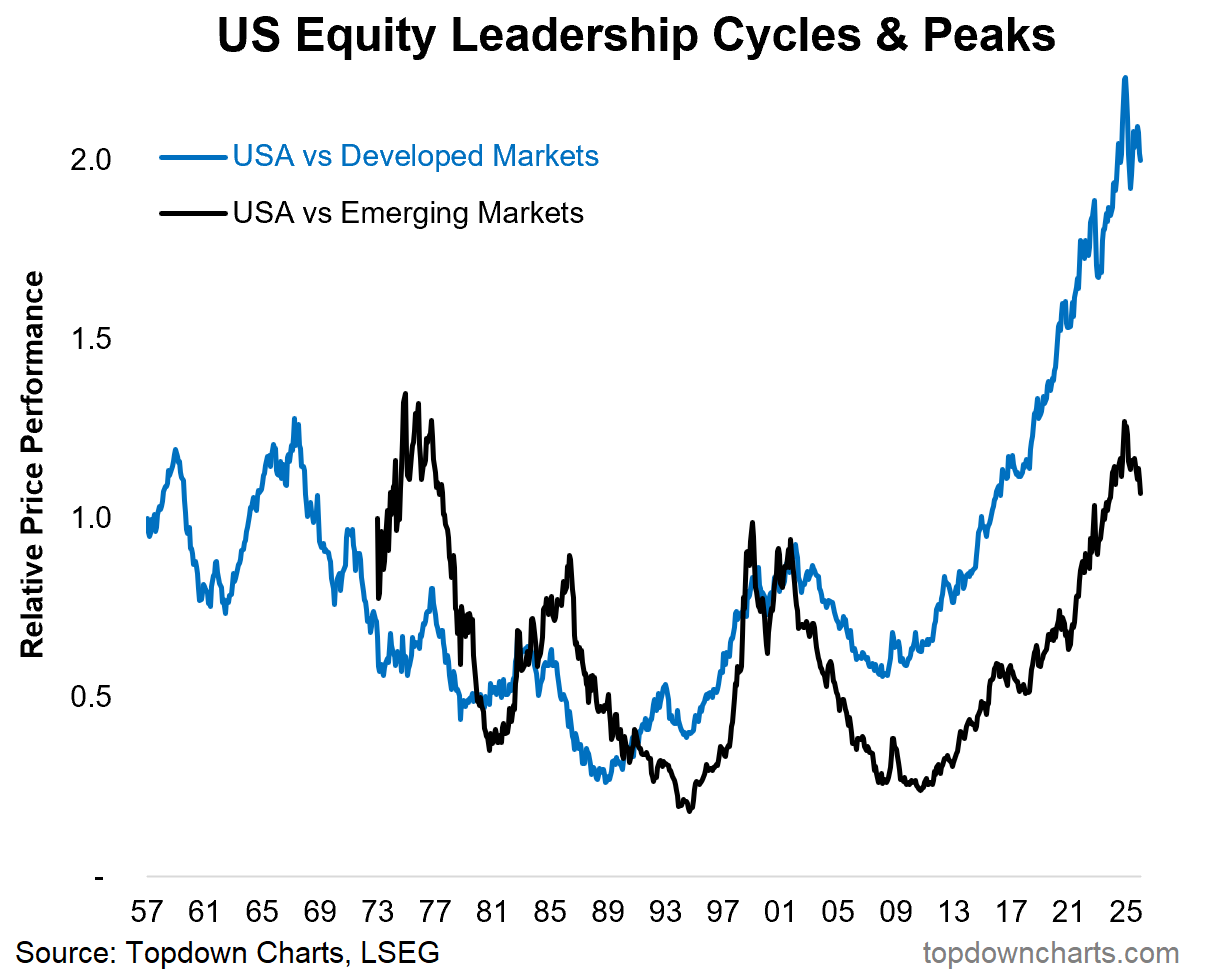

2. Peak performance: this one shows US stock market outperformance peaking vs DM and EM. All good trends come to an end, and all good cycles do what cycles do.

