My Best Charts of 2024

A look at some of our charts and calls that worked particularly well during the year

As we close out the year I thought it would be good to share some of my charts and calls that worked particularly well this year (and don't worry, I will be sharing my worst charts next week... there are always two sides to the coin!!).

These charts were featured in my just-released 2024 End of Year Special Report — check it out when you get a chance (free download as a holiday treat!).

The charts listed below were particularly helpful in developing and updating some of my key calls and recommendations for clients this past year. I find that while I do tell the story around the charts and build the picture with multiple “puzzle pieces“, in many cases a good chart speaks for itself and does much of the heavy lifting in the investment or macro thesis.

It's also a good exercise to go through — to see what worked well. It's conventional wisdom to try and learn from failures, but it's also important (maybe more important!) to try and learn from successes (while also being mindful of hubris, complacency, hindsight bias, and the need to stay humble and trying new things in the quest for innovation).

With that all said, here they are! Hope you find it interesting...

n.b. I have updated the charts with the latest data (in a few cases the original idea has actually come entirely full-circle) —Also on formatting: the italic text is a quote from the specific report in which the chart originally appeared (date of report in brackets).

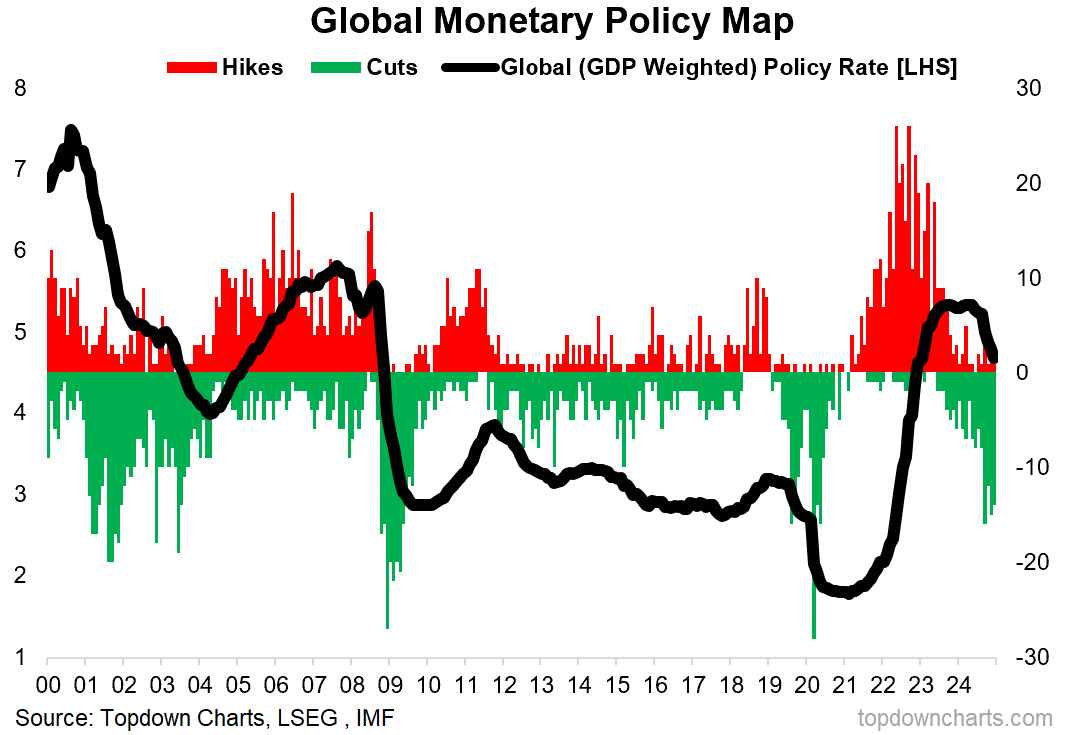

1. Global Monetary Policy Pulse: Perhaps the most important chart of the past few years, it helped again in detecting key shifts in monetary policy settings ─ and that’s really been a key macro call to get right in this day and age.

“With victory being declared on inflation in many regions, most central banks have moved into pause-mode, and some even pivoting back to rate cuts. Typically this is what you see at the end of the cycle – with rate cuts usually being forced by a crisis or recession… So it begs the question: can central banks achieve a sort of policy perfection where inflation is tamed, recession avoided, and rates gently brought back down from panic tightening?” (12 Jan 2024)

2. Gold’s Big Break: This chart and technical line-in-the-sand was key for framing the setup in gold and helping put into context the significance of the eventual breakout. Not only was this a key market development, but also an asset that is at the center of several key macro cross-currents.

“The biggest development (outside of Bitcoin prices surging – which while out of scope for me, is an interesting barometer of speculation and liquidity, and in an odd way linked with gold) has been the breakout to new all-time highs for the gold price in US dollars. With the recent series of higher highs and higher lows, travelling above its 200-day moving average, and improved cross-currency breadth, it sure has a look and feel that this may be *the* big breakout moment for gold.” (8 Mar 2024)

3. Real Estate Washout: This was among a set of charts that helped set the scene for the rate-cut-rally in REITs. They came from a position of extremely pessimistic sentiment, light positioning, oversold breadth, and a decent reset in valuations. The greatest fears of the market around CRE proved to be more manageable than mayhem, and sometimes that’s all you need when sentiment gets that depressed.