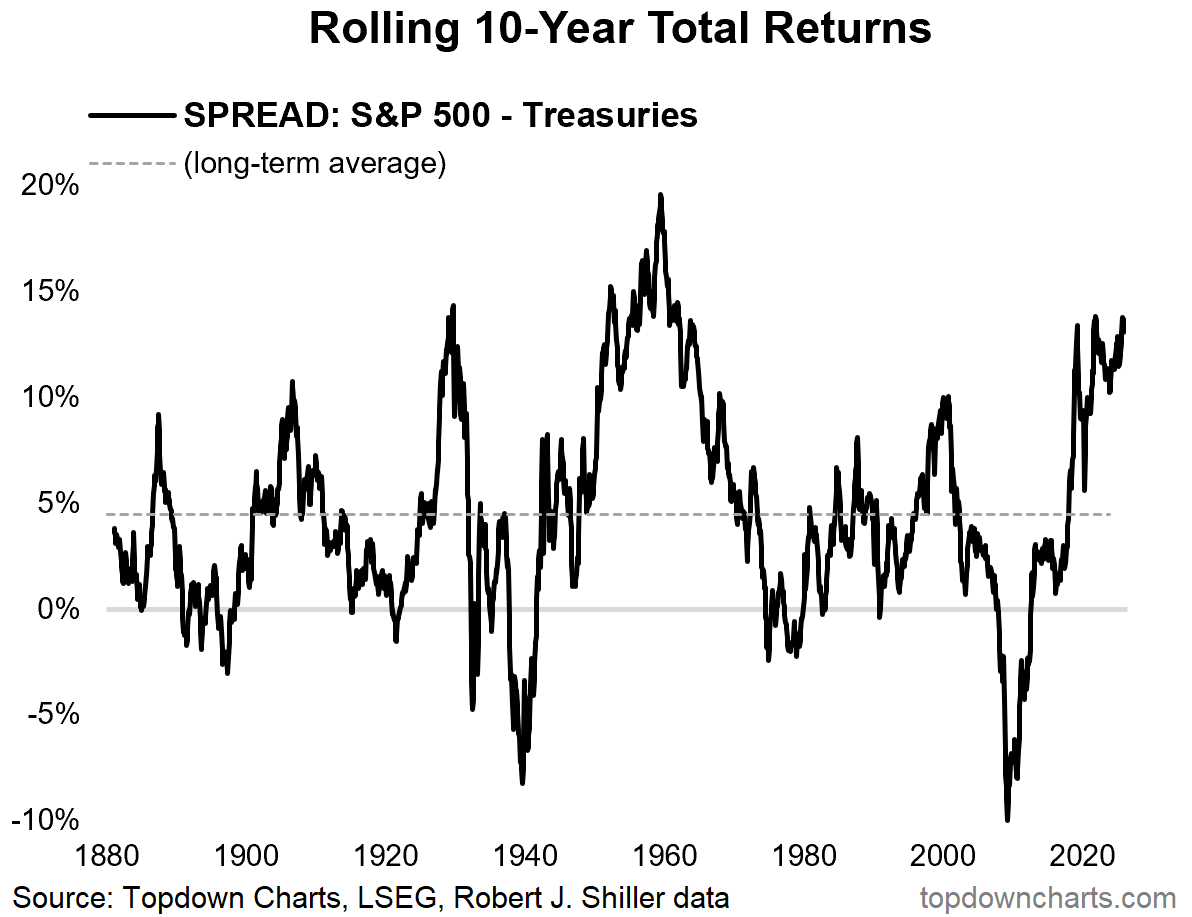

3. Stocks vs Bonds over the Long-run: the rolling 10-year total return premium for stocks over and above that of bonds looks stretched vs long-term average, and it looks late in the cycle (and it does look cyclical).

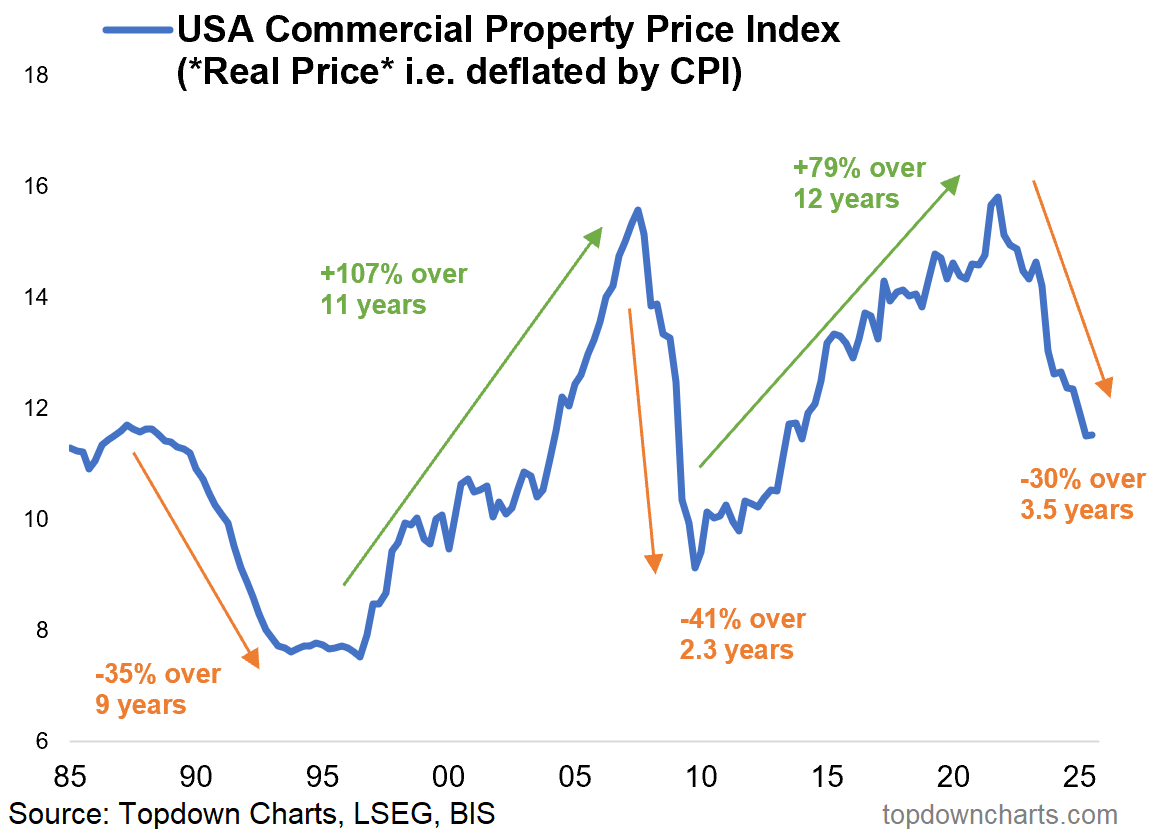

4. The big reset in Commercial Real Estate: in real inflation-adjusted terms, the CRE downturn has been substantial (-30%) and drawn-out (almost 4 years since peak to initial trough). Some might say that’s “enough” (…downturn done?).

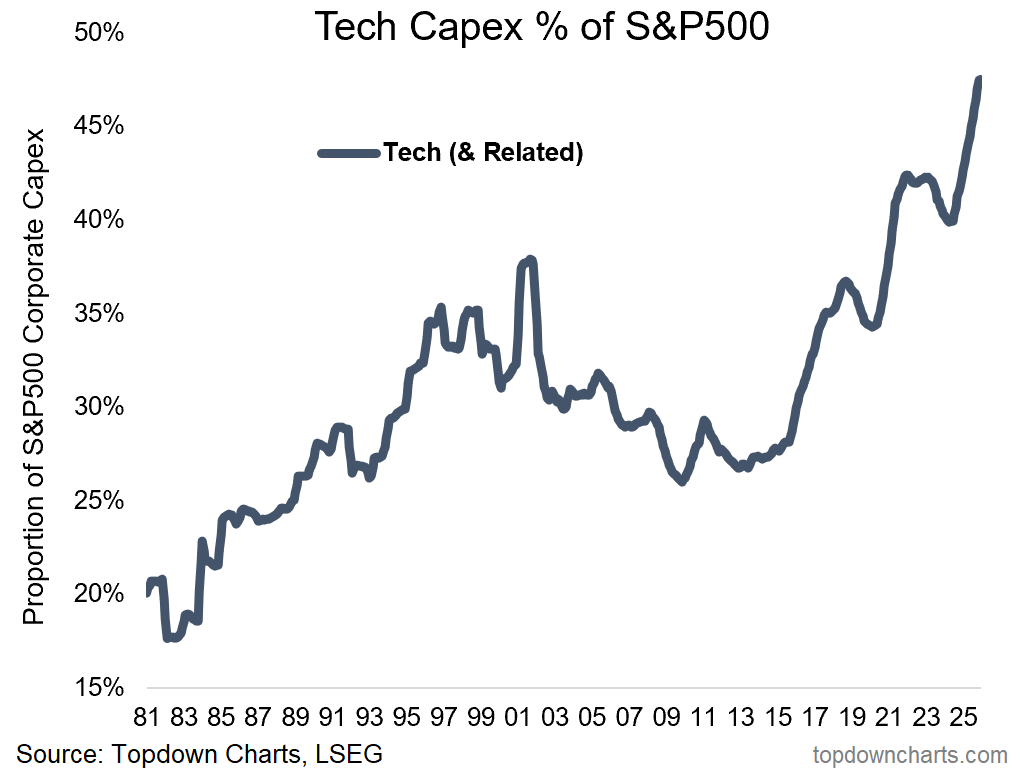

5. Tech capex crowd-out: successive waves of capex by tech and tech related stocks have seen a crowding-out of capex vs the rest of the S&P500.

6. Surging semiconductors: the big beneficiary of the latest wave of capex and indeed of the AI hype bubble has been semiconductor stocks – with that sector’s market cap weight far eclipsing levels seen during the dot com boom. Is it the new normal, or just another cycle of boom and b...?

See Also: Weekly S&P500 ChartStorm - Best Charts of 2025

—

Thanks for reading!

Charts from the 2025 End of Year Special Report (free download)

Best regards

Callum Thomas

Head of Research and Founder of Topdown Charts

Twitter/X: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

Like what you see here? Check out our paid service for more insights and ideas

Subscribed

For more details on the entry-level service check out the following resources:

Getting Started (how to make the most of your subscription)

Reviews (what paid subscribers say about the service)

About (key features and benefits of the service)

But if you have any other questions definitely get in touch.

Other Services by Topdown Charts

Topdown Charts Professional —[institutional research service]

Topdown Charts Entry-Level Service —[entry-level version]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack —[Gold charts]