“REITs saw a much faster and significant reset in valuations (relative to housing and commercial property) and a major washout in sentiment to record pessimism (and record low allocations by investors), along with oversold technicals this created a solid setup for a rally into falling bond yields.” (12 Jan 2024)

4. Higher For Longer: This chart was useful in tempering some of the bullish signs that were presenting on bonds. It was and is going to be hard for bonds to rally without a meaningful downshift in the long-term rate of inflation (which still does not seem forthcoming).

“Depending on the sequence of events, and how fast any possible reacceleration and resurgence comes about, this would limit the scope for inflation normalization and policy rate normalization. In other words, higher-for-longer risk will be around for longer. Thus we’d have to limit enthusiasm for government bonds, outside of any shift in probabilities to recession and deflation risk. Given emerging evidence for reacceleration risk then, it may be best to stay neutral on bonds.”

(9 Feb 2024)

5. Small vs Large Valuations: Arguably this chart slipped under the radar for many, with US small cap stocks (S&P600 in this case) PE10 valuation ratio reaching levels very similar to those seen during the depths of the pandemic crash. I always say when valuations get extreme enough they have a tendency to speak for themselves (case in point here). I’d say this chart remains particularly interesting as large cap stock valuations reach new post-2021 heights.

“Echoing again on from the previous topics, US small caps have the valuation edge vs large caps and big tech – definitely cheap vs large, and reasonable vs history and vs bonds.” (16 Feb 2024)

6. Commodity Cycles: I initially highlighted this chart due to the bullish breadth divergence presenting (lower low on the index vs higher low on the breadth indicator). This is an excellent set-up for identifying turning points and market bottoms. As for now the lines in the sand are clearly laid out, and this is actually going to be a really key chart and asset class (Commodities) in the year ahead.

“And a key piece of the puzzle is the technicals. The commodities index has managed a thus-far successful test of a key long-term support level, and with bullish breadth divergence (and with the breadth indicator turning up from oversold).

So there are some positive technical signs.” (8 Mar 2024)

7. China Stimulus: Another key macro development in 2024 was the pivot to greater stimulus in China. The chart below flagged how the PBOC was running things much more restrictive or much less easy given the inflation pulse vs during previous downturns. In other words the door is/was wide open to further easing, rate cuts, stimulus.

“Based on past reaction functions, the PBOC would have cut by 150bps by now. We can only assume that they have opted for the choice of restructuring vs reflating, or perhaps waiting for the Fed to finish with hikes, or that the pain threshold is higher and it’s still coming (or maybe even just a policy mistake).” (19 Jan 2024)

8. The China Risk Premium: This pivot to greater easing helped Chinese stocks put in a very rapid and large rally. One key ingredient to that has been the very high equity risk premium in China (“it’s in the price”).

“The equity risk premium has also moved up to new highs – which at least partly reflects the increased policy uncertainty, and overall China risk premium. In that respect, we can say that the various concerns on the reg/geopol front are in the price. So aside from stimulus, if the macro turns the corner and if we did get some improvement on geopolitics/regulations then it would be China bullish – but a few things need to go right vs the bad technicals.” (19 Jan 2024)

9. Emerging Markets: The China developments were a key contributor to the strength in EM equities this year, but were certainly not the only part of the story. Multiple charts helped identify the opportunity here including the strength in EM ex-China stocks, but in particular the lukewarm sentiment showed there were minds to be changed on EM.

“Meanwhile surveyed sentiment has ticked up but is still very far from bullish consensus, I would say more people are sceptical on EM now vs this time last year, even though many elements for the EM bull case have actually improved a lot since then.” (19 Jan 2024)

10. Frontier Markets: An often overlooked part of markets (particularly so now as the last ETF on Frontier Market equities was shuttered this year… which may well end up being a bullish signal!!!), FM equities plodded higher through the year – this chart highlights the path but there were numerous indicators supporting (valuations, FX, technicals, inflation and interest rates, to name a few).

“Checking in on Frontier Market equities, the technicals have been turning up – the index tracking above its upwards sloping 200-day moving average, and country breadth indicators turning higher (indicating broadening strength across the countries within the frontier markets classification).” (26 Jan 2024)

—

Thanks for reading!

Check out the Full Report here (free download)

Best regards

Callum Thomas

Head of Research and Founder of Topdown Charts

For more details on the service check out this recent post which highlights: a. What you Get with the service; b. the Performance of the service (results of ideas and TAA); and c. What our Clients say about it.

Follow us on:

LinkedIn https://www.linkedin.com/company/topdown-charts

Twitter http://www.twitter.com/topdowncharts